The rapid adoption of Wi-Max can be attributed to the establishment of industrywide standards, which has enabled service providers as well as technology vendors to make commercial commitments to the technology.

In 2007-08, there was a 91 per cent increase in the Wi-Max subscriber base.According to a report by RNCOS, the number of subscribers worldwide is expected to increase at a compounded annual growth rate (CAGR) of around 102 per cent from 2007 to 2010. Driven by the demand for personal services, the number of fixed and mobile Wi-Max subscribers is likely to cross 76 million in 2011.

However, research firm Infonetics feels that with the global credit crunch, the pace of Wi-Max adoption is expected to slow down. According to the company, worldwide sales of fixed and mobile WiMax equipment as well as phones/ultra mobile PCs fell by 21 per cent in the third quarter of 2008 on a sequential basis.

Moreover, Infonetics expects this downward trend to continue throughout 2009 due to the economic recession. With less cash available for network rollout – and possibly less spectrum being auctioned until the financial crisis passes – Wi-Max deployment is likely to be slow for the next 12 months. According to Infonetics' report, WiMAX and WiFi Mesh Network Equipment and Devices, fixed Wi-Max had already reached a plateau prior to the economic downturn and mobile Wi-Max now accounts for the bulk of global Wi-Max equipment sales.

Revenue from Wi-Max services is also being affected as operators experience stagnation or decline in their average revenue per user. Revenue growth is expected to start only from 2010. It will be driven primarily by mobile Wi-Max, given the number of mobile Wi-Max networks being rolled out.

Also, given the high cost of debt, WiMax vendors like Telsima and leading operators are struggling to fund their plans.

Nonetheless, Wi-Max is now entering a phase of commercial availability that makes volume applications like metrowide mobile broadband and embedded consumer applications feasible. Also, according to industry experts, more mobile WiMax-enabled devices were certified in the latter half of 2008 than fixed Wi-Max devices, and the growth rate for base station deployments continues to outpace that of customer premises equipment (CPE). This indicates that networks are expanding ahead of the adoption curve.

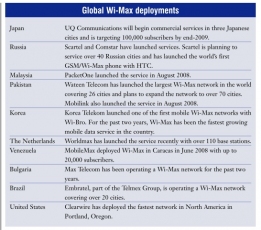

While North America is initially likely to lead in terms of subscriber numbers visà -vis other regions, the Asia Pacific (APAC) region is expected to account for nearly 50 per cent of the total Wi-Max subscriber base by 2012.

In the US, Clearwire, the poster boy for Wi-Max, had over 469,000 subscribers as of December 2008. The company has launched services in Baltimore and Portland and is getting ready for the commercial launch of high speed mobile data services in Chicago, Washington, DC, Boston and Dallas-Fort Worth.

Clearwire is also working on converting its more than 40 pre-Wi-Max networks to true Wi-Max. The company is backed by Intel, Google and some of the largest cable operators in the US. Together, these companies have injected $3.2 billion into the venture.

But the company too has been witnessing a slowdown in subscriber additions. It also reported a net loss of $166.6 million for the quarter ended September 2008. Intel, Google and Time Warner have all had to write off their losses from their investments in Clearwire. Intel wrote off a $1 billion net loss in its equity investment.

Overall, Wi-Max adoption in the US seems to have slowed down. For instance, Nortel Networks has discontinued its mobile Wi-Max business. And with operators planning long term evolution (LTE) deployments, the viability of Wi-Max is being threatened. LTE will essentially convert the universal mobile telecommunications system (UMTS) into a wireless broadband internet system, with voice and

other services built on the top.In the APAC, both mobile and fixed Wi-Max are likely to drive the market.While mobile Wi-Max deployments will take place in mature markets like Korea and Japan, fixed Wi-Max is set to grow in key developing countries like China and India.

The unavailability of wired infrastructure for accessing the internet will be a major growth driver for Wi-Max in these markets. Government support and initiatives undertaken by service providers to provide internet services in remote areas will also play a significant role.

The second quarter of 2008 witnessed the largest mobile Wi-Max deployments by Korea Telecom, which has nearly 190,000 subscribers, and Pakistan-based Wateen Telecom, which has more than 25,000 subscribers. Wateen Telecom has placed an order of 198,000 CPEs with Motorola, which is expected to be delivered by the end of this year. The gap between mobile 16e deployments and 16d will narrow once trials of 16e equipment are complete and certified equipment becomes widely available. Wateen is likely to face growing competition in the WiMax arena from operators including WiTribe, Mobilink and LinkDotNet.

In India, Bharti Tele-Ventures, Reliance Communications, Sify, Bharat Sanchar Nigam Limited and Tata Communications have all acquired WiMax licences in the 3.3 GHz range. Their services are at various stages of trials. Once these are over, analysts expect the Wi-Max subscriber base to grow to about 19 million in India by 2012.

Intending to capitalise on the huge Wi-Max opportunity in the APAC region, manufacturers and application vendors are aggressively entering these markets.

In Latin America too, given the lack of wired infrastructure, low broadband penetration and numerous Wi-Max licence opportunities, there is a huge market for the service. Currently, there are 95 WiMax deployments in the Caribbean and Latin America, including ten deployments in Brazil and seven in Peru. This technology has clearly moved to the centrestage in Latin America with several key auctions expected in 2009.

In fact, this region is likely to be a major growth area for Wi-Max in the next few years. The WiMAX Forum expects more than 13 million Wi-Max users in Latin America by 2012.

While the need for connectivity in emerging markets offers a significant opportunity for Wi-Max companies, industry experts are of the opinion that there is just as much potential for Wi-Max in developed countries since traffic growth may exhaust 3G network capacity.

In the UK, telecom regulator Ofcom is finally planning to auction a huge portion of spectrum suitable for high speed mobile broadband, including 190 MHz in the 2.6 GHz band and 15 MHz in the 2010 MHz band. Spectrum in these bands will play an important role in the development of advanced mobile data services in the UK.Operators looking to adopt technologies such as LTE and Wi-Max have shown great interest in this auction. OnCommunications, a UK-based wireless broadband service provider, intends to roll out fixed Wi-Max services in major cities and towns and will deploy a substantial number of fixed Wi-Max base stations.

Netherlands-based Worldmax has launched Europe's first mobile Wi-Max network with over 110 base stations in Amsterdam. Designed to cater for both indoor and outdoor users, the Worldmax Aerea service provides wireless broadband access to users of laptops, smartphones and PDAs. The company, a privately owned start-up with Intel as one of its investors, is aiming for a broad demographic user base and is planning national expansion. According to Worldmax, it would need about 3,000 sites to cover all of the Netherlands, costing hundreds of millions of dollars.

Meanwhile, in the Wi-Max vendor community, the July-September quarter of 2008 witnessed a change in the pecking order with Alvarion overtaking AlcatelLucent and Motorola and taking the lead in the mobile Wi-Max market. The three companies together accounted for over 60 per cent of the global mobile Wi-Max revenue. Alvarion, Alcatel-Lucent, Motorola and Samsung together account for nearly three-quarters of all mobile Wi-Max customers. In the fixed Wi-Max segment, Telsima and Airspan are the joint leaders.

While there is potential for Wi-Max in mature markets, the really big opportunity clearly lies in emerging markets in South Asia and Latin America, where some of the biggest deployments of Wi-Max are slated to take place.