Idea Cellular - Aims for a pan-Indian footprint, strong brand recall

-

Aschoolmaster unable to enrol a village girl into his school as the classroom is already full uses mobile technology and a loudspeaker to extend his lessons to a large number of children in the village. The punchline of the ad reads: "What an Idea, sir-ji!" Such commercials have helped to create a strong brand image for Idea Cellular, which has been consciously shifting its focus from the classes to the masses.

"The company has been innovative in building a brand around the whole `What an Idea' tag line, which has worked quite well for it," says Dr Mahesh Uppal, director of telecom consultancy ComFirst. According to Pradeep Shrivastava, chief marketing officer, Idea Cellular, "It is the emotional connect of the brand with its millions of customers that distinguishes it from the rest of the service providers. The brand name is associated with reliability."

For Idea Cellular, this is a crucial strategy. Currently the fifth largest mobile operator by subscribers in the country, the company failed to gain momentum in the initial years due to promoter-related problems. Incorporated in 1995, Idea began as a three-way venture between Tata, Birla and AT&T. Subsequently, AT&T opted out of the business and in 2006, Tata too sold its stake in the company, leaving the Aditya Birla Group as the key promoter.

Thereafter, the operator focused on growth and increasing its footprint across the country. In 2008, after getting licences and spectrum to operate in all telecom circles, the company put its rollout plans on the fast track. In June 2008, Idea acquired Spice Communications, which brought to the table its considerable presence in the Punjab and Karnataka circles. The year 2008-09 also saw Idea enter new circles including Bihar and Mumbai.

Carrying the momentum forward, Idea has launched services in Orissa, Tamil Nadu (including Chennai) in 2009-10 so far, increasing its presence to 17 out of the 22 telecom circles in the country.

Twenty-five per cent of Idea's overall subscriber base in southern India is from Kerala, Andhra Pradesh and Karnataka. The company plans to set up a network of 2,400 cell sites in Tamil Nadu and Chennai by March 2010, which will be increased to 4,000 sites by March 2011. Idea has earmarked an investment of Rs 10 billion by March 2011 for these growth initiatives.

The company is also gearing up to launch services in Kolkata, which registered the highest GSM growth rate among the four metro circles in March 2009. Making a dent in Kolkata, where Idea will be the sixth operator, is a challenge that the company is looking forward to.

By end 2009, there are plans to acquire a pan-Indian footprint. "By the year end, the company will have launched services in Kolkata, West Bengal, Assam, the northeastern states and Jammu and Kashmir," says Shrivastava.

Market position

For Idea, speed is of the essence. The company needs to rapidly ramp up capacity and launch operations in new circles. According to telecom experts, the biggest challenge for the operator is to match the market leaders in the circles it is operating in. And with new players coming in, the competition will only get more intense.

Responding to the situation, Idea has shifted gears and increased its network capacity by at least four times. It has recently tied up with telecom equipment manufacturer Nokia Siemens Networks (NSN) to upgrade its network. NSN will provide GPRS technology and its unified charging solution, which will help Idea offer mobile services like multimedia messaging, email, web browsing and online music.

Capacity expansion and the entry into new circles have helped Idea push up its subscriber base by more than 70 per cent over the past one year. As of end-June 2009, Idea had 47.08 million subscribers, ahead of Tata Teleservices Limited (TTSL) which had 36.48 million subscribers (as of May 2009). The other four operators preceding Idea in June were Bharti Airtel (102.36 million users), Vodafone Essar (76.45 million), Reliance Communications (RCOM) (77 million as of May) and Bharat Sanchar Nigam Limited (49.07 million).

Idea's market share increased from 9.4 per cent in March 2008 to 11.4 per cent in May 2009. According to company officials, Idea's network and pricing competitiveness have helped to improve its market share. In terms of subscriber additions too, Idea is beginning to match its rivals. In June, the company added 1.6 million subscribers.

