High Speed VAS - Killer applications with 3G

-

It has been more than a decade since the launch of mobile services and operators have stuck to time-tested VAS (value-added service) offerings such as SMS, ringtones, caller tunes and wallpapers. Considered to be a revenue spinner worldwide, VAS in India is still to see a revolution. This is partly owing to the lack of "killer" mobile applications in the arena. While there is tremendous potential, most applications require a high speed network to be utilised. In that respect, the prolonged delay of 3G and Wi-Max services is a key hurdle.

However, with the government clearing the decks for 3G and Wi-Max spectrum auctions, operators are expected to launch these services within six to eight months of receiving spectrum. The VAS market will then certainly get a boost. Operators will be able to enhance their VAS portfolio with the introduction of rich media content and services on new technology platforms.

However, while this remains a popular trend, it is yet to witness the level of success seen in developed markets like Japan, the US and Europe. For instance, in the US and the UK, VAS accounts for 20-25 per cent of operator revenues, as compared to about 10 per cent in India.

Over the years, while the MVAS market has evolved from basic person-to-person (P2P) text messages to caller ringback tones (CRBTs) and mobile mail, SMS in all its forms (P2P, P2A, subscriptions, A2P) continues to be the biggest revenue generator after voice and accounts for nearly 44 per cent of the market. In fact, its popularity is boosted by the SMS voting option on television reality shows.

Music-centric options such as CRBT and ringtones are also extremely popular and account for over 35 per cent of VAS revenues excluding SMS. Voice portals are the other big revenue generator as they enable access to a wide variety of content that is primarily dominated by films and cricket.

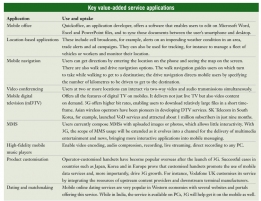

Some of the value-added services that are likely to take off are as follows...

Mobile advertising: As 3G will enable better video quality and faster internet access, entrepreneurs can build innovative internet advertisement platforms and applications suitable for the mobile space. Moreover, advertisements aired on television can be aired direct to customers over a 3G phone. Currently, internet advertising, which accounts for 1.8 per cent of the country's total advertising spend, stands at around Rs 3 billion. This is slated to rise by 7.1 per cent in 2010-11. While internet advertising through the mobile space currently holds a very minute share, analysts believe this should grow with increased data usage on the handset as the ability to directly target the individual on the phone is a key capability.

Voice-to-video: All voice-based VAS applications such as ringtones and ringback tones can be migrated to video in 3G. VoD would be a convenient and easy medium, wherein users can download a video and watch it at their convenience.

Data-rich services: VAS players can lease lines from operators to offer a gamut of services such as real-time video streaming, games-on-demand, karaokeon-demand, TV-on-demand, and mapson-demand.

News: News on the mobile has tremendous potential. In fact, news-centric content through the SMS route has already caught on. Going forward, industry analysts believe that the mobile platform will be used by consumers for customised content. While news channels have already begun exploring this medium in a big way, digital agencies too are upbeat about it and are hoping 3G rollouts would further boost news on the mobile. NewsX and Star News are among the broadcasting channels that are already providing news through mobiles.

Enterprise VAS: Enterprises are looking at MVAS applications to ensure 24x7 connectivity for employees. Therefore, applications like mobile email and mobile data connectivity are already very popular, whereas applications such as mobile access to customer relationship management and sales force automation are being used, though in a limited fashion. Moreover, the integration of 3G with e-governance, finance, manufacturing, education, health care and other industries will enable the integration of industrialisation and mobilisation.

Also, 3G is expected to offer a wide range of benefits and services for low-end users like farmers, hawkers, etc. Says Dr Mahesh Uppal, director, ComFirst, "This opportunity will drive the value addition."

Content providers are also gearing up to make the most of this opportunity. For instance, OnMobile Global is planning a citizen journalism portal. The Bangalorebased firm has developed a technology that will allow subscribers to shoot a video or a photograph and upload these on a citizen journalism website with a voiceover, in minutes rather than in hours. The firm is in talks with some media houses, which could regulate the content, to launch the portal. The same technology will give users options to share the photographs and videos with friends or upload these on social networking sites.

Similarly, CanvasM Technologies will offer a video portal and video calling services, while Comviva Technologies will introduce video ringback tones and video mail.

California-based wireless technology provider Qualcomm has grander ambitions. It plans to launch its low-cost Kayak PC in India, which uses 3G to connect to the internet as well as smartbooks – much like smartphones but with larger, high resolution screens.

Clearly, the upcoming 3G and WiMax services will change the rules of the mobile/VAS game, with a series of innovative services in the pipeline. The 2010 Commonwealth Games are likely to act as a trigger for these services. Usage will be determined by the variety of content available. And, even if 3G does not make a breakthrough differentiation in VAS revenues, the increase in dataand multimedia-related activity should significantly hike ARPU levels.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...

| Your cart is empty |