Pay-TV Potential - Operators explore new business opportunities

-

With the Ministry of Information and Broadcasting accepting the Telecom Regulatory Authority of India's (TRAI) recommendations on internet protocol TV (IPTV), and TRAI making it mandatory for broadcasters to offer interconnection to direct to home (DTH) operators and allowing cellular service providers to offer mobile TV services on their existing licences, the decks have been cleared for telecom operators to pursue the opportunities in broadcasting.

There are currently three convergence trends in the telecom space – the convergence of networks (a move towards an IPcentric world), the convergence of content (a move towards digitisation – recognisable across multiple platforms), and the convergence of devices (since every device has different features).

We bring you excerpts from presentations made by analysts, operators and vendors at tele.net's recent conference - "Television via Telcos: 3G & Mobile TV, IPTV and DTH".

The TV industry has witnessed phenomenal growth in the country. Currently, there are more TV sets in India than landline telephones. The revenue in this industry was pegged at Rs 226 billion in 2007 and is expected to reach Rs 600 billion by 2012, registering a compounded annual growth rate (CAGR) of 22 per cent. The number of TV households, at 115 million, has increased at a CAGR of 21 per cent over the past decade.

Economic growth will drive households, both in the rural and urban areas, to buy TV sets and subscribe to pay services. New distribution platforms like DTH and IPTV are expected to increase the television subscriber base and push up subscription revenues. This, coupled with the burgeoning working population and increasing disposable incomes, will make India one of the more compelling markets for broadcasters.

The digitisation of broadcasting transmission will provide telecom operators with an opportunity to enhance their position in the value chain to that of a digital content provider. In addition, triple-play services and the convergence of data, voice and video will help operators to increase their revenues and profits by bundling services.

With experience in providing delivery services as a network operator (such as customer liaison), telecom operators are expected to enjoy a significant advantage over other players. As they make a foray into content services, the operators can derive cost synergies from the use of their existing distribution and service network, and can leverage on their existing base of subscribers by offering a bouquet of solutions.

As Indian telecom operators experiment with IPTV and get ready for mobile TV, it is important to note the experience of operators offering these services in other countries, and try to apply the knowledge in the Indian market.

IPTV

The key IPTV markets are Hong Kong and West Europe. In Hong Kong, IPTV was launched in 2003 by PCCW. Today with over 1 million subscribers, IPTV accounts for approximately 47 per cent of the pay-TV market, with DTH and cable TV making up the rest. A key driver of IPTV's success in Hong Kong was the provision of exclusive content and free set-top boxes. Hong Kong's geography also played a major role. Deploying fibre to the home (FTTH) – critical for quality of service and the success of IPTV – in the densely populated island involved relatively low costs.

Western Europe is the largest market for IPTV with about 7 million subscribers, and accounts for 57 per cent of the global IPTV subscriber base. France alone accounts for nearly 5 million subscribers, who are split amongst France Telecom, Alice (Telecom Italia), Free and Neuf. In France, the key driver for IPTV uptake was the allpervasive growth in broadband penetration.The basic IPTV package was bundled free with broadband and video-on-demand.

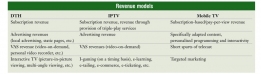

In India, Mahanagar Telephone Nigam Limited (MTNL) has launched IPTV services in Delhi and Mumbai. Bharat Sanchar Nigam Limited (BSNL) is planning to launch the service in 100 cities, and Airtel is currently conducting IPTV trials. Revenue from IPTV can be maximised by offering a bouquet of services and deriving benefits from the interactive TV feature that the distribution model offers.

However, IPTV is not likely to take off in the immediate future in India. While over 50 per cent of the country's telephony infrastructure is ready for IPTV and the current fixed line subscriber base at about 40 million represents the proximal market opportunity, the current broadband subscriber base, at approximately 3.5 million subscribers, is extremely low.Moreover, extensive upgradation of the broadband infrastructure is required to support IPTV services.

The other issues are low FTTH coverage and the lack of regulatory clarity. Also, the business models need to be competitive on price and compelling on content.

Mobile TV

There have been more than 170 launches of mobile TV globally, of which more than 130 are over cellular networks. The global mobile TV subscriber base is estimated to cross 400 million by 2010. In Asia, there are currently over 15 million subscribers.

