Mixed Performance - Telecom companies declare third quarter financial results

-

Meanwhile, India is on its way to becoming the growth engine of the UKbased Vodafone Group, which reported a 4.2 per cent increase in revenue to $18.3 billion for the quarter ended December 2007. The rise was fuelled by almost 56 per cent growth in the group's India revenues. India also accounted for almost 38 per cent of Vodafone's subscriber additions during this period.

Bharti Airtel: Impressive results, yet again

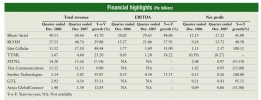

Bharti Airtel's net profit increased to Rs 17.22 billion in the quarter ended December 2007 from Rs 12.15 billion in the quarter ended December 2006, a growth of 41.7 per cent. Revenue also grew by 41.7 per cent from Rs 49.13 billion to Rs 69.64 billion over the same period, while EBITDA grew by 48 per cent to Rs 29.63 billion. The strong financial performance was driven by a huge surge in the company's subscriber base, which grew to over 57 million during the quarter.

The operating margin rose from 40.8 per cent to 42.5 per cent on a year-on-year basis. However, sequentially, it fell by 30 basis points.According to analysts, this was largely due to spectrum shortage, which led to higher network operating costs. The problem may be alleviated considering that Bharti has recently been granted additional spectrum in five circles – West Bengal, Gujarat, Uttar Pradesh (West), Assam and Haryana – and is expecting additional spectrum in another five telecom circles.

According to the segment-wise classification, mobile services, with revenues of Rs 56.1 billion, accounted for over 80 per cent of total revenue. This indicates that the segment is still the key revenue driver for the company. Non-mobile divisions, comprising telemedia and enterprise services, reported revenue of Rs 21.94 billion, a 24 per cent increase over the Rs 17.71 billion reported in the quarter ended December 2006. The enterprise services segment alone, however, witnessed a 3.9 per cent decline in revenue.

Bharti is planning to invest Rs 100 billion in 2008-09, compared to the Rs 140 billion that had been earmarked for 2007-08.

RCOM: Pushing for growth

RCOM, India's second largest wireless service provider in terms of mobile subscriber base, registered 48.5 per cent increase in net profit from Rs 9.24 billion in the quarter ended December 2006 to Rs 13.72 billion in the quarter ended December 2007. Net revenue grew by 29.8 per cent from Rs 37.55 billion to Rs 48.74 billion. However, on a standalone basis, the company reported a 43.3 per cent decline in net profit after tax, from Rs 7.71 billion to Rs 4.36 billion. EBITDA grew by 53.7 per cent to Rs 15.82 billion from Rs 10.29 billion.

EBITDA margins expanded from 37.4 per cent to 40 per cent, helped by an expansion in the wireless business, which contributes 80 per cent to the company's revenue.Wireless revenue rose by 43.8 per cent from Rs 27.52 billion to Rs 39.57 billion.

The company added 4.6 million subscribers during the October-December 2007 quarter, as compared to about 4 million additions in the corresponding quarter in 2006. RCOM had close to 41 million wireless subscribers as of December 2007.

RCOM, which has been granted spectrum for starting GSM services in 14 circles, is planning to spend $6 billion in 200809 on expanding its GSM operations and strengthening its wireless network. With an end-to-end telecom services model covering voice, data, international connectivity and internet protocol TV (IPTV), RCOM appears well placed to deliver strong earnings growth in the future.

Idea Cellular: The upward momentum

Idea Cellular's consolidated net profit increased by 108.11 per cent to Rs 2.36 billion for the quarter ended December 2007 from Rs 1.13 billion in the corresponding period in 2006. Total revenue rose to Rs 17.1 billion from Rs 11.52 billion.

Idea currently operates in 11 telecom circles, and has recently received letters of intent for pan-Indian services. The company intends to roll out services in all circles, including Mumbai, as soon as it gets the requisite spectrum.

