Super Six - Key players in the telecom sector

-

Much of the success of the Indian teleom industry can be attributed to the ntrepreneurship, ambition and dynamism of the telecom operators. In the past 10 years, they have grown, stumbled, shaped up and, in most cases, transformed from one-circle operators to pan-Indian and even global players.

In the telecom volume game, the competition for subscribers has always been intense. Over the years, the state-owned Bharat Sanchar Nigam Limited (BSNL) and Mahanagar Telephone Nigam Limited (MTNL) have lost some of their sheen and their priority position to the more agile, aggressive and better managed private players.The latter, in some cases, also had the financial muscle of corporate powerhouses like Reliance, Tata and Birla behind them.

The past 10 years have witnessed several rounds of consolidation and ownership changes. Vodafone Essar (earlier Hutchison Essar), for instance, has gone through several promoter, brand and colour changes to settle into its present form (UK-based Vodafone Plc bought a majority stake from Hutchison in the company). Regional players like BPL Mobile, Shyam Telelink, Aircel and Spice Telecom either tied up or merged with larger promoters to access funds for expansion.

Today, the Indian telecom industry has 12 operational telecom service providers, the largest number in the world. Entrepreneur operator Bharti Airtel is strongly positioned at the top, recognised not just in India but internationally too. Its rivals – Reliance Communications (RCOM), Vodafone Essar, BSNL, Tata Teleservices Limited (TTSL) and Idea Cellular – are all jostling for more space and market share.

These operators have upped the teledensity of the country, of course nudged along the way by timely and liberal telecom policies and regulations. In 2009, when the world was reeling from the global economic downturn, Indian telecom operators were notching up over 17 million subscribers a month through attractive tariff packages. They have also put India on the global telecom map and it is today the fastest growing telecom market in the world.

Meanwhile, new companies, looking to cash in on the big telecom opportunity, signed up in droves in 2007. Companies with diversified interests – from real estate developers to FMCGs such as Unitech and Videocon – along with international players like Telenor, Etisalat, MTS, Bahrain Telecom and Maxis, all jumped onto the Indian telecom bandwagon in the past three years.

In all this, it has been the users who have emerged as the biggest gainers. The cut-throat competition has ensured that subscribers are spoilt for choice of operators as well as tariff options. Today, there are as many as 12 operators in some circles who offer a range of rates such as Re 0.01 per one, two, six or eight seconds, and SMS charges of Re 0.01 per letter. And the offers just keep coming.

For 2010 too, the prognosis is promising according to industry experts. There is a huge rural market waiting to be tapped, and the potential of 3G and Wi-Max to look forward to (as and when the auctions go through). Competition, of course, can be expected to intensify with operators like RCOM and TTSL rolling out both GSM and CDMA mobile services. Vodafone Essar will aggressively use the ZooZoos to promote its valueadded services offerings while Idea Cellular will "ideate" on new marketing campaigns. Meanwhile, Bharti Airtel, after picking stake in Bangladesh's Warid Telecom, will be sifting through its other global buyout options. And for the combative new players with their eyes trained on an 8 to 10 per cent market share initially, it will be an open game.

In the following pages, tele.net takes stock of the performance, the highs and lows of the key telecom operators in the industry, including the new players...

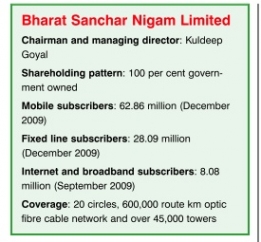

BSNL: Looking to recover lost ground

In 2000, the Department of Telecommunications' (DoT) services arm was hived off to create a corporate entity, BSNL. The only telecom service provider at the time, the company enjoyed monopoly status for fairly long in the fixed line segment. Even today it has the largest market share (73 per cent) in the fixed line business.

In 2000, the Department of Telecommunications' (DoT) services arm was hived off to create a corporate entity, BSNL. The only telecom service provider at the time, the company enjoyed monopoly status for fairly long in the fixed line segment. Even today it has the largest market share (73 per cent) in the fixed line business.

With the advent of cellular services, BSNL decided to join the bandwagon of private players offering mobile services. It launched mobile services in 2002, taking the market by storm and giving the private operators a run for their money. It matched their service offerings and competitive tariffs and soon became a contender for the top slot.