The company is the leader or in the second position in some of the circles it operates in. In the Madhya Pradesh (including Chhattisgarh), Maharashtra and Kerala circles, for instance, Idea is the market leader.

Financials

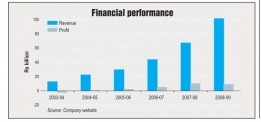

As a result of the increase in the mobile subscriber base, wider footprint and higher operating efficiency, Idea's financial performance during the January-March 2009 quarter exceeded market expectations. Sales jumped by 48 per cent as compared to January-March 2008 to Rs 29.35 billion. Net profit stood at Rs 2.74 billion, despite the Rs 250 million loss posted by Spice.

For the year 2008-09, though, the net profit fell by 13.6 per cent over 2007-08 to Rs 9 billion. Consolidated sales rose by 50.6 per cent to Rs 101.48 billion. The fall in net profit was largely due to the loss posted by Spice. Analysts expect that the extensive capital expenditure made by Idea will start paying back in the coming quarters as operations in the new circles stabilise.

According to news reports, following strong fourth quarter results, Idea has announced plans to invest Rs 60 billion in 2009-10 for its pan-Indian network expansion and augmentation. This does not include any allocation for 3G spectrum.

The company plans to raise the funds through a mix of foreign currency and rupee debt. At a time when most companies are finding it hard to obtain loans, Idea has been able to raise a fresh line of credit from the export credit agencies of Finland, Sweden and China. The loan is expected to be for a period of 8-10 years and at a rate much lower than what is charged by the commercial banks. Analysts believe that Idea's success in raising debt in the midst of the economic slowdown indicates the strength of the company's operations.

"This loan, along with Idea's internal accruals, will meet the investment requirements for the next 18-24 months," notes a banker involved in the fund-raising process. The company is currently sitting on cash reserves of around Rs 50 billion with a debt of Rs 77.6 billion on its balance sheet. Last year, Idea's cash position was strengthened by the infusion of $650 million by private equity firm Providence, which picked up stake in Idea Cellular's subsidiary, Aditya Birla Telecom. Also, in June 2008, Telekom Malaysia (now Axiata) paid Rs 73 billion to buy a 15 per cent stake in Idea, while Idea paid Rs 27 billion to buy out the stake held by the Modis in Spice.

Company snapshot

Managing director: Sanjeev Aga

Market cap: Rs 221 billion (June 30, 2009)

Subscriber base: 47.08 million (June 2009)

Presence: 17 circles

Shareholding (March 2009): Promoter group – 49.13 per cent, foreign holding – 38.87 per cent, Indian institutions – 7.83 per cent, others – 4.18 per cent. Capex outlay for 2009-10: Rs 60 billion (does not include outlay for 3G spectrum auction)

Financial status: Idea Cellular has cash reserves of around Rs 50 billion and a debt of Rs 77.6 billion. It is currently raising Rs 60 billion through a mix of foreign currency and rupee debt.

Analyst views

Idea's strengths are its strong brand recall, solid technology base and efficient management practices. Also, as part of the $28 billion Aditya Birla Group which has a market capitalisation of $32 billion, the operator has a committed promoter with deep pockets. This will be a definite advantage as Idea scales up its operations in the wireless space.

Says Sridhar Pai, CEO, Tonse Telecom, "Idea's strength lies in its brand, which is aggressively pitched. The company was recently voted the fourth busiest brand in India after Airtel, Google and Nokia; its growth, till about March 2009, was one of the highest in terms of subscriber additions." Pai adds that Idea's reasonable quality of service is also considered a strength.

Moreover, even without a pan-Indian footprint, the company's execution of strategies has been excellent so far. The company is quick in taking decisions. According to analysts, these advantages will help the company take on its rivals. Focusing on differentiating its product portfolio will also be crucial. "Stepping up the quality of service as well as aggressive marketing strategies will go a long way in giving the company an edge," adds Sourabh Kaushal, principal consultant, BDA India.

