TV's set to become the next telecom battleground, with operators readying themselves for the big fight. Last month, Bharti Airtel launched Digital Television, its direct to home (DTH) service, taking on Reliance ADAG's Big TV, launched just a little earlier. With four operators, including Tata Sky, already occupying the DTH space, the entry of these two industry heavyweights is expected to intensify the competition further. For viewers of course, this should translate into better quality of service and perhaps, a downward revision in tariffs.

"The time is right for Airtel to enter the market. Airtel Digital TV is the culmination of our `three-screens' strategy, which is to be present across mobile phones, computers and TV screens," noted Manoj Kohli, chief executive officer and joint managing director of Bharti Airtel at the launch, adding confidently, "We are very clear that Airtel will take over as a leader of the sector as soon as possible."

Reliance ADAG and the Tatas believe the same of themselves. Both rivals have been ambitiously chalking out strategies to corner a share of this very lucrative market. The fight has already begun on price points and subscriber acquisitions. Tata recently introduced below Rs 100 packages for its users. Reliance, which introduced Big TV in August, has already booked 500,000 subscribers (as of October 2008) and is targeting 5 million by March 2009.

Given the huge potential of this business, the operators are willing to invest heavily in it. Reliance ADAG is looking to spend over Rs 20 billion over the next two years, while Airtel has put aside Rs 1.5 billion for the first phase. Dish TV is looking to put in Rs 16 billion. And even a new player like Videocon has earmarked Rs 10 billion for a start-up fund in order to get in on the action. Meanwhile, Tata Sky's project cost has risen to Rs 40 billion.

Clearly, there is a strong business case for TV via telcos. Telecom operators have extensive networks that can be utilised to offer diverse products. Besides, with new players entering the fray, the telecom space is set to become even more competitive. Other compelling reasons for turning to TV are falling telecom ARPUs (average revenue per user), customer demand for product diversity, and the predicted plateauing of the wireless subscriber base, especially in the urban metro areas. In light of this, TV could spell a new lease of life for telecom operators.

There are currently six operational DTH players (five of them private) in the Indian market with a combined subscriber base of about 9 million (Bharti is still to garner subscribers). This presents a huge untapped potential in a country of a billion-plus population, and not just in DTH but in the entire TV/entertainment domain, including internet protocol TV (IPTV), mobile TV and 3G.

While state-run entities Bharat Sanchar Nigam Limited (BSNL) and Mahanagar Telephone Nigam Limited (MTNL) have launched IPTV, private operators like Bharti Airtel, Reliance Communications and Tata Teleservices Limited (TTSL) are still running trials. Airtel recently announced that following its IPTV trials in Delhi and the NCR, it would be launching the service commercially in six cities.

3G, of course, is what operators have been readying for. They have been waiting long for the policy guidelines to be announced, so there is a higher sense of urgency in procuring and tendering for network equipment. They are also stepping up their investment in technology and content, and plan to offer enhanced data services, mobile TV, etc. as soon as the 3G spectrum auction is complete (expectedly by January 2009). BSNL and MTNL, which already have the spectrum, are busy fine-tuning their plans and intend to run trials by the end of 2008 so as to steal a march over their rivals.

Size and growth

Realistically speaking, till now, it is only DTH that has experienced any sort of significant uptake. The IPTV subscriber base is still very modest, two years after it was first launched by MTNL. 3G-based mobile TV, meanwhile, is still waiting in the sidelines to become a reality.

Though commercial DTH operations were initiated in 2003, significant growth has taken place only in the past seven months. Over 4 million users having been added since March 2008 taking the subscriber base to 9 million (excluding Doordarshan's unpaid service). Today, the industry is adding 500,000 customers a month (double that in August) and could go up to 800,000, according to industry sources. Reliance ADAG's DTH venture alone expects to add 400,000 users a month. An Ernst & Young study predicts that DTH will rake in over 19 million subscribers by 2010.

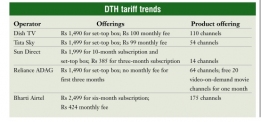

The growth in the DTH segment is being driven by various factors. This includes declining tariffs (monthly tariffs are now as low as Rs 99 for a significant number of channels) as a result of growing competition as well as improved service offerings such as the availability of new channels and value-added services like digital video recorders (DVRs).

