Aiming High - Spice Telecom set to hit capital markets

-

The offer comprises a fresh issue of 137.98 million equity shares with a face value of Rs 10 each, of which 14.49 per cent has been reserved for employees, at least 59.13 per cent for qualified institutional buyers, up to 9.85 per cent for noninstitutional buyers and up to 29.56 per cent for retail investors. The fresh issue will increase the equity of the company from Rs 5.51 billion to Rs 6.89 billion.

The company is also considering a private placement prior to the completion of the issue, which will decrease the size of the IPO by an equivalent amount. Enam Financial Consultants is acting as the bookrunning lead manager for the issue.

Besides providing visibility to the company and adding liquidity to its stock, the issue will help it garner funds for part-payment of its long-term debt, payment for NLD/ILD licence fees and related capital expenditure (estimated at about Rs 636 million), payment to vendors for network equipment, other capital expenditure (Rs 1.77 billion) and general corporate purposes.

According to the company, what will act in its favour is its strong position in its areas of operation, its established brand name and backing from Telekom Malaysia.

Under the current equity structure of Spice, 51 per cent is held by Modi Wellvest and 49 per cent by Telekom Malaysia's subsidiary, TMI India. Postissue, Modi Wellvest's equity will come down to 40.8 per cent and TMI's holding will stand reduced to 39.2 per cent.

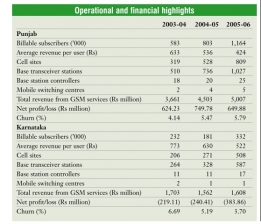

Over the last 10 years of its existence, Spice has managed to secure second position in the Punjab market, where it has 23.96 per cent share and sixth position in Karnataka, where it has 7.1 per cent share.It had a combined customer base of 2.45 million subscribers as of December 2006, comprising 1.92 million prepaid subscribers and the balance post-paid. The company is aiming for a national footprint and has applied for licences to provide GSM-based cellular services apart from licences for NLD and ILD services.

Its big plans notwithstanding, some industry analysts are sceptical of the success of its IPO. "In an era of consolidation and buyouts, and given the fact that the company is a small regional player with operations in only two circles with a relatively weaker foothold, I am sceptical about the success of the issue," says an analyst.

This could be true. To reach the size of its competitors Bharti, Hutch and Reliance, it would need to make large capital investments. Further, while the company is making profits in the Punjab circle, it is running at a loss in Karnataka.Also, whether the company will be able to sustain its growth in the Punjab circle given the tough competition from its peers remains to be seen.

However, there is an optimistic view as well. According to Romal Shetty, director, Telecom Risk Advisory Services, KPMG, "The company is aiming to become a larger player, so the vision is there. It is getting into new circles as well as ILD and NLD. The IPO will provide it funds for expansion. Moreover, the telecom market has matured and the teledensity is increasing, and considering that, there is definitely room for four or five players. Thus, although the other companies have a headstart, if Spice pursues the right path after the IPO, it may do well."

It is already giving signals of doing so. It has brought in a new player – TM. With this and additional funds, the company can witness strong growth. Obviously, the demand for its stock will depend on a number of other factors as well, such as the price it sets for the issue vis-Ã -vis its valuation and the timing of issue.

With telecom being one of the most rapidly growing sectors in the country and Spice aiming to be a key player in it, the company may well manage to repeat Idea's IPO success.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!