However, in the past three years, BSNL's revenues from its mobile business have declined considerably. Growth has been marginal compared to the unprecedented expansion of the other players. Its peers are way ahead, and even the new entrants are closing in on BSNL.

The growth years

In March 2003, five months after the commercial launch of BSNL's mobile service, CellOne, the company's subscriber base stood at 2.25 million, making it the second largest cellular operator in the country, replacing Vodafone Essar (the erstwhile Hutchison Essar).

In the two years that followed, the state-owned player made concerted efforts to stay ahead in the highly competitive market. The company was aggressive with price cuts. Sensing a decline in demand for its services, BSNL slashed its tariff by 60 per cent, a move which took even its rivals by surprise. It also planned massive capacity expansion. In September 2004, it placed orders worth Rs 40 billion for GSM equipment with Nortel and Nokia for augmenting capacity in the northern, eastern and southern regions of the country. The western region received a similar revamp in early 2004. The following year also saw continued capacity expansion by BSNL.

BSNL was proactive in other service segments as well. It diversified its product portfolio to stay ahead in the race. In September 2004, BSNL started its own international long distance services to various countries including the US, Canada, Singapore and Kuwait. The following year, this was extended to other countries like Hong Kong, Japan and the UK.

Meanwhile, BSNL made headway in the internet service segment and, in fact, leads the segment till date. In February 2005, it launched broadband services under the brand name DataOne in Bangalore, Chennai, Hyderabad, Kolkata, Mumbai, Delhi and Karnataka.

The company had to contend with several issues and often found its hands tied owing to its PSU status. But in spite of the hurdles, it managed to make its mark in the telecom market. In August 2006, its mobile user base crossed the 20 million mark (accounting for 25 per cent market share). It added 1 million mobile subscribers in December 2006. After RCOM, BSNL became the second operator to report a million new additions in a month.

The slide BSNL's slide began shortly thereafter. The company faced a huge capacity crunch with the last major network expansion having been undertaken in 2005. By 2007, subscriber additions had hit an all-time low. Subsequent expansion plans were either stalled or delayed. Its mobile business, operating on a highly overburdened network, ran to the ground.

BSNL's biggest handicap has been its PSU baggage. Its operations have continuously suffered from bureaucratic delays, interference and controversy. For example, its mega equipment order of 47 million lines in 2006 was halved by telecom minister A. Raja a year later as it did not meet the ministry's per-line price expectation. Motorola, upset about being rejected on technical grounds, decided to take the company to court.

Strapped for capacity, BSNL then floated a bigger tender of 93 million lines in 2008. That order too seems to be meeting a similar fate. After much deliberation on national security issues, the tender was to be awarded to the lowest bidders, China's Huawei (for south India) and Ericsson (for the northern, western and eastern regions). However, the 20 million GSM lines contract for the south zone to Huawei stands revoked as of now. This time, Nokia Siemens Networks is upset with the PSU and has resorted to legal action.

In the past few years, the company's landline business, its mainstay from where it still derives 63 per cent of its revenues and has nearly 80 per cent market share, has been taking a hit, with subscribers less and less interested in fixed line phones. In 2009, the company lost as many as 1.18 million wireline subscribers. What does not augur well for the company is that this slide is expected to continue.

Apart from rural telephony, internet, broadband and 3G (where it has the firstmover advantage), BSNL has lost most of its incumbent advantages as well as its dominant position. It is certainly more vulnerable now than it was even three years back.

Today, with 62.86 million mobile subscribers, BSNL trails way behind private telecom majors such as Bharti Airtel (118.86 million subscribers as of December 2009), RCOM (93.79 million) and Vodafone Essar (91.4 million). In 2008, BSNL made way for Bharti Airtel to overtake it as the country's largest integrated telecom company.

Positives

In BSNL's favour, however, is its ubiquitous reach. It has the largest fixed line network in the country as well as an extensive mobile network. It is also the only player with such widespread rural coverage and last mile connectivity. BSNL's big advantage in contrast to the private players is that its copper and optic fibre networks can be used to provide rich and high speed data services that are best provided through wireline technology.

BSNL is also one of India's top five service providers, with cash reserves in excess of Rs 380 billion and telecom infrastructure and real estate valued at Rs 4 trillion.