In contrast, IPTV has managed to garner just a little over 20,000 subscribers. Future forecasts are, however, upbeat for both services. A March 2008 Assocham study, "India's Digital Revolution", indicates that 28 per cent of an estimated 100 million cable TV households will migrate to digital pay-TV platforms such as DTH and IPTV. The study predicts that IPTV services will account for over 1 million subscribers by 2010.

Mobile TV services have equally strong prospects in the country once 3G is launched. According to Frost & Sullivan estimates, by 2012, about 11 per cent of operators' data revenues will come from mobile TV. Moreover, mobile TV is predicted to be the third fastest growing mobile application after mobile music and application downloads.

Player initiatives

Over the next few years, telecom operators will be ramping up efforts to increase their digital TV operations. While BSNL and MTNL will be more aggressive in the IPTV space, Bharti Airtel, Reliance ADAG and the Tatas will attempt to capture sizeable portions of the DTH market. And all the key operators will make a play for 3G.

BSNL

BSNL is extremely bullish on IPTV and intends to capture 4 millionplus subscribers by 2013. It introduced the service along with video-on-demand (VoD) over its broadband infrastructure as part of its multi-play package. The effort was primarily directed to stymie the bleed it was facing in its wireline subscriber base in the past few years.

The incumbent launched the service in early 2008 in 25 cities including Kolkata, Bangalore, Jaipur and Jodhpur. It plans to extend this to 10 other cities, including Pune, Nashik, Lucknow and Madurai, and the areas around Delhi, Bangalore and Kolkata before the year is out. By end-March 2010, BSNL hopes to take this service to 200 cities.

BSNL's IPTV service is not only extremely competitive in tariff terms, but its delivery model is also dynamic with a variety of elements and players in the value chain. Still, uptake has been slow. Says P.K. Shah, deputy general manager, broadband services, "There are hurdles in the key areas of technology, quality of service, network, regulation and content. We should, however, be able to iron these out over time."

The company does not currently have any major plans for DTH services, but it has its hands full with the rollout of 3G mobile. In fact, it hopes to get a head start over other operators in 3G. Its first move on this front has been placing orders for 5 million lines with Swedish firm Ericsson.

BSNL has already launched a pilot project to provide 3G mobile services in Pune and expects to roll out services in about six months. It has tied up with mobile solution vendors ITI and AlcatelLucent to provide these services. About 2,000 BSNL post-paid mobile subscribers in Pune will receive 2 Mbps data connectivity free of cost for the time being. The subscribers will initially have access to only video call facility, followed by other offerings over the next six months. BSNL will finalise the charges for the service only after completion of the bidding procedure for spectrum allocation.

MTNL

MTNL, like BSNL, is upbeat on IPTV services. By leveraging its extensive network in Delhi and Mumbai, the two circles it operates in, it hopes to benefit from a new revenue stream and also stem the loss of wireline subscribers.

MTNL soft-launched IPTV services in October 2006, but introduced tariff plans for the service only in August 2008. The company has adopted a franchisee model to deliver IPTV services to its customers. It currently has two franchisees. The service delivery model is based on revenue sharing, in which revenue from advertising forms a part of the sharable revenue. The technologies used for service delivery include ADSL 2+, VDSL and metro Ethernet.

The bouquet of services currently offered by MTNL includes multicast, VoD and time-shifted TV. In the pipeline are passive optic network and mobile TV on a 3G platform.

IPTV uptake has not really kicked in so far. However, according to B.K. Badola, general manager, IT, the service provides a strong value proposition to all segments: consumers, content owners and distributors, advertisers and service providers. Going forward, MTNL intends to provide services such as TV gaming, HDTV and mobile TV (using a 3G mobile network).

Already, MTNL is testing 3G services in Delhi and is in the process of installing 1.5 million 3G lines in Delhi and Mumbai. It is planning to roll out services by the year-end in Delhi and by early next year in Mumbai. MTNL already has some experience in mobile TV, which it has launched on a 2G platform in Delhi and Mumbai, offering 20 channels for Rs 99 per month. Once 3G is launched, the company hopes that mobile TV will take off significantly.

Bharti Airtel

Bharti Airtel is looking at both IPTV and DTH for augmenting its revenues. It has already trialled IPTV and plans to launch the service in major cities across the country shortly. Since the service requires very high bandwidth, the company will restrict IPTV to metros like Delhi, Mumbai, Kolkata, Chennai, Bangalore and Hyderabad, where broadband speeds of up to 8 Mbps are available.

