Margins Under Pressure - Bharti and Idea announce fourth quarter results

-

On the face of it, the Indian telecom industry is growing at an exponential rate. With over 620 million subscribers, India is the second largest telecom market in the world. However, the real picture of the industry is marred by severe competition and frequent price cuts, leading to declining profits.

Two of the country's key telecom players, Bharti Airtel and Idea Cellular have recently released their financial results for the quarter and year ended March 2010. Bharti Airtel, the largest telecom operator in terms of subscribers as well as revenues, has reported a decline in quarterly net profits for the first time in the past three years. According to Akhil Gupta, deputy chief executive officer, Bharti Enterprises, the last quarter of 2009-10 was perhaps the toughest as far as the intensity and irrationality of tariff plans is concerned.

On the other hand, Idea Cellular has reported impressive results for the quarter ended March 2010. However, this is largely because Idea's actual sales figures include the full revenue of the merged entity Spice Communications, with effect from March 1, 2010. This makes the company's quarterly results largely non-comparable to the corresponding quarter last year.

tele.net takes a look at the financial results of the two operators:

Bharti Airtel

Falling call rates due to rising competition have pulled Bharti Airtel's net profit down by 8 per cent for the quarter ended March 2010. Its net profit dropped from Rs 22.39 billion in the January-March 2009 quarter to Rs 20.55 billion for the same period in 2010. On the other hand, revenues increased by 2.3 per cent, from Rs 98.25 billion to Rs 100.55 billion during the same period. Earnings before interest, taxes, depreciation and amortisation (EBITDA) fell 4.5 per cent to Rs 38.20 billion, while the EBITDA margin declined from 41 per cent to 38 per cent. It should be noted that during the reported quarter, Bharti recorded the lowest customer additions among the top seven operators in the country.

For the entire year 2009-10, the consolidated revenue was up 7 per cent at Rs 396.20 billion, compared to Rs 369.92 billion in 2008-09. Net profit was also up 7 per cent at Rs 91.03 billion compared to Rs 84.79 billion in 2008-09. Bharti Airtel's subscriber base went up by 41 per cent in 2009-10 to 137.5 million at the end of March 2010.

Segment results

Bharti's revenue from mobile services was Rs 81.97 billion in the quarter ended March 2010 compared to Rs 82.22 billion in the corresponding quarter last year.The contribution of mobile services to the consolidated revenues declined from 84 per cent to 82 per cent.

Meanwhile, the firm's focus on the non-voice segment is paying off with its revenue from the segment growing by 10.2 per cent, contributing to around 17 per cent of the total. Within that, value-added services (VAS) contributed 12 per cent to revenues, an increase of 9 per cent over the previous fiscal year. The ARPU for the quarter from telemedia services was Rs 950, while that from mobile services was Rs 220. Telemedia services include broadband, data and fixed line services, and cover at least 3 million customers, including 1.3 million subscribing to digital subscriber line (DSL) connections.

Operational performance

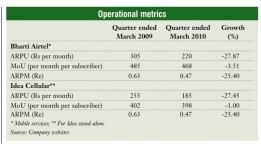

Bharti Airtel reported a strong growth in traffic carried on its mobile network with minutes of usage (MoUs) rising 32.24 per cent to 172.8 billion minutes. The incremental usage of 42.13 billion minutes is close to the level of the additions in the quarter ended March 2009, which were about 41.61 billion minutes. However, the average revenue per minute (ARPM) of traffic carried fell 25 per cent to Re 0.47. In fact, the company's ARPM has fallen at an average rate of 7 per cent in the past four quarters due to intense competition.

It is also worth mentioning that the incremental subscriber base over the last year belonged predominantly to the rural and semi-urban areas which are characterised by low-usage customers. In March 2010, over 58 per cent of customer additions were from Category B and C circles, out of the total 20.31 million wireless subscriber additions. As a result, the company's mobile ARPU fell by 28 per cent from Rs 305 in the quarter ended March 2009 to Rs 220 in the quarter ended March 2010.

Capex direction

Bharti expects the capital expenditure in 2010-11 for its Indian operations to be $1.5 billion to $1.8 billion, excluding costs for the 3G network. The company has already raised $8.3 billion as debt to fund the acquisition of Zain's Africa operations. In addition, it is considering raising funds from the stock market through an initial public offering (IPO) of its tower business. The IPO proceeds may be used to retire debt.

Idea Cellular

In light of the stiff competition in the sector, Idea Cellular's consolidated results for the quarter ended March 2010 look commendable. These are, however, strictly not comparable to the corresponding period last year as the results included Spice Communications' financials. Spice was completely merged with Idea in March 2010; therefore, in these results, the months of January and February include 41 per cent of Spice's financials.

The company posted an increase of 4.56 per cent in its consolidated net profit of Rs 2.66 billion for the quarter ended March 2010 compared to Rs 2.54 billion in the previous year. Revenue rose from Rs 29.42 billion in the quarter ended March 2009 to Rs 33.47 billion. However, its EBITDA declined marginally, by 0.12 per cent from Rs 8.33 million in the quarter ended March 2009 to Rs 8.32 million in the quarter ended March 2010.

For the fiscal year ended March 2010, the company has posted a consolidated net profit of Rs 9.54 billion, up 8.2 per cent compared to the same period in the previous year. During calendar year 2009, Idea increased its revenue market share from 11.4 per cent to 12.7 per cent.

Segment review

Idea Cellular had 63.82 million subscribers (including those of Spice) at the end of March 2010, with an addition of 6.21 million users during the quarter ended March 2010.

The revenue from the mobility business for the quarter ended March 2010 stood at Rs 33.12 billion, constituting 83 per cent of the total revenue. Notably, in the past few quarters, Idea has been able to consistently increase the share of VAS in its revenues. In the quarter ended March 2010, this stood at 12.4 per cent. In the passive infrastructure segment, the company's revenues stood at Rs 2.3 billion.

Operational performance

Idea's user-based parameters suffered just as its competitor Bharti Airtel's did. In fact, the smaller size of operations and lesser diversification into non-mobile businesses compared to Bharti may pull down Idea's valuations in the future. Idea's ARPU fell 27 per cent from Rs 255 in the quarter ended March 2009 to Rs 185 in the quarter ended March 2010.

While the revenue per minute slipped from Re 0.63 to Re 0.47, the company has been able to expand traffic on its mobile network. Idea's total MoUs were up 48.49 per cent to 65.67 million (excluding Spice service areas in March 2010). Meanwhile, its MoU per subscriber marginally declined from 402 to 398 in the quarter ended March 2010.

Capex direction

Idea's total capex (network and non-network) guidance for 2010-11 is pegged at Rs 30 billion without the 3G auction and network rollout.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!