The company is trying to get its act together and is leveraging its assets. It offers one of the cheapest and fastest

growing broadband services in the country. Of a total broadband customer base of 6.62 million, BSNL accounts for about 4 million connections. Going forward, it has set an ambitious target of achieving 50 per cent of the national target of 20 million broadband connections by 2010.Hedging its risks, BSNL is opting for a franchise route to manage its 3G network on a revenue-sharing basis. It has already launched IPTV services and is in the process of expanding its Wi-Max services across the country. Significantly, for the first time in its history, BSNL has decided to expand overseas. It has a cash surplus of over $10 billion, which it plans to use for its overseas foray.

Bit by bit, the company's plans seem to be falling into place. Its aim very clearly is to reclaim its leadership position and restore some of its lost lustre.

Bharti Airtel: Undisputed leader With over 116 million mobile users, Bharti Airtel is the undisputed leader in the private mobile telephony space. Its swift growth as a successful corporate entity is in many ways symbolic of the trailblazing pace of the Indian telecom sector.

With over 116 million mobile users, Bharti Airtel is the undisputed leader in the private mobile telephony space. Its swift growth as a successful corporate entity is in many ways symbolic of the trailblazing pace of the Indian telecom sector.

From a modest start selling push-button phones, the group today, towers over not just its Indian rivals but also its international peers.

Journey over the past decade

Post-1991, economic reforms started changing the business landscape in the country, and telecom was among the first few sectors to make the transition. As the government decided to open the sector to private players, Bharti wasted no time in applying for a licence. It received the licence for the Delhi circle and launched mobile services in the capital in 1995, despite being short of funds for this capital-intensive business.

Soon after, the company began bidding for other circles as well. It added Himachal Pradesh in 1996 and Karnataka and Andhra Pradesh in 1999 (through the acquisition of 63 per cent stake in SC Cellular Holdings, which, in turn, controlled nearly two-thirds of JT Mobiles). By early 2000, the company had succeeded in attracting more than 100,000 subscribers, a significant number given the slow pace of the mobile phone industry in the country at the time. In 1997, the company won a licence for providing fixed line services in Madhya Pradesh.

To that extent, Bharti made some smart moves in the early years, quite undaunted by the deep pockets of its peers. The strategies and objectives were well laid – to be an integrated telecom player with a presence in both the mobile and fixed line sectors. The company signed up with British Telecom, which acquired a 21 per cent stake in Bharti Cellular, to launch new services, including internet services, in 1998. In that year, Bharti also became the first private telecom company in India to launch fixed line services.

Into the 2000s, Bharti increasingly moved towards its goal of national coverage. It bought 40.5 per cent of Skycell Communications, which operated in the Chennai circle. Skycell was renamed Bharti Mobinet. That year, the company also acquired full control of Bharti Mobile. Subsequently, it acquired Spice Cell, which provided mobile services in the Kolkata circle.

By early 2001, Bharti had a footprint across six circles. However, to fund its ambitious plan of covering all the circles in the country, it needed more capital. Interestingly, this was the time when its early investment partners decided to make an exit. But the company managed to find a new partner in Singapore Telecommunications and private equity investors like Warburg Pincus to fund its expansion.

There was then no stopping Bharti. The company's subscriber growth rate continued to outpace the industry, topping 3 million by mid-2003. In less than a decade, Bharti Airtel had claimed the leading position in the sector. Through both organic and inorganic routes, the company achieved an all-Indian presence in 2005, notching up more than 12 million subscribers.

In the process of scaling up for the national stage, the company's business model underwent several rounds of restructuring. It merged all its cellular brands under a single unified brand, Airtel, in 2003. In early-2004, it decided to outsource its network management and IT applications, signing first-oftheir-kind network management deals with equipment manufacturers Ericsson, Nokia and Siemens, and an IT outsourcing deal with IBM. Despite the fact that all these companies were global leaders in their respective businesses, the deals generated a fair amount of scepticism among experts who felt that outsourcing network and IT application management was like giving the heart of the business to an outsider. The deals, however, proved to be path-breaking. They helped Bharti to not only lower costs but, more importantly, have helped the company create a more predictable cost structure. This model has, in fact, gone on to set new standards for the industry globally.

Where it stands now

Over the years, Bharti Airtel has consolidated its number one position in the country. While the mobile sector remains its key growth vehicle, it has also been offering a range of other services such as internet, broadband, long distance, IPTV, mobile TV, satellite and various valueadded services to both end-users and enterprise customers.

