BSNL - Battles capacity crunch and procedural delays

-

The ground is shaky for the country's second largest integrated telecom service provider, Bharat Sanchar Nigam Limited (BSNL). The telecom giant, once a monopoly operator, has been losing market share at an alarming rate in the past three years. Surprisingly, for a business that hinges on subscribers, in a country that is adding about 15 million subscribers a month, BSNL's mobile subscriber base has not been growing. At least, not very much.

In June 2006, four years into providing mobile services, BSNL was racing ahead of its peers to claim the top slot. By early 2006, it had 20 million customers and 25 per cent market share. But then the slide began. The company was faced with a huge capacity crunch with the last major network expansion having been undertaken in 2005. By late 2006, subscriber additions had hit an all-time low. Subsequent expansion plans were either stalled or delayed. Its mobile business, operating on a highly overburdened network, ran to the ground.

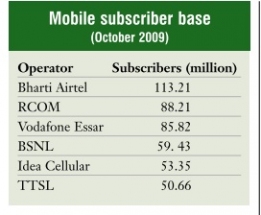

Today, BSNL is fourth in the mobile telecom pecking order with 59.43 million subscribers (as of October 2009), well behind Bharti Airtel with 113.51 million users, Reliance Communications (RCOM) with 88.21 million and Vodafone Essar with 85.82 million. Even Idea and Tata Teleservices Limited (TTSL), with 53.36 million and 50.66 million users respectively, are closing in speedily. BSNL's market share (fixed and mobile combined) is down to 16.69 per cent as of October 2009 from 21.5 per cent in March 2007. In 2008, BSNL also made way for rival Bharti Airtel to take its place as the country's largest integrated telecom company.

BSNL's mainstay, its landline business from which it still derives 63 per cent of its revenue and in which segment it has nearly 80 per cent market share, has also been sliding over the years with subscribers caring less and less for fixed line phones. In 2009, the company lost as many as 1.18 million wireline subscribers. And this slide is expected to continue.

In another blow to the company, its revenues have been hit by the phasing out of the access deficit charge (ADC) – a levy paid by private telecom operators to BSNL to fund its below-cost rural and remote operations. As of now, the Supreme Court has admitted BSNL's appeal challenging the Telecom Regulatory Authority of India's decision to remove ADC.

Apart from rural telephony, internet, broadband and 3G (in which it has the firstmover advantage), BSNL has lost most of its incumbent advantages and dominant position. It is certainly more vulnerable now than it was even three years ago.

A large part of BSNL's problems stem from its PSU ancestry. Like most other public sector organisations in the country, it suffers from excessive governmental interference, red tapism, huge labour force, lack of new talent, long tendering processes, etc.

But then, it has several inherent strengths too. BSNL is one of the country's top five service providers. It has the largest fixed line network in the country and an extensive mobile network. It has 600,000 route km of optic fibre across the country. It is also the only player with such widespread rural coverage and last mile connectivity. "It is larger and broader than most of its competitors and its networks are technically as high on quality as any other," says Mahesh Uppal, director, ComFirst.

The company has cash reserves in excess of Rs 380 billion and its telecom infrastructure and real estate are valued at Rs 4 trillion. "It is sad that an incumbent with this muscle, extensive reach and massive resources is looking at a rather gloomy future compared to its relatively new competitors," observes Sridhar Pai, CEO, Tonse Telecom.

Uppal thinks otherwise. He believes there are signs of change. "There is some level of reorganising taking place at BSNL," he says. The company is also leveraging its extensive network to push IPTV and broadband services (a segment in which it leads). It offers one of the fastest growing and cheapest broadband services in the country. Of the total broadband subscriber base of 6.62 million, BSNL accounts for about 4 million. Going forward, it has set a target of achieving 50 per cent of the national target of 20 million broadband connections by 2010.

The company is also focusing on 3G and Wi-Max (using the franchisee model to cut financial risks) as the vehicle for future growth. It has also opened up to the prospect of tower sharing as a revenuegenerating stream.

Taking the current kamikaze competition levels into account, especially with new players entering the telecom space, BSNL is furiously innovating on valueadded services and tariff packages. It recently joined the ongoing tariff war to announce a one-second billing plan and cut roaming charges significantly. The company will let its users choose roaming charges of either Re 0.49 per minute or Re 0.01 per second. According to the company, this move will open a new front in the ongoing price war that has impacted the profitability of telecom operators.

