Ready to Debut - Idea Cellular gears up for IPO launch

-

The issue will help the company in raising Rs 25 billion through 2.5 billion shares of a face value of Rs 10 each. Of this, shares aggregating Rs 500 million will be reserved for the employees. Idea can also exercise a greenshoe option of 375 million shares (Rs 10 face value) or 15 per cent of the issue size.

While 60 per cent of the net issue (excluding employee reservation) will be allocated to qualified institutional buyers, at least 10 per cent and 30 per cent will be reserved for non-institutional bidders and retail individual bidders respectively.

Meanwhile, the company is also considering a pre-IPO placement of up to 15 per cent of the issue size, which if exercised would stand reduced from the net issue. The company plans to list its shares on the BSE and NSE.

Citigroup Global and UBS Securities are acting as the senior co-bookrunning lead managers while JM Morgan Stanley and DSP Merrill Lynch are the lead managers for the issue.

The company has an existing share capital of 2.259 billion shares with a face value of Rs 10 each. Idea Cellular's promoters, Aditya Birla Nuvo, Birla TMT, Hindalco and Grasim, together hold 65.1 per cent stake while foreign institutional investors hold 34.9 per cent.

The proceeds from the issue would be used primarily for building, strengthening and expanding the company's network and related services in its new circles (Rs 9.78 billion), redemption of preference shares (Rs 7.41 billon) and launch of services in Mumbai circle (Rs 6.47 billion). The balance would go towards meeting the capital expenditure for national long distance operations (Rs 808 million) and issue expenses (Rs 800 million). Apart from the proceeds from the issue, the company would also source funds from internal accruals to finance its expansion plans.

Idea has operations in 11 circles – Andhra Pradesh, Delhi, Gujarat, Haryana, Kerala, Maharashtra, Madhya Pradesh, Uttar Pradesh (West), Himachal Pradesh, Rajasthan and Uttar Pradesh (East). The Category A circles of Andhra Pradesh, Gujarat and Maharashtra, and the Delhi metro circle together account for 62.6 per cent of its mobile base.

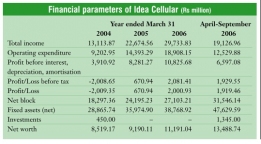

Since November 2005, Idea Cellular has invested over Rs 1 billion in expanding and rolling out its network in 11 circles. As a result of this investment, its subscriber numbers have increased by 40 per cent between April and September 2006. A critical mass of 10.36 million subscribers in the established circles as of September 30, 2006 is another advantage that the company has.Idea's GSM network has been supplied by leading equipment suppliers such as Ericsson and Nokia-Siemens. The company has adopted a distributed network architecture for the base station controllers and switches in the 11 circles, which has helped build a reliable network while minimising transmission costs.

"Idea is a very valuable and profitable company," says Mahesh Uppal, director, TCIS. "In my opinion, its issue will definitely do well."

However, the company has substantial capital requirements and may not be able to raise the additional funds required for its expansion plans. Further, the rapid growth that Idea Cellular has experienced has placed significant demands on the company and led to increased fixed operating costs. Whether the company will be able to sustain this level of growth remains to be seen. Finally, the company faces significant competition from operators that have a pan-Indian presence such as Bharti Airtel, Reliance Communications and Tata Teleservices Limited.

However, despite these weaknesses, most analysts are optimistic about the Idea Cellular IPO. The company is a strong player and is present in all the key circles.Moreover, most of Idea Cellular's key parameters are positive. This issue will definitely be oversubscribed, says Rajat Sharma, industry analyst, ICT Practice, Frost & Sullivan.

Clearly, with telecommunications being one of the most rapidly growing industries in India and Idea Cellular being a key player in the mobile market, this IPO shows all signs of success.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Sterlite Technologies announces results ...

- Margins Under Pressure - Bharti and Idea...

- GTL Limited reports 26 per cent fall in ...

- Sify Technologies Limited reports third ...

- Financial briefs of March 2011

- Rush for Funds - 3G and BWA auctions spu...

- Spice Group plans to raise $ 1 billion t...

- Spice Mobility Limited plans to transfer...

- MTNL posts its results for the first qua...

- Banglalink raises $102 million through c...

No Most Rated articles exists!!