Motorola India - Sales plummet

-

Global telecom major Motorola has or long been a name to reckon with, both in networks and handsets. In the past few years, however, its position has been slipping with competition intensifying in the telecom industry world over. The US-based company has, in fact, been steadily losing ground to rivals like Apple, Nokia, Research In Motion and LG in the handset space and to Huawei, ZTE, NSN, etc. in the equipment and networks space.

Background

Motorola, which has a market presence in over 110 countries, was one of the first telecom equipment manufacturing companies to enter India, back in 1987.

Its operations are divided into three business segments: mobile devices, home and networks mobility, and enterprise mobility solutions. The company's focus areas include mobile handsets, wireless infrastructure, managed and hosted services, and broadband equipment.

The Fortune 100 company launched its first mobile phone in India in 1995. It tried to carve out a niche for itself and was ranked number three in India in February 2006 with 4.6 per cent market share. Samsung had 6.4 per cent and Nokia, a staggering 78.8 per cent. In September 2006, Motorola moved to the number two position with 10 per cent market share. However, as time went by, the company was unable to maintain its growth momentum and lost this position. It is currently estimated to be the fourth largest player in the country in the handset market, behind Nokia, Samsung and Sony Ericsson.

In enterprise solutions, the company prides itself on being in a top slot and boasts of an impressive set of clients owing to its diverse range of end-to-end services and solutions.

Market position

Dwindling market share in the handset market and the economic downturn are forcing Motorola to go slow on its India strategy. In fact, the company has been downsizing its India operations for a couple of quarters now. It has considerably reduced its advertising spend and is in the process of downsizing its executives in the marketing and communications divisions.

In what could be termed as the first instance of job cuts in the Indian telecom space, Motorola handed out pink slips to at least 100 of its 4,000 employees in the country. The move was a part of the company's strategy to slash 3,000 jobs (5 per cent) globally. Of the 100 Indian employees, at least 40 were a part of the company's sales and marketing team. Prior to this, in the quarter ended December 2008, Motorola India issued pink slips to about 400 employees.

The global downturn made things worse and in early 2009, Motorola decided to shut down its distribution division in India amid declining sales and increasing competition. As part of this strategy, in March 2009, Motorola restructured its sales and distribution structure in India. It terminated its sales and distribution arrangement with Bharti Teletech, a subsidiary of Bharti Enterprises. Instead, it roped in Delhi-based distribution firm Jaina Marketing and Appliances as its new nationwide distributor. Most of its distribution work is now being done out of Singapore. This is in sharp contrast to the company's vision for India and emerging markets three years ago. In August 2005, Motorola had established India as the headquarters for high-growth markets as it was focusing on lower-tier products. However, the US-based firm failed to keep up its success in India.

Handset offerings

Motorola tasted success on Indian soil with the launch of MotoRazr in 2005. After the runaway success of this ultra-thin phone model, the company has been unable to come up with a hit phone.

The customer perspective in India is that, compared to Nokia's phones, Motorola's are less user friendly. According to an analyst, Nokia's phones fit into every budget and every pocket.

One of the flaws with Motorola's handset strategy, according to analysts, is its limited product portfolio. "This issue has been characteristic of Motorola. It has not taken into account the booming market and diverse needs of consumers," points out Dr Mahesh Uppal, director, ComFirst. Since 2002, Nokia and Samsung have been expanding their handset range whereas Motorola has failed to do so. An example of this is Motorola's first slider, the Z3, which debuted in 2007 when that segment was already well under the control of Samsung, Nokia, Sony Ericsson and a couple of other manufacturers.

In 2009 too, the company has launched just a handful of handsets (MOTOYUVA, AURA, MOTOYUVA W160, the W156, and MC 9500) in the Indian market whereas competitors like Nokia have launched more than 15 models.

Clearly, Motorola's handset business has been under pressure globally and the management has therefore been considering selling off this unit. "A number of companies have expressed interest in acquiring Motorola's handset business, including India's Videocon. However, the sale will happen at the right valuation," said a company official.

