A Good Fit - TTSL pins hopes on alliance with NTT DoCoMo

-

Just 10 days before the Mumbai attacks sent parts of the 105-year-old landmark Taj Mahal hotel up in flames, the telecom arm of the over $60 billion Tata Group, which also owns the iconic hotel, had good reason for cheer. After months of dialogue and deliberation, Tata Teleservices Limited (TTSL) and Tata Sons (chief promoter of TTSL) clinched a 26 per cent stake sale deal with Japanese telecom major NTT DoCoMo for a huge Rs 130.7 billion.

The sale comes at a time when there is a worldwide freeze on investments owing to the global financial meltdown. Signing the deal, Ratan Tata, chairman of the Tata Group, noted: "It is a partnership of two like-minded organisations. NTT DoCoMo is known for its technology, value-added services (VAS) and value systems. Together, we will offer a wide range of products to our existing customers and to new ones as well."

Today, the mood at Tata Sons, understandably, is sombre. Nevertheless, senior officials indicate their readiness to regroup and move on. In fact, TTSL has been extremely busy, having recently extended its presence to Jammu & Kashmir and before that to Assam and the rest of the Northeast. With this it has established a pan-Indian presence, thereby overcoming a key disadvantage vis-a-vis rivals like Bharti Airtel and Reliance Communications (RCOM).

The company is also putting in place firm growth plans for 2009. A CDMA operator, it is looking to enter the GSM space. "We will be launching GSM services early next year," says Anil Sardana, managing director, TTSL.

With more than 10 million users signing up for mobile telephony each month and over 80 per cent of the total 326 million subscribers in the country (as of October 2008) on the GSM platform, TTSL's move makes sense. Under the dual licence system, TTSL can offer GSM services and has the requisite spectrum to do so in 12 circles where it plans to launch the service shortly.

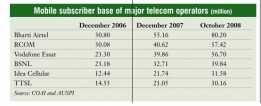

In this context, the alliance with DoCoMo is both timely and strategic. Over the past few months, TTSL has slipped to the sixth position on subscriber count, trailing even 13-circle operator Idea Cellular. In 2007, when other operators were experiencing a downturn in subscriber additions, TTSL had defied sceptics and crossed the 20 million subscriber mark, upping its market share from a mere 3 per cent in 2004 to about 10 per cent. However, as of October 2008, against TTSL's 30.16 million subscribers, Bharti Airtel has 80.19 million, RCOM 57.42 million, Vodafone Essar 56.7 million, Bharat Sanchar Nigam Limited (BSNL) 39.84 million and Idea Cellular 31.58 million. In the wireline segment too, TTSL has only a marginal presence of 2.19 per cent, with 836,819 subscribers as of October 2008.

But the company intends to change this soon. Its future operations are expected to get a big fillip with the alliance with DoCoMo. "The cooperation between DoCoMo and TTSL will extend across various segments – marketing, handset development, technical support, etc., which will expectedly create new opportunities for both companies," says Sardana. Industry analysts also point to the fact that the deal has come just ahead of the 3G spectrum auction, which will help TTSL gain not just financially but also from DoCoMo's extensive experience in 3G and VAS.

Besides, this is Japan's first investment in the Indian telecom industry. As Ryuji Yamada, president and CEO, NTT DoCoMo, puts it, "For us, it is one of the most important transactions. We will proactively support TTSL in areas like technology and setting up a task force." Coming from the relatively saturated Japanese telecom market, where it has a market share of 51.3 per cent, DoCoMo will want to ensure it makes good its investment in the world's fastest growing telecom market. It is naturally keen to help its partner TTSL scale up its revenue from the non-voice segment, offering its own rich experience in the GSM and VAS segments.

Leveraging on DoCoMo's expertise, TTSL expects to turn profitable in three years. "If our competitors take x number of years to turn profitable, we will take x-3 years on the strength of better data services and a stronger network," claims Sardana. His calculations are based on the fact that in India, around 8 per cent of operator revenues come from data-related services. "At TTSL, that number is 11 per cent while it is as much as 40 per cent for NTT DoCoMo." Over the past few years, TTSL has been increasing its VAS offerings. To that end, in 2007, it tied up with Virgin Mobile, a mobile virtual network operator (MVNO) with over 200 branded companies, employing approximately 50,000 people in 29 countries.

Strategic alliance

TTSL's 26 per cent stake sale largely involves capital infusion by DoCoMo and part-sale of equity by the Tata entities (Tata Sons, Tata Communications and Tata Power). DoCoMo will, in addition, make an open offer to acquire up to 20 per cent of the outstanding equity shares of Tata Teleservices Maharashtra Limited (TTML) – the listed subsidiary of TTSL which has operations in Maharashtra – through a joint tender offer along with Tata Sons. "There is a plan to issue fresh equity, the details of which are being worked out," says Sardana.

Prior to the DoCoMo deal, Tata group firms owned 80 per cent stake in TTSL, Temasek 10 per cent, investor C. Sivasankaran 8.6 per cent, and 1.4 per cent was with institutions. While DoCoMo has definitively stated that it, for now, has no plan to increase its holding in TTSL beyond 26 per cent, the plans of Temasek and Sivasankaran post the deal are not very clear.

