This company has played the telecom game differently. When Bharti Airtel, Reliance Communications (RCOM) and Bharat Sanchar Nigam Limited (BSNL) were aggressively expanding their wireless reach, Vodafone Essar preferred to remain selective. Likewise, when others were eagerly sprinting into the long distance telephony segment, it consciously chose not to. A pure-play GSM operator with no apparent indication that it wants to be an integrated service provider like its peers and which, till recently, was not even a pan-Indian operator, Vodafone Essar has still belonged to the top league.

The company's focus has been more on actual revenues from users and on making a strong brand presence. It made its money, though its subscriber base trailed at fourth position behind its more aggressive rivals, till as late as 2007.

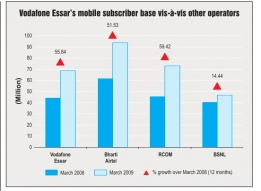

Today that situation has changed somewhat. Having rolled out services in six new circles during the October-December 2008 quarter along with better schemes for users and a bigger push into rural India, Vodafone Essar has been able to pull in new subscribers. So much so that in March, it beat arch-rival and leader, Bharti Airtel, in terms of subscriber additions. Of the record 16 million subscriber additions in March, Vodafone Essar accounted for 2.85 million against Bharti Airtel's 2.81 million.

Vodafone Essar's customer base is up at 71.54 million (as of April 2009), giving it an 18 per cent share of the mobile market. Early 2007, it ousted state-owned BSNL from the number three slot in subscriber terms and is today neck and neck with RCOM, which has 73 million subscribers. Bharti Airtel still leads the pack with 93 million subscribers, but it will need to be careful. According to Kunal Bajaj, director, BDA Connect, "For the past three months, RCOM has added more customers, both GSM and CDMA. Now, with Vodafone Essar also doing well, Airtel should watch out."

Constant change

For the third largest operator in the country and the second largest by revenue, the growth has come through careful strategy and multiple transitions. "As a brand, we have grown over the years by maintaining a service that is consistent, without being constant. We have continued to grow revenues and subscriber share despite changes," notes Harit Nagpal, director, marketing and new business, Vodafone Essar.

There have been several transitions – in company name and promoter in the past, and in the top management more recently. Accompanying the news that the company had made a pre-tax profit of –£9 billion ($17.6 billion) globally in the year ended March 2008, came the surprise announcement that Arun Sarin, the highprofile CEO of Vodafone Plc (the chief promoter of Vodafone Essar), was quitting after three years of holding office.

While still coming to grips with this change, early 2009, managing director Asim Ghosh, 61, decided to end his over 10-year-long relationship with the company for a board role, a move that many consider as having larger implications for the company. Ghosh was not only associated with the company from the days when it was Max Touch in Mumbai, but virtually helped it grow to the stature it has reached today. He also contributed significantly to the country's telecom growth story. Says T.V. Ramachandran, director-general of the Cellular Operators Association of India, "From before 1999 when we were pushing for the New Telecom Policy to the present, he has been one of the key contributors to the sector."

Company snapshot

CEO: Marten Pieters

Mobile subscribers: 71.54 million (as of April 2009)

Mobile market share: 17.8 per cent

Presence: Pan-Indian

Shareholding pattern: UK-based Vodafone Group holds 67 per cent stake; Essar Group holds 33 per cent

Group market cap: –£98 billion

India plans: Invest around $2 billion in 2009-10 on network expansion, capitalise on the group's international expertise in 3G, widen VAS portfolio.

Ghosh has been succeeded by Marten Pieters as CEO. He was earlier with Celtel International BV, a mobile operator with a presence in several African countries, and is currently a director on the board of Luxembourg-based Millicom International Cellular SA.

Meanwhile, Nagpal, a long-standing member of the company, has moved on to a global role with the Vodafone Group, UK, in marketing. Kumar Ramanathan, who currently heads Vodafone Essar's south India operations, will take over as chief marketing officer of the company.

Some of the transitions have been symbolic. Last month, Vodafone's famous pug (also known as the Hutch pug) made way for the new brand ambassador – the "Zoozoos" – egg-headed, stick-like figures that act like humans. They were first seen during the Indian Premier League (IPL) Twenty20 cricket series, promoting different Vodafone offerings. Of the 30 such commercials produced, over 13 have already been introduced and have quickly created a Zoozoo Fan Club.

Implications for the company

With Ghosh and Nagpal no longer in the lead, industry watchers wonder if the performance and growth momentum achieved by the company will suffer. Company officials and analysts do not think so. No doubt they have played a crucial role in making Vodafone's India arm the best performer in the group's operations globally; however, the company has seen enough transitions over the years to not be seriously affected by their move.

