Rural Opportunity - Operators aim for the next level of growth

-

Over the past decade, the telecom secor has been transformed by huge nvestments, the rapidly expanding role of the private sector, growing competition in most market segments and extensive rollout of mobile networks.

As a result of these developments, the sector has witnessed exponential growth, driven primarily by the wireless segment. Networks have also been rolled out in areas where telecom services were not available until 2006.

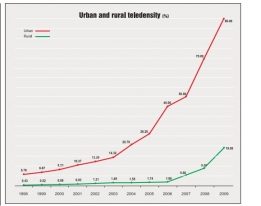

The teledensity, which stood at 2.3 per cent in March 1999, has today reached over 44 per cent. Subscriber additions have risen from a modest 0.68 million for the entire year in 2000 to over 12 million a month. During the same period, the rural and urban teledensities have grown from 0.52 per cent to 19 per cent, and from 6.9 per cent to over 90 per cent respectively.

Till 2006-07, most of the growth in the telecom sector was limited to the urban and metropolitan pockets of the country. The hinterland, which accounts for 70 per cent of the country's population, was technologically a no-man's land with the teledensity increasing from 0.52 per cent in 1999 to only 1.9 per cent as recently as in 2006. Data from the Telecom Regulatory Authority of India (TRAI) indicates that the rural areas accounted for roughly one-tenth of all phones in India, many of which worked intermittently due to poor maintenance of equipment in remote areas where access to power and transport is poor.

For the better part of the decade, connecting rural India had been primarily Bharat Sanchar Nigam Limited's (BSNL) responsibility. Private telecom operators prioritised their capital and attention to serve more lucrative and convenient operational geographies. Their initiatives in rural India were marginal due to the high costs involved.

Providing connectivity in these regions continues to be a challenge due to poor road networks and inadequate power supply. In addition, the low disposable income of the average rural subscriber may lead to a decline in the operator's average revenue per user (ARPU). Moreover, as the coverage of a tower is lesser in these areas as compared to the plains, more towers are required.

Despite these hindrances, there has been a sea change in the operators' perspective over the past two years. Faced with saturated urban markets, the rural sector has now become a key focus area for operators as these regions represent the next level of growth for the sector. Aided in large part by government intervention, operators have expedited network rollout in these regions over the past two years. This is a far cry from the time when BSNL was the only operator setting up rural networks.

As a result of these developments, rural teledensity has witnessed a manifold growth over the past two-three years, primarily in the wireless domain. The rural areas now account for a bulk of the monthly subscriber additions.

While rural teledensity increased marginally over the next few years, there was negligible rural mobile coverage till 2006 and the growth was primarily driven by the PSUs and the Universal Service Obligation (USO) Fund.

As private operators started rolling out mobile networks, telephony in these regions witnessed growth. This was also driven by the availability of low-cost handsets and falling tariffs. Rural teledensity rose from 1.9 per cent in 2006 to over 5 per cent in 2007, a 189 per cent growth rate. This trend accelerated over the next few years as operators crafted innovative strategies to increase the rural subscriber base. Over the past two years, the rural wireless subscriber base has grown to 120 million.

While the trend is likely to continue over the next few years, broadband penetration in these regions continues to be negligible. Broadband will play a key role in supporting applications like e-learning, telemedicine and e-governance, which are essential for the socio-economic development of villages.

Over the past decade, the government has taken several regulatory measures to ease funding, which has been one of the main stumbling blocks in providing services in these areas. A variety of mech nisms have been introduced to fund rural telecom. These include the access deficit charge (ADC), the universal access levy (USL) for the USO Fund, reduced charges on spectrum, and waiver of other levies.

The USO Fund, to which telecom operators contribute 5 per cent of their gross revenues, was created in 2002 to fund rural telephony through an auction for subsidy. The fund has played a key role in financing rural infrastructure. While allocations from the fund were initially restricted to fixed line services only, with the amendment of the Indian Telegraph Act, 1885 in October 2006, mobile and broadband services in rural and remote areas were also brought under the ambit of the USO Fund. Financial support was extended for both passive (land, tower and power back-up) and active (base transceiver station, antennaes and a portion of the backhaul) infrastructure by means of a bidding process.

The government also played a key role in promoting infrastructure sharing which helped operators reduce costs and accelerate rollout into these low-margin areas.

The government's shared mobile infrastructure scheme, which provided subsidy support for setting up mobile towers has also been successful. Approximately 7,871 towers have been set up in the first phase of the scheme and another 11,000 are envisaged in the second.

The government now intends to provide financial support for using renewable energy sources, extending optic fibre connectivity and providing wireless broadband access in these regions.

The operators developed innovative marketing strategies tailored for these regions. Bharti Airtel appointed distributors at the tehsil level and used the existing channels of fast moving consumer goods in these areas to push its products. Its rural penetration increased from 6 per cent in 2007-08 to over 13 per cent in 2009. In 2008, the company successfully partnered with public sector fertiliser major Indian Farmers Fertilizer Co-operative Limited (IFFCO), to provide telecom services to rural households. Riding on IFFCO's cooperative network, the joint venture sells subsidised handsets with Airtel connections to farmers.

Similarly, TTSL used a door-to-door marketing strategy, involving members of gram panchayats and trained marketfeelers to make residents of villages and small towns aware of the usefulness of mobile telephony.

Operators have bundled mobile handsets with products specific to rural customer needs, besides tying up with vendors to offer subsidised handsets. Vodafone Essar has, for instance, tied up with ZTE Corporation for low-cost handsets.

Handset manufacturers are also gearing up to tap this massive opportunity. Nokia is using channels with territorial reach like Doordarshan and All India Radio to reach the interiors. The company has also incorporated nine Indian languages on certain handsets to promote sales. This will become a focus area in the future.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...