Meanwhile, the telecom operator recently launched digital TV services on the MPEG4 standard with DVB S2 technology through 21,000 retail points in 62 cities. This will soon be increased to 252 cities.

Airtel is offering its customers access to 175 channels, competitive tariffs, attractive discount schemes and customised value-added services (like VoD). According to Atul Bindal, president, telemedia services, the company has leveraged its strong brand equity and wide distribution network to offer these services. In order to deliver more interactive services, it has entered into a technology partnership with Infosys Technologies. It will use Infosys's Digital Convergence Platform to provide interactive applications such as iCity, iNet and tPortal, which are websites packaged suitably for TV viewing. Other applications will be added to the portfolio.

Airtel claims that its service brings many "firsts" to the DTH segment in India, including a universal remote for both the set-top box and TV, allowing enhanced viewer convenience; high settop box memory, enabling more interactive applications; exclusive content such as World Space Radio; and a 20 per cent larger dish antenna, which offers better performance during rains.

The company plans to introduce personal video recorder (PVR) services by March 2009 in order to enhance the DTH viewing experience.

Airtel claims to have successfully tested 3G applications with various equipment suppliers and is ready to start services as soon as spectrum is allocated. The company has tested 3G applications at three places – Delhi, Mumbai and Bangalore – using the 3G trial spectrum allocated to it.

Reliance Communications

In August, Reliance ADAG launched DTH services using MPEG4 technology under the Big TV banner. It also intends to offer IPTV and 3G services soon.

Within two months of launching DTH operations, the company has notched up 500,000 subscribers, accounting for 40 per cent of the industry's gross additions. Reliance ADAG is targeting 5 million subscribers within its first year of operations and is looking to add over 400,000 subscribers every month.

The company has joined hands with video solutions provider Thomson to increase the number of TV and radio channels from 200 to 400 and from 10 to 50 respectively. According to the company, the tie-up will help Big TV increase its channel capacity and offer a number of global niche channels in India. Reliance ADAG has also tied up with LG to offer its DTH service at a discounted rate – Rs 700 instead of Rs 1,490 – for three months for customers purchasing 29-inch LG TV sets. Big TV has booked four more transponders on the MEASAT satellite, which will take its total transponder capacity to 12.

As with most of its other ventures, Reliance believes in playing it big – whether it is in terms of visibility or ambition. Accordingly, Big TV has aggressive growth plans, including innovative tariffs and a strong marketing thrust. It also plans to launch DVRs by end-2008 as well as interactive cricket and news. By mid-2009, the company expects to have launched 1520 high definition channels as well. All this is likely to call for an investment figure of Rs 20.5 billion over the next two years.

Arun Kapoor, chief executive officer, Reliance Big TV, claims, "This is an ambitious project and launching such a large bouquet of channels is a challenging proposition as expectations of viewer quality are high and satellite bandwidth over India is limited."

TTSL

TTSL is still at the initial experimental stages of rolling out IPTV services. On the mobile TV front, however, the company has started exploring mobile video-related value-added services (VAS) and has initiated video streaming, video downloads and other offerings for its customers. In June 2007, the company introduced mobile internet radio, offering live streaming radiocasts in different languages. In line with this, the company will look into mobile TV services once 3G is launched.

Meanwhile, Tata subsidiary Tata Sky is putting up an aggressive fight in the DTH segment. In a bid to counter competition from old rivals in the telecom space, the company has recently introduced PVR services, which allow viewers to record a programme while watching another.

There are currently two major commercial DTH players at the national level: Tata Sky and Dish TV, promoted by the Subhash Chandra-owned Essel Group. Tata is now competing by offering the new PVR service, which includes an advanced set-top box with a built-in recording feature and a hard drive capacity of 160 GB, which can save up to 115 movies.

The company is also focusing on customer service and hopes to get an edge over its rival in this respect. It has introduced an interactive voice response application at its call centres, in association with Ubona Technologies, in order to take care of the surge in demand.

The company is reportedly looking to sign on 8 million customers by 2012. Clearly, it sees DTH as the way forward. Points out Neerav Khambatti, general manager, Tata Sons: "At the end of 2007, the global revenue from mobile TV or video services was about $4 billion vis-Ã vis the global revenue from digital TV services, which was about $90 billion."