Key impediments

Saxena, former finance director, BSNL."Tenders have to come out. The eligibility criterion is the key here. It should be an open affair where you call vendors and discuss. The focus should be on project execution without any interference.One of the key impediments in BSNL's growth is the long delays in equipment procurement. "Procurement can be a make-or-break process," points out S.D. Vested interests often prevent BSNL from getting the best. We pay more and don't even get access to the latest technology. Bring in any scrutiny or audit, but allow us to function like private players when it comes to procurement."

Unlike the nimble-footed private players, BSNL's operations are burdened by bureaucratic delays, governmental interference and frequent controversy. Every issue needs to pass through multiple levels before it is cleared. This is time-consuming and certainly not the best way to deal with competition.

After the fiasco of the 2006 mega equipment order of 47 million lines placed by BSNL, which was later halved by telecom minister A. Raja as it did not match the ministry's per-line price expectation, in 2008, BSNL floated a new, bigger tender for 93 million lines – the single largest mobile line contract in the world perhaps. Again, controversies cropped up. After much deliberation on national security issues, the tender was to be awarded to the lowest bidders, China's Huawei (for south India) and Ericsson (for the north, west and east).

Nokia Siemens Networks (NSN), ZTE, Alcatel Lucent and Nortel were disqualified on "technical grounds". NSN dragged BSNL to court, asking for more transparency in its tendering process. The verdict is still pending.

Meanwhile, despite all the brouhaha, BSNL went ahead and awarded a 20 million GSM line contract for the south zone to Huawei in November 2009. Then, in a surprise move, this month it revoked the equipment purchase order as the conditions imposed by the vendor were not acceptable to it. "There was no scope for accepting conditions. The order was placed after detailed negotiations and as a governmentowned firm, we do not accept conditions," stated a senior BSNL official.

Today, though the PSU is at an advanced stage of negotiations with Ericsson for GSM lines for the north (25 million) and east (18 million) zones, nothing has been finalised yet. At the moment, BSNL is weighing various options, including calling fresh bids. Meanwhile, the network capacity problem continues for the company.

Competition and tariffs

As BSNL exhausts whatever remaining capacity it has in various circles, it will lose further market share to private operators. This is bad news coming at a time when competition is at its most intense and the tariff war at its brutal worst. In a bid to outdo each other for a few subscribers more, companies are coming up with irresistible new tariff packages, including variations of the game-changing one-second pulse billing option.

Where does that leave BSNL? It has no choice but to join the tariff game, which will impact its bottom line. The aggressive tariff war that has forced all operators to slash call rates has also resulted in companies' sales figures dipping over the past six months despite the addition of 80 million subscribers during this period. According to analysts, while revenues and profits have plunged across the sector in the quarter ended September 2009, it is the stateowned telecom companies BSNL and MTNL that have taken the maximum hit.

Financials

After posting an all-time high of Rs 101.83 billion in 2004-05, BSNL's profits have been declining since 2005-06. In its worst performance since its inception in October 2000, BSNL registered an 80 per cent decline in net profit in 2008-09 at Rs 5.74 billion from Rs 30.09 billion in the previous year. This is on the back of a total revenue of Rs 358 billion, a meagre rise over the Rs 327 billion registered in the previous year. Of course, a large part of the dip in profits this year is attributed by the company to the increase in employee costs due to the implementation of the Pay Commission recommendations and a decline in fixed line revenues.

Expert speak

For a company that is sitting on hefty cash reserves, efforts can be made to arrest the slide. In terms of revenue, BSNL and Bharti Airtel are fairly close. The key difference is that Bharti has merely 25,000 employees while BSNL has over 300,000, nearly 12 times more.

Then there are trade union issues. "The union wants higher salaries but doesn't want to work and cannot make customers stay with BSNL," says Saxena.

The huge workforce, many on deputation from DoT, is slow and not very market focused. At the same time, if the company wants to streamline its operations, it would have to balance a huge financial outgo on voluntary retirement schemes, etc.

On the brighter side, however, there is change in the making. It is slow and faces typical BSNL hurdles, but initiatives are being taken to train about 10,000 employees across various functions, from networking to support sales and marketing. For instance, executive officers are encouraged to meet middleand high-income users and enterprises to create a positive image of the company.

Kuldeep Goyal, CMD, BSNL, has immense confidence in the company's fundamental strengths. "It will take years for any of the private operators to catch up with our strength of network and operations," he says. Besides, he points out, telecom is a liberalised sector with stiff competition, and BSNL is adapting much better than expected to the new realities.

Goyal, over the past year, has been quietly initiating some reforms. He has, for instance, initiated "Project Shikhar" with the objective of ensuring that BSNL regains its number one slot by 2013.

