Reliance Aims High - Streamlines strategies for higher growth

-

Launched in late 2002, Reliance's CDMA mobile services quickly covered 600 cities and towns, absorbing an initial investment of Rs 80 billion. It took on fierce competition from indomitable GSM players like Bharat Sanchar Nigam Limited, Bharti Airtel and Hutchison Essar to become the country's second largest mobile operator in two short years.

After the initial faltering steps to establish itself, the company, then called Reliance Infocomm, found a winner in its "Monsoon Hungama" package. The hugely popular offering bundled a mobile connection with a handset for as little as Rs 500, for the first time putting mobile phones within the reach of low-income groups.

This virtually "revolutionised" the face of telecom in the country. Rivals hastily came up with similar offers in a bid to replicate Reliance's monsoon success. They knocked down call rates, thus making India's mobile tariffs one of the lowest in the world. Subscribers responded enthusiastically, signing up in droves and pushing up the country's teledensity to new highs.

In 2005, the company faced some upheaval with the Ambani brothers, promoters of Reliance Industries (a major stakeholder in Reliance Communications), engaged in a feud over ownership issues.The dispute was, however, soon resolved, with younger brother Anil Ambani holding the reins as CEO of the lucrative telecom business.

With 32.4 million subscribers as of February 2007, Reliance Communications Limited (RCL), as it is now called, continues to play a crucial role in India's rapidly growing telecom sector. However, analysts feel that over the past two years, the company's pace of growth has slackened somewhat. The top management too seems in disarray. Officials of RCL, now part of the Anil Dhirubhai Ambani Group (ADAG), discount this. The slack, if indeed it exists, appears to be so because the overall telecom business is settling down, as is the new management at Reliance, they explain. The company is now focused on streamlining strategies to push higher levels of growth.

Even so, Reliance's typical cuttingedge, speed-to-market services have certainly been missing of late. As have the high-profile advertising, branding and retailing that had come to be associated with RCL in its early years. Today, the company appears more subdued while its rivals are getting more nimble-footed and are racing ahead with market-driven services.

The question being asked therefore is, how well equipped is the company to face the dynamic competition that Vodafone's entry is likely to trigger? Vodafone, the world's largest mobile operator, is targeting a market share of 20-25 per cent, or 125 million users, in the next four to five years.

But RCL – also a contender for the Hutchison Telecom International Limited (HTIL) stake – seems unperturbed. At the time of Vodafone winning the stake, Ambani commented that although the competition would get tougher, RCL had weathered many storms in the past as well. When it entered the arena, four operators were already present. The Vodafone acquisition would thus only spur the sector further.

The position so far

The temporary slack notwithstanding, there is no doubt that the company is on a fairly strong wicket. It has sufficiently deep pockets to overcome hurdles. Also, in the last one year it has made a determined effort to regain its lost initiative. The year2006 in fact saw a fair amount of consolidation. A new top management team was put in place as was a simpler corporate structure. All the nine subsidiaries that came under the ADAG banner were absorbed into one holding company – RCL – before its listing on the stock market.

Today, RCL is an integrated telecom player offering a full suite of telecom and telephony solutions, including mobile services (both CDMA and GSM), wireline services, national and international long distance services, enterprise broadband, and global voice and data services. It has broadly divided its operations into three strategic business units: mobile, global and broadband. Of these, the mobile business accounts for the largest share of RCL's revenues (roughly 68 per cent of gross revenues). The company remains the largest CDMA operator in the country with a presence across all 23 circles. The other private CDMA operator, Tata Teleservices, follows at some distance with 15.3 million subscribers as on February 2007. In addition, group company Reliance Telecom (which operates in a few circles) has 4.1 million GSM subscribers. That makes RCL second only to market leader Bharti, which has 35.4 million subscribers.

Reliance is followed by BSNL with 25.4 million subscribers and Hutchison Essar with 25.34 million.RCL is increasingly also tapping into overseas opportunities. It is successfully leveraging its acquisition of FLAG Telecom – one of the largest submarine cable systems in the world, connecting several countries across the globe – to meet the burgeoning demand from Asia and the Middle East. Recently, RCL also launched Falcon, an undersea cable aimed at providing cheaper bandwidth for retail and commercial users. The Rs 400 million, 2.56 terabits per second submarine cable system connects 11 countries including Kuwait, Oman, Qatar, Sri Lanka and Maldives along its entire 11,859 km length from Mumbai to Egypt.