It has also expanded its presence beyond India to the Seychelles, the Channel Islands and Sri Lanka, and is now in the process of taking the brand to Bangladesh (it recently acquired a 70 per cent stake in Warid Telecom) and countries in Africa and the Middle East.

However, the company has not been able to get a big break in the global market. It has twice failed in its attempt to merge operations with South Africa's MTN, a deal which would have given it exposure to a high-growth market, apart from eventually enabling substantial cost savings, technology sharing and financial muscle for more expansion.

In all, Bharti Airtel accounts for nearly a fourth of the country's mobile telephony market and nearly a third of the total telecom revenues generated in India. With a pan-Indian presence and a varied basket of services, the company is likely to remain a frontrunner in the race for a long while yet.

Idea Cellular: Pure-play cellular operator

Idea Cellular has come a long way since its inception as a threeway partnership between the Birlas, Tatas and AT&T. While the latter two cashed out of the company over time, Idea emerged as a strong pure-play mobile operator following serious attempts at consolidation. Today, the company occupies the fifth position in the mobile space.

Idea Cellular has come a long way since its inception as a threeway partnership between the Birlas, Tatas and AT&T. While the latter two cashed out of the company over time, Idea emerged as a strong pure-play mobile operator following serious attempts at consolidation. Today, the company occupies the fifth position in the mobile space.

Long corporate battle

In 1995, the firm, promoted by the AV Birla Group, obtained licences for providing GSM-based telecom services in the Gujarat and Maharashtra circles.

The next year, the Birla Group, through its group firm Grasim, formed a joint venture (JV) with US-based AT&T Corporation, called Birla AT&T Communications. Actual operations started in the two circles only in 1997.

With the New Telecom Policy, 1999 (NTP, 1999) in place, the telecom market started picking up pace by 2000. Around the same time, Tata Cellular joined hands with Birla AT&T Communications (each with 33 per cent stake in the company). The same year, the company acquired a licence for the Andhra Pradesh circle.

The inorganic growth story continued the following year with the firm acquiring RPG Cellular, which brought the Madhya Pradesh (including Chhattisgarh) circle on board. Around this time, the company's name was also changed to Birla Tata AT&T. It soon obtained the licence to provide GSM-based services in the lucrative Delhi circle.

Idea Cellular, as the company is known today, was born in 2002, offering services under the Idea brand. That year, the company crossed the 1 million subscriber milestone.

After a relatively slow start, the firm got a fillip and a national presence with its acquisition of Escotel in 2004, which gave it a presence across Maharashtra (excluding Mumbai), Goa, Gujarat, Andhra Pradesh, Madhya Pradesh, Chhattisgarh, Uttar Pradesh (East and West), Haryana, Kerala, Rajasthan and Delhi NCR. It also completed a major debt restructuring exercise and got additional funding for expansion in the Delhi circle.

Meanwhile, in 2005, AT&T decided to exit from the JV. The Tatas and Birlas exercised their right of first refusal and divided up AT&T's stake, 16.45 per cent each.

But soon differences between the two partners started cropping up as the Tatas also had a majority stake in Tata Teleservices Limited (TTSL), an integrated telecom company offering CDMA-based mobile services. Matters reached a flashpoint when the DoT refused to give Idea a licence to offer services in the lucrative Mumbai circle because TTSL already had a presence there. The refusal came as a big blow to Idea and the Kumar Mangalam Birla (chairman of the Birla Group) camp. They decided to take the matter to the Ministry of Communications and asked the Tatas to exit from Idea Cellular as there was a conflict of interest.

The Tata Group sold its 48 per cent stake in the company for Rs 44.06 billion, leaving Idea Cellular solely with the AV Birla Group.

Growth takes off

In 2006, the company received a substantial fund infusion by private equity players.

Three private equity players – ChrysCapital, UK-based TA Associates and Citigroup – picked up a combined 10 per cent stake in Idea for about $300 million, and Providence Equity Partners bought another 15 per cent for an undisclosed amount. The same year, Idea acquired Escorts Telecommunications, gaining over 10 million subscribers in one go. It also received the licence to operate in the Mumbai and Bihar circles.

