Revenues Rise - Driven by mobile subscriber additions

-

Over the past decade, the Indian telecom sector has emerged as a big revenue generator for the government, with the mobile services segment accounting for the largest contribution. Its share is likely to increase in the years to come. In May 2008, Assocham and PricewaterhouseCoopers projected that telecom revenues in the country would reach $35 billion by 2010.Cellular revenues are expected to comprise a large chunk of this revenue. Gartner has forecasted that cellular revenues will exceed $37 billion by 2012, registering a compounded annual growth rate (CAGR) of 21 per cent over 2008-12.

Revenue from wireless services increased at a CAGR of 56.86 per cent, from Rs 122.4 billion in 2003-04 to over Rs 741 billion in 2007-08. Mobile revenue, as a proportion of total telecom revenue, has increased from 27.9 per cent in 2004-05 to over 57 per cent in 2007-08.

While wireless revenue is increasing year over year, the rate of growth seems to be slowing down (Table 1). The annual increase in revenue was 79 per cent in 2005-06, and it fell to 31.94 per cent in 2007-08. The absolute increase in revenue has also started showing signs of slowing down.

In the coming years, the expanding mobile subscriber base will continue to drive revenue. Growth over the past few years has been exponential – the subscriber base expanded from 52.22 million in March 2005 to 261.09 million subscribers in March 2008, registering a CAGR of 71 per cent. In July 2008, monthly mobile subscription additions hit a record high of 9.22 million. Going ahead, the growth in subscriber figures is expected to be enough to negate the effect that lower tariffs and average revenue per user (ARPU) will have on revenue. In fact, ARPU has been plummeting steadily over the past few years. From a high of Rs 1,319 per month in 2000, ARPU decreased to Rs 469 in 2004, and further down to Rs 264 and Rs 159 for GSM and CDMA services respectively for the quarter ended March 2008.

The plummeting ARPUs are a result of the aggressive tariff wars in the industry as well as the Telecom Regulatory Authority of India's (TRAI) tariff regulations. In the national long distance (NLD) segment, for example, operators are undercutting tariffs aggressively and coming up with more innovative and affordable schemes.

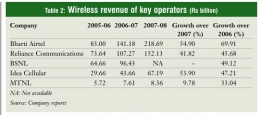

The public sector units have been especially aggressive, with Mahanagar Telephone Nigam Limited (MTNL) and Bharat Sanchar Nigam Limited (BSNL) slashing their NLD rates to as low as Rs 1.20-1.25 per minute (these rates are not part of the One India Plan that allows users to make STD calls for Re 1 per minute).Tata Teleservices Limited (TTSL) has launched two special tariff vouchers that offer prepaid and post-paid customers NLD and roaming tariffs that are reduced by up to 40 per cent. With the Department of Telecommunications looking to permit consumers to select their long distance operator, irrespective of the mobile service provider, the NLD tariff war is slated to intensify and further push down ARPUs.Operators, however, are raking in substantial revenues (Table 2). Bharti Airtel, which has the largest share of the wireless market, posted a revenue of Rs 218.69 billion from the wireless segment in 2007-08.Bharti was followed by Reliance Communications (RCOM), whose revenue from the wireless segment was Rs 152.13 billion. According TRAI estimates, the wireless revenues of Vodafone Essar and TTSL in 2007-08 were Rs 154.75 billion and Rs 76.16 billion respectively.

GSM is clearly the dominant technology in the market and accounts for the major proportion of revenue. The growth in GSM revenue is higher than that in CDMA revenue. The former grew by 42.7 per cent from Rs 100.4 billion in the quarter ended March 2007 to Rs 143.29 in the quarter ended March 2008. Revenue from the CDMA segment increased by 27.4 per cent from Rs 18.92 billion to Rs 24.1 billion during the same period.

With the government allowing the use of dual technology, RCOM and TTSL are looking to venture into the GSM space in a big way. With this, revenue from GSM services is likely to clock higher growth rates and acquire a greater share of total wireless revenue.

Voice versus VAS

In the future, mobile value-added services (VAS) are expected to be the key driver of wireless revenue. Although voice services will continue to be important, their share in operators' total wireless revenue is expected to decrease, according to Gartner, to 85 per cent in 2012 from 89 per cent in 2007. According to a recent report by investment management firm Ambit Capital, the mobile VAS industry will reach Rs 161 billion by 2011-12.

Major operators like Bharti Airtel, RCOM and Idea Cellular are registering steady growth in the non-voice segment.The total mobile VAS revenue increased by 132.97 per cent and 119.2 per cent in 2005-06 and 2006-07 respectively. In 2007-08, revenue grew by over 60 per cent to reach Rs 45.6 billion (Table 3).

SMS is currently the most popular mobile VAS, accounting for 68 per cent of VAS revenue. Industry estimates suggest that 60-70 per cent of consumers use SMS for downloading ringtones, accessing news, cricket scores, etc. Mobile music is also gaining popularity, with consumers increasingly opting for Bollywood content.

In the future, 3G services and the rising popularity of m-commerce will provide a fillip to mobile VAS.

Rural focus

In the future, wireless revenues will be driven by the growth of the rural market.The rural sector currently generates about Rs 9.52 billion in revenue (based on Ernst & Young estimates of a rural subscriber base of 63.5 million with ARPUs of Rs 150). Of this, the wireless segment accounts for Rs 7.87 billion.

The rural shift is already taking place with operators targeting the new markets aggressively. Companies are not only reducing handset costs but also coming up with innovative and affordable tariff schemes. For example, Bharti Airtel has entered into a strategic tie-up with SKS Microfinance and launched the Grameena Mobile Kranthi programme, under which the operator offers mobile handsets bundled with prepaid connections to members of SKS Microfinance in certain areas in Andhra Pradesh.

In February 2008, RCOM introduced the Gramada Phone scheme in Karnataka. Under this, the service provider is targeting to provide 200,000 mobile connections for Rs 699, along with two years of free incoming service.Local calls made to fixed lines or any Reliance phone in Karnataka are charged at Re 0.80 for three minutes.

While a number of new operators are expected to launch services soon, the market seems to be large enough to provide opportunities for the new entrants. All in all, revenue from mobile services will continue to increase steadily in the future.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!