Even as private telecom operators capialise on the huge potential of the Indian telecom sector and global behemoths compete to gain a foothold in this lucrative market, incumbent Mahanagar Telephone Nigam Limited (MTNL) has been unable to cash in on the opportunity.

Despite having all the necessary ingredients for success – a first-mover advantage in 3G, operations in the two most lucrative circles in the country, Delhi and Mumbai, and access to an extensive fixed line infrastructure – the company's performance has been deteriorating. The stateowned company has been battling a declining wireline subscriber base, tepid growth in wireless and a disappointing response to its 3G services on the one hand, and a bureaucratic work culture and political intervention on the other.

In an effort to turn the tide, MTNL has, in the past one year, adopted a multipronged strategy that includes an increased focus on broadband, organic growth through overseas acquisitions and taking the franchisee route for its Wi-Max and 3G operations.

Wireless operations

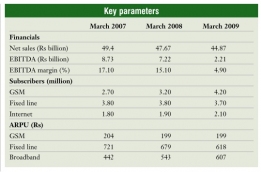

The company today trails behind its counterparts with a wireless subscriber base of 4.2 million in the two circles, as of September 2009, and a market share of 11 per cent. Its ARPU too has declined by 50 per cent over the period March 2008 to March 2009 to stand at Rs 124. With a presence in only two of the 23 telecom circles in India, the company is at a significant competitive disadvantage vis-Ã vis pan-Indian players like Bharti Airtel and Reliance Communications. Also, with penetration levels at over 80 per cent in these circles and strong competition from six to seven players in each circle, there is limited scope for market expansion. As the competition intensifies with new players launching services, MTNL's market share in net additions may drop further in the future.

On the 3G front, MTNL failed to leverage its first-mover advantage. Although the PSU was allocated 5 MHz of 3G spectrum in the 1920-1980 MHz frequency band paired with another 5 MHz channel in the 2110-2170 MHz frequency band – the ostrich feather in any operator's cap – nearly a year ahead of other operators, it was not able to reap the gains and managed to garner only about 1,000 subscribers in eight months, a far cry from its target of 100,000 subscribers in each circle.

According to analysts, one reason for the poor response to MTNL's 3G services could be that its existing subscriber base comprises mainly low-end users. The company also lacks the ability to churn high-end users from the competition. Further, matching the base price of the highest bidder will result in an outflow of funds, which will adversely impact the finances of the company.

Wireline operations

Although MTNL continues to maintain a dominant position in the fixed line segment, it has not been able to stem the decline in its wireline connections. The company currently has over 3.57 million wireline subscribers who contribute the bulk of its revenues. In comparison, its wireless revenues, at Rs 8.46 billion for the year ended March 2009, are a fraction of its wireline revenues which stood at Rs 36.88 billion for the same period.

The company clearly needs to focus on retaining its wireline user base and stem the decline in ARPUs. Broadband remains the key driver and while the company is offering bundled broadband services, it is facing stiff competition from private players. Nonetheless, success on the broadband front has helped the company reduce its rate of decline on the wireline front. Going forward, it intends to step up the efforts in this space.

Financial performance

The financial performance of the company, which is listed on the stock exchange, has been on the decline since March 2009. Its stock gained a little under 50 per cent vis-a-vis the Sensex, which gained 83 per cent.

In the quarter ended June 2009, the company posted earnings before interest, tax, depreciation and amortisation (EBITDA) losses for the second consecutive quarter. It reported an EBITDA loss of Rs 210 million and a net loss of Rs 468.47 million for the quarter, vis-a-vis a net profit of Rs 1.16 billion in the corresponding quarter of the previous year. This was primarily due to low wireless revenues and high wage costs (which were as high as 57 per cent of the company's sales). Revenues at Rs 9.55 billion fell 12 per cent with wireless revenues dropping by 30 per cent, partly due to the cut in termination rates, which accounted for a large part of its revenues, and partly on account of a loss in market share.

Recent initiatives

To get on to a more sound financial footing, the company is looking to streamline its portfolio and target a healthy increase in sales and profits. It has, in recent months, announced several measures that should translate into improved operational efficiency, double-digit productivity and long-term success.