There was greater cohesiveness at the top and strategies were carefully planned out to streamline operations as well as finances with an eye to the future. The company was the first to foray into GPRS and EDGE in the country. These efforts, together with the introduction of a number of mobile value-added services like music messaging, voice portals and e-mail facilities, strengthened the company's competitive ability.

With clarity over its promoter ownership and a pan-Indian licence, Idea went public in 2007. The initial public offering (IPO) received an overwhelming response and Idea was able to raise about Rs 28.18 billion.

Fifth in the pecking order behind Airtel, Reliance, Vodafone Essar and BSNL, Idea has been steadily improving its telecom market share. From 8.5 per cent in 2007, its share has risen to over 11 per cent in 2009. Aside from brief periods of sluggishness, Idea's subscriber additions have been as good as its rivals, over the past three years. In at least eight of the 22 telecom circles where it is well established, Idea has maintained a lead or second lead position.

Going forward, its key focus areas will be the rural areas, including Category B and C towns. It is coming out with innovative schemes such as free two-minute outgoing calls, reduced prepaid tariffs, lifetime recharge and full talktime for this segment of users. Given that rural penetration is way behind the national level, there is huge scope for growth in future. For Idea, a committed promoter with deep pockets is also a definite advantage, and will help the company scale up in the wireless market.

Idea Cellular

Managing director: Sanjeev Aga

Shareholding pattern: 49.05 per cent owned by the AV Birla Group, 15.82 per cent by institutional investors and 35.13 by non-institutional investors

Market capitalisation: Rs 184 billion (January 2010)

Mobile subscribers: 57.61 million (December 2009)

Coverage: 22 circles

Historically, access to telecom services had been the privilege of a select few in India.Challenging conventional cost structures, RCOM (earlier Reliance Infocomm) broke the prevailing tariff barrier with packages that can best be described as the most ambitious ever to be offered by any telecom company in India. Its path-breaking Monsoon Hungama plan, launched in July 2003, was an unparalleled scheme that put a mobile phone and a prepaid connection in the hands of users for a mere Rs 501 upfront.

Historically, access to telecom services had been the privilege of a select few in India.Challenging conventional cost structures, RCOM (earlier Reliance Infocomm) broke the prevailing tariff barrier with packages that can best be described as the most ambitious ever to be offered by any telecom company in India. Its path-breaking Monsoon Hungama plan, launched in July 2003, was an unparalleled scheme that put a mobile phone and a prepaid connection in the hands of users for a mere Rs 501 upfront.

This proved to be the company's biggest promotional success. One million subscribers joined RCOM in just 10 days of the launch. Other operators had to follow suit and bring down prepaid mobile tariffs to less than Rs 500 a month. The price of handsets came down to as low as Rs 1,500.

Since then, RCOM has continued on its growth trajectory and is today the second largest mobile operator in the country.

CDMA launch

RCOM launched its mobile services on the CDMA platform – the first operator to do so in the country – in December 2002. Under its introductory Dhirubhai Ambani Pioneer scheme, consumers were given a free digital mobile phone, unlimited free incoming calls, and billing at a pulse rate of 15 seconds – all for a one-time fee of Rs 3,000 and Rs 600 per month (to be paid in advance) as telephony charges. This, combined with the Monsoon Hungama offer, caught the fancy of subscribers who signed up in droves, significantly pushing up the country's teledensity.

However, offering mobile services on the CDMA platform attracted the ire of GSM service providers as RCOM was providing these services under a basic service operator licence. Legal battles ensued. In November 2003, the company obtained a unified access service licence (UASL) by paying the requisite fee of Rs 15.42 billion as notified by the DoT. By end-2003, the company provided CDMA-based services in 17 circles on a network capable of supporting broadband services as well.

The Ambani feud

In 2005, the company went through some upheaval as the Ambani brothers, Mukesh and Anil, promoters of Reliance Industries (a major stakeholder in RCOM) were engaged in a battle over ownership issues. The dispute was resolved and Anil Ambani got the reins of the lucrative telecom business.

The company was reorganised and Reliance Infocomm merged into the parent firm, Reliance Communication Venture Limited (RCVL). RCVL was renamed RCOM in 2006. That year, in fact, also saw a fair amount of consolidation within the group firm. A new top management team was put in place and all the nine subsidiaries that came under the Anil Dhirubhai Ambani Group banner were absorbed into one holding company, RCOM, before its listing on the Indian stock markets in March 2006.

