Stake Sale - Sector continues to attract foreign investor interest

-

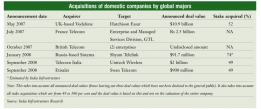

Despite the growing uncertainty and concern following the crash of international financial giants like Lehman Brothers, which impacted markets worldwide, it is reassuring to know that India's rapidly growing telecom market still holds promise for the global investment community. This is evident in the recent acquisitions made by Telecom Italia and Emirates Telecommunications Corporation (Etisalat) in new telecom entrants Unitech and Swan respectively.

Mid-September 2008, UAE-based Etisalat picked up 45 per cent stake in Swan Telecom for $900 million, making the Dynamix Balwas (DB) Group firm the first amongst the new mobile licensees to have clinched a deal. The tie-up is, of course, subject to certain closing conditions and clearances from the Foreign Investment Promotion Board (FIPB). While Citigroup Global Markets is advising Etisalat on the transaction, Deutsche Bank is advising Swan Telecom.

With the remaining 55 per cent stake distributed among several entities including the key promoter, the DB Group (which is involved in the real estate and hospitality businesses), the company is reportedly not averse to the idea of Etisalat raising its stake in Swan to 51 per cent at a later stage.

Meanwhile, having obtained spectrum for 10 circles, Swan Telecom plans to roll out telecom services by the April-June 2009 quarter. The company is also in the process of acquiring two additional licences, thereby increasing its presence to 15 circles in the country. Early this year, it received licences to operate in 13 circles for Rs 15.4 billion.

Recently, Swan also received approval from the Department of Telecommunications (DoT) for offering national and international long distance (NLD and ILD) services. This is in addition to Swan's being allowed to operate as an internet service provider (ISP) in India. These three additional licences will enable Swan to offer the complete array of telecom services – from mobile to fixed line, to carrying voice and data, to internet services.

For Swan, the tie-up gives it access to greater funds, thereby speeding up service rollout. Also, analysts are of the view that at $2 billion, the company has got itself a very good valuation – certainly several times higher than the fees it paid to get the telecom licences. DoT is, in fact, already bemoaning the fact that it may have lost out on higher revenues for the government. According to analysts, while DoT has earned $2 billion from the sale of 120 licences, Swan, a single entity, has walked away with a similar valuation.

For Etisalat meanwhile, the deal finally gives it a foothold in the Indian telecom space. The second largest Arab communications firm (by market value), the company had been looking for an opportunity to enter the Indian telecom space for the past 18 months. Prior to Swan, Etisalat had been in talks with Unitech and was interested in picking up stake in Tata Teleservices Limited (TTSL).

The acquisition, therefore, makes for a valuable addition to its existing presence in 15 countries across Asia, the Middle East and Africa. Etisalat owns a 26 per cent stake in state-owned Pakistan Telecommunications and has recently acquired 16.5 per cent in Indonesian telecom company PT Excelcomindo Pratama. Across these operations, Etisalat has 64 million customers. The operator is also in the business of manufacturing SIM cards and providing payment solutions.

"Our entry into India, the fastest growing mobile market in the world after China, will accelerate our expansion strategy. We are truly excited by the partnership with the DB Group and the prospect of building Swan Telecom into a leading telecom operator," states Mohammad Hassan Omran, chairman, Etisalat.

Last month, beating Telenor, AT&T, Etisalat and Altimo, Telecom Italia was able to clinch a 49 per cent stake acquisition deal with real estate developer Unitech's telecom arm. Even as the finer details of the deal are being worked out, company officials indicate that the draft agreement will include Unitech's telecom business being transferred to a new company in which Telecom Italia will put in $2 billion as price for the stake. Unitech will retain the majority 51 per cent in the joint venture (JV) company.

Going by current plans, Unitech's equity contribution to the JV will be its pan-Indian licences to operate in all 22 telecom circles and the initial groundwork. The funds from Telecom Italia will go towards laying the network, rolling out operations and bidding for 3G spectrum.

Unitech, which plans to roll out services by April 2009, has already hired 250 people for its telecom venture. Overall, it plans to invest Rs 200 billion in its telecom business over the next three years. It recently raised Rs 12 billion for its telecom venture from a syndicate of public sector banks led by Punjab National Bank and Canara Bank. With a partner in place, the company is hoping to further speed up its rollout plan. It has already received spectrum for 12 circles.

For Telecom Italia, which reported revenues of 14.8 billion euro in the first half of 2008, its gaining foothold in one of the world's fastest growing markets will hopefully give its business a big boost.

As of now, these stake sales constitute the first infusion of funds into any of the new licensees. Analysts expect that in the following months, similar deals will be struck as most of the new players – BPL Mobile's Loop Telecom, Videocon's Datacom Solutions, etc. – are in discussion with a host of foreign operators.

With no infrastructure, services or subscribers, high valuations simply qualify as a windfall for the new telecom operators. Based on the valuation of Swan and Unitech, merchant bankers estimate that the six new players can collectively notch a valuation of $15 billion. Having paid only Rs 80 billion as licence fee to get 6.2 MHz of spectrum, they can potentially make eight times the money they have invested, in just eight months, if they were to sell their companies today.

Though this is good news for operators, it is not quite so for the government. Investment bankers are of the opinion that since the high valuation of companies represents the real market value of spectrum, the government gave away spectrum to new players really cheap. Telecom analyst Mahesh Uppal says: "This is entirely a policy problem where the government has underpriced a manifestly valuable product, that is, spectrum. This is an expression of the lack of transparent rule making."

Even the Telecom Regulatory Authority of India had brought up the fact that the price of a pan-Indian licence, at Rs 16.51 billion, ought to be pushed up as this had been fixed in 2004. However, with the harm done, there are talks in DoT of adding a provision that will allow the government to take a 25 per cent share in the income made by the company by selling stake in the first three years of operations. Though it is still tentative, the plan is to collect this levy as spectrum usage charge.

As India continues to add over 9 million subscribers a month, it will remain a sought-after destination for investment. The government, however, needs to capitalise better on this.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...