Smart Capital - PE investments in telecom

-

A noticeable trend has been the role played by private equity (PE) in this space.In the past, PE has contributed to economic growth by both providing smart capital and improving capital efficiency. In addition, it has encouraged entrepreneurship by supporting new ventures and promoting new industries. For instance, Warburg Pincus, a leading PE firm, gave Sunil Mittal early-stage capital for Bharti Airtel. Of course, in the process, Warburg Pincus delivered substantial returns to its own investors.

Changing dynamics

The way the telecom sector has evolved in terms of the number of operators is something investment bankers did not probably foresee. In fact, nowhere across the globe has such a competitive telecom market been seen as in India which today has 12 large operators in many circles.

In terms of competition and tariffs, the Indian telecom industry clearly beats leading international telecom markets such as the US and the UK. Today, every Indian operator is involved in an aggressive per-second tariff war, with offerings priced at Re 0.01 per second and even half a paise per second. And this tariff war has not been restricted to only voice; it has spread to domains such as SMS, MMS and roaming rates, and will soon be extended to the internet and broadband space as well.

While subscribers are signing up in droves, industry analysts believe this will soon start impacting operators' EBITDA margins. According to Kunal Bajaj, managing director, BDA India, "The real tariff war started heating up in October 2009 and the impact will be seen in the quarterly results starting October-December as a larger number of subscribers migrate to these new plans."

In spite of this scenario, several factors have contributed to, and ensured, steady inflow of PE funds. The biggest of these, perhaps, has been the breakneck speed of subscriber additions. Currently, 15-18 million subscribers are being added every month, thereby accelerating growth in terms of penetration.

Besides, the future potential of the sector is promising, be it mobile services, broadband, value-added services (VAS), and even telecom infrastructure like towers. There are still over 600 million mobile subscribers to be tapped; internet and broadband penetration is nowhere close to the planned targets; and the VAS space is still evolving.

Emerging trends in PE investments

While the mobile segment is still a favourite with PE players and venture capitalists (VCs), gradually other "downstream" opportunities are also starting to present themselves. These include mobile VAS, telecom software and other service providers working with/for telecom operators.

To illustrate, as of November 2009, the Indian telecom industry attracted PE investments worth over $300 million through 11 deals during the year, most of which were in the VAS and telecom software spaces.

Also, investors are pinning their hopes on the introduction of 3G services.According to experts, 3G has great potential to alter the dynamics of the Indian telecom market. Besides the expected adoption in the metros, the poor infrastructure on the fixed line side means that an increasing number of users are going to rely on their mobile phones for data-driven services, leading to massive uptake as and when the infrastructure becomes available.

In fact, the launch of 3G is expected to have a trickle-down effect, especially for VAS players. Romal Shetty, head of telecom at KPMG, says, "VAS will take time to grow at high rates, at least two years, because initially all the operators would want to use 3G only for voice purposes." The rationale is that among the top operators, only 11-12 per cent of the revenues come from VAS services. "In Japan and Korea, it's as high as 35-40 per cent, while in the US, it's about 25 per cent," he adds. As the share of VAS increases, it will give equally high returns to PE funds, which will make investments at a time when VAS companies' valuations are low.

Another segment that is likely to prove attractive for PE investments is cable TV. A Venture Intelligence investor poll reveals that the majority of investors believe that several opportunities exist in this space as well, given the unorganised nature of cable TV distribution in the country. In an article, Nithin Kaimal ofPE firm New Silk Route (NSR) Advisors, highlights how the battle over the last mile in cable TV networks is hotting up with the entry of direct-to-home (DTH) services. He feels the success of the cable model over DTH in other markets as well as the performance of organised cable players like Asianet and Ortel provides ample evidence of the economic attractiveness of this model.

Recent deals

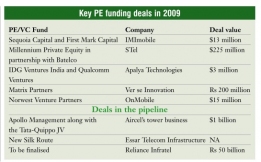

Some of the PE deals that took place during 2009 are as follows:

A few PE players also made profitable exits. For instance, US-based PE firm Q Investment sold its 100 per cent shareholding in telecom tower company XCEL Telecom to American Tower Company. The equity firm had invested about $40 million in XCEL and the company was valued at $154 million at closure of the deal.

Two PE firms – Skycity Foundations and Mauritius-based Telecom Investments – which together own 51 per cent in STel, sold their equity to C. Sivasankaran's investment arm, Sterling Infotech Group (SIG) for Rs 11.5 billion.

Some deals in the pipeline include: Reliance Infratel, a subsidiary of Reliance Communications (RCOM), is planning to raise Rs 50 billion by diluting 10-15 per cent stake in a private placement of shares with PE firms. The company intends to raise about $1 billion through private placement of shares and is likely to finalise the potential investors shortly. The equity sale is likely to value the company at around $7 billion.

The Tata-Quippo joint venture (JV) is reportedly at advanced stages of negotiations with New York-based PE fund Apollo Management to finance the acquisition of Aircel's tower assets, should it win the bid. Apollo is willing to provide about $1 billion to Tata-Quippo to finance the deal, making it the largest PE investment in the country's telecom sector till date.The deal is likely to see Apollo picking up a 30 per cent stake in the Tata-Quippo JV.The Tata-Quippo JV has reportedly emerged as the frontrunner for the acquisition of Aircel's 12,000 towers, valued at $1.2-$1.5 billion.

In another development in the telecom tower space, NSR, which owns a majority stake in telecom tower company Aster Infrastructure, has initiated talks with the Ruias-owned Essar Telecom Infrastructure Limited (ETIL) for a merger. If the deal goes through, NSR will get a stake in the combined tower company. NSR and ETIL will then look for a joint placement or stake sale in the combined entity.

All in all, whether it is mobile or ancillary industries like VAS, towers or other infrastructure, telecom clearly remains one of the top priority sectors for PE investments in India.

According to KPMG, "While the industry will continue to provide attractive returns that PE investors seek, the landscape is likely to remain dynamic and somewhat uncertain over the foreseeable future from a market, regulatory and industry perspective."

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!