Change in the making

Internal changes notwithstanding, the company continued to focus on garnering subscribers. It was the first company to introduce the One Nation, One Tariff plan in 2006, under which calls made from a Reliance IndiaMobile prepaid connection to any mobile or fixed line phone anywhere in India would be charged at Re 1 per minute.

The company also turned its attention to the rural segment. By 2006, Reliance already had an established telecom network in over 40,000 villages under the Universal Service Obligation (USO) Fund, and added close to 750,000 new subscribers in these areas. As part of its strategy, the company next roped in vegetable and grain vendors, cable operators, irrigation pump and tractor dealers, and cooking gas distributors to demonstrate and sell CDMA handsets in villages. Following the success of this strategy, the company bundled handsets with products such as tractors and motorcycles.

RCOM spent the better part of 2007 in applying and getting approvals from DoT to offer mobile services based on GSM technology. It launched one of the cheapest mobile phones in the world, the SIM-based Classic 202, priced at Rs 777. The entry price of the phone was significantly lower than the existing entry-level prices of blackand-white, and colour handsets.

RCOM's infrastructure business also witnessed substantial activity. In July 2007, the company divested 5 per cent stake in its wholly owned tower subsidiary Reliance Telecom Infrastructure Limited for $337.5 million, valuing the entity at $6.75 billion. Since 2008, the company has been looking to sell another 5 per cent stake and has invited bids for the same.

There was also increased focus on the internet and broadband business. In November 2007, RCOM entered into a $500 million, eight-year technology alliance with Microsoft for launching IPTV services by mid-2008.

RCOM launched GSM services across the country in end-2008. It earmarked an investment of Rs 100 billion, and the nationwide network rollout, the largest undertaken in such a short span of time (since RCOM got the spectrum only in January 2008), was completed six months ahead of schedule. Currently, RCOM provides GSM services in all telecom circles.

In March 2009, the company launched its broadband internet service under the name Reliance Netconnect Broadband Plus. Subscribers could now avail of wireless broadband in 35 key cities for a monthly rental starting at only Rs 299.

Eyeing new revenue streams, RCOM made its direct-to-home (DTH) foray in August 2008 under the Big TV banner. Within two months, it notched up 500,000 subscribers, accounting for 40 per cent of the gross additions. Today, with more than a million-and-half DTH subscribers, BIG TV is emerging as one of the fastest growing operators in the country.

Reliance CommunicationsChairman: Anil Ambani

Shareholding pattern: 67.22 per cent owned by the Anil Dhirubhai Ambani Group, 19.18 per cent by institutional investors, 12.89 per cent by non-institutional investors and 0.71 per cent comprises depository receipts.

Market capitalisation: Rs 395 billion (January 2010) Mobile subscribers: 93.79 million (December 2009) Fixed line subscribers: 1.16 million (December 2009) Internet subscribers: 1.09 million (September 2009) Coverage: 22 circles (GSM and CDMA) with over 190,000 route km optic fibre cable network and about 50,000 towers through Reliance Infratel

Global footprint

RCOM started tapping overseas opportunities quite early on. It acquired Flag Telecom in 2004 for $211 million.

In 2007, the company won its first major overseas licence to operate mobile services in countries such as Qatar, Kenya and Saudi Arabia. The company also bagged public infrastructure provider and public service provider licences in Uganda, where it invested Rs 8 billion to roll out fixed and mobile telecom networks. In the same year, RCOM also acquired Yipes Communications.

In April 2008, the company clubbed its global businesses into a new subsidiary, Reliance Globalcom. The latter is the holding company for RCOM's global operations, the submarine cable subsidiary Flag Telecom, and Yipes. Similarly, Reliance Globalcom acquired the global managed network services provider, the Vanco Group, which has a strong presence in developed markets like the UK, the US, France and Germany. With annual revenues of $365 million, Vanco caters to large enterprises including AVIS, British Airways, Siemens and Virgin Megastores. Flag's reach and capacity along with Vanco's long-term relationships with enterprises have put RCOM in the league to offer high-margin VAS to enterprise customers.

In all, apart from its thrust on 3G and the rural sector, RCOM is banking on prepaid and fixed line customers in Tier II and III cities. Mobile TV and IPTV are also going to remain thrust areas for RCOM in 2010.

