Technology Leap - Upgrading to more powerful networks

-

Technologies in the telecom industry have been constantly evolving for over five decades. The pace of evolution has noticeably increased over the past 10 years, especially in the wireless and internet communications space. The original telecom network, which comprised a simple set of wires that connected locations with a manual switchboard and later by mechanical and crossbar switches, has undergone a complete revolution. Technology that was previously viewed as arcane and out of reach has now become easily accessible to the common man with the phone becoming almost indispensable in businesses and homes, and the consumer using the phone for more than just voice.

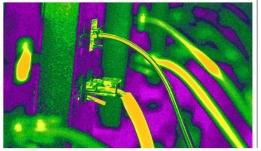

The past decade has witnessed big technology changes in the telecom landscape with wireless operators upgrading to more powerful networks, the emergence of fibre optics and the rapid proliferation of broadband, cellular and other access technologies. These have driven the rollout of many new services and have spurred innovation in multi-functional devices. As a result of these developments, the communications network has become more complex and there has been an exponential growth in bandwidth demand over the past few years.

The progress over the past 10 years includes digital switching and transmission, fibre transport, Synchronous optical network (SONET), synchronous digital hierarchy (SDH), optical data rates, wireless technologies (2G, 3G, Wi-Max, etc.), digital cellular substitution, wireless/ wireline competition, internet demand, broadband access (for example, DSL and cable modems), bandwidth demand and DTV/HDTV, to name a few.

Convergence of these technologies has made it technically possible to deliver voice, data and video services to a subscriber through the same network. This has united the traditionally discrete telecommunications, broadcasting and networking sectors.

While plain old telephone calls continue to be the industry's biggest revenue generator, the trend is likely to change owing to the advances in network technology. As voice becomes commoditised and voice margins decline, telecom will increasingly become less about voice and more about data (text and images), with the internet replacing voice as the staple business. High speed internet access, which delivers computer-based data applications such as broadband information services and interactive entertainment, is rapidly making its way into homes and businesses around the world.

However, there is still a lot left to be achieved. There is a lot of expectation being built around 4G technologies like long term evolution and Wi-Max, as well as next-generation networks, which promise to create a clear separation between the services offered and the underlying network over which these services will be transported.

tele.net takes stock of the key technology developments in the wireline, wireless and networking domains over the past decade and what the future can offer...

Broadband

A decade ago, dial-up internet access with speeds of 30 kbps had captured the attention of the industry and there seemed to be little room for improvement in serving the emerging needs for communication. According to the US Department of Commerce, in 2000, a total of 304 million people worldwide had internet access – an increase of almost 80 per cent compared to 1999, and the US and Canada accounted for 50 per cent of the total.

In the past decade, internet technologies have changed dramatically, with an explosion in the uptake of ground-breaking applications, Web 2.0 and social networking offerings. According to Northwest Telecom experts, internet speeds have become 1,000 times faster. Each year has witnessed new technologies appearing in the market. These developments have redefined the way organisations and individuals use the internet.

Broadband is one such technology that has played and continues to play a pivotal role in shaping the industry's future. While the origin of this technology corresponds to high speed internet access, it has gradually evolved into a multi-purpose access vehicle enabling a range of services (for example, voice, video telephony and video entertainment services). Consumers and businesses are increasingly looking to take advantage of these advancements, which is driving the huge latent demand for fast internet to all mobile devices.

DSL technology along with cable broadband initially drove the growth in the broadband arena. These continue to be the dominant global broadband technologies with over 270 million subscribers, accounting for approximately 65 per cent of the total broadband market. According to Research & Markets, the DSL subscriber base is expected to cross 331 million in 2012 with DSL access revenues reaching $136.4 billion. Fibre-to-thepremises (FTTP) and wireless broadband have further propelled growth in this segment. Telstra first retailed asymmetric digital subscriber loop (ADSL) technology in the US in 1999 and other providers started providing it by 2000. However, it was only by end-2002 that DSL gained worldwide popularity, reaching over 30 million subscribers. Since 2006, there has been a shift towards fibre with operators showing a preference for FTTP with a dedicated wavelength for video.

By 2003, every major carrier had a DSL plan in place. In South Korea, most of the homes were wired with this technology and in the US, DSL became a major new source of revenue, if not profit. Besides retail consumers, growth in DSL was also led by a huge pent-up demand created by the large number of smalland medium-sized businesses, the expansion of the SOHO market, and the growing needs and requirements of teleworkers. However, in India, despite the government prioritising broadband connectivity, growth has lagged, primarily due to the lack of fixed line infrastructure. Broadband uptake started as late as 2006 and with a little over 7.8 million subscribers currently, its penetration is still dismal compared to the rest of the world. This may change with WiMax and 3G services expected to be available on a larger scale by end-2010.