On the enterprise/broadband front, however, RCL's previous grand plans of ushering in an "enterprise netway revolution" are far from taking off. This is despite the fact that the company delivers a wide range of enterprise voice, data, video, internet and IT infrastructure services, including national and international private leased circuits, broadband internet access, audio and video conferencing, MPLS-VPN, Centrex and managed internet data centre services. As a telecom analyst of a leading consulting firm puts it, "Catering to an enterprise customer base of 750 of the top 1,000 Indian and MNC enterprises, the company is nowhere close to achieving its earlier ambitions of providing 100 Mbps Ethernet links to every desktop in half a million enterprise buildings."

Nevertheless, it is continuing to do what it does best: pushing up subscriber numbers by lowering tariffs. It has flooded the domestic market with several valueadded services (VAS) and dropped its ILD rates for calling card users by up to 66 per cent. As S.P. Shukla, president, wireless business, notes, "we were the first company to announce a "OneIndia" plan for mobile telephony on January 1, 2006; we were also the first to announce the same plan for fixed line calls; and the first to offer local calling among all state capitals, what we called the "Capital Plan". Under this plan, subscribers could make calls among 23 state capitals at local rates."

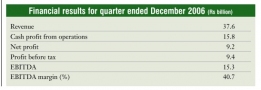

All these initiatives have helped the company get on steadier financial ground.The financial results for the quarter ended December 31, 2006 show a 198 per cent jump in net profits to Rs 9.24 billion from Rs 3.1 billion in the corresponding quarter of the previous year. Likewise, revenue growth shows a 26 per cent rise at Rs 37.55 billion from Rs 29.9 billion during the same period.

One of the most significant announcements in 2006 was Reliance's stated intention to shift to a GSM platform. While this set the alarm bells ringing amongst CDMA operators worldwide, Ambani reasoned that with a nationwide CDMA network in place, investment in GSM infrastructure would involve only an incremental investment of 20 to 30 per cent. Consequently, it applied for radio frequency in the 1800 MHz band (GSM band) for operating mobile networks in 14 circles across the country. The applications were made under the unified access service licence.

Shortly after, the HTIL stake came up for sale and RCL saw an opportunity. If it won the stake it would get immediate access to Hutchison Essar's substantial subscriber base and networks, making it the leading operator in the country with over 50 million subscribers and a significant presence in both mobile technologies.It would also, to some extent, solve spectrum concerns. In pursuing the HTIL stake, it therefore put on hold its own GSM plans for the next three months.

But having lost the race for Hutch, it has now turned its attention back to GSM expansion. With GSM spectrum likely to be available by July 2007, RCL has started advancing its talks with Ericsson, Nokia and Motorola for a big GSM tender for 75 million 2G lines and 25 million 3G lines.The value of the tender is estimated to be $6.5 billion to $7 billion. The company hopes that if all goes as per schedule, it should be able to become a pan-Indian GSM player by 2009.

Market review: Strengths and failings

RCL's extensive network and infrastrucOne of the most significant announcements in 2006 was Reliance's stated intention to shift to a GSM platform. The company hopes to become a pan-Indian GSM player by 2009 and is in talks with leading manufacturers for a big GSM tender.ture comprising over 80,000 km optic fibre cables is certainly an asset. The company has leveraged this well to tap subscribers in smaller towns and cities."Right from the beginning, we understood the potential of the vast untapped market in the rural areas. Therefore, by introducing innovative schemes and handsets specifically targeting this segment, we created a niche for ourselves," says Shukla.

The company has also been able to exploit the VAS segment effectively.CDMA 1X technology, which offers superior voice and data capabilities compared to other competing technologies, has enabled RCL to deliver content-rich data and voice applications including MMS and video streaming. "Our superior CDMA technology gives users high data speed.Today, we are the leading operator (with 90 per cent market share) in terms of data cards utilised with laptops. This is because we are able to offer uniform speed all over the country, the maximum being 144 kbps, (depending on network conditions), whereas our competitors offer the GSM experience and in some cities, GPRS.However, we offer one experience all over India," notes Shukla.