Tata Teleservices: Aggressive of late

A relatively late starter in the telecom sector, Tata Teleservices Limited (TTSL) has gradually made up for some of the missed advantages in the early years to become India's sixth largest mobile operator today.

Early years

TTSL began full-fledged operations only after the UASL regime came into existence in 2003. Its fixed line operations, though older (since 1996), were limited to a few circles only.

The company was among the first to launch basic telecom services in Andhra Pradesh in 1995 using CDMA technology, and began limited mobile services in 2000. TTSL also launched the first pay telephone booth operating on the smart card technology.

It acquired the fixed line licence of Hughes Telecom (India) Limited (renamed Tata Teleservices [Maharashtra] Limited in December 2002).

However, at a time when rivals were aggressively wooing customers, as a moderate risk-taker, TTSL preferred to wait. This cost the company in terms of revenues as well as subscribers. Today, despite offering mobile, wireline, fixed wireless and public booth telephony services along with long distance and broadband services, TTSL is way behind peers like Bharti Airtel, Vodafone Essar and RCOM.

Fast-track growth

Realising that the Indian mobile telephony market was too big an opportunity for the country's oldest business house to pass up, Ratan Tata, chairman of the Tata Group, took over the reins of TTSL in 2005.

In 2007, Anil Sardana, executive director of Tata Power, was roped in to fasttrack the company's growth. What followed was a period of meticulous assessment and redefining of processes. The top deck was reshuffled to realign the company for future growth. Previously unsure about dual-technology plans, TTSL finally decided to apply for all-India GSM spectrum the same year.

The company focused and brought to the market several innovative value-added services (VAS) and schemes like "Lifetime Validity", "Non-stop Mobile" and "Don't Stop". It invested in brand promotion and tied up with handset makers like ZTE and Huawei to offer handsets priced as low as Rs 1,500. TTSL also became one of the first service providers to introduce its own range of branded handsets.

The other area that the company paid attention to was enterprise. Leveraging the strengths of other Tata group companies, TTSL focused on offering customised end-to-end telecom solutions to corporates. It was the first company to introduce CENTREX technology for the corporate segment.

In 2007, TTSL entered into a revenue-sharing agreement with Virgin Mobile, allowing Virgin to ride on its network to provide mobile services in India. In 2008, TTSL and the Virgin Group launched Virgin Mobile services as part of the brand franchise agreement.

The biggest game-changer for TTSL was its alliance with NTT DOCOMO. The Japanese telecom major picked up 26 per cent stake in the unlisted TTSL in 2008 for $2.7 billion. NTT DOCOMO, which has over 50 per cent share in its home market, brought to the table, apart from funds, its extensive experience in 3G and VAS.

The tie-up gave a big fillip to TTSL's operations as the cooperation extended across various segments – marketing, handset development, technical support and creation of new opportunities for both companies.

In 2009, TTSL rolled out GSmbased mobile services in eight new circles under the umbrella brand TATA DOCoMO. A novel "pay-for-what-you-use" model was introduced, with a pulse of one second and pricing of Re 0.10 per second. The plan became a trend-setter and yielded good results for the company. It dramatically changed the pecking order of subscriber additions among mobile operators. Between November and December 2009, TTSL added about 3 million users, surpassing even Bharti Airtel, Vodafone Essar and RCOM in subscriber additions.

Tata Teleservices

Managing director: Anil Sardana

Shareholding pattern: 60 per cent held by the Tata Group, 26 per cent by Japan's NTT DOCOMO, about 7 per cent by Temasek Holdings and 6 per cent by Chennai-based industrialist C. Sivasankaran.

Mobile subscribers: 57.33 million (December 2009) Fixed line subscribers: 1.10 million (December 2009) Internet subscribers: 0.065 million (September 2009)

Coverage: 22 circles (CDMA), 21 circles (GSM)

Future priorities

The key focus of the company for the next few years will naturally be on GSM. Tata Teleservices intends to roll out GSM services across the country within the next six months.

Broadband will be another area of focus. Diversifying its product portfolio from only voice, TTSL has recently launched a bundled offering of its Photon+ broadband service with Olive Telecommunications' 3G-equipped netbook. TTSL also plans to expand coverage of its mobile broadband internet service, sold under the Photon+ brand. The service provides high-speed internet with speeds of up to 3.1 Mbps.

