Putting its past problems firmly behind it, pure-play GSM operator Idea Cellular is focusing on extending its reach across the Indian telecom map, growing its repertoire from 11 circles at present to 22 eventually.

The beleaguered offspring of a threeway partnership among the Tatas, Birlas and AT&T, Idea Cellular has had a chequered past, marked by mergers, acquisitions and promoter-related problems. First AT&T opted out of the busines while Tata and Birla continued to occupy an uncomfortable grey zone, neither friends nor foes. Later, it was decided that one of them should quit the venture in the interest of the company. In 2006, the Tatas sold their 48.14 per cent stake for Rs 44.06 billion (about $970 million), leaving Idea Cellular to the AV Birla (AVB) Group, which now holds 57.69 per cent stake in the company.

But by then, the many internal adjustments and relative indifference of the promoters had begun to tell on the company's operational performance. Vikram Mehmi, at the helm then, often remarked that attention had to be diverted from constructively pursuing the company's prospects to dealing with constant employee concerns.

Change in the making

But all that is behind the company now. Kumar Mangalam Birla, AVB Group chairman, made it clear that the company would be pulling out all the stops to push growth to higher levels. To steer this growth, Sanjeev Aga, the experienced former head of Blow Plast, was brought in as managing director.

Next on the agenda was a visit to the stock market. Its smartly priced IPO, launched in February 2007, was oversubscribed 57 times, mopping up nearly Rs 20 billion. The proceeds were earmarked for expanding the company's network, thereby plugging one of its biggest gap areas – the lack of an all-India presence. This was important given that competition from rivals Bharti, Bharat Sanchar Nigam Limited (BSNL), Vodafone and Reliance Communications (RCOM) was getting tougher.

Late 2007, Idea received approval for providing telecom services across nine new circles, which would establish its presence in 22 circles. In 2008, it received spectrum to operate in the Mumbai, Bihar, Tamil Nadu and Orissa circles. And unlike other recent licensees like Datacom, Unitech and Swan, which were scouting for partners, Idea planned to go solo. In fact, the company was not averse to investing another $400 million, sourced mainly from internal accruals. "The additional investment of $400 million will take this year's total investment to $1.8 billion," notes Aga. "And we are ready for more investments, depending on the spectrum allocation in other circles."

For Idea today, speed is of the essence. It is working rapidly to roll out services. According to telecom experts, "The big challenge for the company is to match the presence of the leaders in the circles it is operating in. With new players coming in, competition can only get more aggressive."

Idea has factored this in and has set a target of increasing its reach from 1,700 towns and 17,000 villages at present to 3,000 towns and 30,000 villages by end 2008-09.

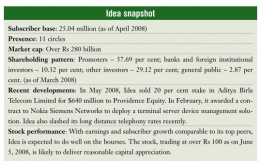

With greater cohesiveness at the top, strategies to strengthen operations and finances are being planned out carefully. Recently, the company tied up with Usbased private equity investor Providence Equity Partners, which will invest $640 million for a 20 per cent stake in Aditya Birla Telecom Limited (ABTL), a wholly owned subsidiary of Idea Cellular, which owns a service licence for the Bihar and Jharkhand circle. The deal is expected to close by August 2008, subject to regulatory approvals. The tie-up will help Idea expedite service rollout in the circle. For Providence, the deal will give it access to Indus Towers, a three-way joint venture with Vodafone and Bharti in which Idea has 16 per cent stake.

Current status

Idea currently operates in 11 circles – Andhra Pradesh, Delhi, Gujarat, Haryana, Kerala, Maharashtra, Madhya Pradesh, Uttar Pradesh (West), Uttar Pradesh (East), Himachal Pradesh and Rajasthan. In December 2006, it received approval to offer services in two more circles – Mumbai and Bihar. This was followed by licences to operate in nine more circles.

The fifth largest operator in the country with 25 million subscribers, Idea trails Bharti Airtel (64.37 million subscribers), RCOM (47.06 million), Vodafone Essar (45.78 million) and BSNL (36.68 million).

The company has been steadily improving its market share, which rose to 9.4 per cent in March 2008 from 8.6 per cent in the previous year. In terms of subscriber additions, it has, by and large, matched its rivals. It has also consistently maintained its lead or second lead position in the eight circles where it is an established player. Its monthly subscriber addition touched 1 million in the last quarter of 2007, indicating its increasing market penetration. However, in the three relatively new circles – Himachal Pradesh, Uttar Pradesh (East) and Rajasthan – where it rolled out services only in the third quarter of 2007-08, Idea is yet to make a dent.

While the company grossed an operating profit of Rs 6.86 billion from its established service areas in the March 2008 quarter, it lost roughly Rs 120 million in the new areas. The management earlier expected the circles to start delivering positive operating profits by the first quarter of 2008-09. However, it now seems that due to ambitious network expansion plans and higher operating expenditure on account of rentals to be paid to Indus Towers, the company expects to break even in these circles by the third quarter of 2008-09.

With network expansion being its top priority, Idea has been banking heavily on infrastructure sharing. It follows a hybrid model that includes its own towers, towers leased from other operators and from independent tower companies. This arrangement is expected to become more structured and generate further savings with the formation of Indus Towers.

The opportunity for Idea lies in increasing tenancy as Indus Towers taps third-party operators for a fee. Idea has 9,000 towers in this entity, which covers 15 of the 22 telecom circles. Infrastructure sharing will create a more optimal cost structure, apart from facilitating quicker rollout of services.

Along with this, Idea is also rolling out its countrywide national long distance service. The simultaneous rollouts will yield cost savings, as the company will be able to carry intercircle traffic on its own network, reducing the carriage costs typically paid to other operators. The other positive from this network capability is the potential to garner larger roaming revenues. Idea's international long distance licence holds similar promise.