Wireline broadband

First, MTNL intends to leverage its fixed line infrastructure to push wireline broadband products. The second largest internet service provider (ISP) in the country, MTNL has witnessed strong growth in the broadband segment. With over 700,000 subscribers, MTNL currently accounts for over 10 per cent of the country's broadband subscriber base. Subscriber additions have risen sharply from a mere four to five a day when the service was first launched in 2005, to about 400-500 a day at present.

Given the strong growth in this space, the incumbent has successfully managed to slow down the decline in its fixed line disconnections. Targeting a larger user base, the service provider slashed its broadband charges by up to 50 per cent in August 2008. It also recently started offering faster broadband speeds for its Mumbai customers and will soon offer the service in Delhi as well. Without implementing a hike in plan charges, it has doubled the broadband speeds for all its unlimited TriBand (broadband) plans.

The company intends to increase its broadband subscriber base by 1 million and is expected to provide broadband services on the fibre-to-the-home platform by the end of 2009.

Franchisee route

The company is also strengthening its IPTV business in order to take advantage of its fixed line infrastructure, while also increasing its fixed line subscriber base.The first operator to launch IPTV services in the country (in 2007), it currently has over 5,000 subscribers each in Delhi and Mumbai.The company, along with Bharat Sanchar Nigam Limited, is currently in the process of rolling out the country's largest IPTV service called MyWay IPTV, which has been franchised to a Delhibased company, Smart Digivision.

Under the franchise agreement, Smart Digivision will have access to the companies' subscribers as well as to the copper wires reaching their homes. In return, the companies will be paid 10 to 25 per cent of the revenues from the service.

While MTNL has had tie-ups with other companies earlier as well to offer IPTV services, the difference this time is the sheer scale of the rollout. This is clearly a sound business model, as MTNL will earn additional revenue from a fixed asset without making any new investment. However, the potential addressable market is dependent on the availability of broadband and it remains to be seen whether the franchisee will be able to deliver efficiently and make the business a success.

Meanwhile, MTNL seems to be opting for the franchisee model for all its new ventures and is now taking this route for its 3G and Wi-Max operations as well.

On the premise that involvement of an experienced 3G operator will boost uptake of the service, in August 2009, the company invited bids from experienced operators to manage and operate its 3G services in Delhi and Mumbai on a revenue-sharing basis.

Notwithstanding its inability to garner a substantial 3G subscriber base, the operator has set stiff targets for the proposed private partner, including assured revenues of Rs 2.4 billion from each metro over a three-year period. A penalty of 10 per cent of the shortfall amount is likely to be imposed on the franchisee if it is unable to meet the targets.

For its part, MTNL is committing to provide average capacity levels of 100,000, 300,000 and 500,000 lines in the first, second and third years respectively, and will be responsible for paying the associated licence and spectrum fees. The franchisee will be responsible for everything else, including SIM creation, customer acquisition, billing and customer care.

The Spice Group and Virgin Mobile have already submitted bids to manage the company's 3G services in the two telecom circles. According to Kuldip Singh, director, technical, MTNL, the successful bidder is likely to be announced within a month.

The company has also sought initial bids from global players to set up and run its Wi-Max operations in Mumbai and Delhi. The one-time Wi-Max spectrum fee (to be decided after the auction) that MTNL will have to pay would be deducted from the revenues from Wi-Max operations by the franchisee partner.

Overseas acquisitions

In light of the limited opportunities that MTNL has in the domestic telecom space as it operates in only two circles, the company is looking to aggressively expand the scope of its operations by acquiring telecom licences in overseas markets. It has put in an initial bid to buy a majority stake (75 per cent) in Nigerian Telecommunications Limited (Nitel), and will appoint a consultant to advise it on the acquisition.

MTNL is currently operating in Nepal through a joint venture called United Telecom Limited and in Mauritius through a 100 per cent subsidiary called Mahanagar Telephone Mauritius Limited.

Going forward

While the company is making every attempt to turn the corner and climb out of the red, this is indeed a tough task. Saddled with a huge workforce, a PSU work culture and limited scope for expansion, MTNL will need to pull out all the stops to reverse its declining fortunes.