New Players: A Slow Start - New licensees struggle to get off the ground

-

A year ago, despite serious resistance from existing operators, the minister for communications and IT, A. Raja, had pushed ahead with his decision to award licences to new players. He had hoped their entry and subsequent launch of services would stir up competition in the industry and make mobile tariffs cheaper.

But that did not happen. The new entrants, barring Sistema Shyam TeleServices Limited (SSTL), have failed to make their debut in the telecom market so far, caught up as they have been with ownership issues and funding constraints.

The scenario was completely different in February 2008. Exultant on receiving licences, the six new companies – Datacom, Loop Telecom, SSTL, STel, Swan Telecom and Unitech Wireless – announced mega plans and strategies to take on the incumbents. Though some had little or no prior experience in telecom, they were confident that they would learn from and leverage the experience of the existing players. They also believed that the pan-Indian licence (which some of them had received) would give them economies of scale in rolling out networks, an advantage the incumbents did not have. They also decided to fight aggressively on the tariff front, the idea being to attract customers with innovative tariff packages. Some even announced ambitious targets of gaining 10 million subscribers by the end of 2009.

However, those plans soon melted along with the global markets. Faced with a sluggish economy and a liquidity crunch, the new entrants are finding it difficult to break into a highly competitive market dominated by heavyweights such as Bharti Airtel, Reliance Communications (RCOM), Bharat Sanchar Nigam Limited (BSNL) and Vodafone Essar.

There are other stresses too. Under the terms of their licence, the new players are required to start services within 12 months of receiving their licences or face heavy penalties. They have to cover at least 10 per cent of each district headquarter in a circle in the first year but, barring SSTL, none of the firms has launched services.

The companies claim that their services have been pushed back because of the delay in receiving spectrum. But this argument is not washing. The Department of Telecommunications (DoT) had at the outset specified that the licence holders could not blame delays in obtaining spectrum or government clearances for not fulfilling their rollout obligations.

In the past, DoT has made defaulting operators lay out fixed line network as penalty. It has even imposed fines of up to Rs 500,000 per week for the first 13 weeks of delay, Rs 1 million for the next 13 weeks of delay and thereafter, at the rate of Rs 2 million for delays of up to 26 weeks. If operators failed to fulfil their obligation post 52 weeks, DoT could even cancel their licence.

But this time, to help the new players get off the ground, DoT has decided to dilute the rollout conditions. Instead of the earlier norm of calculating the rollout targets from the date of grant of licence, it is allowing the new players to fulfil their obligation within one year of getting spectrum.

Further, DoT has decided that coverage will not be mandatory in buildings, though the existing norms make it compulsory for operators to cover the interiors of each building in a district. DoT has already notified these amendments in the cellular licence.

According to DoT, it is important to give a helping hand to the new players as they face a tough job in rolling out greenfield networks and sustaining themselves in today's market conditions. The current business model is not likely to yield adequate returns on investments. To make the business case stronger, the communications and IT ministry had asked the Telecom Regulatory Authority of India (TRAI) to review the current interconnection norms. TRAI has since recommended that termination charges be brought down from Re 0.30 a minute to Re 0.20 a minute. That should give the new players a bit more room to compete with the existing players as it would help them lower their operating expenses.

DoT is also hoping that mobile number portability can be implemented soon. This will make it easier for new players to attract subscribers if they can offer cheaper rates and better quality of service.

Another policy decision that DoT thinks will help new operators is the introduction of mobile virtual network operators (MVNOs). The new players can hope to gain a pan-Indian presence by riding on the network of other operators.

But first, the new players will have to launch their services. tele.net does a status check on the new telecom players, to find out where they stand a year after obtaining licences...

SSTL

SSTL, a joint venture between Russian telecom major Sistema and erstwhile regional player Shyam Telelink, is the only new operator that is on track with its plans.

Having received spectrum for 22 circles, the company, in late 2008, launched services on a CDMA 800 MHz mobile network in Rajasthan under the brand name Rainbow. As of January 2009, it had a subscriber base of more than 500,000 (including Shyam's previous subscriber base).