Analyst viewpoint

Idea, no doubt, has strong brand recall, a solid technology base and sound management practices. Also, as part of the $24 billion Aditya Birla Group, which has a market capitalisation of $31.5 billion, it has the backing of a committed promoter with deep pockets. This would be a definite advantage as Idea scales up its operations in the wireless space.

An analyst from Angel Broking pegs Idea's market cap at over Rs 285 billion. With an EBITDA margin of 13.23 per cent and nearly 10 per cent market share, market analysts predict a positive outlook for the company. It is growing steadily, is more aggressive than before and has ambitious expansion plans in place.

However, there are some key areas that the company needs to focus on, say industry watchers. For instance, though Idea has been operational in India for a long time, it has not really grown the way companies like Bharti Airtel and RCOM have. By limiting itself to being a pure-play cellular operator, it has restricted its growth as well as presence.

While getting an allIndia licence will enable Idea to shed its regional player tag, being a late entrant, it will have to take on entrenched companies in the new circles. "As the seventh or eighth operator, it will be an uphill task, especially if it is looking at getting high-end users. Without number portability, it will be difficult for it to capture this segment. And at the lower end, the tariff war has already eroded margins," points out Kunal Bajaj, director, BDA Connect.

Idea's plans to hit the Mumbai and Bihar markets in the July-September quarter will be a test case. So far, the company does not have a presence in any metro, except for Delhi. Mumbai would be an important – though tough – market for it to penetrate. A bigger market would give it more leverage in negotiating deals with equipment vendors and in making revenue-sharing arrangements with other operators. Also, Mumbai is the highest ARPU-generating circle in the country along with Delhi, and would help improve Idea's realisations. One factor that could work in Idea's favour in its Mumbai foray is number portability. The company would stand to benefit from a churn in subscribers in this circle. In Bihar, however, with mobile penetration still not very substantial, Idea would be exploring an untapped market.

Financially, the company is on firm ground. It recorded more than 50 per cent growth in revenue year-on-year for 200708 and a 15 per cent growth quarter-overquarter in the quarter ended March 2008. Stable margins in excess of 33 per cent at the operating level and about 15 per cent at the net level have helped it grow its bottom line by 43 per cent quarter-over-quarter to Rs 2.76 billion for the March 2008 quarter.

However, analysts are concerned that rising competition may affect profit margins in the future. "The next three years are going to be when all the new operators come into the picture. Margins will be extraordinarily tight. In such a market, how geared up Idea is to face the challenge becomes an important question," says Romal Shetty, executive director, KPMG.

Harit Shah from Angel Broking observes: "Compared to its peers, Idea has a lower cash-in-hand and debt-equity ratio. However, as it gains scale, it should be able to improve these. In terms of acquiring funds, it will be able to raise enough funds on a stand-alone basis to finance its expansion."

All these risks and challenges apart, Idea is fairly well placed in the market. Even with a limited presence, it has been doing well over the past one and a half years. According to Prashant Singhal, partner, Ernst & Young, "The company's main strength is that it does not have a layered structure. So, in terms of decision-making, it is quick. Its brand strategy is also well positioned."

Shah endorses this: "Even without having the luxury of a pan-Indian footprint, its execution is excellent. And that is the biggest strength of the company."

It is a strength that Idea can work to its advantage in the new circles. While it will no doubt be challenging to break into the incumbents' turf, the company will be able to differentiate its product and offer better quality service by rolling out a new network, coming up with an aggressive marketing strategy and, of course, some fresh ideas.

The road ahead

The company's main focus will continue to be on expanding its network. Its three-year contract with Ericsson for GSM expansion in the Maharashtra, Gujarat, Rajasthan, Madhya Pradesh and Himachal Pradesh circles is designed to enable a smooth transition to a 3G-ready network once 3G spectrum is allocated.

Buoyed by the 70 per cent growth in subscribers in 2007-08, the management hopes to repeat, if not exceed, its performance this year. With its footprint growing in the new circles, the company hopes to add over 1.5 million customers each month.

The value-added services (VAS) segment also presents a huge opportunity for the company. Says Shetty: "Its venture into GPRS and EDGE is the very first in the country. This, along with the introduction of new mobile VAS such as music messaging, voice portals and email, will strengthen Idea's ability to compete."

In the backdrop of falling ARPUs, Idea is looking to expand its VAS portfolio considerably. For instance, it has joined hands with Tata Communications, the UAE's Etisalat and HSBC India for a pilot project that will enable UAE-based NRIs to transfer money to Kerala using mobile phones. In the first phase, the pilot will cover over 270,000 Idea Cellular subscribers in Kerala.

Idea is also focusing on tapping Category B and C towns. It has already started targeting rural subscribers through innovative schemes such as free twominute outgoing calls, reduced prepaid tariffs, lifetime recharge and full talktime.

It is also betting big on 3G and WiMax and is awaiting the final policy framework on these. Meanwhile, the company has already conducted indoor Wi-Max trials in Pune, Bangalore and Kochi.

All in all, while not aggressively so, Idea is quietly consolidating its place in the telecom space. Better management, robust subscriber additions, a countrywide presence, and benefits from its Indus Towers stake should all go a long way in achieving this.

As we go to press, it has been reported that Telekom Malaysia has acquired around 15 per cent stake in Idea Cellular at Rs 158 per share via a preferential offering worth $2 billion. Idea is now expected to buy out the Modis' 40.8 per cent stake in Spice Communications for approximately Rs 22 billion, following which Telekom Malaysia would have 20 per cent stake in the newly merged entity. According to sources, the main hindrance in the Idea-Spice deal was Telekom Malaysia's insistence on holding 20 per cent stake in the Idea-Spice combine. This demand has reportedly now been met.