Raring to Go - After successful IPO, Idea pursues new markets

-

The IPO received an overwhelming response. The final issue size was Rs 24.5 billion ($555 million), with an overallotment option of up to Rs 3.19 billion ($73 million). The smartly priced IPO – at Rs 75 per share – going at the top end of the indicated price band was quickly mopped up and oversubscribed nearly 57 times.

The IPO also saw unusually high institutional interest. The qualified institutional buyer portion, which makes up $280 million of the deal, was more than 90 times oversubscribed and the retail portion over 4.5 times.

"This shows demand surpassing even the Reliance IPO last year. The results are a clear indicator of the level of confidence the market is willing to place on the company," notes Romal Shetty, director, telecom, risk advisory services, KPMG.

The response was not entirely unexpected, as a senior official of DSP Merrill Lynch (which co-managed the IPO along with JM Morgan Stanley) points out.Indian mobile operators currently enjoy very high valuations as part of the fastest growing mobile market in the world.Bankers too tie the success of the Idea IPO to the tremendous global interest the Indian mobile market is currently attracting with investor interest further fuelled by recent high-profile acquisitions such as that of Hutchison Essar by Vodafone.

Company position

Incorporated as a three-way joint venture between Tata, Birla and AT&T, Idea, for years, struggled with promoter problems, resulting in somewhat stunted growth.The company still carries a high net debtto-equity ratio of 5.7 (in financial year 2006), the highest among listed Indian telecom stocks, on account of huge carried forward losses of Rs 17 billion and an unamortised licence fee of Rs 10 billion.

It was only after a series of mergers and acquisitions that Idea's position strengthened and it became a solely Aditya Birla Group company. After the exit of the Tatas in July 2006, the Birla Group offloaded a further 34 per cent stake to foreign institutional investors (FIIs). With this, Idea's promoters – ABNL, Birla TMT, Hindalco and Grasim – hold 65.1 per cent stake while FIIs hold 34.9 per cent.

With greater cohesiveness at the top, the company started concentrating on strategic consolidation to spur growth in the ever-competitive mobile market. It started the year with Sanjeev Aga joining as managing director; the IPO was next.

The company plans to use the IPO proceeds to service its new circles – Mumbai and Bihar – for which it has recently acquired unified access service (UAS) licences.

"The constraints, dilemmas and conflicts that were earlier there because the Tatas were running both CDMA and GSM services at the same time are now gone. The brand is good, and the company is getting more aggressive," says telecom analyst Mahesh Uppal.

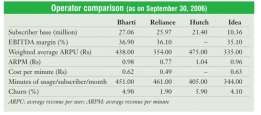

Nimesh Kampani of JM Morgan Stanley pegs the company's current market cap at $3.4 billion. And with a 14 per cent share of the market and an EBITDA margin of 13.23 per cent, the consensus among market analysts is – it is as good a company as any. It is growing well, is more aggressive than before, and with expansion plans in place, its prospects look good in the long term.

Idea currently operates in 11 circles – Andhra Pradesh, Delhi, Gujarat, Haryana, Kerala, Maharashtra, Madhya Pradesh, Uttar Pradesh (West), Uttar Pradesh (East), Himachal Pradesh and Rajasthan. Its subscriber base as of February 2007 stands at 13.64 million, placing it sixth behind Bharti Airtel (35.44 million subscribers), Reliance Communications (32.4 million), Bharat Sanchar Nigam Limited (25.44 million), Hutch (25.34 million) and Tata Teleservices (15.32 million).

Post-July 2006, the company invested over Rs 20 billion to expand its network.As a result, during the period MarchDecember 2006, its subscriber numbers grew by approximately 69 per cent, from 7.37 million as on March 31 to 12.4 million as on December 31, 2006.

Key strengths

Idea's main strength, say analysts, lies in its ability to tap the opportunity in the valueadded services segment. Says Shetty: "Its venture into GPRS and EDGE was the very first in the country. This, together with the introduction of new mobile value-added services like music messaging services, voice portals and e-mail, has only strengthened Idea's ability to compete.Also, Idea is very competitive in introducing tariff plans that are transparent, easy to understand and customer friendly."

This has given the company "a leadership position in Maharashtra, Uttar Pradesh (West) and Haryana, and placed it second in Kerala and Madhya Pradesh, though the overall market share may be low compared to competitors," observes Aga.

There is no denying that Idea has strong brand recall, a solid technology base and sound management practices.

Says Rajesh Chharia, president, ISPAI: "One of the company's main strengths is its staff of long-serving, dedicated employees, which is difficult to come by in this industry. The leadership of the company is also not new in the business." A committed promoter with deep pockets is also a definite advantage, and will help Idea overcome hurdles while scaling up in the wireless market.

Expansion plans

So far, the company has shown foresight in its expansion plans. Its merger with Escotel, at $250 million, was considered to be one of the largest of its kind. Its plans to expand its reach in Mumbai and Bihar will also stand it in good stead.Mumbai being the commercial capital of India is a lucrative circle and will offer the benefit of traffic flows to and from other circles, particularly Maharashtra, Delhi and Gujarat. Meanwhile, Bihar, with its low mobile penetration, provides good growth potential for the company.

