Greater Worth - MVAS uptake on the rise

-

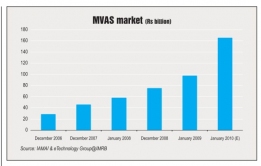

The market size of the mobile VAS (MVAS) industry has been estimated at about Rs 65 billion ($1.35 billion) as of March 2009. With the wait-and-watch game for 3G likely to be over soon, this industry is poised to grow exponentially with some industry estimates pegging the figure at Rs 200 billion by 2015.

The Indian mobile market is now in the process of transitioning from being a voice-only market to one offering various kinds of services. MVAS offers a whole range of applications from simple SMSbased services to multimedia video clips and live TV. Further, over 10 million monthly subscriber additions have been driving the strong demand for MVAS as subscribers widely use their handsets to play games, download ringtones, read news headlines, surf the internet, access information from banks, railways and airlines, check examination results, or participate in contests.

MVAS can be categorised as information (news alerts, stock prices, air/rail ticket status, etc.), entertainment (music, wallpapers, games, etc.) and m-commerce (mpayment, m-banking, etc.).

Currently, MVAS accounts for about 10 per cent of a mobile operator's revenues and is expected to reach 18 per cent by 2010. With telecom operators in the country focusing on subscriber acquisition and network expansion till as recently as three years ago, increasing their emphasis on VAS in the past two to three years, the share of data revenue is expected to increase significantly.

As mobile operators continue their never-ending battle with dwindling ARPUs, VAS will contribute to the bottom line. In addition, with mobile number portability expected to be available soon, and new operators launching services, VAS will be the crucial differentiator that will help reduce churn.

The growth in this space has also been driven by the availability of low-priced handsets with enhanced features such as colour screens and GPRS.

Key trends

Popular VAS

Apart from voice and peer-to-peer (P2P) SMS, ringtones, wallpapers, games, caller ringback tones (CRBTs) and music have also witnessed success. SMS in all its forms (P2P, person-to-application, subscriptions, application-to-person) continues to be the biggest revenue generator after voice, and accounts for nearly 44 per cent of the market. The SMS voting option for TV reality shows is reported to have helped increase the use of SMS.

Music (CRBTs, ringtones) is the other bedrock of the VAS industry and accounts for over 35 per cent of VAS revenues excluding SMS. Voice portals are the other big revenue generator, as they enable access to a wide variety of content, which is primarily dominated by movies and cricket.

PE interest

The VAS segment continues to attract significant PE interest. According to Venture Intelligence, the year 2007 saw nine PE deals worth a total of $41 million in the VAS space, while in 2008, there were about seven deals worth $91 million.

The financial crisis does not seem to have made a dent in the investment plans of firms such as Helion Venture Partners, Canaan Advisors, Matrix India Asset Advisors and Fidelity, which are scouting for investments or acquisitions in the VAS space in India. For instance, despite investing $13 million in Kirusa and $10 million in SMS GupShup in 2008, and $2.5 million in NGPay in 2007, Helion Ventures is looking to make fresh investments in this space.

In February 2009, MapmyIndia received a $9 million funding from Qualcomm Ventures, while ValueFirst received $6 million from New Enterprise Associates.These companies intend to capitalise on the enormous opportunity in the MVAS space, as the entire segment is growing at around 20 per cent on a year-on-year basis.

PE firms are more interested in innovative product offerings such as payment options, advertising, voice-based SMS and satellite video streaming, rather than ringtones and CRBTs which offer lower revenues potential.

Consolidation

The MVAS market is a highly fragmented one with a large number of domestic players. There are currently over 150 VAS companies registered with the Internet and Mobile Association of India. This segment is also witnessing the entry of new players as the entry barriers are low.However, a few players account for the lion's share of the market and are witnesSing 100 per cent growth year on year.Given the large number of players in this space, consolidation is clearly on the cards.Increased private funding may also lead to a possible surge in mergers and acquisitions (M&As). Companies that have been around for the past seven to eight years are not only established in terms of scale of operations and operator relationships, but are also equipped with the necessary management bandwidth that new entrants lack. These companies are now considering the M&A route for expansion. For instance, Mobile2Win merged with another VAS player, the Altruist Group.

