500 Million and More - Mobile segment pushes the envelope

-

The Indian telecom sector has undergone a revolution over the past decade and is currently the second largest telecom market in the world after China with over 550 million subscribers and a teledensity of over 45 per cent. This is a sharp rise from less than 30 million subscribers and a teledensity of 2.7 per cent in 1999. This growth is attributed primarily to the wireless space which accounts for over 90 per cent of the total subscriber base at over 534 million subscribers as of December 2009, up from less than 2 million in 1999.

The wireless sector's growth has put India on the global map. With a population of 1.1 billion and penetration rates of below 50 per cent, the country offers enormous potential to global operators faced with saturation in their domestic markets. Industry behemoths like Vodafone, Telenor and NTT DOCOMO and other global operators like Bahrain Telecom and Etisalat have already entered the market.

Even within the country, the sector has attracted companies from diverse verticals like real estate and consumer goods. The mobile segment, with eight to ten service providers in some circles, is a welcome aberration when compared to the global average of three to four telecom operators and represents a unique business model.

Operators expanded their coverage and, as a result of the increasing competitiveness, started lowering prices to the point where these finally became the lowest in the world by 2004. Affordability and demand for mobile services further increased when, in 2003, the country switched from a receiving-party-pays to a calling-party-pays method of charging. The emergence of low-cost handsets and the rising popularity of prepaid options further propelled growth in the segment.

The accelerated growth of the wireless sector can also be attributed to the launch of CDMA-based services. Despite being a late entrant in the Indian wireless space (CDMA services began in November 2003), CDMA has maintained a steady pace of growth. CDMA subscriber growth in the period 2002-05 was pegged at a whopping 203 per cent and it currently accounts for about 28 per cent of the wireless market.

The growth rate further accelerated 2003 onwards with the incumbent Bharat Sanchar Nigam Limited (BSNL) and the fourth licence winner, Reliance Communications (RCOM), entering the wireless space. The intensifying competition led to further falls in airtime rates as operators began incentivising schemes and offered special low rates during off-peak hours. Reliance's Monsoon Hungama, which offered a CDMA connection and a handset for Rs 501, started a new trend of clubbing handsets with connections at the entry level in May 2003.

The constant reduction in tariffs also triggered growth in the prepaid segment which accounted for about 55 per cent of the total mobile subscriptions in 2002.Mahanagar Telephone Nigam Limited's (MTNL) launch of prepaid services in February 2002, offering low airtime charges, kicked off a price war. All operators like Bharti Airtel and Essar followed suit and some even reduced their airtime charges by over 46 per cent. The prepaid option became appealing to the consumers overnight. Moreover, a continuous drop in prepaid denominations, from Rs 300 in 2002 to Rs 100 in 2004, and a further reduction of over 60 per cent in prepaid tariffs by RCOM added to the segment's growth (by end-2004, prepaid subscribers accounted for over 70 per cent of the total mobile subscriber base). The price war raged across both the prepaid and postpaid segments. As a result, tariffs reduced further by nearly 50 per cent to become the lowest in the world in 2004. This, coupled with the decline in handset prices due to import duty cuts, effectively lowered the entry barrier for cellular services. Once fancied as "a toy for the rich", the mobile phone started becoming an essential for the masses.

Though fixed line growth still accounted for a bulk of the total subscribers, wireless connections were growing at a faster pace 2003 onwards and by October 2004, according to Telecom Regulatory Authority of India estimates, the mobile subscriber base at 44.51 million overtook the 43.96 million fixed line users in the country.

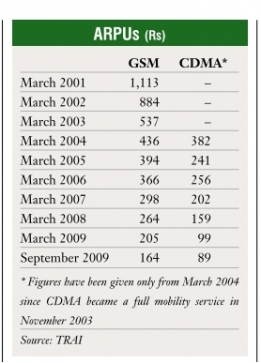

Meanwhile, with mobile services becoming affordable to budget users, the average revenue per user (ARPU) reduced consistently over the years for both GSM and CDMA players. The all-India blended ARPU per month in the GSM segment declined by over 60 per cent from Rs 1,113 in March 2001 to Rs 436 in March 2004.

On the regulatory front, the introduction of the unified access service licence (UASL) regime in November 2003 paved the way for consolidation in the industry. The major deals of 2004 included Idea Cellular's acquisition of Escotel Mobile Communications for about Rs 12 billion; Bharti Tele Venture's (now Bharti Airtel) acquisition of a 67.5 per cent stake in the mobile operations of Hexacom for Rs 4.3 billion; and Hutchison Essar's (now Vodafone Essar) integration of the Essar-owned Aircel Diglink circles (Haryana, Uttar Pradesh [East] and Rajasthan) into its fold.

Following this consolidation, GSM operators like Bharti, BSNL, Idea Cellular and Hutchison, and CDMA operators like Tata Teleservices Limited (TTSL) and RCOM started dominating the Indian mobile space with Bharti Airtel in the lead.

The industry witnessed a major consolidation and expansion phase with operators trying to establish a pan-Indian presence. By end-2005, Bharti Airtel, RCOM, TTSL and BSNL had become prominent national players.

Meanwhile, the government's decision to raise foreign direct investment in the sector in February 2005 paved the way for the entry of global players. Aircel was acquired by Malaysian mobile company Maxis and Vodafone (the largest global player by revenue) first acquired a 10 per stake in Bharti Airtel in November 2005, and then accomplished the Indian telecom sector's biggest deal by acquiring a 67.5 per cent stake in Hutchison-Essar for $10.9 billion.

