Promising Future - Wi-Max technology and deployment

-

Technology performance

There are two flavours of Wi-Max. Fixed Wi-Max, based on the IEEE 802.16d2004 amendment, is the first version that supports fixed and nomadic access, and operates in licensed bands only. The second version, mobile Wi-Max, is based on the IEEE 802.16e-2005 amendment, which specifies the orthogonal frequency division multiple access (OFDMA) air interface and provides support for mobility including handoffs. The second version of the technology operates not only in licensed bands, but is also available in products operating in licence-exempt bands. However, licence-exempt equipment does not yet carry the WiMAX Forum's certification stamp that is currently limited to licensed bands (2.3 GHz, 2.5 GHz and 3.5 GHz). This is because mobile services predominantly use licensed bands and certification establishes a required base for plug-and-play interoperability that enables any device to work on any network worldwide.

Over the past few years, the 802.16e Wi-Max platform has become the dominant Wi-Max standard, with wider equipment and chipset vendor support, a rapidly growing number of terminal devices and base station form factors (from femtocells to single-sector compact picocells to multi-sector macro base stations). With the 802.16e Wi-Max market reaching economies of scale, 802.16d TDD WiMax, while still supported by vendors, is quickly becoming a legacy technology, mostly targeted at niche markets.

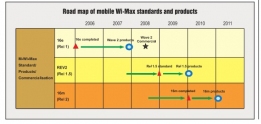

More importantly, the 802.16d TDD Wi-Max lacks a clear upgrade road map, mostly on account of the limited interest from vendors and operators. Mobile WiMax, on the other hand, not only has the ability to meet operators' requirements, both from a performance as well as business model perspective, but also has a well-established evolution road map with strong industry backing and a rapidly expanding ecosystem. The upgradation of this technology to the next Wi-Max version, 802.16m, is currently in progress and will enable operators with 802.16e WiMax-based networks to upgrade their infrastructure to 802.16m Wi-Max when the equipment becomes available. However, for fixed Wi-Max, operators will need to build an overlay network or entirely replace the old equipment with the new 802.16e one.

Support for mobility is another key driver of 802.16e Wi-Max, even though most operators still have to leverage it within the fixed services they currently offer. From a business model perspective, operators in licence-exempt bands have so far focused on fixed services and applications. From a technology perspective, full mobility in high frequency licence-exempt bands is very challenging.

Finally, the 802.16e Wi-Max-based equipment supports advanced functionality that improves performance in comparison to the 802.16d Wi-Max and other wireless broadband technologies. The spectral efficiency of the air interface in the two versions of Wi-Max in their basic configurations is comparable, but several features that are available or required in 802.16e are not available in the 802.16d equipment. For instance, quality of service (QoS) is available in both versions of WiMax, but 802.16e Wi-Max can provide better support for voice services through an additional QoS level that makes it possible to dynamically allocate capacity to voice traffic only when needed. The 802.16m Wi-Max, currently under development, is expected to provide enhanced voice support.

Also, the 802.16d version only supports multiple input, multiple output (MIMO) Matrix A as an option, while for 802.16e, support for MIMO A (for more robust coverage) and for MIMO B (for increasing capacity) is part of the standard. MIMO A is especially beneficial for rural operators because it allows them to deploy fewer base stations to cover the same area. It also uses a diversity transmission scheme that helps operators to manage interference. MIMO B is better suited for operators in metropolitan areas, where multi-path environments, including indoor locations, dominate.

The use of sub-channellisation with OFDMA in 802.16e Wi-Max also enhances coverage since terminal devices can receive and transmit more efficiently than with other wireless interfaces. The hybrid automatic repeat request and convolutional turbo code also provide improved coverage, but are not supported in the 802.16d version.Finally, the 802.16d Wi-Max equipment only supports channel widths up to 7 MHz, while 802.16e Wi-Max supports up to 10 MHz. The 802.16m version is expected to reach 20 MHz. The increase in channel size effectively lowers the cost per bit for the operator because each base station can transport more traffic.

The move from 802.16e Wi-Max to IEEE 802.16m will provide wider channels as well as improved performance and support for voice services. The 802.16m standard is the core technology for the proposed Mobile Wi-Max Release 2, which enables faster, more efficient and converged data communications and is a strong contender for IMT-Advanced technologies by ITU. Among other enhancements, IEEE 802.16m systems can provide up to four times faster data speeds than the current Mobile Wi-Max Release 1 based on the IEEE 802.16e technology. Mobile Wi-Max Release 2 will also provide strong backward compatibility with Release 1 solutions and will enable mobile Wi-Max operators to easily migrate their Release 1 solutions to Release 2 by a simple upgrade of channel cards or software systems. Also, subscribers who use the currently available mobile Wi-Max devices can communicate with new Release 2 systems without any difficulty. Wi-Max Release 2 is likely to be available commercially in the 2011- 12 time frame.

Wi-Max and VOIP

The flexible bandwidth allocation and multiple built-in types of QoS support in the Wi-Max network allow the provision of high speed internet access, voice over IP (VOIP) and video calls, multimedia chats and mobile entertainment. When bundled with broadband internet access and IPTV, a Wi-Max triple play becomes attractive to more subscribers.