The past one year has also seen several top executives leave the company. Lloyd Mathias, senior director for sales and marketing (mobile devices), moved to Tata Teleservices while corporate vice-president and MD, software and services, Mohan Kumar, quit to join Norwest Venture Partners.

Networks

Motorola's networks division has brighter prospects. This segment is slated to grow, driven by the entry of new players, the expansion plans of existing players and the expected launch of new technologies like Wi-Max.

However, the company needs to improve its strategies. After winning a major contract from Bharat Sanchar Nigam Limited (BSNL) in end-2008, it has not been able to manage a single big contract from any new licensee. In 2008, the company bagged a $90 million GSM line expansion contract from BSNL, under which it will ship GSM network equipment and provide network services support – both software and hardware – to BSNL in the southern region. Motorola has started executing the project.

According to Subhendu Mohanty, country head and senior director, home and networks amobility business, "Motorola's key focus and strength are on the value-added side, radio frequency performance, network improvement and optimisation. This is important as customers tend to pick operators on the basis of their network performance – superior voice quality, lower congestion, etc."

But analysts are quick to point out the chinks in the armour. Says Pankaj Agrawal, BDA India, "Motorola has some gaps in its equipment portfolio, especially in its UMTS network equipment portfolio, and is partnering with Huawei for a 3G go-to-market. Going forward, the end-result and effectiveness of this partnership remain to be seen. Until the company develops its own end-to-end product offering, there is no way it is going to be a serious player in UMTS."

Mohanty, however, counters this. "It is true that we don't manufacture the switch and core part of the infrastructure, but we have an ecosystem of different partners and interact with all major manufacturers for this. So, this can actually translate into a strength depending on who you are talking to."

Meanwhile, Motorola's government and public safety business division is gaining traction. The company has won three contracts from Delhi international airport, Bangalore international airport and GMR Hyderabad International Airport for providing terrestrial trunked radio (TETRA) digital radio communication networks. Under the contract, the equipment manufacturer will replace the airports' existing analog radio networks with the new IPbased mission-critical ones.

More recently, Delhi Metro's airport express link and Mumbai Metro have both chosen Motorola's TETRA communication system. According to a senior company official, "After deploying the TETRA network for the Delhi Metro Rail System, we are looking at introducing services for the Mumbai Metro Rail System as well. We are also hoping to bag a signalling and telecom contract for the Bangalore Metro Rail System."

Global operations

Founded in 1928, Motorola was a lynchpin of the communications boom, pioneering the use of car radios in the 1930s and manufacturing the equipment that carried the first words from the moon. When the cellphone revolution began, Motorola rode high on the popularity of devices like its StarTAC and Razr phones, which were design icons in their eras.

Its stock market capitalisation touched $55 billion four years ago. But today, the value of the Schaumburg, Illinois-based company is just over $20 billion.

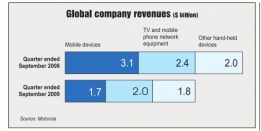

Sales are plummeting at all three of its divisions, with the handset unit being the hardest hit. Overall, Motorola's sales fell 27 per cent in the third quarter of 2009 to $5.5 billion. It reported $12 million of earnings as it slashed costs.

Handsets were long Motorola's marquee business. But this year, it has been surpassed by the set-top-box unit, which is called the home and network mobility division. That business has also been hit by the economic downturn, with sales falling 15 per cent in the third quarter from a year earlier to $2 billion. Still, the unit remains profitable, posting operating earnings of $199 million in the period.

On the anvil...

Motorola is now set to start trial services of 4G in India. It has asked the Department of Telecommunications for trial spectrum. The new 4G service will provide 70 Mbps of download speed on a mobile phone. The company is also keen on Wi-Max and has been successful in deploying Wi-Max networks worldwide.In India too, it expects to gain significant business once the government auctions the requisite spectrum.

Gearing up in the handset domain, the company has lined up at least seven handset models to be launched in India and over 15 worldwide.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...