Demand for Funds - Financing opportunities and trends in telecom

-

Telecom service providers are ramping up investments, expanding into new regions, trying out new technologies and acquiring overseas assets. And with the Department of Telecommunications (DoT) awarding licences to six new players and finalising the 3G and Wi-Max spectrum policies, the sector is likely to receive a further fillip. All this has translated into a huge requirement for funds.

tele.net takes a look at the key telecom financing trends...

Background

Telecom financing has evolved over the years. While operators started out using a combination of promoters' funds and longterm rupee loans from domestic banks and financial institutions, over the past few years, they have been increasingly tapping the international market for funds.

Companies are also taking the initial public offering (IPO) route. Encouraged by the country's stock market, which was doing well until recently, many operators including Bharti Airtel and Reliance Communications (RCOM) raised funds by launching immensely successful IPOs.

The telecom segment is one of the key attractions for foreign investors, who have increasingly picked up stake at high premiums. Private equity (PE) funds are also no strangers to Indian telecom companies.

Foreign investor interest has been fuelled by gradual policy liberalisation. In 2005, the government provided a major boost to the telecom sector by increasing the foreign direct investment (FDI) limit from 49 per cent to 74 per cent for basic, cellular, unified and internet services for providers with gateways.

The government also raised the ceiling for external commercial borrowing (ECB), including foreign currency commercial bonds (FCCBs), for 2006-07 from $18 billion to $22 billion, and allowed telecom companies to access these funds without approval from the Reserve Bank of India or the government.

On the flip side, DoT recently tightened the norms for mergers and acquisitions (M&As). With new licences being issued, the government has stipulated that: pre-approval by DoT is required for any merger; the threshold market share of the merged entity will be 40 per cent; and the merged entity will have to pay extra for spectrum.

This move, which is in line with the government's objective of ensuring that there are over eight operators in all circles, will make it tougher for the new entrants to acquire funds and grow inorganically by way of M&As.

Financing trends

Over the next two years, the telecom subscriber base is expected to grow by about 250-350 million. As the service providers rush to capture a greater share of this market, the sector will witness, according to industry estimates, investments of about $25 billion. This will be the single largest investment in the telecom sector over a two-year period anywhere in the world.

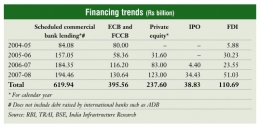

Loans are likely to be a popular method of raising funds. The total loans taken by the telecom sector have increased consistently every year and were at over Rs 195 billion in 2007-08. Companies like GTL Infrastructure Limited (GIL), RCOM and the Essar Group took loans from the Asian Development Bank (ADB), China Development Bank, Bank of TokyoMitsubishi, BNP Paribas, Citigroup Global, Commerzbank AG and Standard Chartered in 2007-08.

Idea Cellular is currently in the process of taking a $100 million loan from the International Finance Corporation (IFC), the private sector funding arm of the World Bank. The funds will be used to roll out services in the Bihar circle and strengthen the existing networks. GIL recently raised around Rs 35 billion in debt financing from foreign and Indian investors including the ADB, State Bank of India, Bank of India, Bank of Baroda, Life Insurance Corporation of India and Punjab National Bank.Interestingly, during its merger negotiations with South Africa-based MTN, RCOM reportedly appointed Barclays and HSBC to raise debt for the transaction.(RCOM was also expected to raise $2-3 billion from PE funds.)

ECBs are another popular method of financing. In 2007-08, the aggregate value of FCCBs raised by telecom companies was over Rs 14 billion. However, the corresponding figure was much higher in 2006-07 at Rs 40.16 billion as RCOM raised $1 billion in what is still the country's largest zero-coupon FCCB offering till date. Recently, GIL raised Rs 18 billion through equity and quasi-equity offerings including preferential warrants and FCCBs. The funds will help the company achieve its target of rolling out 23,700 towers by 2011.

PE funds are also very important for the telecom sector. Thanks to the rapidly expanding valuation of telecom companies, the aggregate value of PE deals in India increased from Rs 31.6 billion in 2005-06 to Rs 83 billion in 2006-07 to Rs 123 billion in 2007-08. Some of the largest deals till date include Bharti Infratel offloading a combined 12.5 per cent stake for $1.3 billion and Aditya Birla Telecom divesting 20 per cent stake for $640 million.