Also, the company has carefully drawn-up strategies that should give it enough momentum to run on its own steam. Both operationally and financially, the company is on a strong wicket. Operating in 23 telecom circles, Vodafone Essar provides 2G services on 900 MHz and 1800 MHz digital GSM technology. It provides both prepaid and post-paid mobile phone services and has a strong position in the major Indian cities. In the Kolkata and West Bengal circles for instance, the company is the biggest cellular service provider with a presence in 3,253 cities and towns and 31,000 villages. It recently crossed the 7 million subscriber mark in these circles, up from 4 million in February 2008.

The company has a strong top management. And despite some complex court cases, run-ins with tax officials and promoter-related issues, it is holding its own in terms of both revenues and subscribers. For instance, its revenue of about Rs 50 billion for the quarter ended December 2008 is more than that of RCOM.

Journey so far

An early entrant in the telecom space, Hutchison's (the company's former promoter) presence in India goes back to 1992. It initially tied up with local partners to establish a company to provide GSM services in Mumbai. Commercial operations began in 1995. Between 2000 and 2004, it extended its presence to 13 of the 23 defined telecom circles. In the past two years, the company has established a pan-Indian presence.

Prior to 2007, the company operated as Hutchison Essar, jointly owned by Hutchison Telecommunications Limited and the Essar Group. It offered services under the Hutch brand name. On February 11, 2007, Vodafone bought Hutchison Telecommunications International Limited's 67 per cent stake from Li Ka Shing Holdings (chief promoter of the Hutchison Group) for $11.1 billion. The transaction was completed on May 8, 2007.

Vodafone currently holds majority stake in the company while 33 per cent is jointly held by the Essar Group and others, including the Hinduja Group and Essar Global Limited.

Globally, Vodafone is the largest mobile telecom company in the world in terms of turnover. Headquartered in the UK, the company's market value as of April 2009 is –£98 billion. It currently operates in over 25 countries and has partner networks in 42 countries around the world. In terms of subscribers, Vodafone is the second largest telecom company in the world after China Mobile. It has a subscriber base of over 300 million. Vodafone also owns 45 per cent stake in Verizon Wireless, the largest American mobile telecommunications company.

Soon after the acquisition in India, Vodafone Essar effected a massive brand overhaul at an estimated $62.5 million. As part of the makeover, it virtually painted the country red (Vodafone's trademark colour) and unleashed a media blitz establishing the brand Vodafone.

The gamble paid off. Today, Vodafone Essar is the star performer of the Vodafone Group. In the quarter ended December 2008, it posted a 37.3 per cent jump in revenue to $674 million, the highest in percentage terms among all the countries that the firm operates in. India also accounted for 65 per cent of the 9.7 million customers Vodafone added globally during the three-month period. Importantly, India now accounts for about 45 per cent of Vodafone's global traffic – 141.3 billion minutes of usage – up from 37 per cent during the same period in the previous year.

Analyst views

Without doubt, Vodafone has, in a short span of time, managed to establish a strong brand presence in the country. "It has come up with very innovative methods and never-seen-before ad campaigns to make its presence felt. For instance, its `Happy To Help' campaign focuses on strong customer care and is a manner of reaching out to its customers better," observes Dr Mahesh Uppal, telecom analyst and director, ComFirst.

One of Vodafone Essar's key strengths, apart from its access to a formidable global partner, is its innovative value-added services (VAS) portfolio. "There is a strong perception that the company is ahead of the rest in its VAS offerings. It has devised innovative ways to introduce value-added services, which contribute much more to the company's overall revenue than in the case of other operators. For instance, it was the first company to launch mobile data services, which offer higher ARPUs compared to other services," says Sridhar Pai, CEO, Tonse Telecom.

In terms of competition too, the company is doing well. Its aggressive expansion across the country is paying off. Says Bajaj, "It has a good presence in Category A circles and is expanding to the rest of the country. Its monthly net additions have increased and, in fact, exceeded Airtel's. What we are seeing is more of the same strategy – higher revenue per month, a higher percentage of subscribers, strong VAS revenues and a continuing investment in building a strong brand."

But there are some grey areas that the company needs to look into, analysts caution. Vodafone's mobile-only model, for instance, which once seemed visionary, is beginning to pale in the face of an increasing trend towards convergence between fixed line, mobile, broadband and TV services.

Bajaj feels that this approach could seriously hinder the company's growth as competition steps up with new players coming into the market. "It will be a challenge. Both RCOM and Airtel are converged telecom operators that can offer broadband, video and mobile telephony services. Vodafone is not present in these spaces and will increasingly find itself short-handed in providing the entire gamut of services."

Analysts feel that Vodafone should look at increasing its service portfolio, with a greater focus on the enterprise segment. This would help generate new revenue streams. Already, there may be some thinking along these lines as the Vodafone Group is considering offering broadband services as well in some regions.

Another concern is about the company's expansion into the rural areas. Analysts feel that Vodafone Essar has for long been catering to upper-end customers. However, with the next level of growth expected in tier II and III cities, the company will have to rework some of its strategies.