Further, the company has hired the Boston Consulting Group (BCG), which has recommended some broad changes that can be implemented over the next two years. One suggestion is that rather than split the organisation based on divisions like finance and marketing, the split should be according to verticals like fixed, mobile, enterprise and new businesses. Other recommendations include shifting the focus from being a network technologies company to a sales-oriented one, building a strong brand, and using IT to streamline business processes.

According to Pai, "The company has brought in higher levels of transparency in information sharing, documentation and logistics. It has attempted to improve brand perception and instil a sense of customer service through large-scale training, orientation, etc."

One of BSNL's strengths is its brand positioning, "especially in Tier II and III areas where there is a huge amount of trust in the company", says Kunal Bajaj, managing director, BDA India. "Since it was the first to go into these areas, people connect with its services."

According to some analysts, what the company needs is a good strategic partner. It also needs to carry through the muchtalked-of IPO. "This will help to a certain extent," says Bajaj. But with no consensus with the employee union on the proposed IPO, "it will require political will to see it through. Besides, unless you have an IPO that reduces the government's stake by more than half, it has only a limited impact on the government's decision-making power," notes Uppal.

Finally, analysts believe that though structurally and internally BSNL is becoming more competitive, it could do with less interference. "BSNL was carved out into a company because everyone believed it was not working as efficiently under the government. Now, if you have made a company, created shares and made it accountable to company laws, why don't you leave BSNL to function under them?" asks Saxena. Observes Uppal, "It is not as though BSNL doesn't have a crisis. But it is surprising how a good management can fix many of these things."

According to Pai, "What BSNL needs is a market-facing, street-smart management to kill its old hum-haw ways and learn a few new tricks of the trade. And DoT should be asked to keep off and not interfere."

Thrust areas

BSNL has lined up an investment of Rs 150 billion for 2009-10, which it plans to use on expansion of both 2G and 3G networks, broadband, wireless broadband, IPTV, WiMax, mobile commerce (m-commerce), value-added landline, and other services.

Wireless broadband, including WiMax, has emerged as a key focus area for BSNL. It has already launched the service in Gujarat, Andhra Pradesh, Goa, Himachal Pradesh and Maharashtra. However, unlike private operators who have started the service in the urban areas, BSNL is concentrating on the rural areas which are difficult to reach through a wired network. For instance, in Karnataka, where the service is expected to be launched soon, six BTSs are coming up in Bangalore's rural areas – Magadi Road, Ramnagar, Devanahalli, Dodballapur, Whitefield and Hoskote – and 10 more will be installed in the other districts. The service will be launched in Punjab in January 2010.

Currently, BSNL is the largest player in the rural wireless internet space with over 50 per cent market share.

In an attempt to leverage its large tower base of about 50,000 towers across the country, BSNL, in 2008, allowed passive infrastructure sharing and has signed several private operators to use its towers on a revenue-sharing basis. In October 2009, it signed a 15-year tower-sharing agreement with TTSL and a 10-year tower-sharing agreement with Aircel. The financial terms of the deals have not been disclosed. More recently, it has signed another such agreement with Datacom, allowing it to access its towers across the country.

Adopting the franchisee route for its new projects to expedite service rollout and reduce costs, BSNL has invited bids from private players for at least five of its projects, including for offering Wi-Max and IPTV services, and for setting up internet data services. The company is planning to allow a private player in each circle to utilise its spectrum and back-haul infrastructure to offer high speed broadband services on a revenue-sharing basis for its Wi-Max project. It has awarded a Rs 2.5 billion contract to Sterlite Technologies to roll out the gigabit capable passive optical network.

BSNL has also signed an MoU with Japan-based NTT Communications to offer customised end-to-end telecom and IT solutions to enterprise customers. It has invited bids for a franchisee partner for its 3G services as well.

Besides, BSNL has tied up with the consulting arm of Ericsson. According to the agreement, Ericsson's consulting arm will provide network improvement and optimisation services for the core, radio and transmission networks installed by its parent company, Ericsson. Also, it has tied up with vendors like Nokia and Samsung to provide high-end handsets for its 3G services.

With a view to establishing itself as a global telecom player and to achieve inorganic growth, BSNL is aiming to expand its area of operations. The PSU will soon appoint a panel of consultants to guide it on its overseas business plans, including mergers and acquisitions and bidding for licences. The company has been shortlisted in the first round of bidding for Africabased Zambia Telecommunications (Zamtel). It is also contemplating buying stake in other foreign players, such as Africa's Zain and Ethiopian Telecommunications, as well as a mobile licence in Tunisia.

In all, the company is taking steps to plug the gaps in its functioning. But given the sharp competition levels in the industry, it will clearly be an uphill task.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...