Brakes on the Bourses - Telecom stocks tumble amidst market slowdown

-

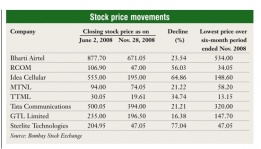

Naturally, the telecom market is not immune to the crisis. It is feeling the heat as the stocks of even blue-chip companies like Bharti Airtel, Reliance Communications (RCOM) and Idea Cellular are trading at an all-time low.

tele.net takes a look at the stock performance of Bharti Airtel, RCOM and Idea Cellular over the past six months (June 2, 2008 to November 28, 2008), their growth drivers, risks and the outlook for the future.

Bharti Airtel

Performance

Over the six-month period, Bharti Airtel's stock has come down from Rs 877 to Rs 671. It plunged to as low as Rs 534 on October 24, 2008. The company's market cap too has fallen significantly, from over Rs 2 trillion to Rs 1.27 trillion over the same period.

In the quarter ended September 2008, Airtel's top line grew by 6.3 per cent over the corresponding quarter in the previous year (quarter-onquarter) to Rs 90.2 billion, which was much lower than market expectation. Earnings before interest, taxes, depreciation and amortisation (EBITDA) grew by 5 per cent to Rs 37 billion. The consolidated EBITDA margin fell by 50 basis points on account of the lower margins in the wireless and enterprise services.

Growth drivers

Bharti Airtel has a strong management core that drives the company's strategy and operations. It has sound financials, a 60,000 km high-speed optical fibre neTwork that covers all major Indian cities, an expanding global footprint, strategic parTnerships with industry leaders like IBM, Nokia Siemens Networks and Ericsson, and the support of SingTel – a strong and experienced global player – which will be especially useful in the 3G arena.

Risks

Airtel is not likely to experience a downturn in its core business line – wireless – at least in the medium term. However, its investment in new business areas like direct-to-home and internet protocol TV bears some degree of risk. There could be some other short-term blips affecting earnings and stock prices: greater competition from RCOM and Aircel as they expand their GSM services (both operators have been allocated start-up GSM spectrum), unfavourable regulation, likely overbidding in 3G spectrum auctions, and a squeeze on EBITDA margins which have come under significant pressure in the past four to five quarters.

Outlook

Positive. Most market analysts believe that Airtel is a strong player and will face fewer challenges in terms of adding users.It will continue to garner premium valuation from domestic and overseas institutional investors. According to brokerage firm Anand Rathi Securities, Bharti Airtel, with its effective net debt of less than $400 million, no greenfield capex and strong free cash flow (FCF) in 200910 (excluding 3G) is much better placed than its peers to absorb potential risks like spectrum-related taxes.

Given Airtel's low debt-equity ratio and expected positive FCF, another brokerage firm estimates that the operator's earnings will increase at a compounded annual growth rate (CAGR) of 21 per cent over 2008-10.

Reliance Communications

Performance

RCOM's is perhaps the worst-hit stock in the telecom sector. Since June 2008, its stock has fallen by about 65 per cent compared to the about 50 per cent fall in the Sensex, which shows significant underperformance. This could be partly due to the company's foray into the GSM segment, involving an investment of around Rs 191 billion. In the next one year, RCOM's operaTing expenses are likely to go up sharply as it will be running two networks simultaneously. In fact, the impact of higher operational costs has already started showing – the wireless segment has seen a fall in operating profit margins in the quarter ended September 2008. RCOM's market cap has come down from a high of Rs 1.14 trillion in June to a low of Rs 403.51 billion in November.

In July-September 2008, RCOM's sales went up by 6.1 per cent on a quarter-on-quarter basis as the national long distance (NLD) traffic increased by 18.3 per cent and wireless net additions grew by 5.9 per cent. However, profit after tax grew marginally by 1.2 per cent.

Growth drivers

RCOM's extensive network and infrastructure, consisting of over 100,000 km of optical fibre cable, is certainly an asset.The biggest advantage is the company's diversified presence across different service lines. A research analyst says, "The company is extremely agile and adapts rapidly to market changes".

