Topline Growth - Volumes drive revenue for major telecom companies

-

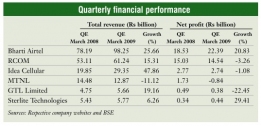

The financial results for the quarter ended March 2009 and the year 2008-09 show that the substantial growth in volumes is driving the top line for most telecom companies despite the intense competition. Among the companies that have registered positive growth in net profits in 2008-09 vis-Ã -vis 2007-08 are Bharti Airtel and Reliance Communications (RCOM). On the other hand, Idea Cellular and Mahanagar Telephone Nigam Limited (MTNL) posted a fall in profit. Other companies like telecom infrastructure and solutions provider GTL and optical fibre manufacturing company Sterlite Technologies also witnessed a fall in net profit.

Bharti Airtel

Bharti Airtel reported a 21 per cent increase in net profit from Rs 18.53 billion in the quarter ended March 2008 to Rs 22.39 billion in the quarter ended March 2009.Total revenue increased by 26 per cent from Rs 78.19 billion to Rs 98.25 billion.

The average revenue per user (ARPU) for mobile services declined by 15 per cent from Rs 357 per month in March 2008 to Rs 305 in March 2009, which, however, was still higher than the industry average of Rs 220. The fall was expected partly because of the competition and also due to the company increasing its rural footprint. During the quarter, 52 per cent of the new subscribers signed up by Airtel were from the rural areas. The company's total subscriber base increased from 64.2 million to 96.6 million. Total minutes of usage (MoU) increased from 89,058 million in March 2008 to 130,669 million by March 2009.

For the year ended March 2009, the company registered a net profit of Rs 84.7 billion, up from Rs 67.01 billion in 200708. Total income increased from Rs 270.25 billion to Rs 369.62 billion over the same period. Airtel plans to invest $3 billion in the current financial year.

In a key development, Bharti Airtel, which has never paid a dividend in the past as it has concentrated on expanding its network, rewarded its investors with a 20 per cent payout in 2008-09 at Rs 2 per share with a Rs 10 face value.

The company also decided to split each stock into two with a face value of Rs 5 to make its shares more affordable."The main reason for the split is to encourage more retail investors to invest and participate in the company. We had heard many complaints that the stock price was too high for the average retail investor," says Akhil Gupta, joint managing director, Bharti Airtel.

RCOM

RCOM reported a 3.3 per cent year-onyear decline in net profit for the quarter ended March 2009. The net profit came down from Rs 15.03 billion in JanuaryMarch 2008 to Rs 14.54 billion in January-March 2009. Its revenue grew by 15.3 per cent on a year-on-year basis to Rs 61.24 billion.

RCOM has attributed the decline in net profit to the increased costs of expanding its GSM-based infrastructure, even though the expansion has led to significant subscriber growth. During the threemonth period, RCOM added 11.3 million subscribers, the maximum ever in a single quarter by any operator, to bring its total subscriber base to 72.7 million. The company claims that it has added 25.6 per cent of all subscriber additions in the JanuaryMarch 2009 quarter.

The company's wireless ARPU, a key yardstick of growth, fell by 29 per cent to Rs 224 in March 2009 from Rs 317 in March 2008, while MoU dipped by 13.5 per cent to 372 per user from 430 over the same period.Despite apprehensions that its newly launched GSM services would put pressure on financial performance, RCOM reported strong profitability figures for the year ended March 2009. The net profit increased by over 9 per cent from Rs 54.01 billion in 2007-08 to Rs 59.07 billion in 2008-09. The total income increased by 20 per cent from Rs 190.67 billion to Rs 229.41 billion over the same period.

RCOM, which had originally earmarked Rs 300 billion in annual capital expenditure and later cut it down to Rs 250 billion, eventually spent Rs 190 billion in 2008-09. In the current year, it expects to spend Rs 100 billion excluding the costs that could be incurred on 3G and broadband wireless access services.

Idea Cellular

Idea Cellular's consolidated net profit fell from Rs 2.77 billion in the quarter ended March 2008 to Rs 2.74 billion in the quarter ended March 2009. Its total income, however, increased to Rs 29.36 billion from Rs 19.85 billion over the same period.

Compared to other operators, Idea faced a relatively small drop in MoU in March 2009, which fell by just over 2 per cent on a year-on-year basis to 402 minutes per user. The fall in ARPU, at 11.5 per cent to Rs 254, was also lower than that reported by Bharti Airtel and RCOM. However, in absolute terms, Idea had the lowest ARPU amongst the three operators.

While the operating losses from the Mumbai and Bihar circles came down during the quarter, cost pressures are likely to remain as the operator rolls out its network in other circles. Idea launched commercial operations in the Orissa circle in April 2009 and now operates in 16 service areas.

With the planned launch of services in Tamil Nadu by June 2009 and the remaining areas by December 2009, Idea Cellular will soon have pan-Indian operations. The company plans to invest Rs 60 billion in 2009-10 to expand and strengthen its existing networks.

On a yearly basis, Idea's net profit after tax dropped from Rs 10.42 billion in 200708 to Rs 9 billion in 2008-09. The total income increased from Rs 67.37 billion to Rs 101.48 billion.

MTNL

MTNL reported a net loss of Rs 838 million for the quarter ended March 2009 on the back of higher staff costs. In the corresponding quarter of the previous year, the company had posted a net profit of Rs 1.73 billion. Staff costs in the January-March 2009 quarter increased over twofold to Rs 6.5 billion from Rs 3.02 billion in JanuaryMarch 2008. Total income decreased from Rs 14.48 billion to Rs 12.87 billion over the same period.

For the year 2008-09, the two-circle operator posted a net profit of Rs 2.15 billion, registering a 57.59 per cent drop from 2007-08. Total income fell marginally from Rs 53.29 billion to Rs 53.04 billion.

GTL

GTL's consolidated net profit fell by 22 per cent from Rs 489 million in the January-March 2008 quarter to Rs 380 million in the quarter ended March 2009.The total income of the network services company increased from Rs 4.75 billion to Rs 5.66 billion on a year-on-year basis.

For the year ended March 31, 2009, GTL registered a consolidated net profit of Rs 1.45 billion, marking a decline of 6 per cent compared to Rs 1.54 billion in the previous fiscal year.

Sterlite Technologies

Sterlite Technologies posted a 29 per cent growth in net profit to Rs 438.2 million for the quarter ended March 2009 from Rs 343 million in the quarter ended March 2008.The company's net sales rose by 6.26 per cent from Rs 5.43 billion to Rs 5.77 billion.

For the year ended March 2009, Sterlite Technologies reported a net profit of Rs 901.5 million, down by 10.89 per cent over 2007-08. The net sales increased from Rs 16.85 billion to Rs 22.89 billion over the same period.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!