PPP route to increase broadband penetration - A viable route for financing rural telecom projects

-

With the telecom subscriber base close to 600 million, and with 10 to 15 million mobile subscribers being added every month, India represents a huge telecom opportunity. At the other end of the spectrum is broadband, which has a subscriber base of a little over 8 million, and rural connectivity, with a teledensity of approximately 19 per cent vis-a - vis 80 per cent in the urban areas. While some progress has been made in the area of rural mobile connectivity, broadband and internet penetration remain very low.

One of the ways being considered to fix these issues and to increase broadband penetration is the public-private partnership (PPP) mode, which has been very successful in the road sector. In the telecom sector, PPP has gained traction since 2006 with the government prioritising rural connectivity and with operators increasingly moving from the saturated urban markets to tap the potential of the rural areas.

Several players have launched internet and broadband connectivity projects in villages. Wireless service providers are setting up towers and other infrastructure to explore and develop the rural telecom market. The government is encouraging these initiatives and in many cases, providing the requisite finances for them. Large-scale government intervention is required for rural connectivity and is being provided through the Universal Service Obligation (USO) Fund, set up in 2004 for this purpose. This is because providing connectivity to these regions is not financially viable since the cost of setting up telecom infrastructure in these regions far exceeds the revenues they yield, given the low disposable income of rural users.

The government has joined hands with the corporate sector to launch various information and communication technology (ICT) initiatives in the rural areas. The PPP model has emerged as an important working model for these projects. Currently, there are many players involved in rural broadband projects across India. Service providers like Bharat Sanchar Nigam Limited (BSNL), Reliance Communications and Bharti Airtel, and telecom vendors such as Qualcomm, Motorola, Nokia and Ericsson, along with IT companies such as Microsoft and Intel, are all experimenting with grass roots ICT initiatives.

There is no one single PPP model being used in the sector. For instance, towards the beginning of this year, the USO Fund developed a scheme to extend financial support for providing wireline broadband connectivity in the rural regions on a build-operate-own (BOO) model. Meanwhile, Gujarat State Wide Area Network (GSWAN), a successful e-governance project commissioned by the Gujarat government, was implemented on a buildown-operate-transfer (BOOT) basis.

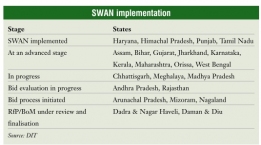

At the state level, PPP projects are currently being implemented in states such as Andhra Pradesh, Gujarat, Karnataka, Madhya Pradesh, Maharashtra, Tamil Nadu, Punjab and West Bengal.

Some of the projects being implemented on a PPP basis include initiatives under the national e-governance plan such as the setting up of common service centres (Rs 100 billion) and SWAN (Rs 33.34 billion) projects. These contracts are primarily awarded by the Department of Information Technology (DIT) (for e-governance projects), along with the respective state governments and the USO Fund of the Department of Telecommunications.

However, the pace of adoption of this model has only increased in the past few years with rural connectivity becoming a key focus area. Prior to that, growth in the telecom sector, driven primarily by the wireless segment, took place largely due to private operators with the role of the government being restricted to policy and regulation.

SWAN projects

The different agencies involved in the government's SWAN projects include DIT, the respective state IT departments, consultants, implementing agencies and third-party monitoring agencies. In the case of a PPP model being adopted for SWAN, an appropriate agency is selected through a suitable competitive process for outsourcing establishment, operation and maintenance of the network.

The consultancy cost for undertaking a technical feasibility study, advising on the most appropriate PPP model, preparation of expressions of interest and requests for proposal (RfPs), service level agreements (SLAs), etc. and managing the bid process for PPPs is provided as 100 per cent grant by DIT to the agency designated by the states to undertake the selection of the consultant.

GSWAN project

Andhra Pradesh SWAN

Future scenario

In August 2008, the Indian government announced a $2 billion PPP initiative to provide broadband and internet connectivity in the rural areas. Of this, approximately $1.5 billion would be generated from the private sector and the balance would be funded from government sources.

However, several issues need to be ironed out. These include the right pricing, which should take into consideration market competition and management control, both strategic and operational.

These issues notwithstanding, there are significant opportunities in telecommunication. PPPs have generated allround interest in the private sector, which is expected to grow as more and more PPP projects get off the ground and play a key role in the growth of the industry.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...