Procall - Leveraging its early start in radio trunking

-

When Bengaluru-based wireless communication solutions provider, Procall, started providing analog public mobile radio trunking services (PMRTS) in 1996, the PMRTS industry was small and fragmented. The service did not have a large user base, and was mainly utilised by government departments, security agencies, defence establishments, hotels, municipal corporations and fleet management systems.

Apart from slow uptake, PMRTS faced other problems. There were several regulatory and technology barriers that severely impacted its growth, and the fledgling industry ran into trouble on the policy front. Besides, the wireless segment had just begun witnessing significant growth, thereby overshadowing radio trunking services.

In June 2001, guidelines set down by the Telecom Regulatory Authority of India gave the green signal to upgrade these services and move towards the digital domain. Today, though still not on the fast track, the PMRTS industry is moving forward slowly and steadily, helped by greater interest in the service.

In light of the new potential, Procall launched digital push-to-talk (PTT) in Bengaluru earlier this year. PTT is the next-generation radio trunking service on a digital platform, based on Motorola's Integrated Digital Enhanced Network (iDEN) technology. The company is gearing itself to take full advantage of the lucrative business opportunities once the service gains substantial ground in the country.

Background

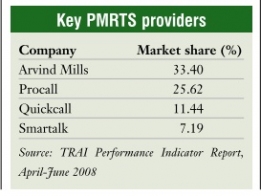

Procall is the radio trunking services arm of Agrani Telecommunications, which is a subsidiary of the Essel Group. According to the company, it has more than 80 per cent share of the Delhi National Capital Region's (NCR) radio trunking market and 100 per cent share in the other markets in which it is present.

Procall operates in seven major markets in India – Delhi NCR, Jaipur, Mumbai, Pune, Bengaluru, Hyderabad and Chennai. Its sister concerns include Quickcall, Smartalk and Bhilwara Telenet Services.

Procall is present in several verticals and its key clients include BSES, the Delhi government, GE Capital, Daksh, Wipro-Spectramind, American Express and Convergys.

Till recently, the company offered simple analog radio trunking services. Today, it has expanded its basket of offerings to include digital PTT (comprising one-to-one, one-to-many, one-to-all communication), online tracking, SMS, bar code scanning, push-to-panic facility and email services.

Industry analysts say that the company's foray into digital services was strategic as the digital platform permits easy communication, is more user friendly and offers better connectivity. Through digital PTT, the user can access the capabilities of a digital wireless phone, two-way radio with instant group talk features, inbuilt GPS, advanced messaging services and other applications – all on just one pocketsized digital handset.

These advantages have enabled Procall to reach out to a wider client base. In fact, the new service has already caught on in the major market segments in Bengaluru.

The quick uptake may also be attributed to the consumer-friendly price tag. Procall charges a competitive fixed tariff per month per subscriber for unlimited digital PTT voice services. GPS tracking and other value-added services like SMS and email are priced as per market norms and charged separately.

According to Procall's chief executive officer, K. Satyanarayana, the digital services will be launched in all major telecom circles of India within the next two years. The company has so far acquired licences for seven circles: Karnataka, Mumbai, Maharashtra, Delhi, Tamil Nadu, Andhra Pradesh and Kolkata. It is in the process of rolling out networks in Mumbai, Delhi, Chennai and Hyderabad.

As it expands the digital services, Procall hopes to target construction, transportation, courier, logistics, security and facilities management companies, taxi fleets, ambulance services, police, public utilities and mobile sales teams.

Issues and concerns

While Procall has the first-mover advantage in digital PTT, a previously unexplored segment, industry analysts feel that the company might not hold its own in the face of competition from bigger telecom players when they enter this space. According to an analyst, whether Procall is able to ward off the threat from larger companies will depend on how fast it expands its network, as this is an area in which telecom operators will have a natural advantage.

However, Procall's advantage is that it has been around for a long time and has the requisite experience which new entrants will have to gather. As Satyanarayana says, "We offer a niche business solution proposition, targeted to meet the customers' specified requirements. Also, we are the only company so far to have received the licence for digital PTT services in the major telecom circles and offer this service on the most successful and widely prevalent PTT technology platform."

Future plans

Procall hopes to garner at least 60-70 per cent market share in the targeted segments for digital services. It intends to have a subscriber base of over 1.5 million within five years of launching digital operations in seven circles. The company hopes to introduce several value-added services in the near future to expand its product range.

All in all, PTT services seem set to pick up pace in India and, when this happens, Procall is confident of riding the wave.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...