TTML: Loss reduction exercise

Tata Teleservices' subsidiary cut back losses as its subscriber base approached the 5 million mark. TTML's net loss decreased from Rs 591.7 million in the quarter ended December 2006 to Rs 274.3 million in the quarter ended December 2007. Revenue grew by 25.2 per cent from Rs 3.67 billion to Rs 4.6 billion, and operating profit from Rs 830.9 million to Rs 1.28 billion.

MTNL:Downward trend

MTNL posted a net profit of Rs 976.3 million for the quarter ended December 2007, a steep decline of 53.19 per cent from a net profit of Rs 2.08 billion in the corresponding quarter in 2006. The decline was mainly due to a 5.59 per cent fall in net sales to Rs 11.89 billion from Rs 12.6 billion. The company's total income also fell from Rs 14.28 billion to Rs 13.26 billion.

Aiming to increase its subscriber base, MTNL recently launched a slew of services like IPTV and voice over IP, and made tariff cuts for mobile, landline and broadband services. To improve quality of service, the operator is in the process of adding 750,000 switching lines to the existing 1,325,000 for its mobile network, and 300 base transmission stations to the existing 512 for the radio network. There is also speculation that MTNL might apply for a pan-Indian GSM licence.

Tata Communications: Facing the effects of transition

Tata Communications reported a 33 per cent decline in net profit to Rs 95.2 million for the quarter ended December 2007 from Rs 1.42 billion in the corresponding quarter in the previous year. This was largely due to the company's struggling wholesale voice division, which incurred losses of Rs 164.5 million. Tata Communications' total income increased marginally to Rs 11.13 billion from Rs 11.12 billion.

Tata Communications is repositioning itself as a full-service retail carrier in the enterprise market. It is making investments in new undersea ventures in order to stay competitive vis-Ã -vis domestic competitor Reliance and international players such as AT&T, BT and Verizon.During the period January-December 2007, the revenue from the enterprise and carrier data segment, which accounts for 50 per cent of the company's revenues, grew by about 5 per cent per quarter.According to Ovum, even though most of Tata Communications' enterprise Ethernet business opportunity is currently limited to India, the company's global reach and partnership abilities make it a possible entrant in a number of large retail enterprise markets abroad.

Sterlite Technologies: A big leap

Sterlite Technologies, which provides transmission, optical fibre and access business solutions, reported earnings of Rs 264 million for the quarter ended December 2007, a growth of 2.05 times from Rs 128.7 million in the quarter ended December 2006.

The company's net sales increased by 59.91 per cent to Rs 5.02 billion, whereas total income grew by 59.96 per cent to Rs 50.22 billion.

GTL: Good going

GTL's consolidated earnings increased by 95.53 per cent to Rs 406.7 million in the quarter ended December 2007 from Rs 208 million in the corresponding quarter in 2006. The consolidated total income grew by 55.31 per cent to Rs 4,546.1 million.The increase in earnings was mainly due to a shift towards higher-margin businesses, and increased revenue from international operations on account of companies acquired during the quarter. During the quarter ended December 2007, GTL acquired two overseas companies, Malaysia-based network planning and optimisation company ADA Cellworks and US-based network deployment company Strategic Communication Services.

On a standalone basis, GTL's earnings grew 3.42 times to Rs 337.2 million from Rs 98.5 million. Net sales grew by 67.05 per cent to Rs 3,622.3 million, while the company's total income rose 70.71 per cent to Rs 3,652.1 million.

Avaya GlobalConnect: Profits dip

Avaya GlobalConnect suffered a 31 per cent decline in its net profit to Rs 68.62 million in the quarter ended December 31, 2007, compared to Rs 99.10 million posted during the corresponding quarter of the previous year.

The company recorded gross sales/ income of Rs 1.58 billion compared to Rs 1.40 billion in the corresponding quarter of the previous year. The profit before tax stood at Rs 110.1 million as compared to Rs 144 million.

According to company sources, there is huge demand for unified communications, contact centre as well as IP telephony solutions. Avaya GlobalConnect intends to tap this market demand to increase company profits. It also intends to continue its focus on intelligent communication solutions.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!