Bharti Airtel: 75 Million and Counting - Bharti Airtel races past BSNL to the top

-

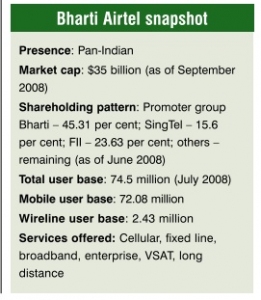

With 75 million telecom users and counting, Bharti Airtel is a success story. It is, in a way, symbolic of the trail-blazing pace of India's telecom sector. Merely 13 years into the business, and the company has established itself not only as a major corporate entity in India but also one that holds its own in the international telecom arena.

BusinessWeek placed it among the 10 best performing companies in the world in its "IT 100" list not so long ago. And recently, Forbes did the same, ranking it among its "Asia Fabulous 50", based on long-term profitability, sales and earnings growth, stock price appreciation and projected earnings.

Airtel's latest milestone – 75 million subscribers – only entrenches its position further in the international market. The company is now the third largest in-country mobile operator in the world in terms of subscriber base, behind only China Mobile (433 million subscribers) and China Unicom (174 million), as of September 2008. That also leaves behind American operator, AT&T, with just under 73 million subscribers.

In India, while Airtel has been the undisputed leader in the private operator space, this July, it challenged and surpassed state-owned telecom operator Bharat Sanchar Nigam Limited (BSNL) as the leading integrated telecom company in the country. To Bharti's total subscriber base (mobile and fixed line) of 74.5 million, BSNL had 73.19 million as of July 2008.

Journey so far

Airtel offers mobile, fixed line, broadband, national and international long distance, satellite and enterprise services, leveraging its nationwide optic fibre backbone. It operates through three key divisions – mobility, telemedia and enterprise. It is also part of the consortium that jointly owns and has developed the next-generation undersea cable system, SEA-ME-WE4.

The company's cellular business is, however, its main growth vehicle. Airtel claims nearly 25 per cent share of the wireless market. Its closest rival in the wireless space is Reliance Communications (RCOM) with 52.54 million mobile subscribers, followed by Vodafone Essar and BSNL with 50.95 million and 42.53 million mobile subscribers respectively.

From a rather humble beginning selling push-button phones, Airtel has grown from strength to strength. Its growth in the past two years has been swift and steep. It crossed the 50 million mark in October 2007 and four months later, crossed 60 million, becoming the fastest growing telecom company in the world.

Key strengths

The company's key strength lies in its management, innovative strategies, sound financials, strategic partnerships and, above all, the entrepreneurial spirit of Sunil Bharti Mittal, chairman and managing director, Bharti Airtel. The company has benefited from the continuous focus on profitability and ensuring sufficient returns on equity and capital investment.

Right from the start, Airtel has nurtured employees as its biggest asset. Not surprisingly therefore, the company has not only been able to retain industry stalwarts such as Akhil Gupta, Manoj Kohli, Jagbir Singh and Don Price in its top management; it has also had the best talent pick in the industry.

Airtel often juggles its management team (as it did recently) to achieve the best organisational structure with a strong management core that drives the company's strategy and operations. Currently, in line with its corporate global strategy, Airtel is planning to hire senior and middle management personnel with international experience. This is important as the company scales up. "Airtel will be an organisation that attracts the top talent of the world," says Kohli, who recently took over as joint managing director and CEO of Bharti Airtel.

Besides, as the company ramps up its technological platform and gears up to offer new services, it is essential for it to hire people with experience in these segments. Such experience, for example in 3G, may not be available in India, and hence it makes better sense to tap the international talent pool.

Outside perspective

In fact, today though Airtel has a significant international standing, some analysts questions whether it can truly measure up to global brands like Vodafone, France Telecom, Deutsche Telekom or AT&T.

"Airtel needs to spend considerable time and energy in building a global brand," believes Sridhar Pai, CEO of Tonse Telecom. "This is currently completely missing. It needs to acquire a Tier 2 international player to quickly build up a global presence. The company must also build a strong international end-to-end IP and content strategy, which must have a strong India broadband component. The organisation must also target ethnic minorities across key global hubs to quickly build a high-volume story."