Future growth areas

While MVAS in India will continue to be driven by entertainment-related services, the role of information VAS has also increased over the past 12-18 months.However, m-commerce transactions are still in their infancy.

Enterprise VAS is also coming up as enterprises increase their reliance on mobiles to reach their employees. Mobile applications like sales and field force automation are on the radar of these companies, as they look to deploy these applications on a large scale. Most enterprises are currently using mobile messaging services to stay in touch with customers and employees. Driven by their ease of use and with the ability for real-time dissemination of information, companies are increasingly opting for these applications, thus driving enterprise VAS growth.

Mobile payment, which currently accounts for just 1 per cent of the data services market, is set to add 70.9 million users by 2010, says a report by PricewaterhouseCoopers. According to the report, the key driver for the growth of VAS in the mobile payment segment will be demand from rural and semi-urban areas, where a huge gap exists in banking infrastructure. Mobile wallets will also replace plastic cards (credit cards) over the next few years.

Though in a nascent stage, m-commerce services have seen a number of initiatives recently. For instance, the Reserve Bank of India recently came out with some guidelines on m-commerce.

In 2008, m-banking services were launched by ICICI, India's largest private sector bank. Almost all operators are now conducting pilot exercises for m-commerce services and are betting on technologies like unstructured supplementary services data (USSD) to ensure that the service is handset agnostic.

Currently, mobile advertising in India is at a minimal level, but the service is nevertheless going forward, it can be an important VAS segment. It has the potential to grow at 200 per cent a year, giving operators a new revenue source.

The growth in this segment is expected to be fuelled predominantly by the rollout of 3G networks, IPTV and high-end gaming on mobile phones.

The launch of 3G services is likely to give a further impetus to m-commerce transactions and mobile advertising, and is likely to lead to a higher uptake of visual data. VAS companies are likely to migrate from text and pictures to video, as the latter is the killer application for 3G. Even in Singapore, VAS firms started to use the increased bandwidth available to them to provide live video, video calling and video portals, after 3G was launched.

Another service that is likely to witness growth with the launch of 3G is mobile TV. This market has been estimated at $360 million in India, according to a survey conducted by Springboard Research.

Based on the research, India is likely to have 12 million mobile TV subscribers within the first year of its launch, which signifies a penetration level of 5-6 per cent. Easy availability and affordable pricing will be the critical factors for mobile TV's success in India.

With 3G auctions expected soon, VAS companies are gearing up to launch new, higher-priced services targeted at 3G subscribers. For instance, OnMobile Global is planning a citizen journalism portal and has developed a technology that will allow subscribers to shoot a video or a photograph and upload these on a citizen journalism website along with a voiceover.

Rural VAS is another segment that presents a huge opportunity as these regions now account for the bulk of the monthly subscriber additions. Since there are few means of entertainment in these regions, the potential for entertainmentrelated VAS services is huge. However, relevant content applicable to the rural consumer needs to be developed in the local language. For instance, applications that enable the farmer to access mandi prices or weather reports, updates on local activities, etc., need to be made available.

While some of these solutions are already available to the rural consumer and have been successful in pilot projects, there is a need to develop them further and increase their applicability. Reuters' SMSbased market information is one such service launched for farmers in 2007. It has now crossed 100,000 users, with around 91,500 subscribers in Maharashtra and 8,500 subscribers in Punjab.

Clearly, the MVAS industry is on a roll and is poised to grow given the interest being generated from all stakeholders.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Key Revenue Stream - Operators focus on...

- MVAS Market - Key drivers and deterrents

- Set to Grow - Increasing takers for MVAS

- Global Uptake - Strong growth in mobile ...

- Adding Value - Business case for VAS

- Creating Value - Major VAS players in th...

- Global Market - Messaging and music rema...

- Refinement Tool - Use of automated test ...

- Crossing Hurdles - Service diversity key...

- Greater Worth - MVAS uptake on the rise ...

No Most Rated articles exists!!

| Your cart is empty |