Dcember 2008 marked the advent of 3G in India with state-run Mahanagar Telephone Nigam Limited (MTNL) soft-launching the service under the brand Jadoo in Delhi. Commercial launch in the capital took place two months later. The service is expected to begin soon in Mumbai, the other circle MTNL operates in.

The launch of 3G is no mean feat and, moreover, is extremely important for India's second largest fixed line operator. MTNL is hoping to ride on the prospects and excitement of 3G to gain market position and take on competition which has outpaced it over the years.

With the whole spectrum auction and allocation issue wound in a Gordian knot, MTNL and Bharat Sanchar Nigam Limited (BSNL) stand to gain. While private operators are still waiting for 3G spectrum auctions to take place, both government-owned units have already received the required spectrum. They thus have at least a year's lead on the other operators. Besides, even though the public sector units (PSUs) will eventually have to match the highest bid as their licence fee, they do not have to pay anything upfront. In contrast, a private operator might have to pay a minimum of Rs 40 billion upfront if the finance ministry's proposal of doubling the floor price for 3G licences is accepted (the Department of Telecommunications had originally set the reserve price at Rs 20 billion).

MTNL, meanwhile, capitalised on the delay in auctions and worked to increase the distance between itself and the field. The results so far seem encouraging. "The response to the trials has been very good and demand is increasing," claims R.S.P. Sinha, chairman and managing director, MTNL. While there are no official numbers, Kuldip Singh, chief technology officer, MTNL, talks about the factors that are helping the company ramp up the subscriber numbers. "We are the first operator in India to start 3G services, which makes anything possible including mobile TV, high speed internet, voice over IP (VOIP) and loads of value-added services."

Jadoo, which offers mobile downloads, video streaming applications like Live TV, high speed data, etc., has extremely competitive tariffs. The activation charge is Rs 500 and the monthly fee Rs 599. Voice call rates range from Re 0.60 per minute to Re 1 per minute, while video calls are charged at Rs 1.80-Rs 3 per minute. As an analyst notes, with MTNL one can be sure that the tariffs will not be too high. The company, which needs to reverse its fortunes, has kept tariffs deliberately low on all products and services as a strategy.

MTNL really needs to woo users. In the fixed line segment, the company, which accounts for a little over 9 per cent of the all-India subscriber base, has been losing subscribers over the past few years. In December 2008, its user base stood at 3.65 million, a drop from 3.8 million in December 2007. Though MTNL is not alone in its troubles – all fixed line operators including BSNL, Bharti Airtel and Tata Teleservices Limited have been grappling with declining numbers due to the mobile onslaught – it is definitely feeling the maximum heat as fixed line services are its mainstay.

Adding to the problem is the fact that MTNL has been left behind in the mobile rush. Its mobile services are not in great shape. According to Mahesh Uppal, director of telecom consultancy ComFirst, "There is no real focus in MTNL's GSM business and it is an area where the operator can easily be left behind as no one really buys a Garuda." In the Delhi circle, MTNL's mobile subscriber base, as of December 2008, was 1.8 million compared to Airtel's 4.47 million, Vodafone's 3.83 million and Idea Cellular's 2.3 million. Similarly, in the Mumbai circle, MTNL, with 2.1 million mobile users, was trailing Vodafone's 4.2 million and Airtel's 2.7 million.

A key problem is that MTNL, being a public sector utility (PSU), often finds its hands tied. It has to deal with protracted tendering processes and frequent delays in procuring GSM equipment. Often, base station equipment from Delhi has to be moved to Mumbai to keep up with the demand. Nimble-footed private players, meanwhile, are rushing ahead.

Filling the gaps

MTNL's management is well aware of the snags. Over the years, the company has seen all its incumbent advantages being chipped away. To tackle the situation, in 2005, MTNL started offering internet and broadband services on its fixed line network. This proved to be a winner as the bleed in the wireline business was somewhat stemmed.

Leveraging its biggest asset – the extensive telecom network – had to be the best way forward for MTNL. Its robust backhaul of copper and optic fibre network gave it extensive reach to small and medium enterprises, small offices/home offices as well as large enterprises.

Broadband and internet telephony not only gave the company a much-needed reprieve, it also became its strength. MTNL became one of the leading operators in the field, adding close to 1,000 subscribers a day, according to a senior company official. As of September 2008, the company's broadband subscriber base stood at 0.62 million. "MTNL has performed well in this segment and has been very competitive. Its internet and broadband services are considered by many to be as good, if not better, than those offered by private operators," observes Uppal. Nevertheless, the company needs to be careful in the broadband space as it lost market share to Bharti Airtel in July-September 2008. On a yearly basis too, its market share slipped from 15 per cent in 2007 to 12.57 per cent in 2008.

Still, broadband remains MTNL's key thrust area and the company is betting massively on IPTV or triple-play services. It launched triple-play commercially in 2007 under the brand Triband and has been regularly increasing the service. Its latest offering is a combination of a landline with broadband, 150 IPTV channels and/or VOIP (introduced in 2007) that comes for Rs 400-Rs 750 per month. Triband currently has over 50,000 subscribers.

The company is also investing in networks. In June 2008, it floated a Rs 2.5 billion tender for setting up an IP-based multiprotocol label switching (MPLS) network. This was done to introduce services such as bandwidth-on-demand, TV broadcasting (with a minimum of 5,000 channels) and VOIP over the same network. The deployment of the MPLS network will also enable MTNL to transform its legacy time division multiplexing (TDM) network into one that supports new services such as 3G and virtual private networks (VPNs).