According to industry watchers, Chennai-based Sivasankaran had, till recently, been keen to exit TTSL. However, of late, he has decided to drop the idea and retain his stake, bought in 2006 for Rs 12 billion. In the wake of DoCoMo picking up stake in TTSL, he has reportedly stated that he has complete faith in Ratan Tata and the TTSL management, and that DoCoMo would be a substantial value addition for the company.

Temasek Holdings, the investment arm of the Singapore government, on the other hand, is looking at all options, including exiting TTSL. "As of now, we remain an investor but we are looking at all options," says Manish Kejriwal, senior managing director, Temasek Holdings India. "We are happy with the fact that our investments have more than tripled."

The alliance with DoCoMo has, in fact, increased TTSL's valuation substantially. At Rs 502.7 billion, it is higher than the market capitalisation of even its rival, RCOM, the largest CDMA player in India. According to several analysts, the valuation is a little over the top, considering, that TTSL's operation is way smaller than its competitors. That said, there is no great surprise in this given that valuations in the telecom industry have been heading north for some time. Says Dr Mahesh Uppal, director, ComFirst, "I do not think the deal is overpriced at all. Looking at the valuations the new telecom companies have got, even when they have no subscribers or network in place, the value TTSL has got is non-comparable."

For DoCoMo too, the valuations seem fair. It is looking at the exponential growth of mobile telephony in India where TTSL has seen a CAGR of 87.3 per cent in its wireless subscriber base during the period March 2004-08. Compared to this, the Japanese mobile market is saturated with as many as 105 million of the total 120 million people owning mobile phones.

Early years

TTSL, a relatively late entrant into the mobile segment in 2004, began fullfledged operations only after the UASL regime came into existence. Its fixed line operations, though older (since 1996), were limited to a few circles only.

A moderate risk taker, TTSL remained a passive player for some years, preferring to wait when rivals were aggressively wooing customers. The group's attempts at providing long distance services too did not pan out as expected. In 2002, it paid $530 million for a 46 per cent stake in the state-owned international long distance (ILD) monopoly, Tata Communications (the erstwhile VSNL). But the sector was deregulated soon after, leaving the company to grapple with stiff competition and a collapse in rates.

On the national long distance (NLD) front too, the licence for which came free in return for the premature termination of Tata Communications' monopoly, the Tatas missed the bus in cashing in. Airtel and RCOM sped past, leveraging their NLD and ILD licences to push their own traffic on to the international network. Around the same time, state-run BSNL and Mahanagar Telephone Nigam Limited (MTNL) received NLD and ILD licences, making the competition stiffer.

Clearly, TTSL had a lot of catching up to do. In 2005, Ratan Tata stepped in, taking over the reins of TTSL. After all, the lucrative Indian mobile telephony market was too huge a business opportunity to pass up. Over the next two years, TTSL increased its product offerings to include the entire range of telecom services – mobile, wireline, fixed wireless, public booth telephony, long distance and broadband services. It also brought to the market several innovative value-added services and hit schemes such as lifetime validity. The company is today a market leader in the fixed wireless telephony market with a customer base of 3.8 million.

Recent initiatives

- TTSL launched operations in the Jammu & Kashmir circle on December 3, 2008. Under the first phase of operations, the company has provided seamless coverage in 29 towns across the state and is likely to soon cover 36 other towns.

- Prior to this, in November 2008, the company launched CDMA operations in the Assam circle and the rest of the Northeast, at an investment of over Rs 1 billion.

- It tied up with Nortel to launch managed PBX services for small and medium businesses (SMBs) in India.

- In November, Tata Indicom unveiled its instant messenger service, called Tata Indicom Instant Messenger Service, which allows subscribers to create and add friends and relatives as well as chat with them at a monthly subscription of Rs 49 for unlimited messaging.

- Tata Indicom launched the first CDMA AM/FM-enabled mobile phone, the Tata Indicom Radio Phone, in October 2008. The phone is available in various colours at a price of Rs 2,199.

- The company launched BlackBerry services in September 2008.

- In September, the company tied up with Novatium to launch Nova netPC, priced at Rs 2,499. The TTSL service will come bundled with a PC for subscribers.

- The company had the least-congested-network status in the TRAI performance indicator report for the quarter ended June 2008.

- In March 2008, the company tied up with mobile commerce solution company PayMate, to offer Tata Indicom subscribers flight ticketing service on cellphones.

The other area of focus was enterprise. Leveraging the strengths of other Tata group companies like Tata Communications and Tata Consultancy Services (TCS), TTSL decided to offer customised end-toend telecom solutions to corporates through its Tata Indicom Enterprise Business Unit.

The company started looking visibly more aggressive. In 2007, it launched a massive rebranding exercise, which established Tata Indicom as the umbrella brand under which the group's entire telecom activities were consolidated.