Mahesh Uppal, director, ComFirst, agrees: "When Airtel expands services to other countries, it will be important for it to match the market intelligence of its competitors. For example, Vodafone is a British company and it knows the lay of the land in the UK and other countries in Europe. One would assume that Airtel's market intelligence in such regions is comparatively lower."

Analysts are of the view that expansion into other countries is key for Airtel if it wants to find a place among the top 5 or 10 telecom companies in the world by revenue. Tarun Sisodia, director institutional equities, Anand Rathi Securities, points out, "Globally (except in China and the US), the large companies owe their growth to expansion beyond their home countries. Vodafone, France Telecom, Deutsche Telekom, America Movil and Telecom Italia are some of the classic examples."

For Airtel, however, even as it plans to go global, it wants to do so only on its own terms. This is evident from the abortive Bharti-MTN merger talks. Airtel's top management has repeatedly maintained that with a 700 million-strong rural market still waiting to be tapped at home, the company is in no hurry to undertake rapid global expansion.

According to associate director, BDAConnect, Pankaj Agrawal, "Airtel is already operating in Seychelles and Jersey & Guernsey, and is very margin-focused and clear on its acquisition strategy. It is looking to replicate its low-cost model in emerging markets where there is sufficient scale to allow Airtel to emerge as a strong global telco." Thus, if such opportunities arise, Bharti will take them; at the same time, it will concentrate on the markets it has in hand.

However, on financials, Airtel is on stronger turf than most international players. Its financial performance has been better than that of its peers in developed markets like Europe and America. Amit Ahire, research analyst with Ambit Capital, makes the same point: "European companies such as France Telecom and Vodafone have shown marginal revenue growth of 4-8 per cent in the past three years as the markets have saturated, resulting in lower subscriber growth. India and China, on the other hand, are growing markets. Thus, China Mobile has shown revenue growth of 26 per cent over the past three years, while Airtel has exhibited a phenomenal revenue growth of 53 per cent during the same period."

"Similarly, while the EBITDA margins for France Telecom and Vodafone has been in the range of 37 to 40 per cent over the past three years, China, which has a near-monopoly market with only two operators, enjoys higher EBITDA margins of 54 per cent. Airtel, in spite of having stiff competition and one of the lowest tariffs in the world, has exhibited EBITDA margins of over 40 per cent."

According to Sisodia, "The company incurred most of its investments in the past two years, when equipment prices had fallen significantly. This has enabled it to offer services at very low tariffs, yet be profitable."

In the Indian context, analysts feel that the company may need to look into some key issues in order to achieve further growth. As Pai says, "Airtel's mobile and internet content strategy is not very clear. It is riding the mobile wave but is not sure how it will evolve from there. There are no major content business deals or investments made so far." He also feels that "Airtel will have to catch up on its broadband story otherwise it will lose out on the competitiveness of being an integrated player".

Agrawal points to another challenge – to keep EBITDA margins constant while the company rolls out services in rural areas. "Given the electricity and diesel issues in rural areas, unless it is able to control its electricity costs, sustaining the current EBITDA margins will be challenging," he notes.

Meanwhile, Uppal is of the view that Airtel faces its biggest challenge from Vodafone. "Vodafone's plans are very focused and the two companies are com parable in size, scale and much else. In fact, Airtel's average revenue per user (ARPUs) is a little lower than that of Vodafone's. This makes Vodafone a formidable competitor. In fact, any global player with a similar profile can be a potentially serious competitor."

Another area that Airtel needs to work on is its quality of service. TRAI, in its point of interconnection report for the April-June 2008 quarter, pointed to Airtel's heavily congested network, followed by RCOM.

Service quality is emerging as a crucial factor in user retention. Its role will assume even greater relevance with the introduction of number portability. Airtel is aware of this and is putting systems in place to improve the customer satisfaction quotient.

The company is restructuring its BPO contracts so that they are more customer friendly and outcome oriented. Changes are being made in processes as well as in technology. Recently, Dr Jai Menon, group CIO, Bharti Enterprises, stated: "We realise that what matters when a call is made by a customer is whether the problem is resolved or not. So, we are focusing on outcome rather than call duration. The aim is to uplift the BPO model from being transaction oriented to being satisfaction oriented." Towards this end, the company is working with the Indian Market Research Bureau to get feedback from its customers. It is also not averse to supporting its BPO partners in scaling up operations.

