ITI Limited - Readies for disinvestment following unsuccessful bailouts

-

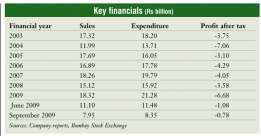

Set up in 1948 for manufacturing teleom equipment, Indian Telephone ndustries (ITI) Limited has provided equipment for over 50 per cent of the country's telecom network. However, while the company was the trusted workhorse of the Indian telecom sector during the 1980s and the early 1990s, it has been unable to hold its own in the face of the intense competition in the industry over the past decade. The company has been in the red since 2003 and even had trouble paying salaries to its 13,000-odd employees in January this year.

The 60-year old telecom equipment manufacturing company has clearly been unable to capitalise on the telecom boom in the country. It has witnessed a sharp decline in financial performance in the face of stiff competition from global equipment makers who provide the latest technology solutions at cost-effective prices.

Like other public sector undertakings (PSUs), ITI too is saddled with huge surplus manpower (even after offering voluntary retirement to 6,365 employees). This has led to heavy dependence on market borrowing at high interest rates with little value addition.

The company has been in the news recently with the government kicking off the process of selling loss-making stateowned companies and putting ITI on the block. In June 2009, the communications and IT ministry invited expressions of interest from global equipment makers and equity investors to buy out or pick up stake in three of the six manufacturing plants run by ITI. The other three units too will be sold and different business models, from outright sale to stake sale to collaborations, are being explored.

Background

Headquartered in Bangalore, ITI is the country's first post-Independence PSU. At present, the company has six manufacturing units – three in Uttar Pradesh (Mankapur, Rae Bareli and Naini), and one each in Srinagar, Palakkad (Kerala) and Bangalore (the main facility). ITI manufactures the entire range of telecom switching, transmission and terminal equipment.

The company began phasing out the production of electromechanical switches in the early 1990s, with switching and transmission equipment taking over as the two key contributors to the company's turnover. It started mobile equipment manufacturing at its Mankapur and Rae Bareli plants in 2005-06. These two facilities supply more than 9 million lines per annum to both the domestic and export markets.

While the company made the most of the captive market situation from the 1950s to the 1980s, the onset of economic liberalisation in 1991 sent the company into a tailspin. By the late 1990s, the government had divested ITI of its protective cloak of monopoly supplier and reserved quotas. With the government's pro-liberalisation policy changes facilitated the opening up of the telecom hardware market to multinational vendors, who quoted low prices to gain entry into the market. As a result, ITI lost a sizeable share of Department of Telecommunications (DoT) purchases and was declared a potentially sick company in September 1996 with net losses totalling Rs 3.17 billion during the 1994-96 period. Production value declined 35 per cent in 1994-95 and a further 29 per cent in 1995-96.

While the company was able to claw its way into the black and delivered profits ranging from Rs 150 million to Rs 460 million during the period 1997-2002 by expanding into new technologies such as optic fibre systems and microwave systems of synchronous digital hierarchy, switch mode power supplies, point-to-multipoint multi-access radio relays, large digital exchanges, wireless in local loop (code division multiple access) and through management changes, it was unable to sustain the growth momentum and slipped back into the red in 2003. Since then, the company has been haemorrhaging government and taxpayer money.

Revival attempts

ITI has, however, been able to garner strong support from the government (the Ministry of Communications and IT in particular), which holds 92.87 stake in the company and has made several attempts for its revival.

In 2005-06, the government formulated a bailout package of Rs 10.25 billion. However, the company was unable to leverage the aid to the fullest and it worked well only in short-term revival.

In December 2007, the company sought another government bailout package of Rs 20 billion. The funds were sought to wipe out accumulated losses of Rs 22.25 billion and to have accessible working capital for telecom equipment manufacturing. With confirmed orders worth Rs 28 billion, the company was confident about turning the corner with support from the government. The new bailout was expected to make ITI independent of projects from Bharat Sanchar Nigam Limited (BSNL) and Mahanagar Telephone Nigam Limited (MTNL), which accounted for more than 80 per cent of its total orders.

In an attempt at turning the company around, the government proposed merging it with BSNL in 2008. However, the telecom major opposed the move on the grounds that its valuation would decrease substantially.

Earlier this year, the cabinet cleared an interest-free loan of Rs 1.25 billion to enable the company to pay salaries. In June, the government also sanctioned a package of Rs 28.2 billion to take care of the company's liabilities and enable it to start with a clean slate.

With the government initiating the process of disinvestment in ITI earlier this year, the company has now invited bids to set up joint venture (JV) companies with ITI. The JV companies are being planned at Rae Bareli, Naini and Bangalore. The majority equity participation can be from Indian or global players for Wi-Max at Rae Bareli; for gigabit passive optical network (GPON), gigabit ether passive optical network (GEPON) and optical transmission equipment at Naini; and for IP core systems at Bangalore. In addition to these products, the JV companies may also manufacture other telecom and IT-related products at the sites, in consultation with ITI.

ITI will hold minority stake (about 26 per cent) in the proposed JV companies while the JV partner would hold the remaining. ITI will provide the necessary infrastructure and real estate, besides manpower for the proposed JV companies. According to S.K. Chatterjee, chairman and managing director, ITI, the JVs will be separate businesses with the company owning stake in them, while ITI will continue with its current business profile.

US-based Intel Capital may emerge as one of the bidders for a stake in the factories owned by the company, as part of its strategy to expand the use of WiMax in the country. Intel Capital is likely to put together a consortium of companies that could be interested in using ITI's facilities for manufacturing WiMax-based network hardware and consumer premises equipment.

However, Intel's participation in the bid would depend on the government's stand on increasing the quota for products manufactured by ITI. At present, BSNL and MTNL buy only 10 per cent of their total equipment requirements from ITI. Companies like Intel could get interested if the government ensures that 30-40 per cent of PSUs such as BSNL, Indian Railways and the defence establishment buy equipment from the Indian manufacturer.

Apart from Intel, Huawei and AlcatelLucent have also shown interest in ITI's plants. However, security concerns related to Chinese manufacturers may pose a problem for Huawei. Alcatel-Lucent, which already has a partnership with ITI for supplying GSM equipment to BSNL, is a strong contender. The company is also a strong player in the Wi-Max and Ipbased telecom equipment market, for which ITI's existing factories can be used.

Companies keen on participating need to submit their bid before end-January 2010. Though interested parties have been asked to participate before January 29, 2010, the ministry is holding a pre-bid conference before selecting them.

The road ahead

Meanwhile, despite a severe financial crunch (the company registered a loss of Rs 6.36 billion in 2007-08), ITI managed to achieve its highest turnover in the past seven years, at Rs 18.29 billion, for financial year 2008-09.

According to company officials, manufacturing, installation and commissioning activities constituted about 82 per cent of the turnover with trading accounting for the remaining portion. ITI has fixed the target for memorandums of understanding at Rs 57.6 billion for the year ended 2009- 10. With a healthy order book position of Rs 68 billion, including fresh orders of Rs 32 billion secured this fiscal year (2009- 10), the company remains upbeat about its future prospects.

However, whether the company is successful in achieving a turnaround this time remains to be seen and much will depend on the outcome of the bids. But clearly, over the next two to three years, the company has a mammoth task ahead of it.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...