The network installation was contracted to Chinese vendor ZTE. The total contract value for network installation for 800 sites was $27 million.

The Rajasthan launch marks the beginning of SSTL's pan-Indian rollout. The company is planning to start mobile operations in Tamil Nadu and Kerala soon under the Mobile TeleSystems (MTS) brand of Russia, which is owned by Sistema. It hopes to be present in at least 10 circles by the year end, launching services in one or two circles every month. By 2012, it aims to notch up more than 35 million subscribers, translating into 7 per cent of the Indian market.

To expedite rollout, SSTL has entered into agreements with infrastructure companies to share towers. About 80 per cent of the towers in its network are shared; however, it plans to invest more in building its own infrastructure. Earlier, SSTL had announced an investment of $5 billion over a five-year period to set up a countrywide network.

The company is also open to outsourcing its IT and call centre functions. "Once our network covers a major part of the country, we would like to have two or three pan-Indian companies manage our call centre requirements. It is important to have call centres with knowledge of the local language in a circle," states Vsevolod Rozanov, president and CEO, SSTL. Aside from outsourcing its call centre functions, SSTL is also open to tapping other opportunities, including acquiring a mobile services company in India.

Recently, the company changed its name from Shyam Telelink to Sistema Shyam TeleServices, reflecting the increasing role being played by Sistema. For instance, Sistema group company Sitronics has supplied the radio relay equipment to Shyam in Rajasthan. And the company will offer services under the MTS brand. "These efforts clearly position Sistema Shyam TeleServices as an integral part of the Sistema Group, which is now reflected in its name," notes Rozanov.

Sistema has been steadily increasing its shareholding in Shyam since 2007. Its stake in the company currently stands at a little over 73 per cent. Sistema has already invested $1 billion in Shyam and plans to invest a further $1.5 billion during the year. Rozanov's concern, however, is that more funds would be called for to ensure smooth rollout of services. In this context, he believes the government should consider relaxing the foreign investment norms to allow international players to bring in funds in the form of loans. "As of now, the situation is under control because the financial meltdown has not impacted Indian banks in a major way. However, if the situation worsens, there could a problem if we are not allowed to bring in foreign funds in the form of debt. We are allowed to bring money in the form of equity but our promoters would like to have the flexibility to decide in which form they want to infuse funds into the company," says Rozanov.

As it rolls out services in other states, the company wants to focus on changing the users' perception that CDMA is the poor man's choice. In a bid to attract highend mobile users, the company is talking to handset vendors to ensure that the latest CDMA devices are launched in the Indian market. Overall, the company's strategy is to gain significant market share over the next three-four years.

SISTEMA SHYAM TELESERVICES

Ownership:A little over 73 per cent owned by Russian company Sistema; rest held by Shyam Telecom

CEO: Vsevolod Rozanov

Licences: 22 circles

Spectrum: 22 circles

Future plans: To roll out services in at least 10 circles by end 2009. Aims to gain significant market share in the next three-four years

Unitech Wireless

The entry of realty major Unitech into the telecom space was greeted with considerable interest. The group had no prior experience in telecom and had received spectrum to operate in 22 out of the 23 circles in the country. Brimming with confidence, the company expected to roll out services by late 2008. As a first step, Aircel's Rohit Chandra, who has considerable experience in telecom, was roped in as the CEO with the responsibility to chart the new venture's growth course.

Mid-year, however, the company began losing steam. The global economic crisis had begun impacting the group's mainstay – its realty business. The company needed to sell stake to finance the telecom venture.

In October 2008, Unitech Wireless found a partner in Norway's Telenor, which picked up 60 per cent stake in the company for $1.2 billion. The fund infusion was welcome and timely, given the vulnerable market conditions. Besides, the deal upped the company's enterprise value to Rs 116.2 billion, which, according to industry watchers, was more than "fair" considering the value of the licences held by the company.

The funds were intended to be used for laying out the network, rolling out operations and bidding for 3G spectrum. But Telenor, which was planning to finance the acquisition by selling $1.8 billion worth of its shares in a rights issue in the first quarter of 2009, was met with strong investor resistance and hence, had to revise its funding strategy.