According to Kohli, however, the key challenge for Airtel today is to differentiate itself from other operators in the market. "We are trying to differentiate ourselves on the basis of service quality and innovation in products, services and features. This is our single biggest external challenge from the market point of view," Kohli notes.

In that direction, Airtel has recently launched a first-of-its-kind offering in India – a Rs 2 billion Airtel Innovation Fund, aimed at providing opportunities to entrepreneurs in the telecom sector.

What next?

Having raced to the top of the subscriber charts, Airtel now needs to look at new opportunities. The telecom landscape is changing with rivals RCOM and Tata Teleservices Limited (TTSL) set to launch GSM services over the next few months. Also, five to six new players are readying to enter the market. And while the ARPU has been falling in the existing 2G-type of mobile services, the launch of 3G will unleash fresh competitive pressure in the market.

So what is the next step for Airtel? What is the company's strategy to maintain its lead in the face of competition that will only get tougher?

Says Uppal, "Though Airtel is quite comfortably placed, one cannot underestimate competitive pressure from companies like RCOM and TTSL."

One thing is certain though, the game will no longer hinge on tariff cutting, as pointed out by Kohli. Based on past experience, he feels users across the country are now fairly agnostic to tariffs. "They want to go with the leader, who brings in new products, has a strong brand and a good distribution network next to his house. Service quality, innovations and new products will be the drivers, not tariffs," Kohli observes. There is a lot more growth ahead, Kohli believes, at least a tenth or so higher than the government's estimate of 500 million by 2010.

At the moment, the company is not fazed at the prospect of 13 to 14 players in the telecom space. In any case, senior Airtel officials note, it would be the new players who face the danger of being unviable as 30 per cent of users are already taken and tariffs are down to Re 0.70 a minute. Globally, just three or four players are viable, but since the Indian market is bigger, five to six players can survive. No new player is likely to beat even the number five player in the market today.

Still, the company can ill afford to be complacent. As Girish Trivedi, deputy director, Telecom-SAME, ICT Practice, Frost & Sullivan, points out, "The new players entering the market will further intensify competition, leading to declining tariffs and ARPUs." This would translate into tighter margins and put return ratios under pressure.

Airtel, however, is not too concerned about ARPU climbs and dips. According to company officials, what Airtel looks for is the cost per minute; the revenue per minute defines the margins it makes. And since Airtel sells more minutes, it is in a good position.

3G and data services will certainly play an important role in the coming years. It will not only elevate the company's position in the urban market, it will immediately increase the company's ability to carry voice calls by 40 per cent, which is still a predominant application. "The first objective will be to use 3G to do full voice penetration. There will, of course, be an overlay of data services in the top 25 cities to begin with. Overall, we expect the top 5 to 10 per cent of users in the large metros to adopt 3G in the first couple of years," notes Kohli.

Here again, the belief is that Airtel will rule. According to Uppal, "Airtel has a fair proportion of lucrative customers who are natural targets for 3G or higher-end services. Moreover, the company has always been a firm proponent of 3G, much before many of its competitors."

The company is also focusing on the enterprise segment. According to Kohli, "The enterprise business is a very important growth area. We are looking at the small and medium business (SMB) segment." The company intends to diversify into the information technology business and offer software applications on a payper-use model to SMBs and enterprises. It is currently negotiating with international software vendors such as Oracle, SAP and Microsoft for providing different applications on a pay-per-use or software-as-a-service model.

Non-telecom areas like direct-tohome (DTH) and IPTV will also be fodder for future growth. On the cards, before the year-end, is the simultaneous rollout of IPTV and DTH services. The plan as of now is that both services will have differential pricing, with DTH targeted at the mass market and IPTV for broadband (high speed internet) users.Though it is still work in progress on both fronts, Atul Bindal, president for Telemedia services notes, "What is certain is that IPTV will be first launched in Delhi while DTH will be rolled out on a much larger scale." Telemedia is Airtel's business division that provides broadband and fixed line services to over 2.5 million customers in 95 cities.