VOIP is an increasingly well received offering in enterprise markets as it provides a broader spectrum of services while reducing costs for subscribers and service providers alike. Revenues from VOIP have witnessed an increase. In fact, WiMax has proven to be an ideal platform for the deployment of VOIP applications and services. Wi-Max operators across the globe are increasingly enhancing their service offerings by providing VOIP in addition to the existing data services to compete with services offered by traditional telephone service providers. For instance, in Africa, operators are using Wi-Max networks to provide VOIP services to their corporate clients and residential subscribers. The trend is expected to witness growth as operator licensees, vendors and analysts are of the opinion that a voice service is essential to WiMax's success and VOIP may be the killer application for Wi-Max.

In the case of VOIP over Wi-Max, there are two sets of network contingencies – the number of base stations, and the distance of the subscriber from the base station. At a basic service level, VOIP over Wi-Max requires that service providers pay attention to QoS and mobility issues.

However, the WiMAX Forum has not completed the certification process for the QoS profile that handles VOIP. For instance, the Unsolicited Grant Service (UGS) QoS class, one of the five QoS service types defined in the Wi-Max standard, which is designed to support real-time service flows that generate fixed-size data packets such as VOIP without silence suppression on a periodic basis, is considered optional in the testing in WiMAX Forum labs. Nevertheless, there is a strong momentum for QoS improvements in WiMax networks.

While VOIP over Wi-Max has been successfully deployed in varying models for over two years now, both fixed and mobile VOIP over Wi-Max markets are still in their infancy. The number of VOIP over Wi-Max users is very low compared to the overall Wi-Max subscriber base, and stands at over 250,000 cumulative worldwide VOIP subscribers vis-Ã -vis 7 million Wi-Max subscribers.

According to telecom market research firm Maravedis, while VOIP will be a baseline service requirement that Wi-Max service providers offer in emerging markets, it is not likely to lead to a substantial rise in ARPU in developed countries. This is because the costs of broadband access and voice services are comparable, and customers are more likely to be attracted by discounted bundled services and the convenience of a consolidated bill.

Industry experts are of the opinion that the VOIP over Wi-Max service needs to be positioned as more of a wireline replacement technology, and should be marketed as a prime solution for customer premise equipment-based residential phone services if it is to actually lead to an increase in ARPUs as voice will eventually become free. The increased usage and features enabled by VOIP-capable mobile internet devices with embedded Wi-Max will be able to significantly increase ARPUs.

The challenge for VOIP over mobile Wi-Max networks is that MIDs are not yet easily available as the technology is still evolving. Handsets will be vital in making voice a major component of Wi-Max based on an 802.16e-2005 network. HTC has recently launched the world's first GSM/Wi-Max phone. However, the keyto VOIP over Wi-Max's success is to have a range of handsets and devices available – one device alone will not be able to drive the market. The expansion of Wi-Max networks and the increasing availability of Wi-Max VOIP-enabled devices will offer a greater choice for customers.

The future of VOIP over Wi-Max as well as broadband wireless looks promising in the next few years.

Convergence with LTE

Though mobile Wi-Max has been competing against long term evolution (LTE) to emerge as the dominant 4G technology, industry experts are of the view that both these rapidly growing and evolving technologies will converge in the long run, as Wi-Max and LTE ecosystems have been increasingly overlapping at several levels.

Looking at the technology road maps, Wi-Max will adopt technologies similar to those adopted by LTE. For instance, there is an overlap in the use of advanced methods of MIMO-AAS and adaptive modulation.

The future will also witness a convergence in handsets, laptops and other devices on a service level for users through multi-mode device integration. The convergence of Wi-Max and LTE will support a more seamless handoff of sessions than can easily or cost effectively be accomplished between either Wi-Max or LTE and non-IP-based networks. Owing to similar architecture and common gateways, these systems will enable IPTV, VOIP and other IP/SIP communications to occur relatively harmoniously, even though handoffs between networks will occur. The wired network infrastructure will be common mostly between systems and element management OS, back-office accounting and billing.

In addition, a number of industry alliances and supply relationships forge common interests between the two technologies including Intel and Nokia, and Ericsson and Sprint Nextel.

For instance, vendors such as Nortel, Alcatel, Alvarion and Motorola have all shifted to software-defined radio platforms that will support both Wi-Max and LTE development. These systems have over 90 per cent in common, and are being modularly designed to be flexible, upgradeable and take advantage of the commonality between applications and systems.

Most of the differences usually lie in core link technologies that are likely to vary in the details of implementation. And RF differences usually occur between applications of specific spectrum rather than on account of differences between Wi-Max and LTE.

On the chip device level as well, there is growing support among vendors for both Wi-Max and LTE. This helps reduce overall costs to support both systems based on common development platform learning curves, common core modules as well as the ability to amortise some costs over common aggregate volumes. Clearly, the common industry goal of reducing developmental expenses and the need to reach new markets is driving the convergence of these technologies.

Net, net, Wi-Max has many growth opportunities beyond traditional mobile operator networks, including data-centric deployments in both developed and developing regions, and has, in fact, witnessed steady progress in the past few years, with ABI Research reporting 164 mobile WiMax networks in trial or commercial operation at the end of 2009, compared to just over 100 LTE trials.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Wi-Max gets a headstart, LTE likely to p...

- Key advantages and challenges of Wi-Max ...

- Operators assess technology options

- Spectrum Setback - Limited Wi-Max rollou...

- Sticky Wicket - Lack of policy focus h...

- Time for Auctions - Spectrum allocatio...

- Wi-Max Rollout - Operators ramp up inv...

- Global Trends - Asia-Pacific and Latin...

- Stiff Competition - Wi-Max tries to ho...

- Promising Future - Wi-Max technology and...

No Most Rated articles exists!!

| Your cart is empty |