Besides, Bajaj points out, "Vodafone is a relatively late entrant into some of the Category B and C circles. These circles are seeing very high growth, and Airtel, RCOM and, in some cases, Tata Teleservices, have already built a strong presence here." Vodafone will therefore have to fight much harder to gain market share. It will also find it difficult to sustain ARPUs at its current levels as it moves towards delivering affordable tariff packages in the rural areas.

Company officials are, however, not distressed. Strategies are in place as well as plans for heavy investments in networks and innovative packages for the rural areas. Says Pai, "The company has managed to penetrate small towns and cities relatively well. It has offered tariff schemes that are not only competitive but are customised for their users." Vodafone has also tied up with Chinese handset-maker ZTE for low-cost phones.

The weak link, analysts feel, could be its partner, Essar. Essar's role in the company is not clear. There are ownership issues with BPL Mobile (now Loop Telecom), which has resulted in a continuing court case. Meanwhile, the Ruia brothers' (promoters of the Essar Group) interest is clearly in Loop Telecom.

According to Uppal, the company also needs to spruce up on the regulatory and policy fronts and be clearer with regard to its dealings and operations. The company is, for instance, facing investigations by the revenue department over its decision to spin off its tower business into Ortus Infratel. Earlier, it had been involved in litigation with the department over the payment of corporate gains tax post acquiring Hutchison's stake.

"The company seems to be more interested in its own innovation and branding rather than with the environment of the sector. It needs to take more external factors into consideration, going forward," notes Uppal.

"Moreover, the leadership is invisible; one does not see or hear from them a whole lot in comparison to, say, a Bharti, where one is familiar with the men behind the brand. They should make an effort to be more visible," he says.

Future outlook

Net, net, however, the company's pluses are higher than its minuses. With its sights set on higher growth and subscriber acquisition, it is ambitiously looking to expand its network. Towards this end, it has raised a debt of about Rs 100 billion from the State Bank of India, spread over five years. The corpus is also expected to come in handy when the company bids for 3G licences. It is definitely looking at bidding for a panIndian 3G service licence, when it is auctioned, as it intends to fully capitalise on the Vodafone Group's expertise in the 3G arena and thus steal a march on its competitors.

It is also strengthening its focus on the VAS segment. In line with this, it has introduced a slew of services in the past six months including "Chhota Credit" for prepaid users who run out of money on their cards. It has also introduced Portfolio Tracker, an application that gives live stock rates and latest financial market updates.

The company has also enhanced its handset portfolio by launching the BlackBerry and Apple's iPhone 3G. In January this year, Vodafone Essar and Research In Motion announced the launch of the muchanticipated BlackBerry Storm, the first-ever touch-screen BlackBerry smartphone designed for Vodafone. The Storm, priced at Rs 27,990, is geared to deliver the functionality of the BlackBerry solution while providing entertainment, information and communications at the fingertips.

With the new management order in place and its future strategies drawn up, the company seems set to continue on its strong growth trajectory.

Tower trouble

In an attempt to consolidate its tower business, Vodafone Tower Holdings and Essar Infratel planned to acquire 100 per cent stake in the recently incorporated Ortus Infratel, which would own the towers currently under Vodafone Essar. Ortus would also hold 42 per cent stake in Indus Towers, the joint venture company between Bharti Airtel, Idea Cellular and Vodafone Essar. The company set aside Rs 5 billion for this venture.

The decision made sense in the lucrative infrastructure-sharing landscape. Indus Towers operates 90,000 towers in around 16 circles, while Vodafone Essar separately operates 6,000 towers in six circles where Indus is not present. Combining the assets would give the company considerable revenue leverage.

However, these plans hit a roadblock with the Department of Revenue raising questions over whether the proposed investment through Mauritius-based companies would result in "round tripping" as both Vodafone Tower and Essar Infratel are incorporated in Mauritius while Ortus Infratel is registered in New Delhi. Round tripping refers to routing of investments by an entity based in India through another country (tax havens like Mauritius) back to India.

As of now, the revenue department has referred the proposal to its Department of International Taxation in Mumbai to further investigate the matter.

The Zoozoo buzz

The Zoozoos, Vodafone Essar's new egg-shaped mascots introduced during the IPL Twenty20 cricket series, seem to have caught the country's imagination. The hugely successful ad campaign aims to highlight the operator's portfolio of value-added services.

A series of 30 ads have been created, shot entirely in Cape Town, South Africa over a period of one month. The over 13 ads aired so far have caught on so fast that one of them, an ad for beauty tips over the phone, was viewed 13,000 times on YouTube in one week. The Zoozoos have also taken Facebook by storm. They have nearly 35,000 friends.

The Zoozoos are not animation characters; they are local theatre actors in costume. According to Harit Nagpal, director, marketing and new business, Vodafone Essar, the entire shoot cost approximately Rs 30 million.

Recent VAS offerings

Portfolio Tracker is a service that gives customers live and near-live stock prices and financial markets information instantly on their GPRS-enabled mobile phones.