That took a while, but early February 2009, it drew up its investment plans for the Indian wireless market. Instead of the earlier funding option, Telenor raised a loan of $1.1 billion. "We have decided that the investment in Unitech Wireless in India will be financed through a combination of cash generated from operations and additional debt," stated Jon Fredrik Baksaas, president and CEO, announcing Telenor's fourth quarter results.

Telenor further announced a $3.2 billion investment in Unitech Wireless over a period of five years, in the expectation that operations would reach break even in that time. The EBITDA (earnings before interest, tax, depreciation and amortisation) break even, the company expected, would be earlier, within three years of launching operations.

For Telenor, the acquisition is strategic. It builds on an existing Asian expansion strategy, which will get the company its long-term subscribers and revenue growth. The plan is for Unitech Wireless to cover nearly 60 per cent of India's population after its first year of operations. Telenor and Unitech are targeting a panIndian market share of 8 per cent and expect the average revenue per user (ARPU) to be in line with rival operators.

Telenor already has a significant presence in Bangladesh with Grameenphone and it expects to achieve the same in India. According to Telenor officials, the company intends to draw on all its experience in order to compete with Indian heavyweights Vodafone Essar, RCOM, BSNL and Tata Teleservices Limited.

Towards that end, it has recently appointed Stein-Erik Vellan as managing director of Unitech Wireless, while Johan Lindgren and David Meneghello have been appointed chief financial officer and chief marketing officer respectively.

With the fund infusion in place, Unitech Wireless expects to launch services in the third quarter of 2009. It has set in motion the first phase – to offer services in 13 circles by mid-2009 – and has already hired 250 people for the venture. Overall, it plans to invest Rs 150Rs 200 billion in its telecom business during the next three years.

Meanwhile, attempting to keep capital and operating expenditures as low as possible, the company has announced a tower-sharing agreement with Tata's tower company Wireless-TT Info Services Limited and Quippo Telecom to share around 40,000 sites. This, the company believes, would reduce capex by almost 75 per cent per site. The company is also open to outsourcing its IT needs and will leverage its tie-up with Telenor to purchase equipment at competitive prices using multiple vendors.

UNITECH WIRELESS

Ownership: 60 per cent owned by Telenor; 40 per cent by Unitech Limited

CEO: Rohit Chandra Licences: 22 circles

Spectrum: 21 circles

Future plans: To launch services in the third quarter of 2009. A $3.2 billion investment announced by Telenor for Unitech Wireless over a period of five years.

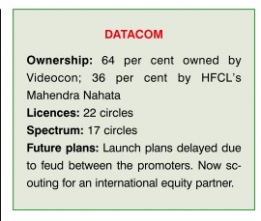

Datacom

Caught in a feud between its promoters, Datacom's rollout plans have been delayed by more than six months. The most aggressive of the new entrants to begin with, the company received spectrum early and planned to launch services by August 2008. However, mid-year, ownership and control issues cropped up between the two promoters – Videocon's Dhoot family (64 per cent) and the Mahendra Nahata Group-owned Jumbo Techno Services. This put paid to any rollout plans during the year. It also deterred prospective international investors from taking any stake in the venture. Meanwhile, the company's CEO, Ravi Sharma, quit on the ground that the dispute was delaying all business decisions.

Realising that the dispute is seriously hurting company interests, the promoters are believed to now be putting their discussions on a fast track. Two compromise options are reportedly being discussed: merging the Punjab telecom business of Nahata's HFCL with Datacom, or the Dhoots buying out Nahata's 36 per cent stake in Datacom at an appropriate price.

Meanwhile, as the company is required to meet its first-year service deadline as mandated by DoT, it is moving ahead on a business plan. It has signed an agreement with Chinese equipment manufacturer Huawei to roll out its GSM-based cellular network across nine circles. Under the agreement, Datacom, which has licences to offer telecom services in 22 circles, has given a contract worth $100 million to Huawei for providing mobile connections to 8 million subscribers. The purchase order on this, however, has still to be placed.

