VSNL - Back in the reckoning

-

It is the first Indian global telecom company with a presence in the US, Canada, the UK, South Africa, Singapore and Sri Lanka. Its range of service offerings includes wholesale voice, private leased circuits, IP MPLS, VPN, internet access, hosting, and several other IP services. The company is now poised to offer managed data services and deliver end-toend telecom solutions to carriers and enterprises globally.

Initially a state-run monopoly, VSNL faced a rough patch soon after the Tatas acquired a 46 per cent stake in it in 2002 (subsequently the Tatas increased their stake in tranches. As of September 2006, they held 50 per cent.)

The government meanwhile deregulated the sector, leading to a collapse in long distance tariffs. This made a huge dent in the company's profits. The international call grey market added to the company's woes.

Repositioning strategies

In an attempt to get back on track, the company had to add new revenue streams.It went on an acquisition spree, both domestically and internationally, over the last two years. It also increased its focus on providing broadband and internet services and building its infrastructure.

In July 2005, VSNL completed the acquisition of Tyco Global Network (TGN) for $130 million adding 60,000 km of valuable international cable capacity.Thereafter, VSNL staked its claim as one of the world's most important international carriers by buying Teleglobe International Holdings for $239 million in February 2006.

VSNL now has one of the largest submarine cable networks of over 200,000 route km. The company intends to shift the Teleglobe traffic to TGN, thereby saving $10 million and freeing up capacity for data and IP traffic on the Teleglobe network. TGN and Teleglobe are expected to contribute an estimated $1 billion to VSNL's revenues and this figure will increase in the future.

Besides this, the company won the second national operator licence for South Africa in December 2005 and launched commercial operations under the brand name Neotel.

Domestically, the company acquired Tata Power Broadband which brings to the table about 1,000 km of optic fibre infrastructure in Mumbai and Pune. Its other domestic acquisitions include the assets of 7 Star.com, a suburban Mumbai cable operator offering broadband services, and Direct Internet which provides internet and related services to small and medium sector enterprises.

The company is taking the cable route to push its broadband services to retail users and is in the process of tying up with cable operators across the country to reach the end-consumer. VSNL has already partnered 2,000 cable service providers to provide the last mile link for its broadband services.

Operations

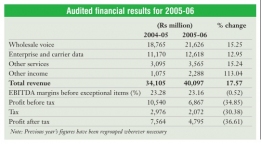

The company operates under three business segments in India – wholesale voice, enterprise, and carrier data and other services. Its largest revenue segment in India is the traditional wholesale voice business consisting of international long distance (ILD) and national long distance (NLD) services. While ILD voice services have been traditionally the core business of the company, over the last four years, this segment has come under pressure from increasing competition, falling rates and lower margins. Despite the reduced margins, the revenue in the wholesale voice segment grew by 15.25 per cent, from Rs 18.77 billion to Rs 21.63 billion.

Consequently, the firm's dependence on the price-sensitive voice traffic has declined from 85 per cent in 2002 to about 65 per cent currently. By the end of the decade, this is projected to fall to 40 per cent.

Most industry experts are of the opinion that the company's revenues from long distance services may get impacted with more operators entering this arena following the reduction in licence fees.

This may, however, work to VSNL's advantage as the new entrants will need infrastructure to offer services. According to DoT's recent ruling, new entrants will be given three years' time to set up their infrastructure and have been permitted to ride on the infrastructure of existing players.

VSNL has robust infrastructure and the operators can optimise their costs by utilising this infrastructure. "DoT's latest ruling, which allows new long distance entrants to lease infrastructure from the existing operators, will open up new revenue streams for VSNL," says Srinivasa Addepalli, vice-president, corporate strategy, VSNL.

Meanwhile, with the Indian enterprise market growing at an exponential rate of 60-70 per cent annually, the company's enterprise division, TATA Indicom Enterprise Business Unit (TIEBU), with revenues of Rs 12.62 billion, has witnessed a growth rate of 12.95 per cent over the previous year. "This segment will continue to grow and will be our key focus area in the future," says Arvind Mathur, vice-president, global product management, VSNL.

Recently, it launched its domestic Ethernet service through its enterprise business division. Ethernet is a diverse family of frame-based computer networking technologies for local area networks.

VSNL's Ethernet services will connect 120 major Indian cities to key business hubs across North America, Europe and Asia."With the global market for Ethernet expected to reach $22.5 billion by 2009 from $5.4 billion in 2004, we hope to get clients from the pharmaceuticals, financial services and manufacturing sectors," says Mathur.

"We intend to launch several new services both in India and globally to meet the emerging enterprise requirements," adds Addepalli.

