Winds of Change - Northeast emerges as a new telecom investment destination

-

India's north-eastern region comprising Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Sikkim, Nagaland and Tripura presents an emerging opportunity for development and growth. The pace of progress in India's northeast has been rather sluggish compared to other parts of the country due to factors like its mountainous terrain, its distance from the markets, high levels of poverty and unemployment, and limited private sector interest. The web of economic backwardness, political unrest, and the conflict of cultural and ethnic identities have all added up to make India's northeast a cocooned region, where the benefits of the country's high growth have failed to trickle down.

The scenario, however, has been changing gradually. Sensing the immense untapped growth potential, several telecom operators have entered the region with large capex investments and future plans. The scope of growth in the region is evident from the fact that Bharti Airtel alone has been churning out monthly revenues worth Rs 750 million from the Northeast, with a subscriber base of about 3.45 million. The Northeast and Assam telecom circles are among the operator's top 12 most profitable circles in the country.

This growth can be attributed to several factors including the strengthening of policies and regulations, an increase in the number of players in the region, growing competition, the emergence of various technologies that make it easier to cover difficult terrains and the saturation of other markets in India.

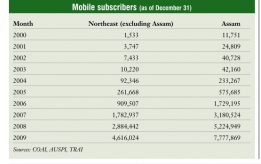

Over the years, the number of operators in the region has grown to eight. Aircel, operating under the banner of Dishnet Wireless, has the highest subscriber base at 3.62 million subscribers as of December 2009, followed closely by Bharti Airtel with 3.4 million users.

However, the region, with a population of over 40 million, has a teledensity of just about 30 per cent compared to India's overall teledensity of 47 per cent. The numbers reflect the fact that there is still a long way to go in terms of establishing and popularising telecom services in the area.

Catering to the needs of rural India has been profitable for Indian businesses.Bharti Airtel, among others, is planning to follow the same strategy. The company planned an investment of Rs 6 billion in the region for 2009-10. Of this, Rs 5 billion was allocated for network rollout and the rest for other associated activities. Airtel has invested Rs 18 billion in the region since 2005. It now aims to cover more highways, tourist hotspots and religious sites in Assam. As of mid-2009, the company had 3,000 towers in the region and it plans to construct 700 more towers in the current fiscal year. It will also open 2,500 Airtel Service Centres in the Northeast.

Idea Cellular is the latest to join the fray. The company launched mobile services in the north-eastern region (including the Assam circle) in December 2009. According to company reports, Idea has already set up a network of 69 cell sites in the region, which will be expanded to 428 by March 2010.

The company has set up a wide network of customer service centres and retail outlets in Meghalaya, comprising six exclusive "My Idea Stores", "Idea Points" and 780 other retail outlets.

The number of operators is likely to rise further as several new operators like S Tel, Uninor and Sistema Shyam TeleServices are planning to enter the region. "In terms of the telecom market in India, the next significant growth area is the potential C circle, comprising India's Northeast region, which covers 26 per cent of the area and 20 per cent of the population," says a senior S Tel official. "Subscribers in this segment will account for 35-45 per cent of the total subscriber base by 2012, making it one of the fastest growing telecom market segments."

Operators have drawn up specific strategies for this region. Most of them are offering local language-based subsidised handsets, lower tariffs and applications that are of use to local communities. In order to expedite network rollout in these regions at reduced costs, they are increasingly opting for infrastructure sharing.

A key trend visible in the operators' strategies is a wave of partnerships to accomplish rural telecom growth. Airtel and Research In Motion have introduced a new service plan, the BlackBerry Personal Mail, specifically for Airtel customers in the Northeast. The plan includes an innovative offering that provides Airtel customers with unlimited email and instant messaging (IM) services on a BlackBerry smartphone for Rs 299 per month. It is the first service plan priced below Rs 300 to offer unlimited email and IM to BlackBerry smartphone customers in the Indian market with internet browsing. Similarly, Nokia has joined hands with Aircel to provide a combo offer for subscribers in the region. With every purchase of Nokia 1203, Nokia 1208, Nokia 1661 and Nokia 3110 handsets, the user receives a free Aircel SIM card. For the first four months, free 25 minutes of local calls are offered. It also comes with valueadded services like free subscription to dialler tunes for two months and a month's free subscription for Aircel alerts.

Such tie-ups are essential given the area that has to be covered and the costs involved. An operator cannot go to a rural market alone, and needs to tie up with various other business groups. State operator BSNL has introduced local tariffs and free roaming for the entire region for both prepaid and post-paid mobile subscribers.

While the region's mobile networks are gradually expanding, the north-eastern states still lack adequate internet and broadband connectivity. Efforts in this direction have been initiated by Airtel and Reliance Communications (RCOM), which recently approached the Bangladesh Telecommunication Regulatory Commission (BTRC) seeking a corridor through the country to reach the Northeast. They have submitted a joint proposal in this regard to the BTRC, offering a standby submarine cable to the country. Thus, in return for allowing Airtel and RCOM to use the corridor, Bangladesh will get a wider link as these Indian companies already have fibre connectivity with Pakistan, Nepal and Bhutan.

