LG India - Greater focus on GSM handsets

-

The Indian handset market has grown tremendously over the past two to three years, and is currently worth over Rs 250 billion. India, with over 280 million mobile subscribers, is the second largest market for handsets in the world after China. The huge demand, coupled with low manufacturing costs, has resulted in many key global players competing for a share of the Indian handset market.

South Korea-based LG Electronics is one such company. While the company had a late entry into handset manufacturing, it is currently the fourth largest manufacturer in the world. LG operates in India through its wholly owned subsidiary, LG Electronics India Limited (LGEIL), which manufacturers a range of consumer durables including handsets. LG currently exports mobile phones made in its Indian facility to the Middle East and Africa, and will eventually export to Europe and the Commonwealth of Independent States. The company intends to make India the export hub for its mobile phone business.

With 8-9 per cent share of the Indian handset market, LG currently trails Nokia, Motorola and Samsung. Nokia, which has a share of over 60 per cent, is the undisputed market leader. To close the gap, LGEIL is expanding its product portfolio, and has plans to launch a number of new handsets by the end of 2008. The company intends to achieve a turnover of Rs 150 billion by 2010.

Company basics

LGEIL entered the Indian handset market in the second half of 2002 with the LGRD2030 CDMA phone, which was customised for Indian conditions. The company tied up with CDMA operators like Reliance Infocomm (now Reliance Communications) and Tata Teleservices Limited, and worked closely with them for planning and developing products and building a pan-Indian after-sales network.

By 2003, the company acquired a clear lead in the CDMA handset segment, with around 59 per cent share. However, with the CDMA market not doing well in terms of subscriber additions, LGEIL's share in the overall handset market remained low. In 2003, the company had a total market share of 11.8 per cent, slightly higher than that of Samsung.

To cater to a larger market, LGEIL set up a GSM handset manufacturing plant in Ranjangaon near Pune in 2005. It was the first company to set up a handset manufacturing facility in India. By doing so, it ensured that it had the first-mover advantage over competition as manufacturing in India has distinct advantages in terms of price and time-to-market. According to an LG official, "Local manufacturing allows adaptation in terms of features and benefits. For instance, we can use Indian languages or load special software for games and rinGtones. Second, we are closer to the markets. Third, when we are producing at such high levels, there are cost benefits and advantages which can, at some point, be shared with the customers."

However, the Ranjangaon plant, which manufactures low-end handsets, does not cater only to the Indian market. Within 18 months of setting up the plant, LGEIL started exporting GSM handsets from India to Sri Lanka, Bangladesh, Nepal, the Middle East and the African countries.

LGEIL is also focusing on research and development (R&D). While the Ranjangaon plant houses LG's R&D centre for GSM technologies, LGEIL has a software subsidiary in Bangalore, called LG Soft India (LGSI). LGSI is LG Electronics' largest R&D centre outside South Korea, and focuses on niche technology areas such as mobile application development, digital video broadcast and biometrics software. LGSI has a team of about 480 people, who support not only LG's Indian operations but also half of the company's Asian operations. LG considers customisation an effective market strategy, and is looking at complete software and hardware integration from its Indian R&D centres.

Recent performance

LGEIL sold about 1.5 million GSM handsets from January to December 2007, indicating a GSM handset market share of about 3 per cent. The company continues to lead the CDMA handset segment, having sold 7 million handsets (5.5 million mobile, 1.5 million WLL) in the year.

The company claims to have registered phenomenal growth in handset sales in the first half of 2008, by maintaining a focus on the rural areas as part of its strategy.

Financially, LGEIL is doing well. In January-December 2007, the overall turnover was Rs 95 billion. In 2008, the company is aimimg to achieve 15 per cent growth in turnover.

Popular offerings

Globally, LG is the market leader in touch-screen phones. During JanuaryJune 2008, the company sold 7 million touch-screen phones worldwide. In 2007, LG launched the world's first full touchscreen handset, the Prada. Its top-selling touch-based phone is the Viewty, a highend cameraphone, of which more than 2 million units have been sold till now. Next are the Venus, which is based around LG's intuitive touch-sensitive InteractPad; and the Voyager, the first handset to incorporate both a full touch-screen and a QWERTY keyboard. These phones have sold 1.6 million and 1.3 million units respectively till now.

In India, in addition to the high-end touch-screen phones, LG offers a range of budget phones, many of which are bundled with tariff plans. However, the company is yet to gain a foothold in the budget handset segment.

Future plans

LGEIL's future plans for its mobile business involve increasing its focus on the GSM segment as the company no longer considers CDMA as a profitable option in India. The company is targeting a 10 per cent share of the GSM handset market by end2008, and eventually intends to become one of the top three players in the domestic market. LGEIL also plans to lay greater emphasis on premium GSM handsets.

In the past few years, CDMA handset sales have shrunk due to competition from Chinese manufacturers offering low-cost models. In 2005, revenue from the seGment stood at $300 million, which declined to $250 million in 2006 and further to about $150 million in 2007. In terms of volume, the company sold 9 million CDMA handsets and 1.2 million GSM handsets in 2006. In 2007, CDMA sales decreased to 6-7 million, while GSM sales grew to over 2 million.

As a step towards establishing a foothold in the GSM segment, LG tied up with Bharat Sanchar Nigam Limited (BSNL) in April 2008 to launch a bundled handset offer for BSNL subscribers. Under the deal, handsets including the Bullet series KG 276 and KG 271 are available with a BSNL connection through various attractive schemes.

In the future, LGEIL is looking to operate on a multi-strategic platform. "The company will continue to introduce handsets for entry-level consumers and offer more premium handsets to the Indian market, and establish itself as a good brand," says Anil Arora, business group head, GSM, LGEIL. Also on the anvil are plans to expand the line of mobile accessories such as Bluetooth and earphones.

The future plans include capitalising on the imminent launch of 3G services in the country, especially as LG is a key player in the global 3G space. "The competition in this segment will be cut-throat as handset majors are pulling out all the stops to provide the latest models and offerings," says Romal Shetty, executive director, KPMG. The company is also planning to increase the number of retail sales points to overcome the lack of market penetration and improve its after-sales support network.

Expansion of the Ranjangaon production unit is also on the anvil. LGEIL, which has invested $60 million in the factory so far, intends to increase the production capacity from the current 2 million handsets to 5 million by investing $5 million. There are plans to add a minimum of two production lines each year. The company hopes to make the plant a strategic facility in three or four years.

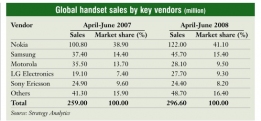

Globally, LG is gearing up to make it big as a handset manufacturer. There are plans to launch new phones in 2008 and increase the number of models offered to around 30. After selling about 80.5 million handsets in 2007, LG is looking to sell more than 100 million units in 2008.

Challenges

For LGEIL, the single biggest challenge is establishing its GSM business. Pricing is another important issue. According to Shetty, "Since future growth will occur in the rural areas, which is dominated by low-end customers, the challenge for a company like LG will be to manage the balance between pricing and profitability."

While the company will have to sort out these issues, with its current thrust on the GSM segment, LGEIL seems to be getting ready to take on competition more aggressively in the years to come.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...