Vodafone Essar

Unlike its rivals in the wireless space, Vodafone Essar has remained a pure-play GSM operator. At a time when other operators were delivering on both technology platforms, Vodafone remained single-minded in its choice of GSM.

It is not surprising, therefore, that when its rivals are ramping up their IPTV, DTH and mobile TV plans, Vodafone is quietly charting a different course. The area where it is likely to take on competition vigorously is 3G. Internationally, the company has extensive experience and a lead in 3G, having offered the service in Europe and the US through Verizon Wireless.

The Vodafone Group UK launched 3G mobile services in October 2005, in conjunction with British satellite broadcaster BSkyB. The service gave Vodafone's 3G subscribers access to 19 channels initially, which was later extended to all channels. Over the years, Vodafone has become the leader in this space, having increased its mobile TV coverage significantly to many European countries while keeping tariffs competitive.

With Vodafone Essar being one of the first telecom operators to launch mobile video streaming services in India in December 2006 (which enabled a video to be played directly on the cellphone without being downloaded first), and owning the largest number of high-end subscribers, analysts expect the company to make a big splash in the mobile TV and 3G segments once spectrum becomes available.

Idea Cellular

Like Vodafone Essar, Idea Cellular is also a pure-play mobile services operator. A strong contender in the 3G spectrum race, the company is likely to focus on mobile TV opportunities once it receives 3G spectrum.

Idea has always focused on VAS and has been amongst the early movers in offering innovative mobile value additions such as ringtone downloads and call-back ringtones targeted at the youth segment. It was also the first cellular operator in India to launch EDGE-based services, enabling customers to download data at a speed of 160 kbps, watch movie previews, use video attachments on their handsets, etc. Says Rajat Mukarji, chief of corporate affairs, "Over the past five to seven years, technology uptake has been fairly substantial. Today, as a result of compression techniques, the bandwidth requirement for streaming video has reduced hugely, thereby enabling sharing of photographs and videos over the internet with people across the world. Extending this to the realm of 3G, TV is a natural capability."

The only concern, according to him, is the price of the service. "Today, by and large, at $8 a month, we can get a bouquet of about 200 channels. Whether this can be replicated at the same price point for TV on the mobile is a question that needs to be answered," says Mukarji.

Issues and challenges

Future uptake of these services will depend on a number of factors. In IPTV, there are both underground and overhead problems with the available last mile connectivity infrastructure, as wires get twisted and thwart the flow of traffic.

Content for all three services will pose a hurdle. It is often difficult and cumbersome to form tie-ups with content providers. While some content creators are simply not willing to part with their content, others ask for huge price premiums on their channels.

Further, while companies are willing to invest heavily in this business and drop tariffs if required, this could result in huge operator losses. With the capex involved in offering these services already high, competing on tariffs would mean operators running into heavy losses, apart from facing long gestation periods before breaking even.

The lack of adequate spectrum is another key challenge. In 3G for instance, operators feel that given the fact that voice is by far the most profitable service and video the least, they would have to decide whether to utilise the 5 MHz spectrum available to them for TV-like services or for decongesting networks by using that spectrum for voice services.

Finally, with the global financial meltdown, there are concerns over a liquidity crunch as international investment may not come in easily. Besides, with the dollar appreciating rapidly, there has been an increase in the import price of set-top boxes. This is also adversely affecting the financial viability of DTH providers, some of whom are mulling raising prices.

Future prospects

In the future, operators intend to explore IPTV on mobile phones. Optic fibre manufacturer Aksh Optifibre is gearing up to offer quad play and has already tested the technology in Mumbai with MTNL, which has 3G spectrum in the circle. Aksh is also ready to tie up with other companies for the quadruple-play venture. The key though is the allocation of 3G spectrum.

In sum, while there are plenty of challenges yet, the volumes in the Indian market are so large that cornering even a small percentage of subscribers makes a sound revenue and profitability business case for operators. So, the market is there, the technologies are there and evolving further.

Clearly, there is a huge market waiting to be tapped – for DTH, IPTV and 3G services. Analyst projections are certainly upbeat. The real challenge now is to determine the price point on which the cost to serve is recovered. Only then would the business case stack up for operators.