Idea plans to establish its telecom network in the two circles by mid-2007. This includes setting up close to 1,200 cell sites in Mumbai and about 700 cell sites in Bihar. For this, says Anil Jhala, chief financial officer, "we expect a capex of Rs 17 billion".

The company has also applied for nine UAS licences in a bid to achieve a pan-Indian presence and has recently obtained a national long distance (NLD) licence. It intends to roll out its long distance service in the next three months.This will allow the company to carry intra-circle as well as intercircle traffic on its own network, resulting in substantial savings on the carriage charges it currently pays. This will, in turn, bring down the overall operating costs.

Trouble spots

Idea Cellular's most obvious weakness is the absence of a pan-Indian presence, unlike its rivals. This means that it has to necessarily depend on other service providers to offer roaming and long distance services. This also makes it far more vulnerable to competition, which is only likely to intensify with the entry of Vodafone into the country.

For nearly 10 years, Idea was operating in only eight circles. It launched services in three new circles – Rajasthan, Himachal Pradesh and Uttar Pradesh (East) – only in the last six months. In the process, it has not been able to establish operational efficiencies. In the nine months ended December 2006, subscriber acquisition and servicing costs jumped by 159 per cent over the corresponding period in 2005-06.

Moreover, operating essentially in the less lucrative B and C circles, the ARPUs of the company are lower. For both its prepaid and post-paid segments, users spend less compared to its competitors. For instance, Idea's blended (prepaid and post-paid) ARPU at Rs 338 is much lower than Bharti's at Rs 427 for the period ended December 31, 2006. Its minutes of usage too are lower at 353 against Bharti's 467.

According to Aga, the main reason for the low ARPUs is the low roaming revenues, as it is forced to share its revenue with other operators with whom it has aroaming arrangement.

The other big issue is that the company is not an integrated player. It earns revenues solely from its cellular services, unlike its rivals who operate in more than one segment. Moreover, a large part of its revenues derive from its leadership position in four of its established circles."Thus, any change in customer preferences for its services will severely dent topline growth and overall financial performance, as well as impact the prospects of the company," says telecom analyst, R.S. Iyer of KR Choksey Securities.

"Players with an all-India footprint such as Bharti Airtel, Tata Teleservices and Reliance can easily raise the level of competition by offering services at relatively lower cost (cross-subsidised by revenue derived from other telecom services).They can bundle services and offer complete telecom solutions, something Idea may not be in a position to do individually," claims Shetty.

In the current backdrop of competitive pressures, analysts feel it runs the risk of reduced opportunity for margin expansion from current levels. It simply does not have the cushion and stability of relatively higher margins accruing from other nonmobility-related business streams that its competitors have.

Moreover, says Iyer, "A large part of the growth in EBITDA margins for Idea over the last few quarters was primarily on account of immediate booking of one-time rentals from lifetime prepaid schemes rather than any leg-up in core business performance. Going forward, we believe there is limited scope for margin expansion as margin growth is likely to be constrained by competitive pressures, besides being contingent on the turnaround time for new circles."

Therefore, although the company has reported a consolidated net profit of Rs 3.01 billion for the nine-month period ended December 31, 2006, with two more circles to be rolled out, the operating margins will continue to remain under pressure.

The key to staying ahead in the highly competitive Indian telecom market is to innovate, sustain and expand. While Idea has made its mark in its existing circles, it has to constantly find ways to sustain its leadership position. It also needs to arrest the fall in ARPUs it has been facing in the last six months to remain competitive and it can do this by improving the quality of service.

Telecom experts believe that Idea should also actively look at foreign collaborations in order to sustain the pressures of competition in the long run. Some of the other top players in the market are today strengthening their position through strategic partnerships, investments and tieups with foreign players and investors.

The road ahead

At the moment, the company is buoyant and optimistic. But it realises that it needs to quickly achieve scale and control costs, since pricing leverage is virtually absent in an environment where tariffs are coming down.

With an eye on the future, Idea has recently tied up with Swedish equipment giant Ericsson for GSM expansion in Maharashtra, Gujarat, Rajasthan, Madhya Pradesh and Himachal Pradesh circles.Ericsson is to provide radio access, microwave transmission and next-generation mobile softswitch network architecture.

Idea is currently in talks with independent tower vendors, including GTL and Essar, for setting up more towers and smaller base transceiver stations. This would be apart from sharing cell sites with other mobile operators. Himanshu Kapania, COO, Idea believes that this kind of outsourcing will result in a substantial reduction in infrastructure costs and will allow the company to spend more on corporate brand building across the country.

For the current year, Idea has lined up an aggressive brand building exercise on TV at the national level. It also intends to invest in retail outlets.

Further, keen to tap the rural market, Idea has launched the shared access programme in Maharashtra. This model envisages sharing mobile telecom devices like a mobile PCO and aims to create a new revenue stream for low-income rural entrepreneurs.

Overall, competition is the new reality that telecom players have to contend with.For Idea, the key challenge will be to maintain its position among the top players. The most immediate threat, of course, is from Tata Teleservices, which has been running neck and neck with it.

Shampa Bahadur

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...