Great Expectations - Idea Cellular plans big after acquiring stake in Spice

-

After months of speculation, Idea Cellular bought 40.8 per cent stake in egional operator Spice Communications for Rs 27 billion in July 2008. Idea outbid companies like Etisalat and Bahrain Telecom, which were also in the running for acquiring the stake. Subsequently, India has bought another 0.29 per cent stake in Spice at a price of Rs 74.81 per share. This was Idea's second attempt at buying stake in Spice. In 2007, the operator had come very close to clinching a deal which, however, failed to materialise due to differences over valuation.

Spice, which has 4.5 million subscribers in the Punjab and Karnataka circles, is considered a good buy. The acquisition will add to Idea's 26.14 million subscribers and firmly establish the company as the fifth largest cellular operator in the country with 16.8 per cent GSM market share. Moreover, it will give Idea a solid entry into the high-revenue circles of Punjab and Karnataka.

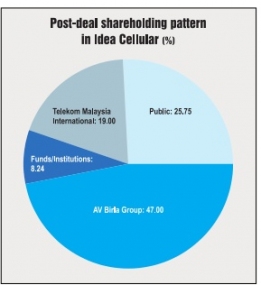

According to the deal between Idea and Spice, MCorpGlobal Communications – the Spice Group's investment vehicle – has divested its entire holding to Idea Cellular at Rs 77.3 per share. MCorpGlobal Communications will receive an additional Rs 5.43 billion from Idea as non-compete fee. Telekom Malaysia International (TMI), which holds 39.2 per cent share in Spice Communications, will be offered 469 million shares by way of preferential allotment in the merged entity at Rs 156.96 per share. This will allow TMI to acquire nearly 14.99 per cent stake in Idea. The infusion of nearly Rs 75 billion from TMI will make Idea Cellular a debt-free company, which is rare amongst telecom operators.

TMI might eventually pick up 3-4 per cent additional stake, depending on the response of small stakeholders to Idea's open offer, which is subject to a cap of 20 per cent. According to the agreement, the minority shareholders of Spice will get 49 shares of Idea Cellular for every 100 shares of Spice Communications.

For B.K. Modi, chairman of the Spice Group, the deal with Idea marks a lucrative exit. The relations between Modi and TMI had turned sour over the company's performance, as a result of which the former was looking to sell his stake. According to Sourabh Kaushal, industry manager, ICT practice, Frost & Sullivan, "Selling out has been long expected from players like Spice who haven't really managed to be profitable."

Spice Communications: Company basics

Spice is the second largest operator in the Punjab circle with a subscriber base of 2.73 million and a market share of 22.6 per cent as of May 2008. The largest operator in the circle is Bharti Airtel. To provide better coverage to its subscribers, Spice has increased the number of cell sites in the circle by 70 per cent since March 2007 to 2,314. Its network now covers 924 of the 968 towns, and reaches out to 68 per cent of the population.

The increased coverage has had a positive effect on the company's operational performance. Network minutes per month increased from 785 million in December 2007 to 896 million in March 2008. Revenue increased from Rs 524 million to Rs 605 million over the same period, while average revenue per user (ARPU) went up from Rs 288 to Rs 304.

In the Karnataka circle, Spice ranks fifth with a subscriber base of 1.76 million and a market share of 10 per cent as of May 2008. Over the past one year, the company has increased the number of cell sites in the circle by 87 per cent to 1,906. This has enabled it to cover 40 per cent of the population and reach out to 432 of the 950 towns.

The network minutes per month in Karnataka increased from 307 million in December 2007 to 597 million in March 2008, while revenue increased from Rs 238 million to Rs 395 million. ARPU increased from Rs 267 to Rs 283 over the same period.

Spice has consistently focused on providing top-of-the-line value-added services (VAS). Its VAS portfolio includes innovative offerings like Jukebox, Mukhwak and Gita Saar. "Spice has always built on low-cost mobile services targeting the youth," says Sridhar Pai, chief executive officer, Tonse Telecom.

Spice was recently awarded licences to launch services in four new circles by the Department of Telecommunications (DoT). The company, however, had applied for licences in 20 circles. According to DoT, Spice was not awarded a pan-Indian licence due to low net worth. The company then challenged DoT's decision at the Telecom Disputes Settlement and Appellate Tribunal. However, after the acquisition, Spice has withdrawn the case.

The way ahead

Idea is extremely upbeat about the acquisition of Spice. Though Spice has not been profitable in both the circles it operates in, mainly on account of suboptimal utilisation of infrastructure and subsequently high infrastructure cost per subscriber, Idea hopes to use operational synergies and economies of scale to nudge Spice into the black within the next three quarters. Till then, it is willing to bear the losses as its balance sheet is five times that of Spice. The acquisition will increase the number of circles in which Idea has spectrum in the 900 MHz band to nine from seven. As spectrum in the 900 MHz band is more efficient than the regular 1800 MHz band and can carry more traffic, Idea is hoping to gain economies of scale and operational synergies.

Idea is also banking heavily on its association with TMI. Says Sanjeev Aga, managing director, Idea Cellular: "Idea will be getting access to TMI's thirdgeneration technology. We can also offer international roaming to our customers." Idea has earmarked an investment of Rs 1-Rs 2 billion for the current fiscal to upgrade its networks and roll out services in four new circles.

B.K. Modi feels that the divestment will allow Spice to redeploy resources and strengthen the group's businesses, particularly mobile VAS, telecom retail and mobile devices. Over the past few years, Spice has built up a significant presence in the mobile devices market through its handset division, Spice Mobile. It was the first company to introduce a dual-mode handset that supports both GSM and CDMA connections. With the imminent launch of 3G services in India, Spice Mobile has tied up with Qualcomm to launch the first 3G-enabled handset in the country. The company has also launched the first open market CDMA handset.

Idea, for now, is busy seeking clarifications from DoT regarding issues such as licences and radio frequencies that were recently awarded to Spice. Idea has sought clarifications regarding spectrum allotted to Spice in Andhra Pradesh, where the merged entity would hold 12.5 MHz of spectrum with a subscriber base of under 4 million. This is not permitted under DoT's current norms. While these points will eventually be sorted out, it remains to be seen whether the acquisition turns out to be the win-win deal Idea and Spice hope it is.

Major benefits of the deal

Key gains for Idea Cellular

Key gains for the Modi Group

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...