However, competition will be tough. DTH services, for instance, are already being offered by TataSky, Dish TV, Sun Direct and RCOM, but none of them is making any money yet. Airtel, therefore, is planning carefully. "The idea is to offer our users telecom as well as media products. Telecom and TV together make for a powerful combination to enhance the wallet share," claims Kohli. On the pricing front, the company reckons that as IPTV sits on top of broadband, it will give the company an opportunity to cross-sell and deepen the relationship with existing customers using the local loop or broadband or both. The pricing for IPTV will include all voice, data and video. "For DTH, however, we will explore single play, double play as well as triple play, and introduce it in around 5,000 towns and villages," says Bindal.

Rural telephony is another area in which Airtel is planning to make a splash. Though most telecom operators are heading in this direction, Airtel believes it can capture a higher market share in the villages through its network, distribution and brand value.

In the past year or so, the company has learnt a lesson or two with many myths being broken. For instance, the expectation that the sale of e-recharge coupons in rural India would be low has been proved to the contrary as 90 per cent of the recharges in, say, Bihar and Uttar Pradesh has been through erecharges. Rural users also demand better customer service. For instance, rural users do not want pre-recorded interactive customer services in the way it is offered in the cities. Based on these examples, Airtel is customising its products to aggressively tap the rural market. Over the next few years, the company is looking at an overall $3 billion investment in its various projects.

Nonetheless, for the next few years to come, it is the mobile services segment that is expected to be the company's main revenue generator. Carrier services are also expected to grow more or less in line with its wireless division. Analysts also expect Airtel's broadband business to be largely driven by the introduction of 3G services. Besides, new businesses like DTH and IPTV will give a further fillip to the company's performance.

Recent initiatives

- Bharti Airtel and Asia-Pacific-based enterprise service provider Pacnet have entered into a network-to-network interface (NNI) agreement under which the two companies will directly interconnect their network infrastructure to expand their respective multi protocol label switching (MPLS)-based internet protocol virtual private network (IP VPN) capabilities and provide advanced IP solutions.

- On the handset side, the company has launched the Apple iPhone for Rs 31,000 and Rs 36,100 for the 8 GB and 16 GB versions respectively. It has also entered into a strategic tie-up with global smartphone company HTC, to offer large-scale mobile broadband applications.

- In order to augment capacity, Bharti Airtel has been especially active in the submarine cable segment. The company has joined 15 global telecommunications companies, including British Telecom, US-based AT&T and Verizon to construct a subsea cable system, called the Europe India Gateway, linking the UK and India via 13 countries. It has also formed a partnership with five international companies to build a $300 million cable called Unity, linking Asia and the US.Bharti has also signed a construction and maintenance agreement with eight global telecom players, including Etisalat (UAE), France Telecom and Tata Communications, to set up a cable system, called the I-ME-WE (India, Middle East, Western Europe).

- The telecom major has also started addressing the rural market. Towards this end, it has unveiled the Grameena Mobile Kranthi programme under which it has entered into a strategic tie-up with SKS Microfinance. The initiative is aimed at offering mobile handsets bundled with prepaid connections to SKS members in select areas of Andhra Pradesh.

- On the international front, the Bharti Group's wholly owned subsidiary, Guernsey Airtel, has launched mobile services in Guernsey in the Channel Islands in Europe. Meanwhile, its Sri Lankan subsidiary, Bharti Airtel Lanka, has signed a $100 million investment agreement to begin operations in Sri Lanka in 2008, and plans to soon launch 2G and 3G mobile services.

- Bharti Infratel divested stake in two tranches. First, the company divested $1 billion worth of stake to a group of international investors. Later, US-based private equity firm Kohlberg Kravis Roberts bought a 2-2.5 per cent stake in the tower firm for $250 million.

- In line with its outsourcing trend, Bharti Airtel has signed a six-year $150 million outsourcing deal with IBM. Under the deal, the company will outsource its IT functions in broadband, media and enterprise services to IBM. IBM will also implement IT systems that will enable the company to launch differentiated services in the direct-to-home (DTH) and internet protocol TV (IPTV) segments.

- In a first-time move for the Indian and global telecom industry, Bharti Airtel has announced the launch of a Rs 2 billion Airtel Innovation Fund. The fund, which aims to provide opportunities for entrepreneurs and innovators in the telecom sector, especially seeks to enhance innovation in the fields of telecom content, software and technology.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...