Key Indicators - TRAI quarterly performance report on telecom services

-

The Telecom Regulatory Authority of India has released the Performance Indicator Report of Indian Telecom Services for the quarter ended March 2008. According to the report, the total number of wireline and wireless subscribers stood at 300.49 million in March 2008, up from 272.87 million in December 2007, registering an increase of 10.12 per cent. Teledensity touched 26.22 during the quarter under review, as against 23.87 in the previous quarter. The following are the highlights of the report:

Wireline services

The wireline subscriber base rose from 39.25 million in December 2007 to 39.42 million in end-March 2008. The rural wireline subscriber base, however, slipped from 11.75 million to 11.64 million during this period.

While Bharat Sanchar Nigam Limited (BSNL) and Mahanagar Telephone Nigam Limited (MTNL) had 80.05 per cent and 9.33 per cent market share respectively, the five private operators together made up 10.62 per cent of the market.

Wireless services

The wireless subscriber base registered a growth of 11.75 per cent, increasing from 233.62 million in end-December 2007 to 261.07 million during the quarter under review. The rural wireless subscriber base rose from 52.52 million to 62.28 million during the same period, registering a growth of 18.58 per cent.

The GSM segment accounted for 73.81 per cent of the total mobile subscriber base while CDMA accounted for 26.19 per cent. With a subscriber base of 192.7 million, the GSM segment reported a growth of 11.89 per cent from 172.23 million at end-December 2007. CDMA witnessed a growth of 11.37 per cent over the same period with 68.37 million subscribers as of end-March 2008.

Bharti Airtel continued to maintain its leadership position with a wireless subscriber base of 61.98 million and a market share of 32.16 per cent. It was followed by Reliance Communications and Vodafone Essar with 45.79 million and 44.13 million wireless subscribers respectively.

ARPUs and MoUs

The blended all-India average revenue per user (ARPU) per month for GSM subscribers increased by 1.15 per cent from Rs 261 in December 2007 to Rs 264 in March 2008. Segment-wise, the ARPU for postpaid GSM subscribers showed an increase of 1.59 per cent, from Rs 628 in the quarter ended December 2007 to Rs 638 during the following quarter. Prepaid ARPUs showed a higher growth rate of 2.3 per cent, from Rs 219 to Rs 224, during the same period.

Meanwhile, the minutes of usage (MoU) per subscriber per month increased from 464 to 493 – a growth of 6.25 per cent. In the post-paid segment, the total MoU increased from 968 to 1,015. Prepaid MoUs increased from 407 to 438.

In contrast, on the CDMA front, the all-India blended ARPU per month for the quarter ended March 2008 dropped from Rs 176 to Rs 159, a decline of 9.65 per cent. Uttar Pradesh (West) registered the lowest ARPU of Rs 117 per month while Mumbai recorded the highest ARPU at Rs 228.

The total blended MoU per subscriber per month witnessed a decline from 375 minutes to 364 minutes. The lowest MoU was reported in the Punjab circle at 262 per subscriber per month, 39 per cent lower than the all-India figure of 364, while the highest MoU was recorded in Andhra Pradesh at 492 per subscriber per month.

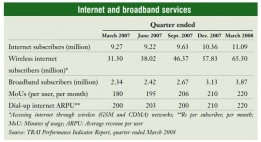

The ARPU per month for dial-up internet subscribers was Rs 220 at the end of March 2008.

Internet services

As of March 2008, there were 11.09 million wireline internet subscribers as compared to 10.36 million at the end of December 2007, a growth of 7.08 per cent. This growth rate is slightly lower than the growth rate of 7.64 per cent registered at the end of December 2007. In addition, there were 66.09 million wireless data subscribers capable of accessing data services including the internet, through mobile handsets (GSM/CDMA) at the end of March 2008.

Meanwhile, the number of broadband subscribers grew by 23.64 per cent, from 3.13 million to 3.87 million. Of these, 3,281,012 subscribers were DSL based, 376,200 used cable modem, 107,128 used Ethernet local area networks, 50,739 were on fibre-based networks, 39,051 were radio based, 16,494 used leased lines, and 3,555 used other access technologies.

In terms of market share, while BSNL and MTNL together catered to 67.94 per cent of the wireline internet market (compared to 66.04 per cent in the quarter ended December 2007), private internet service providers (ISPs) accounted for 32.06 per cent. In the broadband segment, BSNL alone held 52.49 per cent market share. Among the private companies, Bharti Airtel led with 11.95 per cent market share.

The bandwidth owned by various independent gateway service providers for their ISP operations and internet leased lines was reported to be 47 GB for downlinking and 46 GB for uplinking. In comparison, at the end of December 2007, these figures stood at 42 GB for downlinking and 41 GB for uplinking.

PMRTS and VSAT services

The subscriber base of public mobile radio trunk service (PMRTS) increased from 34,825 in December 2007 to 36,240 in March 2008, registering a growth rate of 4.06 per cent. Delhi was in the lead with 9,787 subscribers, followed by Bangalore, Mumbai and Chennai with 6,772, 5,093 and 3,907 subscribers respectively.

On the very small aperture terminal (VSAT) front, there was an addition of 13,986 subscribers during the quarter. The total number of VSAT subscribers increased from 67,409 in December 2007 to 81,395 in March 2008, a growth of 20.75 per cent. Hughes Communications and HCL Comnet were the market leaders with 31.28 per cent and 28.32 per cent share respectively. Bharti Airtel followed, recording the highest growth rate of 81.58 per cent during the quarter. (Hughes' market share has been calculated using the subscriber figure for the quarter ended December 2007.)

Quality of service

The quality of service (QoS) offered by fixed line service providers improved over the quarter ended March 2008 on parameters such as fault incidence; mean time to repair; call completion rate; metering and billing credibility; customer care services (additional facilities); response time to the customer for assistance – percentage of calls answered by operator (voice to voice); and time taken for refund of deposits following closure. However, their performance deteriorated with respect to parameters such as provisioning of telephones, fault repair by the next working day and grade of service. The performance of fixed line service providers remained at the same level as compared to the previous quarter with respect to parameters like customer care services (shifts) and response time to the customer for assistance (percentage of calls answered).

In contrast, wireless services showed improvement only with respect to accumulated downtime of community isolation, service access delay, percentage of connections with good voice quality, response time to the customer for assistance, and percentage of complaints resolved within four weeks. On the remaining parameters, the performance either deteriorated or remained the same as the previous quarter.

Financial performance

The total revenue from telecom services was Rs 357.7 billion, up 8.21 per cent from Rs 330.55 billion in the quarter ended December 2007. Of this, the private sector, which witnessed a growth of 5.71 per cent in revenue during the quarter, accounted for 66 per cent. Public sector operators' revenue recorded a growth of 13.38 per cent. The adjusted gross revenue (AGR) of the telecom sector was Rs 278.45 billion, a growth of 7.48 per cent compared to Rs 259.06 billion in the quarter ended December 2007. While the public sector operators' share of AGR stood at 38 per cent, that of the private operators was 62 per cent.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Manufacturing Hub: India emerges as a ke...

- TRAI performance indicator report for Se...

- Prashant Singhal, partner, telecom indus...

- 2G spectrum scam: continuing controversy

- An Eventful Year: Telecom highlights of ...

- Telecom Round Table: TRAI’s spectrum p...

- Manufacturing Hub: TRAI recommends indig...

- Linking Up: ITIL to merge with Ascend

- High Speed VAS - Killer applications w...

- Bharti Airtel seals deal with Zain - Zai...