DSL uses the existing copper to provide data over voice, independent voice and data transmission, and plain old telephone service. Since DSL is a loop technology, and not a broadband access technology, it has been deployed in different configurations and in different types of equipment. There are now nine variants of DSL which include the ADSL Annex J in Europe, which supports 3-Mbps symmetric service; G.SHDSL, with similar functions; various flavours of very high bit rate DSL (VDSL), which offer speeds of up to 50 Mbps depending on the loop length; and a number of DSL varieties that support the bonding of multiple pairs to create true full-rate Ethernet connections in the access network.

DSL also paved the way for "triple play", a trifecta of voice, video and data over a single access connection. Using VDSL, connections of 20 Mbps and beyond can be provisioned to a home, with ample room for three simultaneous cable television sessions, symmetric data and voice, all through one telephone line.

As a result of the broadband revolution, applications like video-on-demand, internet protocol television (IPTV) and voice over IP have flourished in the latter part of the decade as service providers explored alternative revenue-generating streams to augment the revenue from voice.

SONET and SDH, a time division multiplexed system, were the preferred transmission methods over fibre optics during the past decade. However, the optical network is evolving to accommodate the growing demand for transporting large data and video streams. Because such traffic is served better with wavelength division multiplexing (WDM) than with SONET/ SDH systems, the WDM system market will eventually overtake the SONET/SDH multiplexer market. But this will take some time as the metro network is still principally serviced by SONET/SDH multiplexer systems. There will be a market for SONET/SDH multiplexers as long as voice drives revenue. While wireline operators have switched their focus to data services, wireless operators are still focused on voice services to drive their business. These two opposing forces continue to mould SONET/SDH.

Wireline telecom operators have focused on delivering new services beyond POTS. This shift of focus to faster broadband speed and video services has directed the operators' demands towards equipment capable of delivering higher data rates economically. The access network, as a result, has evolved to VDSL and passive optical network (PON) equipment capable of delivering 100 Mbps-plus speeds. Optical equipment to back-haul these new services at the aggregation sites must be able to transport multiple gigabit Ethernet (GbE) trunks, a requirement that created a demand for WDM metro as an economical optical transport alternative.

During the same period, the SONET/SDH multiplexer market continued to grow with the positive market force created by the wireless telecom operators. They wanted more subscribers and an increased number of base stations to ensure a high quality voice experience. As wireless coverage proliferated and voice quality improved, users increasingly began choosing mobile phone service over fixed phone service.

The equipment used to back-haul mobile data from base stations continued to be multiple T1 (1.5 Mbps) line rates over copper or microwave. The optical equipment to backhaul at the aggregation sites to ensure voice quality and network protection also continued to be the "tried and true" technology, SONET/SDH multiplexers.

As the industry enters a new decade, wireless telecom operators are beginning to follow the wired world, offering its users higher data speeds. This will, once again, favour WDM technology at the aggregation sites that are currently serviced with SONET/SDH multiplexers. Growing use of WDM technology for optical transport has been the trend as access speeds increased beyond 56 kbps dial-up. The market for WDM systems has expanded at a compounded annual growth rate of 28 per cent over the past five years, and the future might call for even more WDM metro systems as access technology advances to 10 gigabit PON. Migration to WDM technology is likely to spread to the backhaul of mobile data at base station aggregation sites as operators deploy higher capacity mobile base stations to deliver access to high speed broadband to all. The success of Apple's iPhone has shown that users will readily consume 30 times the bandwidth offered with 3G and are willing to pay for it (operators are currently upgrading to the latest 3G mobile technology, HSPA+, with peak data rates of 21 Mbps).

The addition of other mobile internet devices, such as netbooks with embedded 3G connectivity, is further reinforcing the mobile data ecosystem by demanding another order of magnitude of bandwidth. The evolution to 4G mobile technologies such as LTE will accelerate this migration further, with peak data rates of more than 300 Mbps per base station.

Like wireline infrastructure, wireless infrastructure will eventually be driven by data rather than voice services. The economics to back-haul this higher bandwidth will thus give WDM technology an edge. These market dynamics, driven by higher broadband speeds and faster mobile networks, will eventually reduce the demand for SONET/SDH multiplexers and increase demand for WDM metro by 2012.

