Investing in Telecom - PE funds look to tap new opportunities

-

While sectors like energy and transportation have recently started generating PE interest, telecom has been attracting PE investments for a long time. In fact, the telecom sector was responsible for attracting PE funds to India. During the 1999-2001 period, New York-based PE firm Warburg Pincus made a $300 million investment in the then regional carrier Bharti Airtel. The operator has since grown into India's biggest cellular company. Warburg, over the past few years, has sold its stake in Bharti for a total of $1.6 billion.

According to an ASSOCHAM study, in 2007, a total of 386 PE deals were concluded in India. The real estate sector accounted for the biggest share of 26 per cent, receiving $2.6 billion through 32 deals, while the telecom sector followed closely with 21 per cent share, receiving $2.1 billion.

Expanding scope of PE investments

Earlier, telecom operators accounted for the bulk of PE investments in the Indian telecom sector. However, of late, investments are being made in almost every segment – telecom infrastructure (especially towers), mobile services, value-added services (VAS), IT and software, etc.

"Until last year, the focus of PE investors was on infrastructure service providers. The focus is now slowly shifting to infrastructure builders," says an official from a PE research firm. Today, over a dozen independent as well as hived-off tower companies have become an attractive investment proposition for PE investment firms.

Bharti Infratel, the tower arm of Bharti Airtel, had raised capital in multiple rounds from a number of investors like Temasek and Kohlberg Kravis Roberts and Company at an enterprise valuation of $10$12.5 billion. Reliance Infratel also divested minority stake in two rounds. In August 2007, the company made a PE placement of 5 per cent stake for Rs 14 billion to a group of institutional investors such as George Soros's Quantum Fund, HSBC Principal Investments, Fortress Capital, New Silk Route, Galleon, DA Capital and GLG Capital. Following this, in May 2008, Reliance Infratel sold 5 per cent stake to a number of American and European investors in a pre-initial public offering (IPO) placement that valued the company at about Rs 500 billion.American Tower Corporation, a Usbased firm, is looking to make a foray into the Indian telecom sector. TowerVision, an existing player, is owned by UK-based Ashmore Investment. Xcel Telecom is backed by US-based Q Investment, which has provided $500 million in funding. Xcel Telecom plans to install about 2,000 towers and acquire other companies in the segment. GTL has received over $250 million in funding from PE investors.Even the smaller companies in the segment are attracting funds. Aster Tower, for example, has obtained about $35 million from US-based funds.

Apart from the infrastructure segment, manufacturing, VAS and content aggregation are also witnessing significant PE interest. In April 2007, Aureos Capital announced that it would invest $8-$10 million in Ordyn Technologies, a Bangalore-based manufacturer of optical telecom transmission equipment. Other PE firms like Sequoia Capital, Northwest Venture Partners, Lehman Brothers and Matrix Partners are capitalising on the opportunities in the VAS and content aggregation segment. Sequoia has made investments in about half a dozen companies in these segments. Lehman Brothers recently invested about $15 million in Cellebrum, while Northwest Venture Partners and Nexus invested $12-$15 million in Mobile2Win.com.

Amongst service providers, most private operators have divested minority stake to at least one PE fund. Idea Cellular saw multiple investments from various PE groups prior to its IPO in 2006, with UKbased GLG Partners picking up 8 per cent stake for $213 million and ChrysCapital buying 5 per cent stake for $116 million.The other Indian telecom operator that has seen high PE interest is Tata Teleservices Limited (TTSL). Singapore's Temasek Holdings and Sterling Infotech have invested approximately $397 million in TTSL.

Bharti sold 4.99 per cent equity stake to Temasek Holdings in June 2007. Prior to being acquired by Vodafone, Hutch was approached by a clutch of investors, including PE firms Blackstone and Texas Pacific, for the sale of stake.

Major deals in 2008

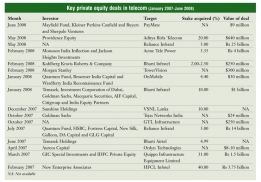

While PE investments in the country have been witnessing a slowdown in 2008, the telecom sector has seen robust growth in terms of the value of deals. During January-May 2008, despite all the turbulence in the stock market and the subsequent valuation crisis, eight PE investment deals worth $1.27 billion were made in the sector. This marked a sharp increase from the PE investments of $18 million made in the corresponding period in 2007. A major PE deal took place in May 2008 with Providence Equity picking up 20 per cent stake in Aditya Birla Telecom, a subsidiary of Idea Cellular, for $640 million.

In June 2008, mobile payment solutions provider PayMate India, in a second round of funding, sold undisclosed stake to raise $9 million from three PE funds, Mayfield Fund, Kleiner Perkins Caufield and Buyers and Sherpalo Ventures. In July 2006, Sherpalo Ventures and Kleiner Perkins Caufield and Buyers had invested $5 million in PayMate India.Return on investment

The average equity returns in the telecom sector are around 15 per cent. However, returns on private investments in public enterprises (PIPE) are much higher.While the overall return on PIPE deals in India in 2007 was negative, investments in the telecom sector defied the trend.According to a survey by the investment banking arm of domestic brokerage firm SMC Global, in 2007, private investment deals in publicly listed telecom firms such as Bharti Airtel stood out in volatile capital market conditions. The survey points out that up to $1.3 billion was invested in the telecom sector in 2007, and that the mark to market value stood at $1.6 billion.

Positive outlook

With the government granting licences to 9 new and existing companies to launch/ expand operations, the telecom sector presents a huge potential for PE funds. All the new licensees will be scouting for funds to roll out services as soon as possible. For instance, Datacom, a subsidiary of the Videocon Group, has finalised a rollout plan that involves an investment of about Rs 150 billion. Unitech is planning to divest about 26 per cent stake by end-2008 to raise funds.

CDMA operators Reliance Communications (RCOM) and TTSL have been granted GSM licences, and are planning to roll out GSM networks across the country.These companies are also on the lookout for funds.

Moreover, RCOM is reportedly in talks with PE funds such as the Carlyle Group, Blackstone and Apax Partners to raise about $14 billion to fund its proposed deal with MTN. The operator has appointed Deutsche Bank as the lead manager of funds.

According to industry estimates, over the next two years, telecom companies will make investments of about $25 billion as they rush to capture a larger chunk of the 250-350 million new subscribers. It would be the single largest investment in a timeframe of two years in any telecom market in the world. Private equity would play a key role in raising the funds required to finance the ambitious expansion plans of Indian telecom firms.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!