Sticky Wicket - Lack of policy focus hinders Wi-Max deployment

-

In December 2008, there were indications that things were starting to move.The date for 3G spectrum auction was set for January 16, 2009, with broadband wireless access (BWA) spectrum auction to follow two days later. But the dates got postponed as the communications and IT ministry and the finance ministry disagreed over the base price for spectrum, with the finance ministry demanding that the price for pan-Indian 3G spectrum be doubled from Rs 20.2 billion.

No new dates have been set for the auction yet. The decision on how to proceed has been handed over to a group of ministers. Given the number of issues involved, the auctions are not likely to take place anytime soon. Even though the communications and IT minister, A. Raja, announced in early February that 3G and Wi-Max spectrum auctions would take place before March 31, the finance ministry has clearly indicated that the auctions will not be possible before the next financial year.

The delay in auctions is a key concern for operators looking to deploy Wi-Max services. According to the WiMAX Forum, the estimated revenue potential from the Wi-Max business is at least $1.6 billion per year, including various taxes.Moreover, the industry would have got around $600 million per year from the sale of Wi-Max equipment. This adds to the total loss by around $2.2 billion.

The global economic downturn, coupled with the postponement of spectrum auction, has made the government significantly revise its expected revenue earnings from the sale of 3G and Wi-Max airwaves.The current estimate is Rs 200 billion, a 50 per cent drop from the Rs 400 billion announced by Raja in 2008.

According to C.S. Rao, chairman, WiMax Forum, India Chapter, the entire WiMax ecosystem is being adversely affected:

- Operators are losing service revenue potential for an estimated 2.5 million subscribers.

- Equipment vendors are also losing revenue. Wi-Max devices are available today at low price points because the ecosystem is driven by 25 chip vendors.Wi-Max device makers are losing revenue on the sale of notebooks and other devices like USB dongles, indoor customer premises equipment and mobile internet devices.

- The content industry is losing revenue in the form of content ARPUs.

Background

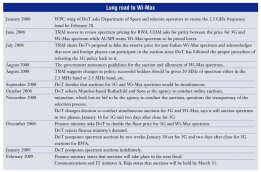

The Telecom Regulatory Authority of India (TRAI) released its 3G and BWA spectrum recommendations in September 2006. The policy was finalised by the Department of Telecommunications (DoT) two years later in August 2008, after several amendments and referrals of the amendments to TRAI (as stipulated by the law)

The policy stated that spectrum in the 2.5 GHz and 2.3 GHz bands would be allocated through a controlled, simultaneously ascending e-auction. The auction would be open to unified access service licensees as well as Category A internet service provider (ISP) licensees.

Successful bidders could get up to 20 MHz of spectrum in the 2.3 GHz and 2.5 GHz bands in each telecom service area, with the reserve price per MHz in the 2.3 GHz and 2.5 GHz bands being 25 per cent of the 3G reserve price. According to the policy, spectrum in the 700 MHz and 3.3-3.6 GHz bands would also be auctioned later.

In many ways, the policy did not conform to TRAI's recommendations.Though TRAI had recommended that successful bidders for Wi-Max spectrum be given licences for five years, DoT raised this to 15 years. TRAI had suggested a single-stage auction process, while DoT decided on an ascending scale e-auction. DoT did not stick to the regulator's proposal to auction blocks of 15 MHz in the 3.3-3.4 GHz and 3.4-3.6 GHz bands.

There were differences in pricing as well. DoT initially pegged the reserve price for Wi-Max spectrum at Rs 400 million, as against Rs 100 million suggested by TRAI. Most importantly, DoT opened the auction to both domestic and foreign players, as against TRAI's recommendation of allowing only domestic participants.

Concerns

The following are the major issues regarding the Wi-Max spectrum policy:

Opposition from ISPA

IThe Internet Service Providers Association of India (ISPAI) recently opposed DoT's decision to take back radio frequencies allotted to ISPs in 2003 for wireless broadband services, and auction the sameas Wi-Max spectrum. Following a government circular issued in January 2008 asking the ISPs to return the 40 MHz spectrum they held together, three ISPs – Sify, Spectranet and Aircel – moved the Delhi High Court on the issue. The litigation is likely to impact the government's plans to auction spectrum in the 2.5 GHz band for Wi-Max services. The other ISPs have returned the spectrum.

Spectrum pricing

Pricing of spectrum has been a longstanding issue. In late 2008, DoT finalised the spectrum policy and set the reserve price for 3G and BWA spectrum at Rs 20.2 billion and Rs 10.1 billion respectively. But by January 2009, the global economic downturn had started affecting the valuations of telecom companies which, in turn, prompted the cashstrapped finance ministry to seek a doubling of the floor price to Rs 40.4 billion and Rs 20.2 billion respectively

.However, DoT is not in favour of increasing the base price. Going by the tepid response in the pre-bid rounds, it fears that increasing the base price in the current economic situation would lead to a major slide in international participation in the auction.

Earlier, TRAI had attempted to review the pricing of spectrum for wireless broadband services. But this led to considerable debate, with the Cellular Operators Association of India demanding parity between the price for 3G and Wi-Max spectrum to keep the playing field level, and the Association of Unified Telecom Service Providers of India (AUSPI) wanting Wi-Max spectrum to be priced lower to make broadband services more affordable.

Other issues

TRAI recently accused the communications and IT ministry of being secretive about the amount of Wi-Max spectrum available in the country. According to the regulator, the results of the Wireless Planning and Coordination (WPC) wing's attempts to get spectrum bands vacated/refarmed from the incumbents should be made available in the public domain.

Moreover, the WiMAX Forum and AUSPI have approached the Prime Minister's Office over the allocation of Wi-Max spectrum in the frequency division duplex (FDD) (paired) mode to Bharat Sanchar Nigam Limited (BSNL) in three circles. Globally, in the 2.3 GHz and 2.5 GHz bands, Wi-Max technology operates only in the time division duplex mode as opposed to the FDD mode.According to the two industry associations, the allotment of spectrum to BSNL in FDD mode will result in a situation whereby a Wi-Max customer from one of the three circles will not be able to use the services in other circles. The WiMAX Forum and AUSPI have also stated that BSNL has appointed US-based Soma Networks to provide Wi-Max solutions without following the due tender process.

All in all, the road to Wi-Max for Indian operators remains riddled with obstacles. It is imperative that the government quickly gets a policy fix on the issue. Otherwise, the fastest growing mobile market in the world will keep losing out in broadband.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Wi-Max gets a headstart, LTE likely to p...

- Key advantages and challenges of Wi-Max ...

- Operators assess technology options

- Spectrum Setback - Limited Wi-Max rollou...

- Sticky Wicket - Lack of policy focus h...

- Time for Auctions - Spectrum allocatio...

- Wi-Max Rollout - Operators ramp up inv...

- Global Trends - Asia-Pacific and Latin...

- Stiff Competition - Wi-Max tries to ho...

- Promising Future - Wi-Max technology and...

No Most Rated articles exists!!

| Your cart is empty |