Risks

RCOM will not find it easy to attract new GSM subscribers as the competition in the segment is already quite stiff. Another key concern for the company is its unhedged forex exposure of about $3.2 billion as of 2007-08. Analysts expect RCOM to underperform in terms of operating parameters such as average revenue per user (ARPU) and revenue per minute as compared to its peers. As the company largely caters to lowend users, getting lucrative customers who bring in higher ARPUs is going to be a challenging task. Another concern pointed out by analysts is the company's inability to retain key personnel as many have left in the past few months.

Outlook

The company is venturing into a number of segments which have the potential to generate higher operating cash flows. According to industry estimates, RCOM is likely to add over 38 million subscribers over the next two years on its countrywide dual neTwork, helped by the expected GSM rollout.Globalcom, RCOM's overseas subsidiary which significantly adds to the latter's topline, is expected to continue its healthy year-on-year growth. Thus, with several potential upsides, RCOM's stock seems to offer an attractive reward/risk ratio. A brokerage firm has estimated a sales and earnings CAGR of 22.6 per cent and 15.7 per cent respectively, for RCOM in 2007-10.

Idea Cellular

Performance

Pressures on short-term margins and earnings due to entry into new circles and high capex have seen Idea Cellular's stocks coming down. It closed at Rs 47 on November 28, 2008, down from Rs 106.90 as on June 2, 2008. Analysts believe that at such a low price, the stock offers a good option for investors who are willing to look beyond the next few quarters, for appreciation over a threeto four-year time-frame. However, the major fall in stock price has led to Idea's market cap declining from Rs 281.72 billion as on June 2, 2008 to Rs 145.7 billion as on November 28, 2008.

In the quarter ended September 2008, the company's net profit dropped by 45 per cent as compared to the previous quarter. This was a result of lower operating profit margins, which came down by nearly 700 basis points to just over 26 per cent.Revenues went up by just 5.8 per cent to Rs 23.03 billion.

Growth drivers

Idea has a strong brand recall, a solid technology base and sound management practices. It is backed by a committed promoter with deep pockets, the Aditya Birla Group. The acquisition of Spice Communications, apart from increasing its subscriber base, has given Idea access to the 900 MHz band in Karnataka, which involves lower expenses. It has increased NLD volumes and, moreover, now carries 15 per cent of its own traffic.

Idea, which launched services in Mumbai and Bihar two months ago, accounts for 18.5 per cent and 21 per cent share respectively of new subscriber additions, despite being the sixth or seventh operator in these circles. The subscriber churn rate in Idea's existing 11 circles has also declined.

Risks

According to a recent report prepared by Citigroup, compared to the larger operators, Idea's relatively weaker balance sheet reduces funding flexibility in a tougher macro environment and constrains the company's valuation. This can especially prove to be a problem in the bidding for 3G licences.

Outlook

Idea's strong pace of subscriber addition, entry into circles with higher realisations, and the potential synergies with Indus Towers have led many market analysts to recommend a "buy" on the company's stock. According to a brokerage firm, "Idea is still in a strong investment phase and the stock will take time to generate returns. Once Idea's capex in new circles tapers off (possibly by mid-2010), its overall profitability will start to increase."

Other players

Companies like Mahanagar Telephone Nigam Limited (MTNL) and Tata Teleservices (Maharashtra) Limited (TTML) are also facing the heat of the crisis.MTNL's stock has dipped from Rs 94 to Rs 74.05 over the period under review. TTML has witnessed a similar decline, with its market cap falling from Rs 57.01 billion to Rs 37.56 billion. Also trapped in the same downturn are vendors like Sterlite Technologies and GTL. The former's stock has fallen sharply from Rs 204.95 to Rs 47.05, a fall of 77 per cent. GTL has fared slightly better as its stocks have slipped by only 16 per cent, from Rs 235 to Rs 196.50.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!