MTNL attempts to deploy the best technology. For 3G, it is using the popular universal mobile telecommunications system (UMTS), and has got Motorola to supply equipment. "We are always a step or two ahead of our rivals on the technology front. For instance, we have an MPLS backbone in our city network. We are running broadband services on ADSL2+. We are the first and only operator to launch 3G services. We were the first company to provide IPTV services, and are still the dominant company in this field. Our IPTV services are provided on MPEG4, the latest technology," claims Singh.

In November 2008, in a first-of-itskind move, MTNL along with Aksh Optifibre launched fibre-to-the-home (FTTH)-based multi-play and high definition TV (HDTV) services. According to MTNL, FTTH is a superior technology and is expected to replace traditional copper lines for last mile connectivity.

On the services front, in August 2008, MTNL became the first telecom operator to launch mobile TV in Delhi and Mumbai. On offer are 20 channels for Rs 99 per month.

MTNL has also dropped its broadband charges by 50 per cent to enlarge its consumer base in Delhi. The new plan announced by the company offers users high speed internet access at a monthly rental of Rs 99, with free content download of up to 150 MB. Users can also pay a monthly rental of Rs 149 for free downloads of 400 MB.

Challenges and the outside view

But this is not enough. There is consensus amongst analysts that if MTNL has to face up to the competition, it needs to spruce up its image and operations. The company is intrinsically strong on infrastructure and experience and the long queues to get a telephone connection (which people from the previous two generations had become used to) have gone. But what lingers is the perception that the company takes a longer time to resolve problems, that the staff is non-interactive, that there is the typical laid-back sarkari attitude to tackling problems or doing business, and that the quality of service and customer care are poor compared to rivals.

Uppal drives the point home. "When the whole telecom business today is about numbers, how can MTNL afford to remain a poorly run company? This is reflected in the stock prices – MTNL has one of the world's cheapest telecom stocks. The message in it is obvious," he says. Of course, he adds that there is substantial interference from the government and bureaucrats.

But MTNL does need to step up its performance as it has not been able to capitalise on its incumbent status in the fixed line business. Even in IPTV services, it hasn't made significant inroads though it is the only player apart from BSNL to have commercially launched the service.

On the 3G front, though MTNL currently has an edge, it has to be seen whether the company will be able to sustain the advantage once private players enter the fray. The latter are likely to get aggressive and MTNL might find it difficult to match their steps.

Analysts feel that MTNL lacks significantly in marketing prowess. It has also faced problems in managing the security aspects while rolling out 3G services.

The other big question mark with 3G is whether operators including MTNL will be able to deliver the minimum speed of 2 Mbps (3G can deliver as much as 7 Mbps), or whether the offerings will be as disappointing as their GPRS and EDGE services which offer under 100 kbps against a minimum of 144 kbps.

MTNL has been working on this issue. Its service offers speeds of 2 Mbps, but this has required making significant additional investment.

The lack of spectrum is a potential issue. Says Singh, "We have 5 MHz spectrum for 3G, which is less than the international norm of 20 MHz. For some 3G services, 5 MHz is not sufficient. Initially, when the subscriber base is low it will suffice, but when the subscriber base grows, spectrum could become a problem."

The other major hurdle unique to state-run outfits is the huge workforce. This weighs the company down and prevents it from responding to market forces quickly. Also, with operations confined to two high-teledensity metros, MTNL's prospects of adding new subscribers and increasing profits look fairly discouraging. Morever, as Abhishek Kapur, manager, advisory services, KPMG, points out, "The frequent tariff cuts are not helping the company's bottom line either."

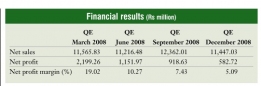

Over the years, this has affected the company's financials. Net profit in the third quarter of 2008-09 fell by 38.12 per cent to Rs 0.58 billion over the corresponding period in the previous year. Total income also dropped to Rs 11.44 billion from Rs 12.18 billion.

Moving on

Going forward, MTNL must draw upon its strengths and address the weaknesses. Says Kapur, "MTNL is a strong company. It can still exploit some of the residual advantages of an incumbent. But its management has to be focused and be allowed to do business unfettered."

MTNL is also a cash-rich company and despite the global economic slowdown, its expansion plans will not be impacted. As Singh says, "We don't have any liquidity issues. We are a zero-debt company and have sufficient cash."

MTNL officials are optimistic. They believe that they have an ace up their sleeve in IPTV, broadband and 3G. Says Singh, "Our strategy for growth is to provide new services in areas in which we are present. We also plan to expand overseas. We think that Africa has a lot of potential."

Expansion abroad might be more of a compulsion than a choice. With a two-circle presence and the government not keen to give it a pan-Indian licence, going global is the only lucrative option. The company already offers CDMA-based services in Mauritius and is planning to offer GSM services there as well. In fact, the Mauritius operation has broken even and is generating substantial revenues. But the company has not been as fortunate in its bid to enter the Sri Lankan market. In late 2008, MTNL, which had emerged as the frontrunner to acquire Sri Lankan telecom operator Suntel for about $180 million, put the acquisition plans on hold as it could not find a suitable partner for a 50:50 joint venture.

In 2008, MTNL got long distance licences. It is in the process of laying a submarine cable between the west coast and the UAE and Djibouti, and one on the eastern side through Singapore and Malaysia. "Our aim is to provide end-toend bandwidth in Europe and the US. We are also looking at opportunities such as new licences, servicing tenders, etc.," says Singh.

MTNL has an old legacy. Early telephony was associated with the company. But over the past few years, other operators have raced way ahead. Given the rules and regulations it is bound with, it is a difficult task for MTNL to keep its networks upgraded and simultaneously achieve growth.

But having said that, 3G, broadband and IPTV are its options to go forward. This is where the company needs to pull out all the stops.