The company has also asked DoT to allocate the available spectrum in the Delhi region. According to its licence terms, Datacom is entitled to get start-up spectrum of 4.4 MHz. However, DoT has about 3 MHz in Delhi, which the company is willing to accept and launch services. Datacom is also scouting for an international equity partner.Loop Telecom

Loop Telecom, a wholly owned subsidiary of BPL Mobile, obtained a pan-Indian licence in 2008, and received start-up spectrum in 13 circles. However, like Datacom, it has been weighed down by ownership-related problems. The Essar Group, which has a direct 9.9 per cent stake and controlling interest in BPL Mobile, is currently engaged in arbitration proceedings with UK-based Vodafone over the ownership of BPL Mobile. Till the conflict is resolved, Loop will find it difficult to move ahead.

Already, the dispute has impacted the company's ability to attract potential investors, which will further delay the rollout of services. The company is looking at an investment of $2-$2.5 billion. BPL Mobile has been considering various funding options, including debt and equity.

In September 2008, BPL Mobile raised about $80 million by selling around 17.6 per cent equity shares in Loop to a Mauritius-based company, owned by an international institutional fund. Following the sale, BPL Mobile has 61 per cent stake in Loop. This fund infusion should go some way in meeting the company's needs. Further, to reduce rollout costs, the company is partnering with Essar Telecom Infrastructure to share infrastructure. However, Loop is still looking for a partner, after its earlier talks with Kuwait's Zain Telecom and Norwegian Telenor failed to translate into a stake sale.

Swan Telecom

In September 2008, Emirates Telecommunications Corporation (Etisalat), the largest telecom operator in the Arab world, bought a 45 per cent stake in Swan Telecom for $900 million. The remaining 55 per cent is held by several entities including the Mumbai-based Dynamix Balwas Group, which is involved in the real estate and hospitality businesses.

For a company that paid about Rs 14 billion for licences for 13 circles, it was a good deal. On the basis of the valuation of the Etisalat deal, Swan's market worth rose to $2 billion.

Soon after, Swan received approval to offer national and international long distance (NLD and ILD) services, in addition to approval to operate as an internet service provider. In December 2008, it received spectrum for its 13 circles.

The company has put together a plan to launch services by June 2009. On its immediate agenda is putting up a skeletal network that would ensure at least basic coverage. To speed up rollout, the company intends to take advantage of the infrastructure-sharing policy. In fact, it had entered into a strategic alliance with BSNL to utilise its network, but the agreement ran into controversy with existing operators and some members of Parliament claiming that BSNL had behaved in a partisan manner as it had so far refused to open up its network to any private telecom company. Swan is currently in talks with other operators and standalone tower companies for infrastructure sharing. It is likely to finalise an infrastructure-sharing deal with RCOM's tower arm, Reliance Telecom Infrastructure Limited, for 15 years. RCOM will reportedly lend 13,000 tenancy slots to Swan in the first year, which would go up to about 20,000 slots by the second year, and to 45,000 by the fifth year. This will help Swan reduce its capex significantly.

As of now, the company cannot hope to roll out services before mid-2009. What is key for the company is that the Etisalat deal is closed at the earliest, following clearance from the Foreign Investment Promotion Board, so that funds are available for the Indian operation.

STel

Promoted by Skycity Foundations and Mauritius-based Telecom Investments, STel is still a long way from starting services. Although the Chennai-based company had applied for licences in 22 circles, it got letters of intent for only six – Bihar, Orissa, Jammu & Kashmir, Himachal Pradesh, the Northeast and Assam. It also received a Category A ISP licence. In December 2008, the company received spectrum to offer services in the six circles. But it is still firming up its rollout plans.

Recently, Batelco, which has operations in six markets in the Middle East, expressed interest in buying stake in STel for $225 million. Batelco will partner with Millennium Private Equity, a Dubai Financial Services Authority-regulated entity, to form Batelco Millennium India Company, which will purchase the shares in STel. The acquisition has yet to be finalised and will be subject to various preconditions. However, STel expects the deal to come through by April 2009.

For Batelco, the acquisition will provide it significant growth opportunities in India's expanding telecom market. According to Batelco officials, the company's priority now is to assist STel to rapidly roll out network infrastructure and offer mobile services to customers.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...