Airtel and RCOM are ready to collabNortheast: Key facts States and territories Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim and Tripura Area 262,230 square km Population Over 40 million Population density 148 per square km Official languages Assamese, Bengali, Bodo, Manipuri Telecom operators Bharti Airtel, Aircel, BSNL, Reliance Telecom, RCOM, TTSL, Idea Cellular and Vodafone Essar Mobile teledensity 30 per cent Mobile subscribers 12.39 million, of which 7.78 million are in Assam (December 2009) Wireline subscribers 654,831 (December 2009) orate with any Bangladeshi fibre optic operator to provide telecom services in the Northeast. As per the proposed plan, the Indian companies will build a fibre optic link to Assam from Meherpur on the Kolkata-Meherpur-Dhaka-Haflong route with the option of an alternative route through Kolkata, Meherpur, Dhaka, Comilla and Agartala. They are also willing to bring Myanmar on their network, subject to the approval of its government. At present, the eight north-eastern states get telecom services through very small aperture terminal at a high price.

The government has also been playing a role in promoting telecom growth in the region. Given that optic fibre connectivity is essential for carrying large volumes of data and backhaul, the Universal Service Obligation (USO) Fund is undertaking a fibre connectivity project in Assam at a cost of Rs 1.5 billion. This project is likely to be launched in the next few months and the fund has commissioned Telecommunications Consultants India Limited to identify the gaps in coverage in Assam. The project will be then extended to other parts of the country. Also, under the USO Fund's mobile tower scheme for the rural and remote areas, subsidies have been provided for 579 towers in the region.

Like Jammu & Kashmir, many areas of the Northeast are beset with insurgency. This places larger responsibility on telecom operators to closely monitor usage. There is also a threat that prepaid connections can be banned any time, as in the case of Jammu & Kashmir where these connections have been banned with effect from November 1, 2009. Unlike in other states, operators in the Northeast have to obtain approval for providing prepaid services, which need to be renewed from time to time.

The government has recently eased some norms for operators in the region. While there has been a union home ministry restriction on setting up towers within 10 km of the international border, the distance has now been reduced to 500 metres. As a result, several operators like BSNL have been further deepening their networks in the region. Of late, some of the trading hubs and checkposts in areas like Meghalaya, Assam and Tripura along the border with Bangladesh have been brought under BSNL's network. The operator has recently launched 3G services in Guwahati (Assam), Gangtok (Sikkim), Agartala (Tripura) and Shillong (Meghalaya).

Apart from security concerns, the region's difficult terrain has also been a challenge for telecom operators. However, with technologies like Wi-Max and several infrastructure-sharing options, the issue is in the process of being resolved.

In terms of new business opportunity, the region is clearly emerging as a key growth area for operators dealing with increasingly saturated markets within India. Their scope not only lies in the individual user segment but largely in terms of the growing industrial and corporate base in the region.

Under the "Look East Policy" of the union government, the Ministry of Development of North Eastern Region has been showcasing the strengths of the Northeast to the neighbouring countries to set up new industries, attract foreign investments, boost tourism, and enhance business and trade.

In one of the largest externally funded infrastructure investments in the northeastern region, the Asian Development Bank has decided to assist the capital cities of five of the north-eastern states with the objective of improving infrastructure and sanitation. The bank will reportedly provide a loan of up to $200 million for the North Eastern Region Capital Cities Development Investment Programme in Shillong (Meghalaya), Aizawl (Mizoram), Kohima (Nagaland), Gangtok (Sikkim) and Agartala (Sikkim).

The state governments' cluster plantation scheme, under which rural households are provided with financial assistance, equipment, and training to carry out the production process, thereby generating more profit and employment, has immensely benefited the traditional silk growers of Assam. India's northeast has the potential to become a hub for several industries, especially telecommunication as it is essential for the economic growth of the region. It is proved that the contribution of the telecom sector to the economic growth of the country has been immense. "The telecom sector is directly contributing more than 1.5 per cent GDP of the country, and has a multiplier effect on growth because of connecting the people and business around it," states the minister of state for communication and information technology, Gurudas Kamat.

Moreover, the region has the potential to promote international trade due to its strategic landlocked location, which invites the bordering countries to create effective trade relations. Given the fact that the Northeast is the closest land mass connecting the dynamic economies of South and Southeast Asia, it has attracted several investment proposals in the past from countries in these regions. In February 2009, Air Asia, a leading aviation company of Thailand, showed its willingness to connect Guwahati through its services. Such efforts call for a strong communication network and provide an incentive for the telecom companies to expand their reach in the region.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...