Key concerns

Despite the company's progress, some issues need to be resolved on an immediate basis. An important concern for the company is the lack of direct access to end-customers on its voice business. VSNL is dependent on service providers to route national and ILD calls of their customers through VSNL. Some of these operators are also competitors of VSNL in the long distance and other markets.Another serious issue is the grey market for ILD calls. According to various market estimates, the grey market for ILD services accounts for as much as 30-40 per cent of the incoming ILD traffic into India. These unauthorised operators take away the business of licensed providers like VSNL.Further, the deregulation of the Indian telecom market has exposed the company to increased competition. VSNL has also entered new businesses such as NLD and broadband, where there are several potential and existing competitors.For instance, there is stiff competition in the long distance sector. The government is currently processing 20 new applications and seven players have already been given licences. Players like AT&T, which had earlier used VSNL for carrying traffic, no longer require VSNL's infrastructure.Similarly, British Telecom is likely to launch its services within the next six weeks and will target enterprises. Bharti and Reliance have leveraged their long distance licences and stolen a march over VSNL, which lost time in entering this segment. Clearly, VSNL has an uphill task ahead of it as competition in the market increases.

According to Addepalli, "One of the key challenges faced by the company is to manage costs and assets better, and meet the customer's quality expectations in the face of reduced tariffs and very low margins in the voice segment. Moreover, as we grow through multiple acquisitions, consolidating and integrating our business is a challenge. We have managed very well till now and hope to keep pace in the future as well."

VSNL's accompanying inefficient PSU baggage is another stumbling block. It has inherited a huge workforce which was used to the old ways of running its business when VSNL was still a monopoly.

Finally, FLAG Telecom, Reliance Communications' global undersea cable business division, has issued a notice for a $406 million damage claim. This is a critical issue as it could wipe out VSNL's several years of profitability.

Financial performance

VSNL posted a net profit of Rs 1.42 billion for the quarter ended December 31, 2006, down 5.34 per cent from Rs 1.5 billion recorded in the same quarter a year ago.

The total income of the company, however, rose by 3.62 per cent to Rs 11.15 billion for the third quarter of this fiscal as against Rs 10.76 billion in the corresponding quarter of 2005.

According to broking firm Edelweiss, VSNL's results were above expectations in terms of profitability and margins. On a year-on-year basis, while revenues and EBITDA were higher in quarter three of financial year 2007, net profits were marginally down by 5.34 per cent primarily on account of lower other income.

Future plans

With sound financial parameters and a strong global presence, the company has charted ambitious plans for itself. It intends to increase its presence in the international telecom market. According to N. Srinath, managing director, VSNL, more than 50 per cent of the company's revenues come from its international business.

VSNL recently won ILD and ISP licences in Sri Lanka, and is hoping to expand its existing inbound carrier business through acquisitions to become a fullservice telecom provider on the island.

It may also bid for a US-based technology entity involved in managed hosting services (MHS) and IT operations. This will allow it to enter the MHS and IT outsourcing markets.

With Asian bandwidth demand forecasted to grow at an average of 27 per cent CAGR, the company is focused on establishing a monopoly in the sector. It is building two new submarine cable systems – one between India and Europe and the other intra-Asia – in partnership with carriers in the respective regions.

The overall cost of these two cable systems is expected to be about of $600 million. The new cables will enhance VSNL's global network in two of the fastest growing regions in the world. "We expect the cable systems to be ready by the middle of next year," says Addepalli.

"Broadband is another key thrust area for VSNL. We are hoping that by the second half of the year, wireless broadband technologies like Wi-Max will become available for retail rollout. This depends on the cost of the customer premises equipment and spectrum allocation by the government. We will also be using the cable route," says Addepalli.

The company has begun operations for Wi-Max in Bangalore and plans to roll out the service in 100 cities by end-2007.Initially, Wi-Max will be offered to enterprise customers and later to individuals.

Clearly, VSNL is now dreaming bigger and is pulling out all stops to become the world's leader in the wholesale voice and enterprise businesses.

- Most Viewed

- Most Rated

- Most Shared

- Related Articles

- Brand Idea: Focus on 3G, rural areas and...

- Samsung Mobiles: Smartphone strategy for...

- BSNL: Exploring revival strategies

- Reliance Jio Infocomm: Set to change the...

- Reliance Infotel: Strongly placed to tap...

- Tulip Telecom: On a sticky financial wic...

- MTNL: Survival strategies

- Bharat Sanchar Nigam Limited: Attempts t...

- Aircel: Increasing its footprint

- Vodafone India: Growth despite regulator...