Considering its latest innovations, competitive offers and subsequent increase in market share, the future holds promise for TTSL. The mobile virtual network operator relationship with Virgin has been a pioneering step, as has been its strategic alliance with DOCOMO.

Vodafone Essar: Strong on strategy

A pure-play GSM operator with no apparent indication for a long time of wanting to become an integrated service provider like its peers and till recently not even a pan-Indian operator, Vodafone Essar has always belonged to the top league.

A pure-play GSM operator with no apparent indication for a long time of wanting to become an integrated service provider like its peers and till recently not even a pan-Indian operator, Vodafone Essar has always belonged to the top league.

For the third largest operator in the country and the second largest private operator in terms of revenue, growth has come with significant strategising and, as company officials claim, through multiple transitions, name and promoter changes, and significant management shuffles.

However, being backed by strong and experienced global players (Hutchison and Vodafone), the company has had a smooth run in the Indian telecom market.

The road so far

An early entrant in the telecom space, Hutchison's presence in India goes back to the 1990s. Hutchison Telecom came into existence in 1994, when the Hong Kong-based Hutchison Whampoa Group tied up with Max Telecom to establish a company to provide GSM services in Mumbai. Commercial operations began in 1995 under the brand name Max Touch, which was changed to Orange in December 2000.

The company's strategy was to acquire a countrywide presence through various tie-ups. In 1997, it partnered with Kotak Mahindra and the Hindujas to roll out services in Gujarat under the brand name Fascel. The same year, it bought a 20 per cent stake in Usha Martin to provide cellular services in Kolkata. And in 1999, it picked up a stake in Sterling Cellular, owned by the Essar Group, to offer services in Delhi. The company added Punjab to its list in 2003, after the implementation of the unified access licence regime.

In early 2004, Hutchison Essar kicked off services in Haryana, Uttar Pradesh and Rajasthan. This followed the integration of Essar-owned Aircel Digilink's circles into the Hutch fold.

Its number of licences grew from 13 circles to 22 in 2006. The licence for the last circle, Madhya Pradesh, was obtained in early 2007.

Vodafone's entry

Before 2007, the company operated as Hutchison Essar Limited, offering services under the brand name Hutch. On February 11, 2007, Vodafone bought 67 per cent stake of Hutchison Telecommunications International Limited from Li Ka Shing Holdings (the chief promoter of the Hutchison Group) for $11.1 billion. Slated as the biggest deal at the time, it brought the world's largest telecom operator (in revenue terms) to India.

After the acquisition, the company effected a massive brand overhaul at an estimated $62.5 million. As part of the makeover, the country was "painted" red (Vodafone's trademark colour) and accompanied by a media blitz, which successfully established the brand Vodafone.

The makeover paid off. For the Vodafone Group, faced with saturated markets in the developed countries, the Indian operation gave it a much-needed leg up, making Vodafone Essar the star performer of the group.

In early 2007, Vodafone Essar left behind state-owned BSNL and inched closer to RCOM in subscriber terms.

All along, the company's focus had been on actual revenues and establishing a strong brand presence. Later, that changed somewhat. It rolled out services in six new circles during the OctoberDecember 2008 quarter, which along with better schemes and a bigger push into rural India, helped the company pull in new subscribers. The new focus helped it beat arch-rival and industry leader Bharti Airtel in terms of subscriber additions in March 2009.

Around the same time, it hived off its tower assets to a subsidiary, Ortus Infratel, much like its rivals Bharti Airtel and RCOM.

Plan to diversify

Two and a half years after taking over Hutchison's operations in India, Vodafone is finally moving away from being a pureplay mobile operator. Vodafone Essar is now replicating the company's European business model in the country. Its operations in India will now be divided into mobile and enterprise services.

Offering enterprise services implies Vodafone Essar rolling out fixed line and internet services, software solutions and packages, and online security services, and also selling national and international bandwidth for corporate customers in India. The company is also considering listing itself on the Indian stock markets.

Its target is now to reduce its gap with Bharti Airtel in terms of overall mobile revenue share. At present, Vodafone Essar has a revenue share of 22 per cent while Bharti has 34 per cent.

With the new plan in place, analysts believe the company is well placed to consolidate its position as an established and prominent player in the Indian telecom space.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...