In a recent survey, it was found that 37 per cent of the global population wanted to subscribe to mobile TV services. In India, however, only 23 per cent wanted to do so. According to Manesh Patel, partner, technology, communications and entertainment (TCE), advisory services, Ernst & Young, "The success of mobile TV globally can be attributed to low subscriber and delivery costs, different user experience compared to traditional TV (viewing situation, shorter viewing, etc.), content (live sports), scalability (especially for telecom-based platforms), partnerships with content owners, interactivity on telecom-based platforms and anytime viewing." On the technology front, broadcast technologies like MediaFlo and DVB-H have proven to be more effective vis-Ã -vis telecom technologies such as 2.5G (GPRS, EDGE) and 3G and satellitebased technologies such as DVB-S.

Telecom players in India already provide non-live TV on 2.5G networks. The 3G licensees have invested in the upgradation of networks. However, satellite-based technologies such as DVB-S are not likely to be adopted.

A recent report by Springboard Research predicts that India's mobile TV subscriber base will reach 12 million within the first year of launch. MTNL launched its mobile TV service in Delhi in August 2008 and offers a basic package of 20 channels for Rs 99 per month. BSNL is conducting trials, as are BPL Mobile and Idea Cellular, who have partnered with NetEdge Telesolutions for mobile TV. NetEdge is also in talks with Bharti Airtel and Vodafone Essar for mobile TV services.

For the service to be successful, telecom operators would have to go beyond the traditional subscription-based/payper-view models. For instance, they could offer specific, adapted content, personalised programming and interactivity. The business models need to be built around spurts of telecast rather than full-length programmes. With a strong subscriber base, operators should focus on customer profiling, that is, targeted marketing as a revenue model. More importantly, revenue models would have to be designed keeping in mind the price sensitivity of Indian consumers.

DTH

In India, DTH services are being offered by Tata Sky and Dish TV and, amongst the operators, by Reliance Communications and Bharti Airtel. According to Romal Shetty, executive director, risk advisory services, KPMG, the revenue model for DTH can be maximised by convergence towards the interactive features of IPTV; middleware is already available to enable DTH service providers to offer services similar in nature to IPTV, like time shift.

The regulatory aspect

IPTV, DTH and mobile TV are multiple ways of carrying content. The real goal in regulation has been to recognise the multiplicity in content carriage and to create a regulatory regime conducive to investment in this market, while ensuring that the prices are affordable for the end-users.

In India, the entry costs for mobile TV, IPTV and DTH are different. Moreover, the foreign direct investment level also varies for the services. The spectrum rules are still rather skewed with spectrum pricing being a key issue.

For IPTV to take off, unbundling of the local loop needs to be done to enable all operators to have access to fibre.

For mobile TV, spectrum is a key issue.Dr Mahesh Uppal, director, ComFirst says, "In India, in contrast to other countries, spectrum allocation is linked to the number of subscribers. This acts as a disincentive as the operators focus on subscriber acquisition and not on efficient utilisation of spectrum." Moreover, he feels, spectrum is technology specific and this distorts the market as the regulators determine which players and technology will be dominant.

There is a need to create consistency to enable these markets to gain momentum on their own, as is the case in global markets where the regulators do not intervene except to ensure that scarce resources like spectrum are priced competitively.

The road ahead

In the long run, mobile TV, IPTV and DTH would all coexist in the pay-TV market. There will be a move towards similar offerings on DTH and IPTV.

With increased competition, the payTV industry will witness some rationalisation in terms of price and value. The key differentiators for service providers would be value-added services, online gaming and attractive channel bundling.

While customer acquisition costs and marketing costs would be significantly less for digital TV service providers, content acquisition, maintenance costs and operating expenditure would be the major cost components. To ensure sustainable subscription revenue, the marketing budget would soar as the subscriber growth stabilises. Only service providers with deep pockets will be able to sail through the initial wave of high costs and become profitable in the long run.

(Based on presentations by Manesh Patel, partner, TCE, advisory services, Ernst & Young; Romal Shetty, executive director, risk advisory services, KPMG; and Dr Mahesh Uppal, director, ComFirst)

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...