Modest Gains - Operator earnings take a hit

-

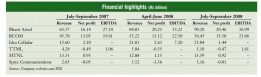

According to a recent report by Citigroup Equity Research, while the net profits of companies in the telecom sector grew by 52.3 per cent in July-September 2007, the growth slowed down to 38.6 per cent in July-September 2008. However, the rise in sales remained steady. After clocking an average 27.9 per cent growth in total sales in the second quarter of 2007-08, telecom companies registered a 29.9 per cent rise in sales in the corresponding quarter of 2008-09.

tele.net takes a look at the financial performance of telecom operators that recently announced their financial results for the July-September 2008 quarter...

Bharti Airtel

Airtel's revenues for the quarter ended September 2008 increased by 42 per cent year-on-year to Rs 90.2 billion, driven by a record subscriber addition of over 8 million, the highest by any telecom operator in any quarter. Net profit rose by 26.8 per cent from Rs 16.13 billion to Rs 20.46 billion.

However, the company performed poorly with regard to several key financial parameters. The earnings before interest, taxes, depreciation and amortisation (EBITDA) margin – an indicator of profitability – fell from 42.8 per cent in the second quarter of 2007-08 to 41 per cent in the reporting quarter.

On a sequential (quarter-on-quarter) basis, the company's performance was anything but impressive. Net profits went up by a mere 1 per cent, though revenue grew by 6.3 per cent.

The margins for the mobile business declined from 30.7 per cent to 30.2 per cent on a sequential basis. This was due to decreasing ARPUs as well as MoUs.ARPUs declined by 4 per cent from Rs 350 in April-June 2008 to Rs 335 in JulySeptember 2008.

On a year-on-year basis, ARPUs decreased by 8 per cent, while MoUs fell sharply from 534 minutes per month to 526 minutes per month. However, this decline was in line with market expectations, given that telecom operators are penetrating into the rural areas and C circle towns and villages, which typically have lower MoUs than metro regions.

RCOM

The Anil Dhirubhai Ambani Group company reported a 23.3 per cent year-onyear rise in revenue to Rs 56.45 billion.Of this, Rs 41.19 billion (65 per cent) came from the wireless business (comprising both GSM and CDMA services) and Rs 5.6 billion (10 per cent) from the broadband business, while Rs 15.26 billion (24 per cent) was contributed by the global business comprising national and international long distance voice, video and data services.

As revenues rose across business segments, RCOM, the second largest wireless service provider in the country, posted a 17.3 per cent rise in net profit for JulySeptember 2008 to Rs 15.31 billion, from Rs 13.05 billion in the corresponding quarter of the previous year. This, significantly, is the lowest growth in profit that the company has had in several quarters.

The low growth could be attributed to the fact that RCOM's capex has peaked in the current fiscal year due to its aggressive expansion plans. The company expects capex to start declining from next year as most of its projects have now reached the execution stage.

Notwithstanding the current financial performance, the company is optimistic about the future. It is banking heavily on GSM expansion to boost its subscriber numbers (RCOM made 5.25 million subscriber additions during July-September 2008). "There will be a rise in revenue from additional subscribers, which will reflect as soon as we launch GSM services," says a senior company official. The full-fledged commercial launch of GSM services is scheduled for December 2008. The company, which currently provides GSM services in eight circles, has a target to complete rollout in the remaining 14 circles by mid2009. "We expect strong growth across segments, with a margin expansion of 2 per cent in each of the next two quarters. New revenue will flow in from high-margin services like international private leased circuits and virtual private networks. Wi-Max services will also be rolled out in the quarters to come," adds the official.

Idea Cellular

Idea Cellular reported total revenues of Rs 23.04 billion for the quarter ended September 2008, up by 48 per cent from Rs 15.6 billion in the corresponding quarter of the previous year. However, net profit declined by 31.75 per cent from Rs 2.2 billion to Rs 1.44 billion.

On a quarter-on-quarter basis, revenue went up by a mere 5.75 per cent. This was mainly on account of the fall in ARPUs, which declined from Rs 278 in the quarter ended June 2008 to Rs 261 in the quarter ended September 2008 – a sharp drop of 6 per cent. MoUs too fell by 2.6 per cent to Rs 417. As a result, Idea's net profit fell by 45.23 per cent on a sequential basis.

What also hurt the margins was the increase in network operating costs, which went up by 19 per cent in the reporting quarter, compared to a 15 per cent rise in the quarter ended June 2008. Opex was high as the company rolled out operations in Mumbai and added cell sites in circles where it already operates. In the past six months, Idea has expanded its presence by over 36 per cent.

While the company is undertaking aggressive expansion, this needs to translate into top-line growth. While Idea is yet to turn profitable in the circles of Himachal Pradesh and Rajasthan, it has broken even, at the operating level, in the Uttar Pradesh (East) circle. The company started operating in these circles in end-2007.

TTML

TTML crossed the Rs 5 billion revenue mark in the quarter ended September 2008. At Rs 5.18 billion, revenue was up 21 per cent compared to the corresponding quarter in the previous year.

While the company is yet to break even, it has reported a marginal 4 per cent year-on-year decline in net loss for the reporting quarter at Rs 474 million.EBITDA rose by 52 per cent to Rs 1.61 billion over the same period.

As of September 2008, TTML's mobile subscriber base stood at 6.2 million – an increase of 49 per cent over September 2007.

The company has a market share of 14 per cent in the Maharashtra and Mumbai circles. But, according to sources, most of its subscribers are from the lower end of the market. Analysts believe that this makes TTML vulnerable to rollouts by new players as the latter are most likely to focus on the lower end of the market.

To offset competition and attract new subscribers, the loss-making company is expected to complete the trial run of its GSM network in the next three months, and subsequently launch services.

MTNL

MTNL's net profit declined marginally by 1.38 per cent to Rs 918.6 million in the second quarter of 2007-08, from Rs 931.5 million in the corresponding quarter of the previous year. Total income rose from Rs 13.33 billion to Rs 13.59 billion.

The public sector operator added 240,066 mobile customers and 19,631 broadband subscribers during the quarter ended September 2008.

Spice Communications

Spice Communications' net sales increased by 22.15 per cent year-on-year to Rs 3.08 billion, while total income rose by 19.17 per cent to Rs 3.16 billion. Net loss, however, increased from Rs 55.33 million to Rs 810.26 million.

Conclusion

While the financial performance of telecom operators has not been very good for the quarter, things are expected to improve in the future. Operators are counting on higher subscriber additions, new business segments like direct to home and internet protocol TV, and the launch of 3G and Wi-Max services to improve their financial performance. However, all these initiatives would require huge investments, and the global market meltdown might impact these expansion plans as the credit situation gets tighter.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!