There are, however, some areas of concern. Industry watchers feel that though Idea has been operating for a long time, it has not really grown the way companies like Bharti Airtel and RCOM have. By limiting itself to being a pureplay cellular operator, it has restricted its growth and presence.

According to Pai, the following are Idea's major challenges: lack of pan-Indian coverage, a spectrum mix of 900 MHz and 1800 MHz, no broadband network and no major enterprise presence. Idea also lacks global operations and its minutes of usage have been slipping consistently.

While getting an all-India licence will enable Idea to shed its regional tag, being a late entrant, it will have to take on entrenched companies in the new circles. "As the seventh or eighth operator, Idea will face an uphill task, especially if it is looking at getting high-end users," says Uppal. Also, with new entrants like Aircel and Unitech Wireless looking to get the high-paying subscriber in the same circles, the competition will be immense. Idea's closest rival, TTSL, is gearing up to launch GSM-based mobile services, which will further step up the competition.

Future growth

Idea is investing in the value-added services (VAS) segment, which offers a huge opportunity for growth. Says Uppal, "The company's GPRS and EDGE venture was the very first in the country. This, along with the introduction of mobile value-added services such as music messaging, voice portals and email, will strengthen Idea's ability to compete with other operators."

The company is upgrading its networks to tap the VAS data services market and take advantage of a key revenue stream. By 2010, the operator hopes to offer its users services such as multimedia messaging, web browsing and online music. According to company officials, the right technology foundation is fundamental to success in the VAS space, and Idea needs to develop not just a method of delivering services but also of monetising them effectively.

To tap the VAS market, Idea has unveiled several new services in the past few months. In collaboration with Research In Motion, the company has announced the launch of a BlackBerry solution for its customers. The solution provides users with access to a number of mobile business and lifestyle applications. The operator also offers the BlackBerry Enterprise Server and BlackBerry Internet services.

Idea has collaborated with Ziva Software to launch a stock search and subscription service for subscribers in Punjab. The service provides market alerts on specific stocks to users on their mobile phones.

In Kerala, through a partnership with India Post, Idea offers its customers mobile recharge coupons, ranging from Rs 10 to Rs 100, that are available at all post offices in the state.

Under a brand building initiative in east India, Idea has created a virtual character called "Dada", which is being used to promote the company's offerings. Says Shrivastava, "We are hopeful that the beloved character of Dada will engage a large number of people in the digital space, thus helping us gain mindshare and establish a connection with our target group. We see the digital space as a good way to engage with the youth."

Idea is also focusing on the rural market in a big way. The company offers rural subscribers innovative schemes such as free two-minute outgoing calls, reduced prepaid tariffs, lifetime recharge and full talktime. Given that the rural telecom penetration is much lower than the national penetration, Shrivastava says that the rural markets offer the company scope for impressive growth in the future. Analysts also feel that rural services could be the company's strong suit. Says Pai, "Idea's brand recall is pro-rural, unlike RCOM or Bharti Airtel which need to show a stronger rural face."

Idea is also betting big on 3G and WiMax and is awaiting the final policy framework on these services. The company has already conducted indoor Wi-Max trials in Pune, Bangalore and Kochi.

All in all, with the aggressive expansion throughout the country and the focus on enhancing its product portfolio, it looks like Idea Cellular is on its way to becoming part of the big league in the Indian telecom space.

After rolling out pan-Indian services, what is the next target for Idea Cellular?

Having got pan-Indian licences as well as spectrum for the entire country, Idea is growing at a rapid pace to ensure that it covers all service areas by the end of the current year. Last year, we expanded our services to crucial circles such as Mumbai and Bihar. We also acquired Spice, which has operations in Punjab and Karnataka. These two circles have seen a revamp in network quality and coverage.

We started this year with a bang, launching services in Orissa and Tamil Nadu (excluding Chennai). During the July-September quarter of 2009, we expect to launch services in Chennai and Kolkata. By December 31, 2009, if things go according to plan, we would have a national footprint including services in the Jammu & Kashmir, Assam and Northeast circles.