However, the company's thrust on low-income segments did not help it generate higher average revenue per user (ARPU) compared to its rivals. According to telecom analyst Mahesh Uppal, "The brand got associated with economy and value-for-money for low-end customers, which is not necessarily a bad thing, but it does mean that the ability to attract highend customers is, to a certain extent, compromised."

The increasing subscriber volumes have however made up for the lower ARPUs.Says Shukla, "We are perfecting our business model to serve a very large base of customers with low ARPUs. When multiplied by a large customer base, it adds up to a large turnover." This is evident from the fact that the company is generating profits within four years of operations.

"Its strong financial status was also highlighted when, in the race for Hutch, it got the full backing of international private equity players. This in itself is very significant as private equity players closely examine the fundamentals of a company and check if there are any risk factors before committing. Therefore, their confidence is a clear indicator of the company's strength in the market," says an analyst from Angel Broking.

The main stumbling block as perceived by market analysts is Reliance's lack of clarity in choosing the right technology path. "It needs a technology strategy. The company is confused; it is not clear which road to take: CDMA or GSM," notes Uppal. Today, even as the company claims that it is focused on GSM as the technology for the future, it is expanding its CDMA network. It has already awarded Chinese equipment major, Huawei, a contract for around 4.5 million CDMA lines.

"It appears that at present, the company is not entirely clear on what image it wants to portray to the public. It wanted to get Hutch and then decided not to pursue it aggressively. It wanted to go the GSM way but somewhere down the line, it stopped talking about that. Spectrum is scarce but is central to a company's technology strategy.

Until its technology strategy is in place and it has devised a way of attracting more lucrative customers, I think there will be a bit of struggle for the company," says an SBI Caps analyst.

The overall market opinion is that the company needs to chart a clear path in terms of its expansion strategy. The trend in recent times has also shown that the company has not done too well in its attempts at acquisition in the telecom field. Further, while RCL's strength is its national vision, analysts claim its weakness lies in its seemingly centralised management structure, where none of its senior management is particularly well known. "The company seems to have given less attention to the quality of senior management as compared to a company like Bharti Airtel for example," says Uppal.

Another setback for RCL is its poor quality of service. Though company officials disagree, analysts like Rajesh Chharia, president, ISPAI, say, "The only thing standing between Reliance and a leadership position in the market is its poor quality of service vis-Ã -vis its competition. It has to deal with this immediately and efficiently to combat competition."

Going forward...

Having said this, there is no denying that RCL is a fairly competitive company. As of now, the company is working on a framework to eventually shift to the GSM platform once regulatory and spectrum issues are sorted out, which could take well over two years.

RCL is also turning it attention seriously towards broadband and rural telephony. For this, Ambani has outlined a capex of $2.5 billion in 2007. "We are looking at setting up 20,000 new towers in the course of the year and have the advantage of co-locating our own networks, that is, GSM or CDMA on our own towers. In addition, we have agreements with all the major operators and it is this combination that will give us capital efficiency, going forward," says Ambani.

Recently, the company announced its intention of unlocking value by hiving off its telecom towers business into a separate subsidiary. This move is expected to help RCL increase efficiency and gain from what could in itself be a strong business model. "With a planned expansion of 20,000 towers for financial year 2008, the total value of this business could be conservatively estimated at Rs 100 billion, which would add Rs 46 per share to the current market price. Such a move could unlock significant value for shareholders over the long term," states an investment report by Angel Broking.

Also on the anvil is a global listing of FLAG Telecom. With FLAG Telecom winning new contracts worth more than $100 million during the third quarter of financial year 2007, it is increasingly making sense to do so. The proposal has already been cleared by the board of RCL.In FLAG Telecom, RCL sees enormous growth potential. It has recently announced an investment of nearly Rs 70 billion in a next-generation network project which, on completion, will make the company the largest fully IP-enabled global undersea cable system operator, covering 80 per cent of the world population.

In the immediate term, RCL is testing the waters with several new products and solutions. "We are focused on strengthening our position within India's rapidly growing telecom sector, achieving profitable growth and delivering long-term value for our 2 million shareholders," says Ambani.

All in all, if RCL can regain its momentum, the future looks promising.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...