Turnaround Efforts - Telecom PSUs aim to catch up with nimbler private competitors

-

These disadvantages have adversely affected the performance of the incumbents. For example, in 2007, BSNL lost its top position amongst operators in terms of subscribers and revenues to Bharti Airtel, largely due to its inability to increase network capacity fast. ITI, despite several attempts at revival, has failed to register profits for a long time.

However, BSNL, MTNL and ITI are looking to regain some lost ground. The companies are reworking their strategies and consolidating operations to keep up with the competition and enhance their performance. tele.net takes a look at the plans of the three telecom PSUs...

BSNL

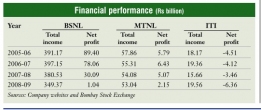

With 48 million mobile subscribers, BSNL is currently the fourth largest mobile operator behind Bharti Airtel (100 million), Reliance Communications (77 million) and Vodafone Essar (74 million). Its net profit dipped from Rs 30 billion in 2007-08 to Rs 1.04 billion in 2008-09, while revenues decreased from Rs 380 billion to Rs 349 billion. BSNL has been affected by rising staff costs as well as the phasing out of the access deficit charge regime, through which it used to receive a certain part of private operators' revenues.

According to industry analysts, BSNL's sarkari image has been its undoing.Further, as a PSU, its decision-making powers are limited and approval processes long and tedious. For instance, the company's crucial 45 million GSM line tender was delayed for about two years and was ultimately reduced by half to 23 million lines in 2008.

Last year, in a bid to raise $10 billion to fund its expansion plans, the company proposed to sell 10 per cent stake to the public.The communications and IT ministry offered to increase employees' benefits following the divestment. However, the plans were put on hold after the unions rejected the ministry's proposal.

Now, after multiple rounds of negotiations with the union, BSNL has again approached the government for the proposed listing. Currently, cabinet approval is awaited on the issue.

Another option being considered by BSNL is to rope in a strategic foreign partner to improve its valuation. Industry watchers feel that the company's countrywide network will certainly work in its favour during a stake sale.

Also, BSNL's board has approved plans for overseas expansion and acquisition, and the company is currently scouting for such opportunities in several markets abroad.

BSNL has appointed eight consultants – Ernst & Young, McKinsey, KPMG, PricewaterhouseCoopers, British Tele While the private operators are fast and agile in their approach, state-owned players such as BSNL, MTNL and ITI, are still held back by red tape, political interference and high employee costs.Consults, Value Partners, PRPM Consults and Diamond Management and Technology Consultants – to assist it in the ventures abroad. Each time BSNL undertakes an overseas initiative, these firms will be asked to quote their commission price and the lowest bidder will be selected.

Slow growth rates and being overtaken by Bharti Airtel seem to have pushed the one-time monopoly service provider towards taking decisive action. And while the company is busy reviving its business, it may also get the "Mahanavratna" status, which would confer upon it greater operational autonomy.

MTNL

Following BSNL and Bharti Airtel, both of which have their sights set on the African telecom market, MTNL is looking to extend its footprint to Nigeria and Zimbabwe. The company, however, is not looking to take the direct acquisition route, and is instead planning to buy stakes diluted in foreign telecom companies by the respective governments.

MTNL has been facing several issues at home. In May 2009, nearly 4,000 company executives went on strike demanding revised pay including 30 per cent fitment benefit. However, according to R.S.P. Sinha, chairman and managing director, MTNL, the proposal is not feasible. "If the demand is fulfilled, the company will not be able to sustain itself in the future. MTNL's salary bill has already gone up to Rs 22 billion in 2009 from Rs 10 billion in 2003," he says.

Also, the company has been witnessing a steady decline in profits and revenues. Its net profit declined by over 55 per cent in 2008-09 to Rs 2.1 billion from Rs 5 billion in 2007-08. Revenues fell from Rs 54 billion to Rs 53 billion over the same period.

Even though MTNL and BSNL stole a march over competitors by launching 3G services first in the Indian market, neither company has been able to position the services successfully. In the introductory phase, MTNL and BSNL have managed to garner only 400 and 9,000 customers respectively.

ITI Limited

The 60-year-old telecom equipment manufacturing company has been swimming against the tide for quite some time now. ITI has failed to cash in on the demand for telecom gear in the Indian mobile and broadband services market.Earlier, the government had even made regulations that guaranteed ITI 30 per cent of all orders placed by the government. However, owing to the company's poor delivery records, this provision had to be scrapped. Facing intense competition from global equipment makers who offer the latest technology at economical prices, ITI has witnessed a sharp drop in financial performance. Between 2005-06 and 2008-09, the company's losses increased from Rs 4.51 million to Rs 6.36 million while revenues marginally increased from Rs 18.17 billion to Rs 19.56 billion. The company sought additional aid of around Rs 25 billion from the government in 2008 to compensate for the losses.

Help has been at hand for the company. In 2005-06, the government formulated a bailout package of Rs 10.25 billion for ITI. Earlier this year, the union cabinet cleared an interest-free loan of Rs 1.25 billion so that the company could pay salaries to its employees. As part of its budget for 2009-10, the government has allotted Rs 28.2 billion to the company.While the fresh line of credit augurs well for ITI, the company must ensure that that the funds are utilised in an efficient manner, with a mechanism for ensuring accountability.

The Government of India, along with the Karnataka government, owns 92.98 per cent stake in the Bangalore-based company. ITI has nearly 13,000 employees at its six manufacturing units in Bangalore, Mankapur, Rae Bareli, Naini, Srinagar and Palakkad.

In April 2009, the Department of Telecommunications proposed to merge ITI with BSNL, but the move was opposed by ITI's employees. Now, the exchequer has identified disinvestment as a viable option. The communications and IT ministry has invited expressions of interest from global and domestic equipment makers and equity investors to purchase stakes initially in three of ITI's manufacturing units.

According to the bid document, ITI is planning to set up a special purpose vehicle (SPV) or joint venture (JV) company with equity participation from local or global telecom equipment companies for each of the three units. The strategic partner, having equity participation in the range of 51-74 per cent, will have controlling stake in the SPV/JV. The remaining stake will be owned by ITI. The three remaining manufacturing units will be sold later. The government is currently in the process of appointing a consultancy firm to advise it on the sale of stake in ITI.

Net, net, all three telecom PSUs are making attempts to match the private competitors and regain their lost market positions. However, it is still early to determine whether or not these efforts will succeed.

Upcoming plans

BSNL

MTNL

ITI

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!