Viable Business Models - Case for active infrastructure sharing

-

International experience

Globally, active infrastructure sharing has primarily been in the context of 3G.Different variants of RAN and transmission sharing are also popular. However, core networks are still largely not shared or are partly shared.

Equipment vendors have already come up with active infrastructure sharingfriendly products and are increasingly focusing on managed services. Active RAN sharing solutions are provided by vendors such as Nokia Siemens Networks (NSN), Ericsson, Huawei and Vanu.Dual/quad antennas are provided by Andrews & Kathrein.

There are several challenges in active infrastructure sharing, judging from the global experience. Commercial deployments are required to establish if traffic of players is properly managed. There are compatibility issues in terms of sharing equipment with frequencies from 800 MHz to 2100 MHz and also to share equipment sourced from multiple vendors.

Potential active sharing models

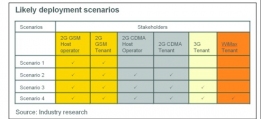

Active infrastructure sharing models are likely to involve different stakeholders. In the process, local factors present critical opportunities and challenges for operators.

There would be a simultaneous existence of multiple ownership models depending on operators' interests in specific areas. The likely engagement models are - fixed rental per base transceiver station (BTS)/Node B;

pay per use, based on subscribers or traffic; and pay per use with minimum traffic commitment.

Business models in India are likely to be a combination of RAN and backhaul sharing. While there are regulatory restrictions in spectrum sharing, these will be overcome by intra-circle roaming. Active infrastructure sharing is also likely to be across 2G, 3G, CDMA and Wi-Max platforms.

The key growth drivers for active infrastructure sharing will be the service rollout by new operators, rollout of GSM services by CDMA operators, the impending auction of 3G and broadband wireless access spectrum and the large expected capex requirements for bidding.

The fact that operators would need to squeeze out more savings to counter the declining average revenue per user will also necessitate active infrastructure sharing in India.

However, there are going to be several challenges in implementing active infrastructure sharing. The telecom industry is intensely competitive and there is a blurring of service offerings; there is a need for operators to collaborate to plan networks; and the equipment used is not uniform.

Impact on passive sharing models

In terms of industry structure, active infrastructure sharing is likely to drive further consolidation in the infrastructure space. There may be several passive infrastructure players providing both active as well as passive infrastructure.

The engagement model may change in such a way that the customer shifts from the operator to the active infrastructure player. There is also likely to be a shift towards pay per use models rather than fixed rental-based models.

Evolution of passive sharing models

Going forward, the existing passive infrastructure models are likely to undergo several changes in terms of energy management, engagement models and service footprint. Passive infrastructure players will have to deploy energy-efficient equipment or use alternative energy sources. Power and fuel are likely to be built into contracts.

Operators are likely to de-risk business through pay per use models. And active infrastructure players may pass this on to passive infrastructure players. Over time, service level agreements will become more critical as operators move away from networks.

Further, the service footprint of passive infrastructure players is likely to expand to include backhaul bundling. Capability building will be key for passive infrastructure players.

Hari Balasubramanian, Senior Associate,Transactions Advisory Services, E&Y

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...