In 2005, the trend of recharge coupons with denomination values ranging from Rs 10 to Rs 200 for low-end prepaid users and the introduction of lifetime validity schemes on prepaid cards fuelled growth. Tariffs dropped further as operators continued to tailor service packages for low-end users. In February 2006, the state incumbents launched the "one India tariff" whereby calls from BSNL and MTNL phones anywhere in the country were charged at a flat rate of Re 1 a minute. This move forced other telecom operators, including Bharti and Idea Cellular, to follow suit.

The focus on low-end users also resulted in falling handset prices 2005 onwards, with Motorola launching a handset priced at Rs 1,700. The lowest prices were recorded in May 2007 when RCOM introduced a handset with connection for Rs 777 and sold 1 million connections within a week. GSM operators also began tying up with handset manufacturers to bundle instruments with their tariff plans. Bharti entered into an alliance with vendors like Nokia, Motorola and Huawei to offer bundled phones at subsidised rates to tap the midand lower-end segments. The Indian mobile segment, with eight to ten service providers in some circles, is a welcome aberration when compared to the global average of three to four telecom operators and represents a unique business model. These developments made mobile services more affordable with the average subscriber outgo being a little over Re 1 for GSM and Re 0.71 for CDMA by end2007. As a result of the steady decline in tariffs, ARPUs continued to fall and, at Rs 275 as of end-2007, were the lowest in the world. To reduce the impact of low tariffs, operators started focusing on value-added services (VAS) like mobile music, ringtones, wallpapers and SMS.

As operators expedited network rollout and accelerated their push into the low-margin areas, passive infrastructure sharing emerged as a key trend in the industry to reduce costs. The operators also began hiving off their physical infrastructure into separate tower companies. In addition, the increasing adoption of passive infrastructure sharing paved the way for the emergence of independent tower companies in 2007.

Towards end-2007, the sector drew interest from both global and Indian companies with the Department of Telecommunications receiving over 570 applications for telecom licences. Apart from leading global telecom giants for tie-ups with various Indian companies, those with a presence in the real estate, information technology, automobile, finance and infrastructure sectors also applied for mobile licences.

Bharti Airtel maintained its lead, followed by RCOM, Vodafone Essar, BSNL, Idea Cellular and TTSL. The operators strengthened their focus on the rural regions with innovative schemes and aggressive marketing campaigns.

Their efforts paid off as the rural teledensity multiplied to 19 per cent over the past three years from a dismal 1.9 per cent in 2006. However, with Category C circles accounting for the bulk of subscriber additions, operators continued to battle falling ARPUs which dropped to Rs 164 for GSM and Rs 89 for CDMA services in September 2009.

Well entrenched in the domestic market, Bharti Airtel and RCOM made attempts to expand overseas. While Bharti Airtel launched services in Sri Lanka and the Jersey and Guernsey islands, RCOM formed a joint venture with Sri Lankabased Electrotels to offer GSM services. Bharti Airtel also managed to gain a foothold in the Bangladesh telecom market by acquiring Warid Telecom in January 2010. However, both operators failed to acquire African telecom operator MTN.

In the meantime, BSNL and MTNL launched 3G services in the beginning of 2009 even as the other operators were kept waiting for the 3G auctions. The auction of 3G licences in the country has been repeatedly delayed due to disputes within the government.

With the government allowing dual technology in 2008 and awarding licences to six new players, CDMA operators RCOM and TTSL launched their GSM services on a pan-Indian basis to meet competition levels, and six new players – Datacom, Loop Telecom, Shyam Sistema TeleServices (SSTL), STel, Unitech Wireless and Etisalat DB India (formerly Swan Telecom) – entered the telecom space. Meanwhile, existing players like Idea Cellular and Aircel ramped up to establish a nationwide footprint.

Consolidation in the industry continued with Idea Cellular acquiring a 40.8 per cent stake in Spice Communications. The Indian telecom market managed to coax Japanese operator NTT DOCOMO out of its lair. Spending its way out of a recession, the Japanese carrier acquired a 26 per cent stake in TTSL for $2.7 billion towards end-2008. New entrants Unitech Wireless, SSTL, STel and Swan Telecom also offloaded stakes to global players like Telenor, Sistema, Batelco and Etisalat.

While Unitech Wireless, STel, Loop Mobile and SSTL successfully launched their services, Datacom and Etisalat are expected to begin operations shortly. TTSL's introduction of per-second billing in the GSM space and the pay-per-use model in the CDMA segment in 2009 set off an unprecedented tariff war that brought down the already low tariffs towards end-2009. Every operator followed with same levels of tariff cuts. While this cut-throat competition maintained the 15 million monthly subscriber addition figure, it hit the margins of all telecom operators and the industry experienced a collective decline in revenues.

Even as questions are being raised about the ability of the sector to continue on its growth trajectory, it is now readying for the launch of 3G and Wi-Max services. As subscriber numbers grow and plateau over the next few years, operators will need to focus on ARPUs, churn and the growth of non-voice VAS as well as the inevitable consolidation faced by any large, fast growing and maturing market.

As the Indian telecom market evolves from this unprecedented growth phase into a more controlled and mature phase, there will be a need to shift direction and focus to sustain this expansion.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...