Global Reach - Submarine cable segment in expansion mode

-

The Indian submarine cable industry, whose roots can be traced back to 863 when a cable link was laid between Mumbai and Saudi Arabia, is showing signs of rapid growth. This has been fuelled by the demand for additional capacity. Over the past few years, a number of Indian enterprises have gone global, while many multinational corporations have set up shop in India. As a result, there has been an exponential increase in the demand for international voice and data transmission.

Indian international long distance operators like Bharti Airtel, Tata Communications and Reliance Communications (RCOM) Limited are looking to cash in on this demand. The companies are joining international consortiums that are involved in almost every key global cable project, and are expected to cumulatively invest $4 billion in ramping up their submarine cable operations over the next two years.

But the investment is nothing compared to the gains that are to be had. The increase in cable capacity will enable the companies to serve the Indian data services market, which is expected to grow at around 30 per cent to Rs 110.85 billion by 2011 from the current Rs 85.15 billion. Even now, enterprise data services account for an average 25-30 per cent of a service provider's revenues.

Apart from the increase in the volume of international voice and data transmission, another factor driving the construction of additional global links is the need to safeguard users from service disruptions. The recent cuts in the Flag Europe Asia (FEA), FALCON and Southeast AsiaMiddle East-Western Europe (SEA-MEWE) cables severely affected many companies, especially those in the outsourcing industry, which is one of the largest customers of bandwidth. Building additional capacity will enable business process outsourcing and knowledge process outsourcing companies to lease capacity on multiple cables, as a safeguard against service disruptions. Moreover, additional capacity is likEly to keep bandwidth prices down.

tele.net takes a look at the key players in the submarine cable segment and their recent initiatives...

Bharti Airtel

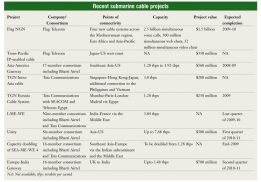

Bharti Airtel is aggressively building up its cable capacity. The company has joined a 16-member consortium including British Telecom (BT), Cable & Wireless and AT&T, which will construct the first direct, high-bandwidth optic fibre submarine cable system from the UK to India. The cable system, called the Europe India Gateway, is expected to cost over $700 million and provide capacity of up to 3.48 tbps. It will be operational by the second quarter of 2010. The consortium has awarded the cable's construction contract to AlcatelLucent and Tyco Telecommunications.

Along with Tata Communications and 14 other companies, it is also doubling the capacity of the SEA-ME-WE-4 submarine cable that spans 14 countries between France and Singapore. Alcatel-Lucent and Fujitsu have been awarded a contract for the upgradation, which is expected to be completed by end-2009.

Earlier, Bharti Airtel had tied up with five international companies – US-based Google, Malaysia-based Global Transit, Japan-based KDDI Corporation and Singapore-based Pacnet and SingTel – to construct the $300 million Unity submarine cable system linking the US and Japan. Though the cable will not touch India, Bharti will carry domestic traffic on the i2i cable network to Singapore, after which it will be routed through the new cable. NEC Corporation and Tyco Telecommunications will construct and install the Unity cable system, which is expected to provide its initial capacity in the first quarter of 2010-11.

Bharti Airtel is also part of the 17member international consortium that will set up the $560 million Asia-America Gateway cable system, linking Southeast Asia and the US. The other members of the consortium include AT&T, BT Global Network Services, Thailand-based CAT Telecom and Malaysia-based Maxis and Telekom Malaysia. The cable system is expected to be completed during the fourth quarter of 2008-09.

Tata Communications

Tata Communications is also enlarging its submarine cable portfolio, and is reportedly planning to invest about $2 billion to connect Asia, the Middle East and Africa to Europe over the next five to eight years.

The company will set up the $200 million Tata Global Network (TGN) IntraAsia cable system, connecting Hong Kong, Japan, Singapore, the Philippines and Vietnam. The cable will be built by Tyco. Tata Communications, in association with SEACOM and Telecom Egypt, will also build the $250 million TGN Eurasia cable system, linking Mumbai to Paris, London and Madrid via Egypt.

The company, along with Bharti Airtel, is also part of the nine-member consortium that will set up the 13,000 km India-Middle East-Western Europe (iME-WE) submarine cable network, linking Mumbai to Marseilles in France. The I-ME-WE cable is likely to be available for service by 2009-10. Alcatel-Lucent has the turnkey contract for setting up the cable system, and will be supported by the subcontractor, NEC Corporation, which will provide and install the wet plant from Mumbai to Jeddah.

However, Tata Communications rEcently suffered a minor setback when the district court in The Hague, Netherlands, ruled that it had to provide landing station access in Mumbai to Flag Telecom, a subsidiary of Reliance Globalcom. Flag wanted access to Tata's Mumbai landing station so that it could enhance the capacity of the FEA cable system, which goes through India at the Tata-controlled Mumbai landing station. According to Tata Communications, the construction and maintenance agreement between the two companies did not obligate Tata to grant access to Flag. The latter had sought damages of $400 million.

RCOM

RCOM is also ramping up its submarine cable operations. However, unlike Bharti or Tata Communications, it has not joined any international consortium recently. The company underwent a major organisational change under which its global business, including its submarine cable operations, was consolidated into the newly formed subsidiary Reliance Globalcom, headquartered in London. The company has become the holding firm for RCOM's global operations, its submarine cable subsidiary Flag Telecom and Yipes Enterprise Services. Reliance Globalcom plans to launch an initial public offering in the future.

In February 2008, Flag Telecom awarded a $350 million contract to Alcatel-Lucent to build an IP-based trans-Pacific cable linking Japan and the west coast of the US. The cable will be seamlessly integrated with the other cable assets of Flag Telecom, including the FEA cable, Flag Atlantic (US east coast to Europe), Flag North Asia loop cable, FALCON (Egypt to the Middle East to India) and the planned cable systems connecting the Mediterranean, African and East Asian countries.

In September 2007, the company granted a $1.5 billion contract to Japanbased Fujitsu for constructing the Flag next-generation network undersea cable spanning 50,000 km across 60 countries.

Future growth

The Indian submarine cable industry is expected to receive a fillip with the entry of a large new player – the public sector Millennium Telecom Limited (MTL) – a 51:49 joint venture between Mahanagar Telephone Nigam Limited and Bharat Sanchar Nigam Limited.

In October 2007, MTL floated a Rs 16 billion tender to lay a submarine cable connecting India to Southeast Asia and the Middle East. The cable will be built in two phases. Dataware has been appointed the consultant for the first phase and Axiom for the second. The contract for the project is yet to be awarded.

Earlier, in September 2006, MTL chalked out plans to invest $390 million and build an undersea cable joining India and Singapore. Alcatel-Lucent is reportedly one of the frontrunners for bagging the contract for this project.

With all this activity, the sector seems set to take off in a big way. The expansion initiatives will lead to lower bandwidth prices and greater bandwidth availability, paving the way for the Indian internet sector to grow from strength to strength.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...