3G technology, developed in the early part of the past decade, offers speeds of more than 144 kbps, supporting applications such as video transmission, video conferencing and mobile broadband. This technology uses the 1885-2025 MHz and 2110-2200 MHz frequency bands and consists of two main standards, CDMA2000 and WCDMA/UMTS (universal mobile telecommunications system). It also includes other 3G variants such as NTT DOCOMO's freedom of mobile multimedia access and time division synchronous code division multiple access, used mainly in China.

NTT DOCOMO launched the first 3G network in Japan in 2001 and SK Telecom launched the second in South Korea. Today both countries have 3G penetration rates in excess of 80 per cent. While 3G was launched in Europe in 2001, rapid deployment took place only after 2005 as financial considerations during 2001-04 hampered developments in 3G rollouts.

Following the successful deployment of UMTS networks around the world, operators started deploying HSDPA from 2006, which was a relatively straightforward upgradation.

Globally, there are more than 300 commercial HSDPA networks today. Research firm Informa Telecoms and Media has pegged the UMTS/HSPA subscribers at over 400 million as of September 2009. 3G is likely to represent 1.4 billion subscriptions or an 85 per cent share of the mobile wireless broadband market by end-2012, playing a key role in providing broadband in developing countries like India which lack an extensive fixed line infrastructure.

In India, only the state incumbents are offering these services currently. The launch of 3G is awaited, impeded primarily by the lack of 3G spectrum. Private operators are expected to roll out services by end-2010, following the 3G auctions in February.

3G applications and devices have multiplied since its launch. Mobile broadband has grown at a rapid rate and its users have exceeded fixed line broadband users in global markets. In countries like Singapore and Malaysia, mobile broadband witnessed rapid growth with the launch of 3G services over the past few years. There is a clear growth path for mobile broadband whereby GSM subscribers migrate first to 3G/HSPA and then to LTE.

Large-screen smartphones like Apple's iPhone and laptops have now morphed into mobile gadgets in the form of netbooks. Along with these, consumers now demand continuous 3G connectivity to enable intensive use of high-bandwidth applications resulting in a tenfold increase in data traffic. With netbooks set to get a dedicated browser-based Google operating system, and smartphones set to penetrate further, data usage will only grow.

While there are different flavours within the Wi-Max standard, the most widely used standards are fixed (802.16d) and mobile (802.16e) Wi-Max, which use orthogonal frequency division multiplexing and orthogonal frequency division multiplexing access.

This technology witnessed a 91 per cent increase in its subscriber base during 2007-08, as it entered a phase of commercial availability that made volume applications like metro-wide mobile broadband and embedded consumer applications feasible. According to industry experts, other mobile Wi-Max-enabled devices were certified in the latter half of 2008 and the growth rate for base station sector deployments outpaced that of CPEs, showing that networks are expanding faster than the adoption curve.

Currently, mobile Wi-Max is the most used version of the standard and is even being pitted against LTE as a 4G technology. This version of the standard was ratified in December 2005 and has been available for a number of years.

Going forward, there is no question that mobile broadband will be a part of the telecom landscape. As the number of networks and overall coverage continue to expand, Wi-Max is likely to become an option for broadband connectivity and data backhaul for a number of markets. The technology has industry participation by a number of companies including Sprint Nextel, Intel, Motorola and Nokia. While there is potential for Wi-Max in mature markets, a clear opportunity lies in the emerging markets of South Asia and Latin America, which are witnessing some of its biggest planned deployments. In India, WiMax is expected to play a key role in increasing broadband penetration, particularly in rural areas which have limited or no fixed line infrastructure. While BSNL has rolled out the service, Wi-Max will witness widespread deployment only by end-2010, following the spectrum auctions.

Operators are also embracing cloud computing for application delivery because it places more value on the core network and increases customer "stickiness". However, there are challenges of response time and coverage, and network security and vulnerability issues make customers hesitant. Meanwhile, other players, including device suppliers, are engaging in a technology battle between capabilities in the cloud and at the edge. Other cloud companies, such as Amazon and Google, provide these services across wireless and fixed line in an "over-the-top" way, relegating operators to "transport pipe" status. However, in future, the differences between over-the-top players (Google, Amazon) and carriers are likely to blur with increasing cooperation between web companies and telecom operators.

Meanwhile, the replacement of the old circuit switched backhaul with all-IP networks is rapidly gaining momentum. While the timelines for these next-generation networks appear hazy, consumer experience is only going to get better with high speed bandwidth availability and a brand new class of innovative applications and services.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...