India has been adding a record 15 million and more mobile subscribers every month. This phenomenal growth has triggered a similar expansion in the telecom infrastructure space. The tower industry especially, has been growing at 17 per cent per annum, driven primarily by the growth in the subscriber base and a desire to keep capex low in the capitalintensive telecom industry.

This trend is only likely to continue with demand increasing. According to the estimates of the Telecom Regulatory Authority of India (TRAI), India will need about 350,000 towers by end-2010 to cater to the growing subscriber base. This has resulted in tower companies setting aggressive rollout targets for 2010-11.

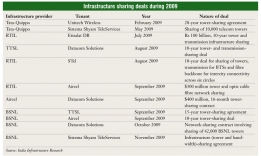

Further, for companies rolling out infrastructure in Category B and C circles from where new users are expected to come in, sharing infrastructure reduces costs. This is reflected in the increasing number of tower-sharing deals that have been signed recently. A look at the evolving telecom infrastructure sector and recent trends...

In 2007, TRAI recommended active infrastructure sharing, which was implemented in April 2008. This allowed operators access to common antenna, feeder cables, Node B, radio access network (RAN) and transmission systems.

With these guidelines in place, the stage was set for high growth in this segment.

Currently, the tower subsidiaries are at an advantage over pure-play operators on account of their strong operational and management links with their parent companies. The positive for pure-play tower companies, however, is that they have flexible rollout plans and, at times, are also better equipped to address the needs of new entrants in the initial years of their operation.

As of March 31, 2009, there were about 270,000 towers in the country, of which about 100,000 were owned by operator-driven joint ventures (JVs), about 125,000 by operators, either directly or through their tower infrastructure subsidiaries, and over 45,000 by pureplay tower companies.

Pure-play tower companies like GTL Infrastructure, Quippo Telecom Infrastructure and Essar Telecom Tower and Infrastructure entered the fray in 2005-06. However, it was not until all the major operators in the country started hiving off their tower businesses into separate companies that the market for towers and infrastructure sharing developed. Reliance Communications (RCOM) pioneered this trend with the demerger of its tower operations into Reliance Infratel (formerly, Reliance Telecom Infrastructure Limited). RCOM is now preparing to become the first telecom operator to get its tower subsidiary listed on the stock market. It has already filed its draft red herring prospectus for the initial public offering (IPO).

In 2007, Bharti Airtel, Tata Teleservices Limited (TTSL) and Idea Cellular came together and merged their towers across 16 circles to form Indus Towers. Indus is currently the largest telecom infrastructure provider in the country with a portfolio of over 100,000 towers (as of May 2009) and a net monthly addition rate of about 7,000 towers. In January 2009, after TTSL sold off 49 per cent of its stake in its tower and infrastructure arm to Quippo Telecom Infrastructure Limited, the combined entity has now emerged as a major competitor to Indus.

Meanwhile, in January 2010, Aircel, which has one of the fastest growing mobile networks in the country, has sold off its portfolio of 17,500 towers to GTL Infrastructure Limited (GIL) in a cash transfer worth Rs 84 billion. Following the completion of this deal, GIL will become the largest tower company in the world. State-owned Bharat Sanchar Nigam Limited is also planning to lease its towers for better revenues.

All in all, the sector has been witnessing a growing trend towards consolidation, with larger tower operators like Indus, Reliance and Bharti Infratel planning to buy smaller players like Essar Telecom Infra, Tower Vision, Aster Infrastructure and KEC International.

Following the global economic crisis of 2008-09, there has been a nearly 40 per cent reduction in the projected tower construction plan of telecom companies. According to industry estimates, about 200,000 towers of the total 496,000 planned by 2011 are not expected to be constructed. Over the past few years, the average cost of setting up a tower has also increased on account of rising input costs, which has forced tower companies to raise their rental, thereby increasing the operational costs of telecom service providers. However, in 2009, there was a decline in the capital costs to install a ground-based tower to nearly Rs 2.5 million on an average from Rs 2.8-Rs 3 million in 2008, due to the fall in commodity prices. On the tenancy ratio front, this has resulted in a reduction in the revenue per tenant to about Rs 32,000 for the first tenant and to Rs 30,000 for the second tenant. While the ground-based towers attract higher rentals due to land cost and complexity of installation, for rooftop towers, the per-tenant rental is around Rs 21,000. In 2009, However, since operating expenses are similar for both types of towers, companies with more ground towers India is estimated to need about 350,000 towers by end-2010 to cater to the growing subscriber base. This has resulted in tower companies setting aggressive rollout targets for 2010-11. tend to enjoy higher realisations.

The number of tenants a tower firm is able to bring on board to share its infrastructure can be anywhere between two and four tenants to a tower, depending on the technology. While the tenancy ratio in mature markets like the US is 2.6, in India it is between 1.2 and 1.7 per tower. The reason for the lower tenancy ratios in the country is the dominance of operatorowned tower companies, which comprise about 90 per cent of the market. In the US, independent tower operators own 60 per cent of the towers.

Companies require a tenancy ratio of about 2 for long-term viability and profitability. The higher the tenancy rate, the larger the savings for companies, as the overall costs come down. At present, Bharti Infratel has a tenancy ratio of 1.3, Reliance Infratel 1.7 and GTL 0.9. Reliance Infratel continues to be profitable since it charges higher-than-market rental rates and its tenancy ratio is driven mostly by RCOM's GSM launch. However, in a bid to attract external tenancy, the company is expected to cut tenancy rates in the future.

Going forward, tower companies are likely to gain on account of the entry of new telecom players and with the launch of new technologies like 3G and Wi-Max. The launch of these next-generation technologies in the top 100 cities is likely to require an incremental 18,000 cell sites primarily from 900/1800 MHz operators. In addition, new players will be increasingly opting for shared infrastructure to reduce capex since operators with the fastest rollouts and the widest reach will have the strongest chance of survival. This will step up the tenancy ratio for tower operators. Moreover, at the current mobile penetration of 46 per cent, telecom players still have more than 50 per cent of the market, mostly rural, to tap.

In 2007, the government, under its USO Fund scheme, decided to provide subsidy to tower companies for setting up towers in the rural and remote regions. Under Phase I, the USO Fund identified areas in 500 districts spread across 27 states where there was no fixed wireless or mobile coverage. It then launched a scheme to provide subsidy support for setting up and managing 7,440 towers at these locations. The infrastructure was planned to be shared by three service providers for the provision of mobile services, including other wireless services like wireless in local loop. The agreements, effective from June 2007, were to make the shared towers operational in a phased manner by May 2008. As of July 2009, 6,200 towers had been commissioned while the remaining are expected to be commissioned shortly.

The second phase for an additional 11,049 sites for the installation of towers at identified sites has now been announced. These will provide coverage to 242,866 villages. The government seems to have also learnt from its mistakes. Unlike the first phase, once the rural short distance charging areas have been identified, decisions regarding the setting up of mobile infrastructure, the choice of location and the number of towers might be left to the discretion of the service providers. In addition, the USO Fund is trying to do away with the bidding process and concentrate only on planning and monitoring the implementation of schemes.

Wireless infrastructure company Vanu recently showcased the first wireless infrastructure solution which will enable individual base stations to simultaneously operate GSM, CDMA and other technologies.