Smaller telecom companies are also increasingly taking the PE route for financing their expansion plans. For instance, Mauritius-based PE funds Monsoon India Inflection and Jackson Heights Investments picked up 3.35 per cent stake in Acme TelePower for Rs 4 billion, valuing the company at Rs 119.4 billion. Mumbaibased Category A internet service provider You Telecom, which is looking to invest about Rs 1 billion to initiate triple-play services, is expected to raise funds through the PE route.The public offering route has also become increasingly viable for raising capital among telecom companies with an established track record, reasonable subscriber base and a sound business plan.During 2007-08, companies like Idea Cellular and Spice Communications launched IPOs. Idea's issue was oversubscribed by 50 times and raised Rs 24.4 billion, while Spice's was oversubscribed by 37 times to raise Rs 5.2 billion. The aggregate value of all telecom IPOs in 2007-08 was Rs 34.43 billion.

Smaller companies like telecom equipment manufacturers XL Telecom and Aishwarya Telecom and infrastructure service provider Nu Tek also launched IPOs in 2008 and generated reasonable returns.

The current volatility in the stock markets has led to the deferment of the proposed IPOs of Reliance Globalcom, Reliance Infratel and Bharti Infratel.BSNL's proposed IPO is still at the discussion stage.

FDI is another major source of funding, and has increased consistently over the past few years. The percentage of telecom FDI to total FDI increased from 3.43 per cent in 2004-05 to 18.05 per cent in the April-June quarter of 2007. During 2004-08, the major acquisitions made by international companies totalled over Rs 525.2 billion.

Over the years, many telecom companies have divested controlling stakes to foreign companies in order to grow and develop. Major international companies like Hutchison Telecom International Limited, Malaysia's largest telecom service provider Maxis Communications, Vodafone and Russia-based Sistema are now the controlling stakeholders in Indian telecom operators like BPL Mobile, Aircel, the erstwhile Hutchison Essar and Shyam Telelink.

New operators such as Swan Telecom, Unitech Wireless, Datacom and ByCell are following the same path. Swan Telecom has already offloaded 45 per cent stake to UAE-based telecom service provider Etisalat for $900 million.Unitech has tied up with Telecom Italia in a similar deal, and Datacom is exploring options along the same line. Recently, the Foreign Investment Promotion Board cleared Swiss telecom service provider ByCell Communications' proposal to invest about $500 million to launch cellular services across India.

Going forward, it must be kept in mind that the growing trend of outsourcing has caused a fundamental change in the telecom operators' business model; many companies no longer need external financing. Transferring the capex component of the total expenditure to companies like Nokia and Ericsson helps operators expand rapidly without significant capital investment.

Impact of financial crisis

However, the current global financial crisis, which is having a ripple effect in India, may transform the telecom financing scenario substantially. Telecom analysts are concerned that access to funds for expansion will henceforth be difficult to come by (see Forum section). According to Pankaj Agrawal, associate director, BDAConnect, "Private equity interest is likely to be compressed as these players will demand higher internal rates of return to get into the sector."

Moreover, with the stock market plummeting sharply, IPOs will not generate the sort of returns that have made companies rich in the past. The only silver lining to this cloud, however, is that foreign players are likely to still be bullish on the market as its fundamentals are strong and hence be willing to acquire stake in domestic companies.

The way forward

All in all, the Indian telecom sector offers lucrative investment opportunities for financial investors. According to India Infrastructure Research, equity investors have got good returns from telecom deals.All the IPOs in the past four years have generated positive returns on the current market price (as on July 31, 2008), varying from 8.52 per cent for XL Telecom to as high as 276 per cent for Tulip Telecom.Airtel gave a return of 261 per cent.

On the PE front, one of the most profitable deals was the equity stake sale of PE fund Warburg Pincus in Bharti Tele Ventures. The total realisation from the deal was $1.61 billion, over five and a half times the investment. The total profit from the deal was about $1.3 billion.

With almost all telecom service providers having major expansion plans and all business segments slated to expand substantially, investors in the telecom sector will be looking to cash in on the opportunities.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!