Idea has been the fastest growing operator in India for the past two years, both in terms of revenue and subscriber base. Moreover, the remote and rural areas are also getting covered faster. Earlier, we used to consider areas with a population of 10,000 as a cut-off for extending coverage. Till recently, a population of 5,000 was considered as the limit. And now, we have actually extended services to even cluster towns or highway locations which have 2,000 or 3,000 people. This expansion by itself is a mammoth task as well as a huge opportunity.

In this continuously growing category, it is essential to provide a high quality, competitive network, coupled with an effective distribution system and seamless customer service, to all our potential and existing users across the country.

What are the key challenges facing the company at present?

The main challenge in the telecom industry is that while we are witnessing phenomenal growth in the urban market, the rural story is still unfolding. Though it is easy to say "go rural", doing so is extremely complex in terms of logistics, creating distribution infrastructure, creating service support infrastructure, and ensuring that the sales force of the retailers and local channel partners is fully trained. Going rural is a big task for the industry, including top players like Idea.

If a company is the market leader in a circle, it will have services in the remote, rural markets. On the other hand, in a new circle, a company will first cover the urban areas. For example, we have recently launched services in the rest of Tamil Nadu circle, and have covered the key urban markets. Now, we have to begin the phase of expanding into the rural markets.

The next big challenge for the industry is managing ARPUs. This is because there are already eight to nine players in each circle and the new GSM players will launch their services in the future. The "invitational" price offered by a lowfootprint competitor impacts the revenue or ARPU.

As a result, the operators need to unlock the potential of mobile telephony and ensure that people use the mobile for much more than making voice calls and sending SMSs in English. There is so much more that can be done in valueadded services (VAS). Making that happen is the next big challenge. You have to educate the consumers. You have to do a lot of hand-holding. And you need to have the right infrastructure. For data services, a company needs GPRS infrastructure, educated customers and channel partners, a suitable price point and the right content.

How is Idea placed in the overall competitive scenario?

We are in the situation of being a strong and dominant player in certain markets and a relatively new entrant in some others. In Maharashtra, Goa, Madhya Pradesh, Chhattisgarh, Uttar Pradesh (West) and Kerala, for example, we are far ahead of the other operators. In markets like Andhra Pradesh, Gujarat and Haryana, we are a highly respected player. Then there are markets where Idea is a new entrant and is growing at a fast pace. Therefore, there is no single or linear answer to how Idea is placed in the market.

According to you, which are the areas in which the company needs to improve?

In the overall context, mobile usage is going up and all the operators, including Idea, need to look closely at what more can be done in terms of network quality, uninterrupted signals and a seamless GPRS experience. Ensuring network quality continues to be a major challenge.

What is Idea's key marketing strategy?

We want to be a champion brand, a humane company in terms of our engagement with all the stakeholders, and maintain the touch of difference that the Idea brand name suggests. I think these three planks of marketing have been welcomed by the consumers, which has made us the fastest growing operator.

What will be Idea's focus areas this year?

Expansion of our geographical footprint is one of the key focus areas. We are also hoping to launch customised services for the youth segment, either through VAS or other offerings. At the same time, being a universal service provider, we will focus on all user segments.

What are your company's plans for 3G?

It is difficult to answer this question right now because plans can be made only on the basis of actual information. Let the policy framework and auction details emerge. Obviously, being amongst the top telecom players, Idea would be looking at what next, what more and what else to do. There is no doubt that the future of 3G is bright if the services are affordably priced and widely available.

Is being a pure-play GSM operator an advantage or a disadvantage?

It is a question of context. Mobile telephony is showing the fastest growth and highest returns as compared to any other segment. So, Idea is in the right market, at the right time, with the right focus.

GSM also offers opportunities in terms of alliances and partnerships. You do not have to own every single link in the chain. There are suitable companies offering opportunities for creating alliances that will enable further growth. So, what is considered as a limitation by some people is actually providing us tremendous leverage and advantages.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...