Wireline Woes - Continued decline in subscribers and revenue

-

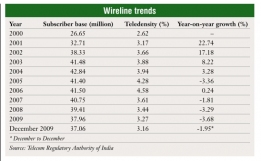

In sharp contrast to the wireless segment in the country, which has witnessed exponential growth in the past decade, the wireline business has seen a steady decline in its user base. The decline has been particularly visible in the past five years. The basic subscriber base, both wireline and wireless in local loop (WLL), declined from 48.93 million in December 2005 to 37.06 million in December 2009.

The good news, however, is that, in the past few months, the metros have recorded some monthly subscriber additions. This is on account of service providers offering fixed line services bundled with broadband connections in a bid to stem the churn and ramp up growth.

Prior to the advent of wireless services in the country, the wireline segment had been the sole means of providing connectivity. A review of the wireline sector over the past decade and the key trends...

Early years

This was a big opportunity for private players as India had a huge untapped market for telecom services. It was expected that competition would help increase the teledensity of the country and thereby enable the sector's growth.

Problems, however, cropped up when the government permitted the use of WLL technology to provide fixed line access. As WLL could support mobile telephony and the licence fee was low, private operators like Reliance Communications (RCOM) (then Reliance Infocomm) and Tata Teleservices Limited (TTSL) started offering mobile services at cheap rates. This led the government to introduce the unified access service licence regime in 2003, giving operators the option to offer fixed or mobile services, and in some cases both. Around the same time, the state incumbents, in order to survive the competition from private operators, increased their monthly rentals and decreased the number of free and discounted calls for the first time. The pulse duration of local calls was also decreased. This eroded their number of subscribers, who found the wireless segment to be a more feasible option.

With these changes and mobile telephony picking up significantly, the number of fixed line subscribers grew by only about 3 million between March 2002 and March 2005. In 2004-05, the wireless subscriber base overtook the wireline subscriber numbers for the first time. In March 2005, while the wireline subscriber base stood at 41.4 million, the number of wireless subscribers crossed the 50 million mark.

Thereafter, fixed line operators, with the exception of MTNL, started losing subscribers. More worryingly, they started seeing a decline in their average revenue per user. The private operators tried to counter this by offering innovative value-added services (VAS) like voice mail, audio conferencing and short messaging service (SMS), all of which failed to make a difference.

The declining subscriber trend in the wireline segment has since been continuing, primarily on account of the easy accessibility of mobile services and their ease of use, VAS and cheap tariffs. In the rural areas too, users have preferred to avail of the wireless option. Moreover, broadband can also be delivered more efficiently and at a much faster rate through wireless technology, making it difficult for wireline teledensity to increase in the rural areas.

Recent trends and operator initiatives

Among private operators, Sistema Shyam TeleServices (under its MTS brand) registered the most severe decline of 19.7 per cent in subscriber numbers between November 2009 and December 2009. TTSL, on the other hand, registered the strongest growth of 1.78 per cent during the same period. Bharti Airtel and RCOM also witnessed a marginal increase in subscriber numbers. Among the various circles, Delhi recorded the highest monthly net subscriber additions while Maharashtra recorded the lowest.

To boost subscriber numbers as well as revenues, operators have had to come up with innovative schemes. In 2005-06, BSNL and MTNL launched the One India Plan, which allowed all users to make calls across the country at Re 1 for three minutes within their network and at Re 1 per minute for calls to private networks. In addition, BSNL bundled its fixed line services with mobile and broadband services.

RCOM also lowered its tariffs and announced new schemes such as zero rentals and the lifetime free incoming plan. Further, in a bid to capitalise on the relatively untapped rural market, it rolled out a massive rural direct exchange lines project, providing telephone connections to over 0.74 million new subscribers in 203 short distance charging areas covering over 40,000 villages by March 31, 2007 under the Universal Service Obligation (USO) Fund.

In urban areas meanwhile, all the major operators were focusing on corporate clients to boost their revenues. Companies like Bharti Airtel also planned to transform their entire fixed line network to an IP/broadband network in a phased manner in order to be able to offer high-end services like triple play, media-rich VAS, high speed internet, multi-protocol label switching and virtual private network for both retail and business customers. To stay ahead in the highly competitive telecom market, Bharti Airtel also forayed into the internet protocol television (IPTV) and direct-tohome businesses, with an initial launch in the Delhi circle in February 2009. The company also launched a 16 Mbps wireline broadband in select cities, to be offered over its carrier Ethernet network.

In order to help BSNL sustain its fixed line operations following the removal of the access deficit levy from September 2008, the government decided to provide the company about Rs 20 billion annually. BSNL, on its part, reduced the rental on the Gramin Telecom plan from Rs 110 to Rs 75 and for the Sulabh plan from Rs 120 to Rs 99, lowering call charges and thereby encouraging fixed line adoption in rural areas. Further, in March 2009, it slashed its national long distance (NLD) tariff by half, enabling its rural users to make calls at Re 0.04 per minute from their fixed line phones. It also did away with any additional security deposit for accessing NLD services. Earlier, in June 2008, BSNL had reduced the call rates for intra-circle calls to its fixed line network by 50 per cent and also permitted a call duration of 120 seconds per pulse. It further introduced two new broadband plans under the USO Fund scheme, offering 512 kbps to 2 Mbps bandwidth, which could also be availed of by rural customers without any registration, security deposit or installation fee.

MTNL too introduced new services to ramp up growth and revenues. In the Delhi circle, it offered a call forwarding facility, which enabled its fixed line users to forward incoming calls to another fixed line/CDMA/GSM number. It also enabled bill payment over SMS through its tie-up with mobile transactions service provider Suvidha. In 2006-07, MTNL launched IPTV services and met with success in reducing its churn rate to some extent. In 2007, the operator also launched internet telephony, a facility that permitted international long distance calls to be made for as little as Re 1 per minute through fixed line phones. MTNL also became the country's first operator to offer Netfone, a voice over IP service, by tying up with Aksh Optifibre. Meanwhile, Himachal Futuristic Communications Limited is planning to undertake several broadband initiatives including triple-play services and tie up with educational institutes for offering Wi-Fi.

Looking ahead

According to a Frost & Sullivan industry analysis, fixed line revenues are expected to touch $12.2 billion while mobile revenues will reach $39.8 billion in India by 2012. However, it remains to be seen whether the initiatives being taken by the fixed line operators will actually help in reversing the current market trend and turn these targets into reality.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...