Despite launching commercial internet services in 1995 and broadband services in 2004, India has still not managed to replicate its wireless success in the internet and broadband segments. While the internet industry has only recently started recording significant growth rates with a substantial number of users connecting to the internet via wireless means (CDMA data cards and mobile internet), the broadband subscriber base is still lagging behind, partially due to the delayed implementation of broadband wireless access.

In the first three and a half years, when Tata Communications, then Videsh Sanchar Nigam Limited (VSNL), was the monopoly provider, the internet subscriber base grew very slowly. By the end of 1998, it had barely reached 170,000 subscribers. However, the end of VSNL's monopoly changed things. The entry of new players and the lowering of tariffs, among other factors, led to a dramatic surge in the subscriber base. From March 1999 to March 2000, the subscriber base grew more than three times, from 250,000 to 850,000.

However, the growth rate decreased significantly from March 2001 to March 2004 to 6-12 per cent per annum, picking up pace from March 2004 to March 2006.

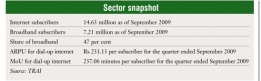

During the period June 2007-09, the subscriber base increased by over 2 million per annum, from 9.22 million subscribers to 11.66 million in June 2008 and to 14.05 million in June 2009.

Meanwhile, the number of subscribers accessing the internet via CDMA and GSM wireless networks rose sharply. The subscriber base increased from 38.02 million in June 2007 to 75.97 million in June 2008, and crossed 100 million by June 2009. This growth was driven mostly by operators like Reliance Communications (RCOM) and Tata Teleservices, which promote internet access through wireless data cards, and by Bharti Airtel and Vodafone Essar, which provide internet access via mobile phones.

The broadband policy announced by the government in 2004 defined broadband as an "always-on" data connection which could support interactive services including internet access and had a minimum download speed of 256 kbps. As of December 31, 2007, the broadband subscriber base stood at 3.13 million subscribers. However, in the past two years, the broadband growth rate picked up, increasing from 4.38 million subscribers in June 2008 to 6.62 million in June 2009. In the past five months, the subscriber base rose by almost 1 million.

Internet protocol television (IPTV) services, launched by Mahanagar Telephone Nigam Limited (MTNL) in October 2006, also witnessed increased uptake. While only the state-run telecom operators launched IPTV initially (Bharat Sanchar Nigam Limited in 2007), Bharti Airtel and RCOM followed suit in 2009. Though the application has not managed to garner a huge subscriber base till date, it is popular globally and is expected to acquire 83 million subscribers worldwide by 2013, according to research firm Gartner. India and China are expected to be important markets for the application.

However, a few of the leading players of the past were subject to market consolidation. Dishnet DSL was a key player in the internet segment, registering consistent market shares of 4 per cent before being acquired by Tata Communications in March 2004. Earlier, in 2002, Tata Internet, with a 4 per cent market share, was amalgamated with Tata Teleservices.

Despite a large number of players, the internet and broadband industry was quite consolidated. The top 10 ISPs accounted for 96 per cent of the total internet and broadband users as of June 2009. Similarly, the top 10 service providers accounted for over 96 per cent of the total broadband subscriber base.

BSNL, MTNL, Bharti Airtel, Sify Technologies, RCOM and Tata Communications were the main players in this segment. State-run BSNL and MTNL dominated the market with 70.42 per cent of the internet and broadband subscriber base, a significant increase from 39 per cent in September 2003. BSNL was the market leader with 54.09 per cent share. These companies increased their subscriber base by bundling their broadband and telecom services.

In contrast, Tata Communications and Sify witnessed a significant decline in their subscriber base. Tata Communications, the market leader in June 2003, slipped to the seventh position in terms of subscriber base with only 2.31 per cent market share in June 2009. Similarly, Sify's market share decreased from 17 per cent in June 2003 to 2.47 per cent in June 2009.

Bharti and RCOM, which, like BSNL and MTNL, also provided voice telephony services in addition to their internet offerings, managed to hold their ground and, in fact, steadily increased their market shares. While Bharti more than doubled its market share from 3 per cent in June 2005 to 8.15 per cent in June 2009, RCOM's market share registered an almost 100 per cent increase from 4 per cent in September 2004 to 7.39 per cent in June 2009.

In the absence of mandatory local loop unbundling in the country, the incumbents have a significant unutilised DSL capacity of over 8 million lines. Deployment of copper cable networks is costly and cumbersome for private operators and spectrum for wireless broadband access hasn't been released.

Internet and broadband penetration in rural areas is also abysmally low. Of the 607,491 villages, only 10,000 have internet and broadband connectivity. It is difficult for operators to set up commercially viable business models with low demand, irregular and infrequent power supply, and a lack of awareness of the benefits of internet and broadband connectivity.

Moreover, stand-alone ISPs like Sify are facing challenges in competing with integrated telecom operators. They argue that the Department of Telecommunications (DoT) is partial towards these telecom service providers and the policies do not ensure a level playing field. According to them, DoT has set a very high reserve price for broadband wireless access (BWA) spectrum, which can only be paid by telecom players. In 2007, the stand-alone ISPs argued against doing away with the Category C licence, stating that this dissuaded regional ISPs from setting up shop, which was adverse for competition.

On the spectrum front, the government has finalised auctions for BWA spectrum to be held in February 2010.

The government is also working towards increasing broadband penetration in the rural areas by joining hands with multiple parties to launch rural information and communications technology initiatives. It is also setting up 112,000 common service centres or rural info-kiosks in these regions.