Optimising Assets - Telcos share infrastructure, hive off tower business

-

Building and managing towers account for a big chunk of the costs of rolling out services. In fact, passive infrastructure constitutes about 40 per cent of the total capital cost of an operator.

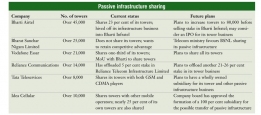

Given these high operating and capital expenses, telecom companies that had rushed to erect towers to cope with the explosion in the number of subscribers are now in a race to hive off their tower businesses. This is the latest trend in the tower business after telecom companies began sharing their towers with rivals in order to leverage their fixed assets.

Telecom tower-sharing companies have a business model of high fixed costs and low variable costs. Around 60 per cent of the total cost goes into tower erection, 20-25 per cent into the setting up of other cell site facilities, and the remaining into pre-operative costs like signing the land lease and obtaining licences from local bodies. Once a tower has enough tenants to cover the fixed costs, almost all the additional revenue contributes to the operating cash. For large, pan-Indian players, this means a new source of revenue, while for companies currently expanding nationwide, this implies lower capital and operating expenditure as well as faster rollout of services.

According to Kotak Securities, tower sharing can reduce the cost of ownership by 16-23 per cent. The telecom tower business opportunity in India has been valued at around $23 billion.

Key incentives

The next level of growth in telecom is going to come from the rural and semiurban areas. As this is expected to further push down the already low average revenue per user (ARPU), there is a strong motivation for cutting costs. Infrastructure sharing seems to be the most feasible way to do so. Moreover, the cost of setting up towers is very high as erecting one cell site costs about Rs 300,000. Sharing therefore frees up capital for investment in other areas such as 3G-based networks.Further, it would bring in the long-term cost component with pre-negotiated service level agreements.

Hiving off their tower businesses serves two main purposes for telecom companies. First, it unlocks value that is stuck in these towers, which can be reinvested in expanding subscriber handling capacities. Second, it helps operators to improve profit margins that have been under pressure due to falling ARPUs.

In a bid to facilitate deeper penetration, the Department of Telecommunications is providing subsidy to encourage infrastructure sharing in the rural areas.

Trends

Given these benefits, sharing tower infrastructure or hiving off the business altogether is becoming popular in the telecom industry. Reliance Communications Limited (RCL), for instance, first set up Reliance Telecom Infrastructure Limited (RTIL), a wholly owned subsidiary, for its infrastructure business, and then sold 5 per cent stake in it to a group of seven overseas investors. The move brought in Rs 14 billion equity for RCL.

RCL, which is reportedly investing $2 billion to take its tower count from 14,000 to 23,000 by March 2008, is currently in talks with several investors to offload another 10 per cent stake. The company may also go in for an IPO, offering 10 per cent stake to the public, thus taking the total divestment in RTIL to 25 per cent.The average initial capacity of RTIL's towers is expected to be approximately four tenants per tower.

Following the trend, Bharti Airtel is also in the process of transfering its tower business to its wholly owned subsidiary Bharti Infratel. It is in talks with a clutch of private equity players for divesting up to 25 per cent stake in Bharti Infratel. But the management is reportedly not satisfied with the valuations it has been getting from the private equity funds.

While RTIL, which currently owns over 14,000 towers, was valued at Rs 270 billion, based on the value commanded by RTIL's 5 per cent stake, Bharti Infratel is likely to fetch significantly more. This is because Bharti's tower count of over 45,000 is way ahead of RTIL's.

And with Bharti planning to spend about $3.5 billion to expand its network and double its cell sites, these numbers could get even bigger. There is also market speculation that Bharti may offload a small stake in its towers business to probe for valuations before opting for a bigger sale.

According to a report by HDFC Securities, tower sharing will help Bharti increase its EBITDA margins by 50-150 basis points. The report also predicts an additional revenue potential of Rs 4 billion for Bharti in 2007-08. Capex savings will be approximately Rs 170 billion, but will depend on tenancy ratios, configuration of base transceiver stations, height of towers and the kind of power plants used.