The company also invested in changing its image from being perceived as a "value for money" brand to an aspirational brand. It expanded its retail business to set up 3,500 Tata Indicom Exclusive Stores. This shift in emphasis from low pricing (the initial criterion was to keep pace with RCOM, the prime mover in CDMA) to differentiated products such as USP modems and data cards, which leverage the higher data capabilities of CDMA, has gone a long way in reinforcing the kind of brand it aims to be. The company is also giving special attention to all its interface points to improve customer relationships, which it feels is the key to retaining subscribers.

Strengths and concerns

Backed by the deep pockets and strong brand equity of the Tata Group, which has been in business since 1868, TTSL has built a credible place for itself in the Indian telecom industry. In the past 10 years, it has made a concerted effort to strengthen its image and operations, and invested over Rs 250 billion across various circles.

Despite this, however, today TTSL no longer finds place among the top five telecom players. Analysts believe the company is paying the price for its slow start. There are a few areas the company specifically needs to look at. For instance, it is way behind its rivals on the growth curve. To keep up with the market, it needs to tune in its processes with market dynamics either by going in for new systems or sprucing up existing ones.

According to Sridhar Pai, CEO, Tonse Telecom, "One wonders why a leading brand like TTSL sometimes gets bogged down in execution issues – is it the slackness of the classical slow-but-sure approach, or is it just too much of diversion between GSM/CDMA/VSNL, as a result of which the bigger telecom strategy is still not in place?"

Amit Ahire, research analyst with Ambit Capital, has an explanation. "TTSL has been the pioneer of a lot of new products and innovative tariff plans, but it has failed to take these forward aggressively. In October 2005, it came out with a plan offering two-year free incoming calls for Rs 600. It also came up with the idea of free outgoing calls for Tata to Tata customers. But the benefits of those ideas were reaped more by other players than by TTSL."

The choice of CDMA technology too, though superior in data capabilities, is proving to be limiting. Says Girish Trivedi, deputy director, telecom, ICT practice, South Asia and Middle East, Frost & Sullivan, "In India now, there are very few takers for this technology. While GSM players have several advantages (for instance, an unlocked handset), this is not the case for CDMA players like TTSL."

The other factor that has worked against the company has been TTSL's mass market approach. This has translated into a largely low-end subscriber base, impacting the company's margins.

Another area that the company needs to watch out for is regulation. Its advocacy is perhaps not as good as that of many of its rivals, with it having had many runins with the Department of Telecommunications over BlackBerry, spectrum and other issues.

Though critical of the company's strategies, analysts are optimistic on its future outlook. The MVNO relationship with Virgin has been a pioneering step and is seen as a positive, as is the strategic alliance with DoCoMo.

"At home, DoCoMo has been very successful in developing a robust ecosystem comprising a lot of application developers around its technology platform and hence generating very high revenues. Using its expertise, TTSL has a good chance of duplicating this success in India," observes Pankaj Agrawal, associate director, BDA India.

Going forward, analysts feel that the company needs to have a very clear strategy as the competition is going to be very tough – five existing GSM players and five new GSM players. "Who will win, time will decide. But for the next three to four years, the company will need to keep endowing funds for network rollout and expansions," says Ahire.

Priorities for the future

On TTSL's immediate agenda is a serious plan to re-enter the handset business (the Tatas had stopped making fixed line phone instruments under the Tata Fone brand some years ago). Following the alliance with DoCoMo, there are plans to resurrect this business as DoCoMo has strong expertise in mobile handset development besides managing next-generation technologies. Though the business model will have to evolve over time, the company has an extensive line-up of lifestyle-focused handsets, tailored to meet different customer needs and preferences such as waterproof models, kids' models with GPS tracking, and handsets with wellness applications to monitor health and fitness.

To sharpen its focus on broadband, TTSL has tied up with Ceragon, which offers migration-ready systems, termed FibeAir IP-10, that support TDM technology and Ethernet over a single platform. Once the solution is deployed, TTSL will be able to offer a wide range of data and multimedia applications on top of its voice-centric package.

Enterprise is another area that the company is focusing on. Leveraging on the higher data capabilities and right partnerships that exist within the Tata ecosystem, it is in a better position to offer customised enterprise solutions than its rivals. The enterprise segment is therefore the right channel to open up opportunities that can bring in the right customers and higher ARPUs. It already provides the backbone for corporates like GE Capital, Wipro and Standard Chartered Bank, in addition to servicing the telecom needs of retail customers.

And of course, the company is waiting for the spectrum auction for 3G, an area in which it expects to score better than its rivals. It already has a 3G-ready infrastructure with an assured migration path to 4G. With its DoCoMo alliance, it is at an advantage to achieve a target of 100 million subscribers by 2011. Unlike earlier, this time round, it intends to hit the ground running.

TTSL snapshot

Mobile subscriber base/market share: 30.16 million/9.5 per cent (October 2008)

Fixed line subscriber base/market share: 836,819/2.19 per cent (June 2008)

Presence: 22 circles

Estimated market value: $10.36 billion

Shareholding pattern, as of October 2008: Tata Sons (45 per cent); Tata Communications (15 per cent); other Tata group companies (80 per cent); Temasek (10 per cent); C. Sivasankaran (8.6 per cent); an institutions (1.4 per cent).

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...