Tata Teleservices Limited (TTSL) and Idea Cellular are also planning to hive off their tower operations into a separate business. TTSL has firmed up plans to sell about 60 per cent of its telecom tower company which owns and operates about 8,000 towers. For divesting stake, the company is currently negotiating with Macquarie Infrastructure Partners, which recently bought US-based Global Tower Group from the Blackstone Group for $1.43 billion. TTSL's expected divestment has been in the news since March 2007 when it was negotiating with several domestic and international investors for selling stake in its wholly owned tower subsidiary.

Meanwhile, although Idea Cellular's board has approved a proposal to demerge its tower business, there seems to be no plan to involve a strategic investor in the demerged entity.

Smaller players like BPL Mobile, Aircel and Spice are embarking on a capacity expansion plan. BPL is looking to hive off its tower businesses into a separate company. It also plans to add 50 towers a month so that by end-2007, it has 1,300 towers compared to the 550 it had in the beginning of June 2007.

Existing tower companies

Towers generate monthly rents varying from Rs 40,000 to Rs 100,000 depending on the location. Moreover, the rent generally increases on an annual basis. As far as a cost-benefit trade-off is concerned, incremental costs go up by approximately 10 per cent annually, while revenues generally increase by 80 per cent.

In order to tap the burgeoning market for telecom towers, nearly half a dozen firms have sprung up over the past year and a half. These include Xcel Telecom, Essar Telecom Tower and Infrastructure, GTL Infrastructure, and the Srei Group's Quipo Infrastructure. They have steadily gained recognition in the industry which is today dominated by global players such as ATC, Tower Vision and Crown Castle.

GTL Infrastructure, for instance, is arranging Rs 10 billion for undertaking global acquisitions, and has already initiated talks with at least four companies for this purpose. It has rolled out 1,200 cell sites and plans to set up another 6,700 towers by March 2008 at an investment of Rs 20 billion. The company has acquired Genesis Consultancy, a UKbased network service provider, for over Rs 400 million.

Growing on similar lines, Xcel Telecom is working to set up 2,000 towers in the current fiscal year. It is spending about $50 million to acquire small tower companies with 50-100 towers. Xcel is also eyeing stakes in the hived-off infrastructure arms of TTSL, Bharti Airtel and RCL.

Essar Telecom Tower and Infrastructure, which is over a year old, has already set up over 1,000 towers. The company has chalked out plans to add another 5,000 towers during the current fiscal year at an investment of Rs 12 billion, and has achieved almost half the target. ETIPL has leased out towers to leading operators like Airtel, Vodafone Essar, Spice Communications, TTSL and BPL. The company is in talks with three small Indian tower companies to buy them out, and, like GTL, is eyeing markets abroad too.

Quipo Infrastructure, which forayed into the tower business in 2005, initially had a hard time marketing the concept of tower sharing. But now, with a number of service providers de-hiving their tower businesses, the company has started leasing out towers, and expects this business to contribute significantly to its topline.Quipo Infrastructure expects the share of revenue from its tower business to go up to 60 per cent in the coming years.

The company is planning to raise around $100 million from private equity funds by early 2008. It intends to use two-thirds of these funds for expanding its telecom tower inventory from around 1,200 towers to over 10,000 towers over the next two years.

Looking ahead

The potential for standalone towers in India can be gauged from the fact that the country will need about 330,000 towers by 2010 (as compared to about 110,000 as of March 2007), according to estimates by the Telecom Regulatory Authority of India.

Given the accelerated growth in the wireless subscriber base, telecom companies will require huge capital expenditure to support this growth. This, in turn, will entail massive deployment of towers, especially in the rural areas, highways and remote areas.

Moreover, government incentives, new services like 3G, Wi-Max (when the government allocates spectrum) and digital terrestrial transmission will create further demand drivers for telecom towers in the future.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!